Is this a turning point for bonds?

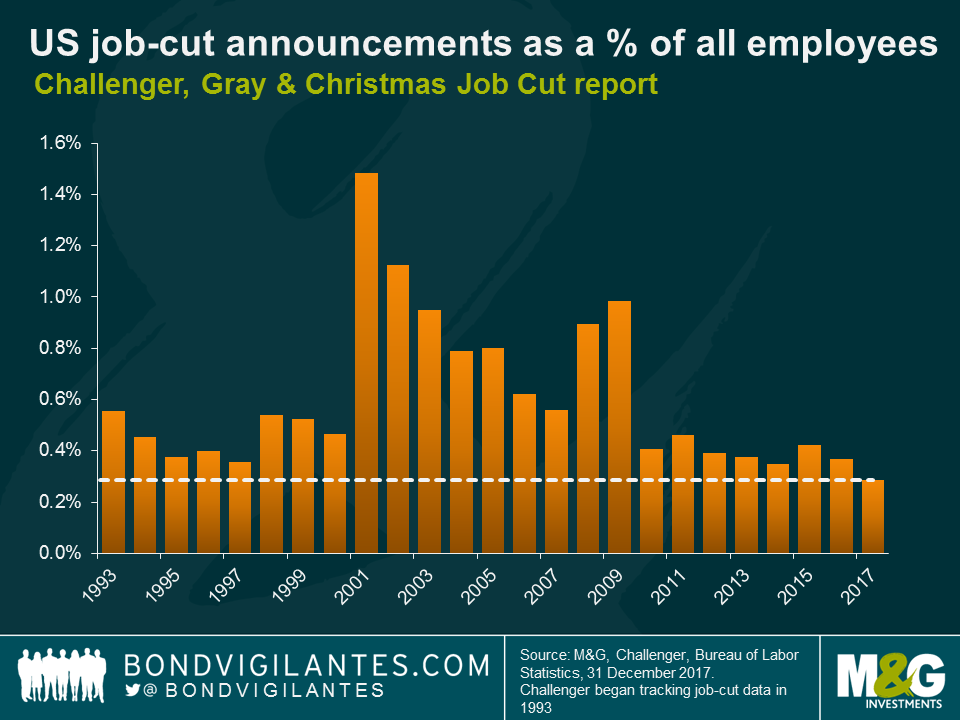

My view is that the US economy is nearer to overheating than slipping into recession. The strength of the US economy is typified by the labour market in many ways. To put some of this strength in context, look at the Challenger, Gray & Christmas Job Cut report. Last year (2017) produced an exceptionally low number of layoffs in nominal terms, and when adjusted to reflect the size of the labour market in real terms, US employers laid off the least amount of workers in the history of the 25 year survey. Due to the strength of the US economy, labour is a wanted good and firms are holding on to their existing workforces.

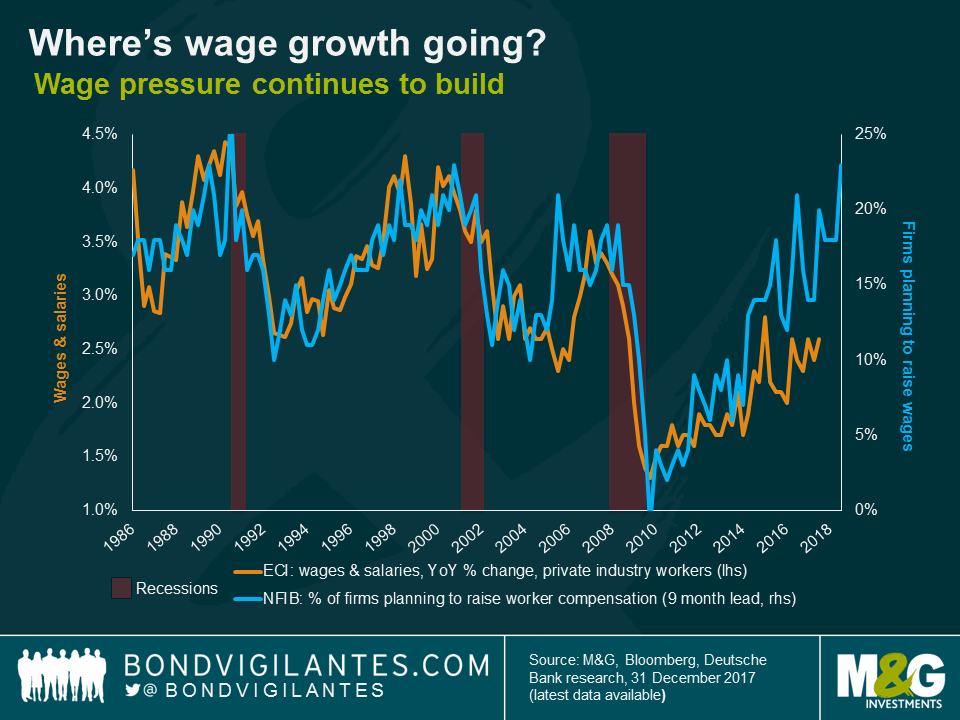

Labour market data is a lagging indicator, so it is important to determine what the outlook for US workers is in 2018. One of the ways to analyse this is to look at leading indicators of likely hiring. One chart I use regularly is shown below. This shows the strong correlation between business confidence and future earnings growth. It looks like a good year for wage growth ahead.

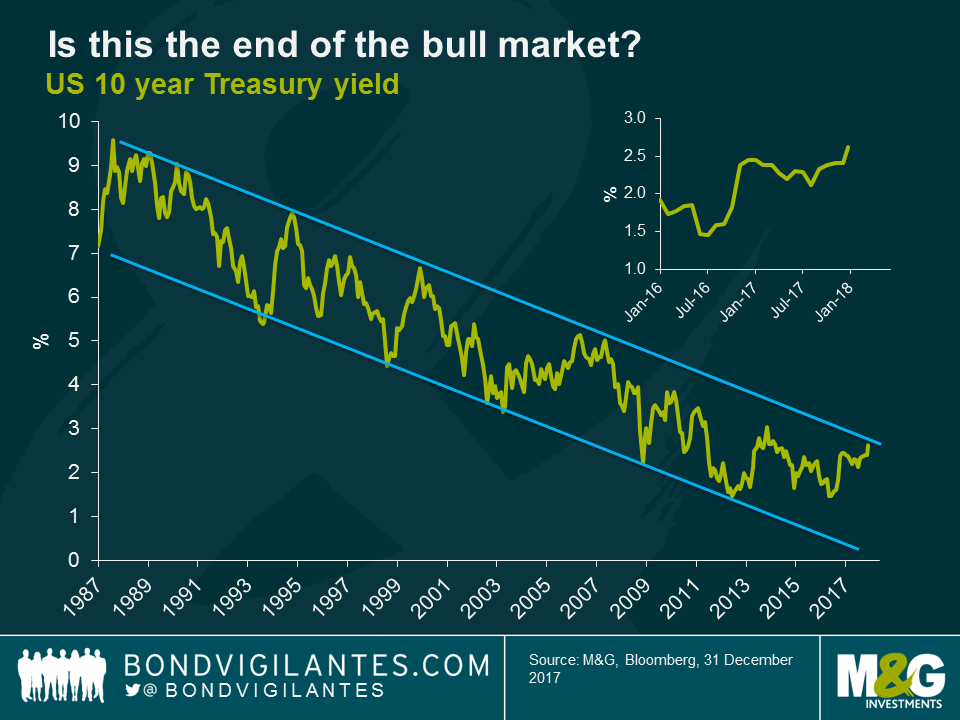

US interest rates have been normalising for a while, and the flatness of the yield curve suggests that markets believe that rates will peak soon. From a technical point of view, as pointed out by Gross and Gundlach, we are at a crucial inflection point. Is the long term structural bull market as shown in the 10 year yield chart below about to resume, or is it over?

Due to US leading indicator data, the added impetus of tax cuts, strong synchronised global growth, and the return of the missing link of US confidence as I outlined last year, I think the probability of the recent bear market in bonds stopping at this point is limited and it is why I remain short duration across my portfolios.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox