Time to sell Bunds?

German government bonds have gone from strength to strength in recent times; much like the German team at the World Cup – I wish! But is the latest Bund rally sustainable? I think not.

Let’s start with the bull case. In a recent blog, I described how Bunds had provided an efficient hedge against surging political uncertainty in Italy, due to the negative correlation between yields on German and Italian government bonds. With all the political turmoil in the European periphery, Germany looks like a beacon of stability, but what about political risks within Germany? Chancellor Angela Merkel has been in office for nearly thirteen years, her authority however has increasingly been challenged of late. After falling out with her minister of the interior over Germany’s refugee policies, Merkel’s fourth cabinet (which had taken her five and a half months to forge), is facing its biggest crisis yet. An end to her chancellorship suddenly doesn’t seem far-fetched.

But even if Merkel gets ousted – and granted that’s a big if – German government bonds might actually benefit. This may sound counter-intuitive. Typically, political uncertainty around a member state of the Euro area triggers a sharp underperformance of its government bonds, as we have witnessed in the case of Italy. Are Bunds the exception though, due to their ‘safe haven’ status? Further tensions in Europe, even those originating in Germany, would most likely strengthen Bund valuations due to the ‘flight to quality’ reflex of investors. On top of that, in the event of a break-up of the Euro area, Bunds might get re-denominated in a new version of the Deutschmark, which would almost certainly appreciate against most other currencies, thus boosting total returns for Bund investors. Therefore, the higher the political risks in Europe, the higher probability of a Bund re-denomination.

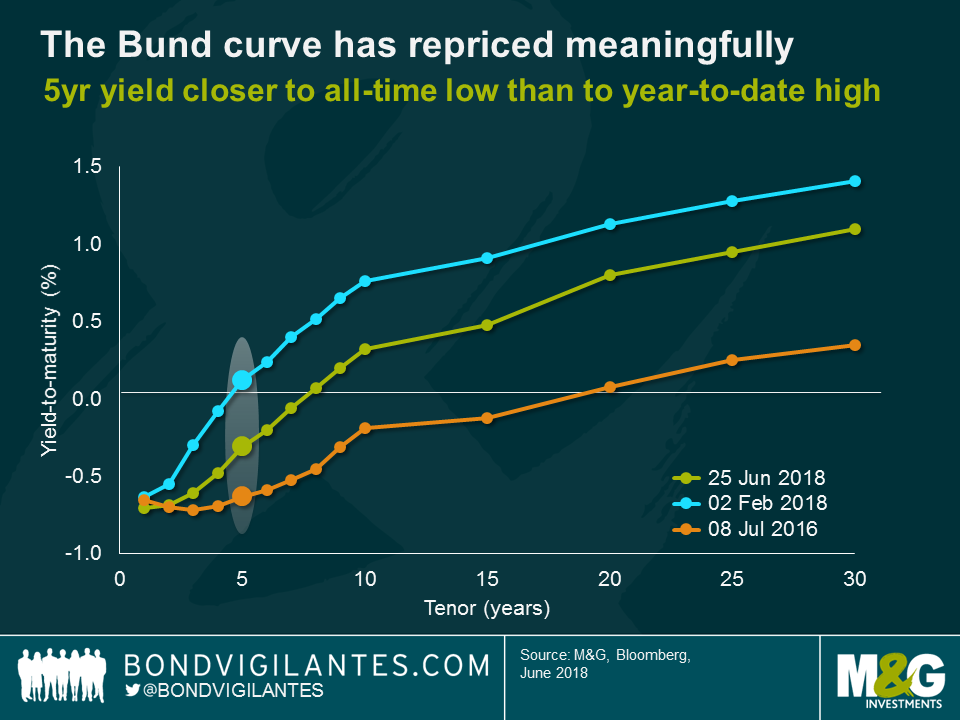

But how much further could Bund yields drop from current levels? It is worth highlighting that Bund yields have already repriced considerably in recent months, particularly at the front-end of the curve. The current five-year yield for instance (-0.3%), is in fact closer to its all-time low reached in early July 2016 (-0.6%) than to its year-to-date high in February this year (+0.1%). The belly of the Bund curve has rallied by around 45 basis points (bps) since February, while the long-end has tightened by more than 30 bps. These are very meaningful moves in the Bund market and I would argue that a fair amount of continued political uncertainty and risk aversion is fully priced in at current levels.

Of course, if ’risk off’ sentiment prevails, in theory Bund yields could drop below the 2016 lows. However, it is important to keep in mind just how extraordinary the situation was back then. In the direct aftermath of the Brexit referendum, doubts about the integrity of the Eurozone were soaring and, consequently, Bunds were benefitting from the aforementioned ‘flight to quality’ impulse and re-denomination speculations. In addition, central banks were flooding the market with liquidity. The European Central Bank (ECB) was buying €80 billion worth of securities per month and Bunds were at the top of their shopping list. Finally, after the dramatic oil price slump below $30 a barrel in early 2016, European inflation was non-existent. In fact, deflation was the concern as the harmonised index of consumer prices (HICP) dropped to -0.2% year-on-year (YoY) in April 2016. In short, all the stars were aligned. It was a unique moment in a time when conditions for Bunds could hardly have been any better.

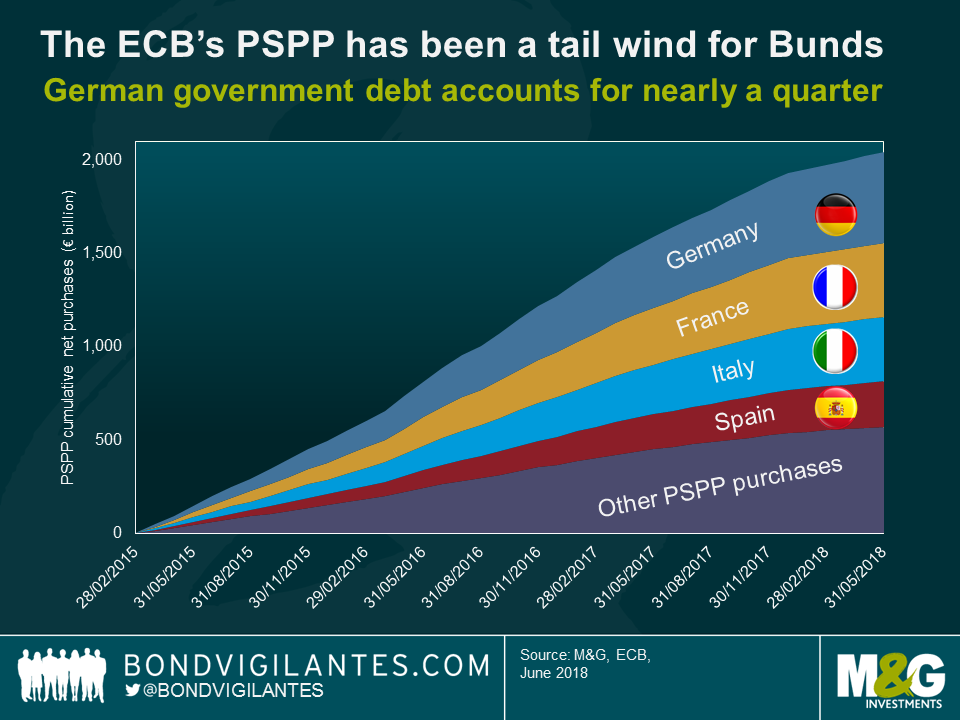

This is why I am sceptical that Bunds will reach mid-2016 levels anytime soon, if ever. European inflation has crept up with the latest HICP reading at 1.9% YoY and is thus in line with the ECB’s definition of price stability, while monetary stimulus is slowly being reduced. Net asset purchases will be phased out over the fourth quarter this year before being stopped altogether at year-end. Bunds have been the main beneficiary of the ECB’s public sector purchase programme (PSPP) (Cumulative monthly net purchases of German debt reached more than €485 billion at the end of May, nearly a quarter of all PSPP net purchases). Although principal payments from maturing securities will be reinvested for the foreseeable future, the ECB tailwind for Bund valuations is going to slow down noticeably going forward.

The market, however, seems to take great comfort from the announcement that the ECB has effectively ruled out any rate hikes at least through the summer of next year. While this measure may well pin down the very front-end of the curve, Bunds with several years to maturity are still vulnerable in my view. Once the general mood in markets becomes less jittery, I believe Bund yields are going to fight an uphill battle over the medium-term. It might thus be a good time to lock-in some profits and dial back Bund exposure.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox