The ECB resumes corporate bond purchases — here is what you have to know

All eyes are on central banks these days as major monetary policy decisions have been driving global bond markets. The eagerly awaited September meeting of the Governing Council of the European Central Bank (ECB) has given bond investors much food for thought. In particular, the new round of its asset purchase programme (APP)—announced in true ECB fashion revealing only the bare minimum of details—leaves plenty of room for speculation. So far, we only know that from November onwards net asset purchases are going to resume at a pace of EUR 20 billion per month for as long as deemed necessary to reinforce the accommodative impact of the ECB’s policy rates.

Credit investors like ourselves are naturally very interested in understanding the exact terms of the corporate bond element of the APP, i.e., the corporate sector purchase programme (CSPP). Here we try to provide answers to a few open questions.

How much corporate debt is the ECB going to buy per month?

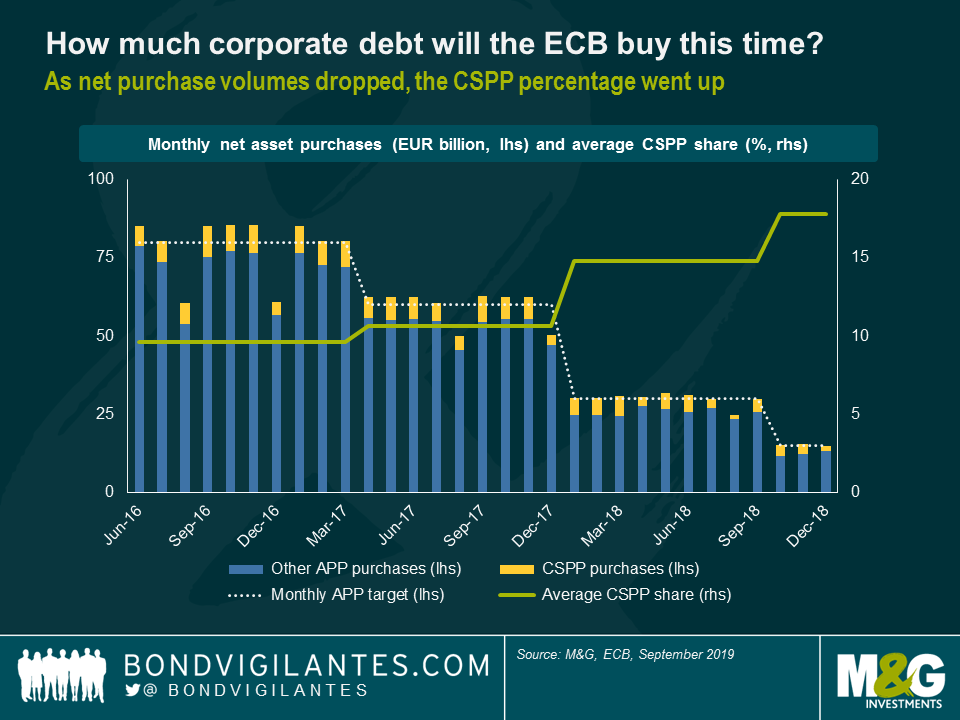

While the exact percentage of CSPP purchases within the upcoming APP round is unknown at this stage, historic data can help us define a realistic range of potential outcomes. It is important to note that the CSPP share has not been constant over time. Initially, when the ECB was buying EUR 80 billion of assets per month (until March 2017), CSPP purchases accounted on average for around 10% of all APP purchases. However, when overall monthly APP net purchase volumes were lowered first to EUR 60 billion (April to December 2017), then to EUR 30 billion (January to September 2018) and finally to EUR 15 billion (October to December 2018), the average CSPP share successively climbed up to around 18% in the end.

Applying the historic CSPP range of around 10% to 20% of all APP purchases, we can expect net purchases of corporate bonds to be anywhere between EUR 2 billion and EUR 4 billion per month from November onwards. My hunch—and it’s not much more than a hunch, I’m afraid—is that the ECB is going to push CSPP purchases towards the upper end of the range, i.e., between EUR 3 billion and EUR 4 billion per month.

Tilting APP net purchases toward the CSPP would effectively help the ECB buy time. The issue with public sector purchases, as opposed to private sector purchases, is that the capital key requires the ECB to purchase large quantities of German government bonds. Simultaneously, the maximum share of any public sector issuer’s outstanding securities that the ECB is allowed to hold is 33%. So, unless Germany abandons its balanced budget mantra (‘black zero’) and embraces fiscal expansion, thus increasing the Bund supply, the ECB will eventually run out of German government bonds to buy. As rules around the CSPP are less restrictive (capital key does not apply; 70% maximum issue share limit), it would make the ECB’s life a bit easier if a substantial share of net purchases was directed towards the private sector.

Are senior bank bonds going to be added to the ECB’s shopping list this time round?

Highly unlikely, in my view. Although Mario Draghi stayed fairly tight-lipped with regards to the finer details of the new APP round, he briefly noted that the types of APP-eligible assets would remain by and large the same as in the past, thus effectively ruling out the inclusion of bank debt. There had been rumours suggesting that the ECB might add senior bank bonds to the shopping list for the first time in an effort to cushion the blow to European banks’ profitability from further rate cuts. However, the distinctly bank-friendly aspects of the ECB’s most recent stimulus package—more favourable terms on targeted longer-term refinancing operations and the introduction of a two-tier system for reserve remuneration—have taken the wind out of the sails for this line of argument, I reckon.

Which parts of the corporate bond universe are likely to benefit the most?

Again, apart from Mario Draghi’s “expect more of the same” comment, we have very little information to work with. Assuming that the main CSPP eligibility criteria remain in place—euro denominated bonds, issued by non-bank corporations established in the euro area, with a remaining maturity between six months and 31 years and at least one investment grade (IG) credit rating—I would expect single-A rated bonds, French companies and the utilities sector to experience the strongest technical support under the new programme, just like under the old one.

Why did the ECB remove the yield floor for CSPP-eligible corporate bonds?

Interestingly, the ECB has flagged one rule change which is going to affect CSPP purchases. So far, purchases of assets with yields below the deposit facility rate (now -0.5%) were only permissible for public sector debt, but not for private sector debt. This time round, however, the yield floor is going to be abolished across all parts of the APP, including the CSPP. Hence, the ECB could buy corporate bonds yielding less than -0.5% from November onwards.

The actual impact of this rule change, at least in the current market environment, is unlikely to be material, though. In fact, apart from short-dated bonds issued by state-owned Deutsche Bahn, it is pretty hard to find corporate bonds with yields below -0.5%. This could change, of course, in case Bund yields take a leap lower at some point, thus dragging corporate bond yields down with them in the process. In this scenario, the yield on short-dated bonds from other highly rated issuers (such as Sanofi, Novartis or Total) might as well drop below the deposit rate.

In my view, the rule change is mainly of symbolic nature. It is a bullish signal telling credit investors that the ECB would be willing to support the high-quality end of the credit universe regardless of the prevailing yield environment.

Will European IG credit rally like in 2016/17?

No doubt, the fact that the ECB is going to buy once again large quantities of European IG corporate bonds is a material technical tailwind for the asset class, putting downward pressure on credit spreads and volatility alike. That being said, I wouldn’t necessarily expect a repetition of the extraordinarily strong credit bull market of 2016/17 for two reasons.

First, the scope of the new CSPP round is going to be more modest than in the past. Even if the ECB gravitates towards the upper end of its historic asset allocation range and directs a punchy 20% of net purchases towards corporate bonds, the absolute purchase volume of EUR 4 billion per month would still only be around half the amount invested in corporate debt on average each month between June 2016 and March 2017, when the original APP was in full swing.

Second, the entry point with regards to prevailing credit spread levels is less appealing. Before the ECB first announced CSPP in March 2016, investors had been spooked by the potential for a hard landing of the Chinese economy and a dramatic fall in the oil price. Consequently, the ICE BofAML EMU Corporate Excluding Banking Index—a rough proxy for the CSPP-eligible bond universe—was trading at an average asset-swap spread level of around 120 basis points (bps) back then. At this crisis-like level, credit spreads offered a lot of pent-up potential for an aggressive rally. Today, however, the index trades at a spread of only around 80 bps, which limits in my view the scope for further spread compression. I think a fair amount of ECB support is already baked into credit valuations at this point.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox