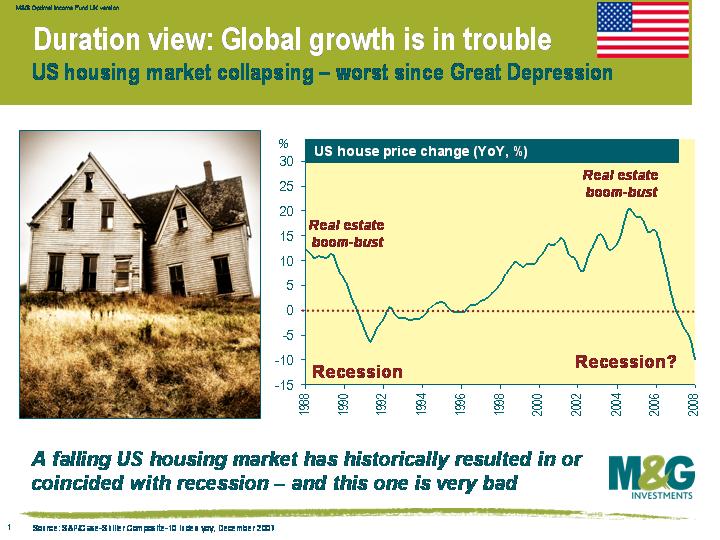

US housing downturn worst since Great Depression – and getting worse

Investors are almost becoming blasé to dire US housing market data releases, but the reality is that things are getting worse and worse.

The monthly S&P/Case-Shiller figures that came out on Tuesday showed that the US housing market downturn is now more severe than the one that led to the US recession in 1991. As the chart below shows, the S&P/Case-Shiller Index Composite-10 Index fell by 9.8% in the year to the end of December. In Q4, the index fell by 21.0% on an annualised basis. This index starts in 1987 – for a longer history, you need to look at indices such as the catchily-named ‘US New One Family Houses Sold Annual Median Year Over Year Price Change’. This index fell 15.1% in the year to the end of January, the biggest fall since records began in 1964.

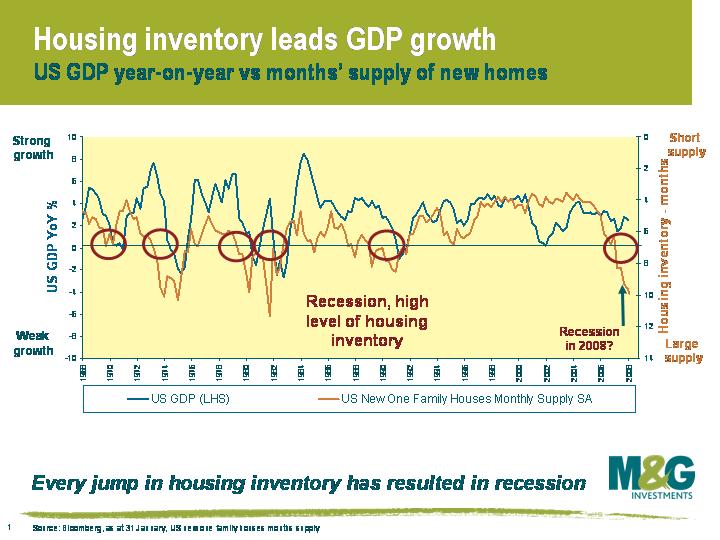

The excess supply of houses in the market suggest US house prices will continue deflating. The number of US homes for sale rose 5.5% to 4.2 million in January – at the reported sales pace, this represents 10.3 months’ supply, just below the record set last October. The months’ supply of new homes on the market rose to 9.9, representing the largest housing stock overhang in the US since 1981. US house prices will continue falling until this overhang is significantly reduced.

This chart shows that the months’ supply of new homes is a very good predictor of US recessions. When the months’ supply of new homes breaks above 7 months (as shown by the yellow line, inverted on the right hand axis), the economy goes into recession (blue line, left hand axis). A figure of around 10 months’ supply suggests the US is about to head into a nasty recession – worse than what we saw in 1991, more akin to 1974-5.

Ben Bernanke yesterday stated that US real GDP has ‘slowed sharply since the third quarter’, US consumer spending has ‘slowed significantly’ since the end of 2007, and that labour market conditions have ‘softened’. Furthermore, ‘the risks to this outlook remain to the downside…the housing market or labour market may deteriorate more than is currently anticipated and that credit conditions may tighten substantially further’. This is a clear indication that the Federal Reserve is prepared to lower interest rates further. The Bank of England now needs to act in a similar manner.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox