Exceptional times

Interest rates – both short and long term – are at record lows in Europe. The driving force behind this is the belief that both employment and inflation will be lower for longer. This is something that concerns the ECB and Drahgi’s Jackson Hole speech implies further easing ahead. These appear to be exceptional times.

The story of how we got here is pretty simple: a global banking collapse in 2008, followed by a further severe bout of local damage to the banking system in Europe caused by the sovereign debt crisis in 2011 and 2012.

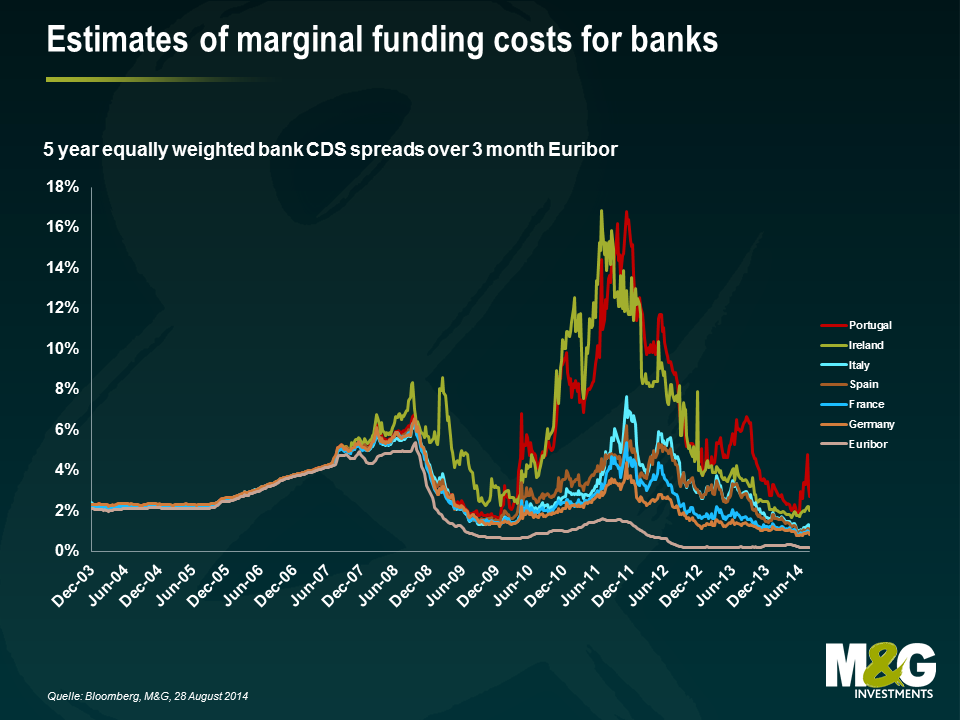

The chart below is an attempt to illustrate where true borrowing rates have been. Taking a proxy for the cost of finance and adding that to three month Euribor gives a better picture of real monetary conditions than by simply looking at the headline ECB rate. Monetary policy in the Euro crisis was tightened in the core, but more so in the periphery.

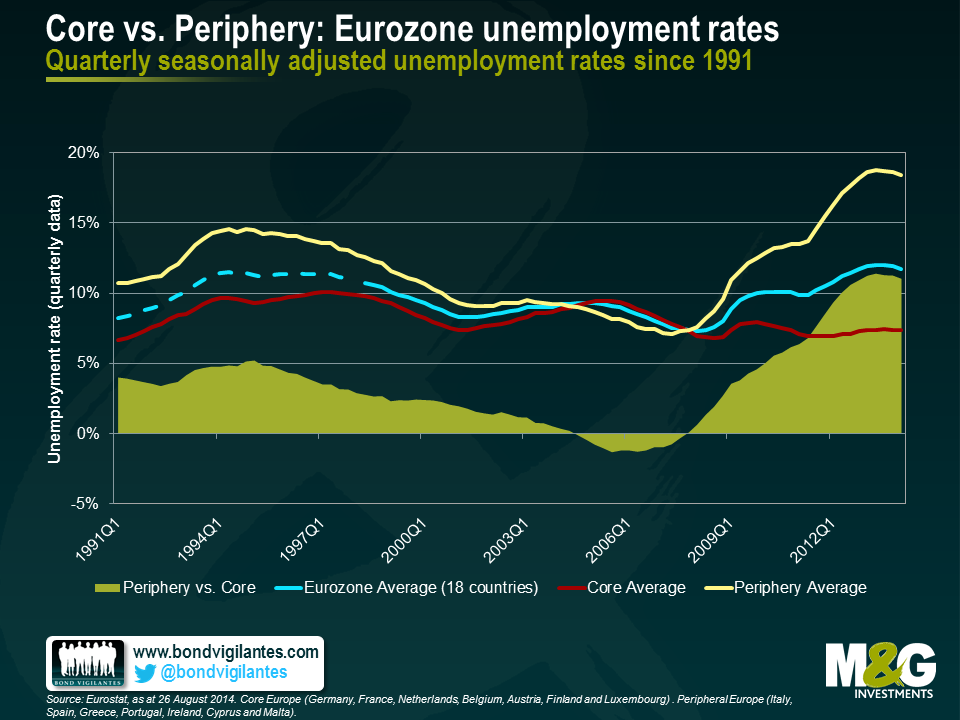

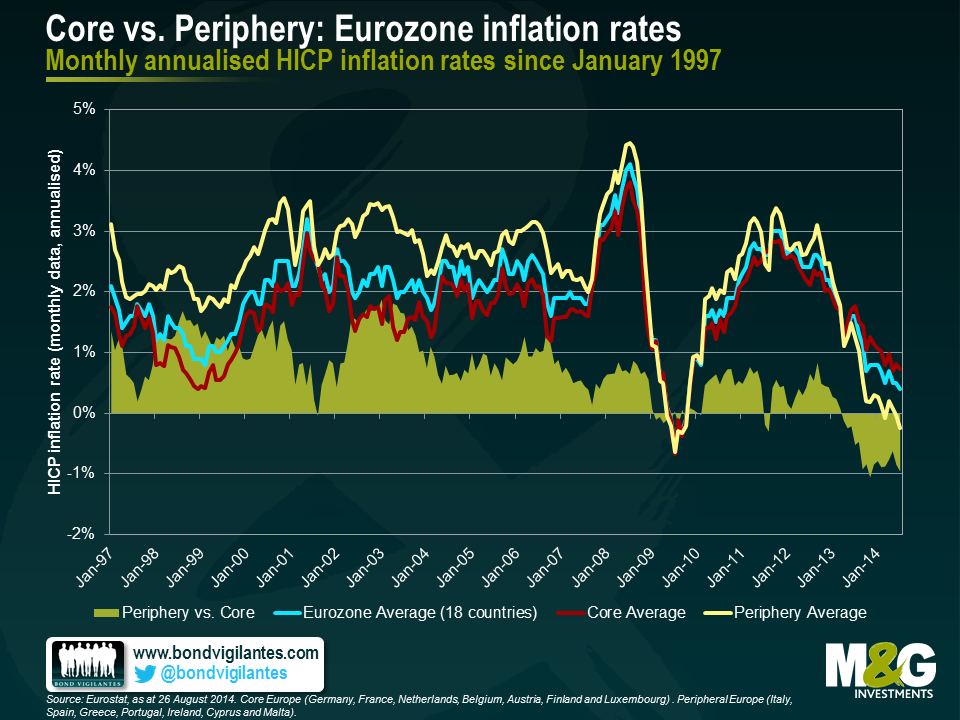

In the following charts we break out the inflation and employment data of the core and the periphery. What we see is that where tighter monetary policy is applied unemployment is subsequently higher and inflation is lower. It is not surprising that the Euro area and particularly the periphery have been weak given the severe monetary shock they took in the Euro crisis. This suggests that monetary policy still works.

Going forward, real monetary policy has effectively been eased aggressively from the summer of 2012 through to now. This should provide a boost to the Euro area, and in particular the periphery. Monetary policy is generally assumed to work with an 18 month lag and interestingly unemployment is already heading down. I expect this trend will continue.

We are in exceptional times from an interest rate perspective, but from an economic perspective unemployment has been this high before from 1994 to 1997, and inflation was below 1.0% in 1999 and 2009.

When economics deviates from markets you have to decide which is correct. I think that monetary policy works, and the huge easing from 2012 will bring about falling unemployment and prevent significant deflation. Exceptionally low interest rates in Europe seem out of line with the current and potential future economic data.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox