Lonesome George (Osborne) should get rid of one and two penny coins

Some sad news has reached us on the bond desk. Lonesome George, a giant tortoise that lived in the Galapagos Islands, has died. Lonesome George was known as the rarest creature in the world because he was the last known individual from his subspecies. Which is kind of relevant, as today’s blog will be covering another endangered species – one penny and two pence coins.

It was announced earlier this year that in an effort to cut costs, the Canadian government would be eliminating the penny from Canada’s coinage system. Canada isn’t the first country to pinch its pennies. Australia removed its one and two cent coins from circulation in 1992 due to the high cost of production, the United Kingdom lost the half-penny in 1984 when it became more expensive to make than its face value, and after getting rid of its one and two cent coins in 1990, New Zealand followed suit in 2006 with the five cent coin.

The Canadian government has asked businesses and consumers to simply round up (or down) to the nearest five cents at the cash register. Businesses will be asked to return pennies to financial institutions. The coins will be melted and the metal content recycled. Could the UK and Eurozone announce similar measures in the future?

Last year, the UK issued 304,304,000 one penny and two pence coins. The value of these coins is around £4 million pounds. They are copper-plated steel and are around 93% steel and 7% copper. Our rough estimate suggests that this equates to around 1,314 tonnes of steel and 100 tonnes of copper. For some context, a London double decker bus weighs about 15 tonnes.

At current market prices, the value of all this metal is about $1.2 million (metal prices are quoted in USD/tonne). But what if all the one penny and two pence coins in circulation were melted down? We could use this metal for other purposes (for example, the Aussies made Bronze Olympic medals out of their one and two cent coins). Using figures from The Royal Mint, we have found that there were 16.7 million coins produced between 1992-2011 (93% steel, 7% copper) and 14.2 million coins produced between 1971-1991 (97% copper), equating to 39,000 tonnes of steel and 73,000 tonnes of copper. If all the coins that were produced over this period were melted down, the value of all that metal on the open market would be $554 million (assuming that not a single penny was lost or destroyed).

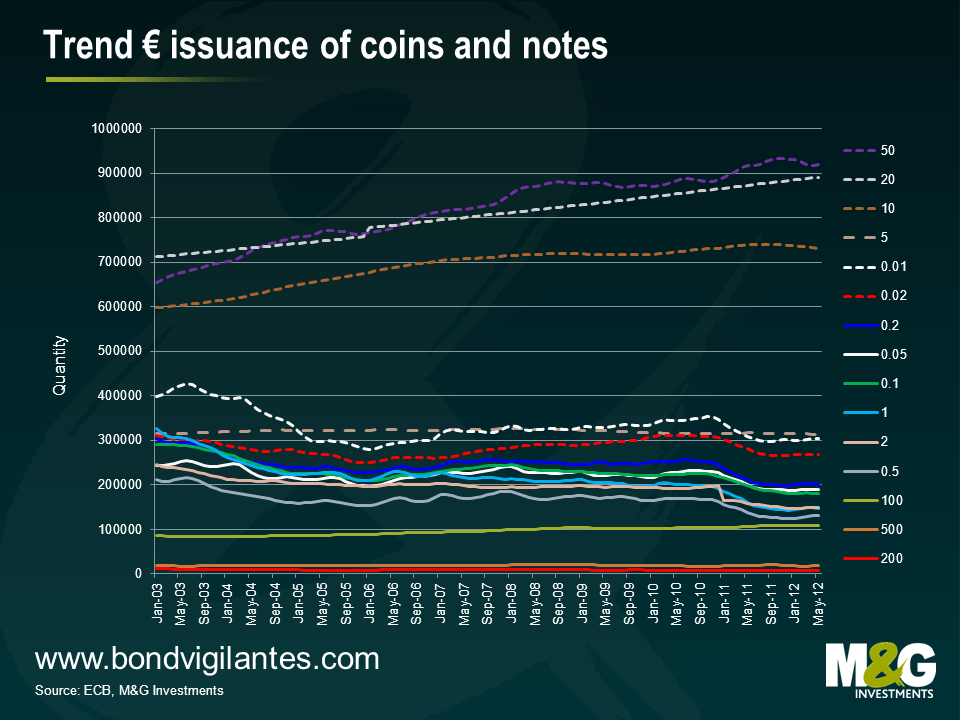

The same analysis for the Eurozone shows that last year’s one and two cent issuance has a scrap value of $17.8 million. Do the peripheral Eurozone nations really have the spare change to mint these coins? The scrap value of all the one and two cent euro coins in existence is almost $200 million.

So is it time the UK and Europe did away with these fiddly coins to save on minting and metal costs for the taxpayer? Some monetary union countries already have. The Netherlands and Finland produce only a small number of one and two cent coins for collecting purposes only. In these countries, businesses round prices up or down to the nearest five cents (Swedish rounding) if paying with cash. Eliminating lower denomination coins in Australia and New Zealand had negligible impact on inflation. Speaking of inflation, one penny in 1970 would buy 13p worth of goods and services today. There are also efficiency gains to be had at shopping tills around the country as businesses move customers through their tills at a quicker rate. And hopefully I would be able to get on my bus faster.

At a time when we are all penny pinching, it’s about time that those in government – including the UK Chancellor George Osborne – started thinking about it too.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox