Jobless claims and Fed policy

Today’s release of jobless claims shows that the US economy is continuing its healthy response to the stimulus provided by the Fed. Momentum in the US labour force remains in a positive direction.

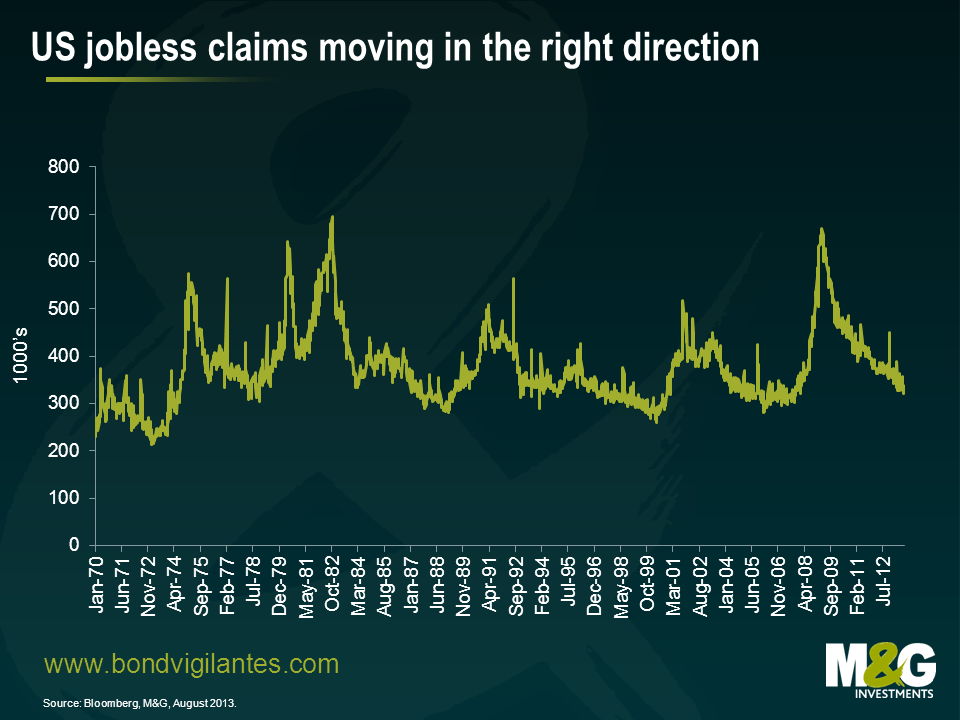

The very long term chart below shows today’s headline number of 331,000 to be relatively low historically. However, this is actually understating the current strength of the labour market.

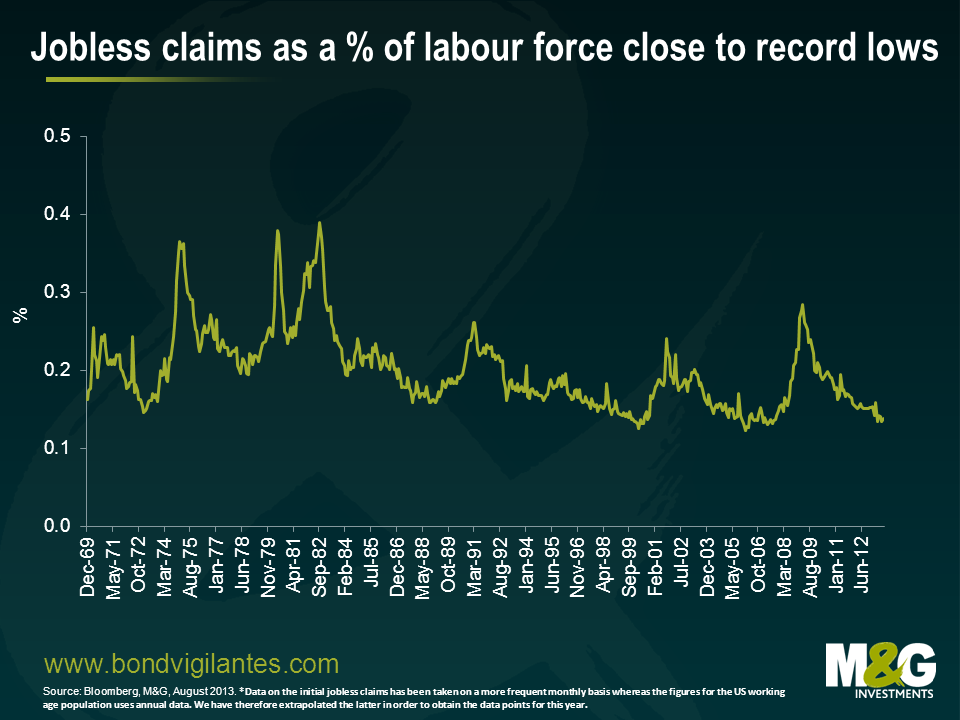

In order to interpret the jobless rate more effectively we need to look at it as a percentage of the ever increasing labour force, and not just the headline number. We have made those adjustments in the chart below.

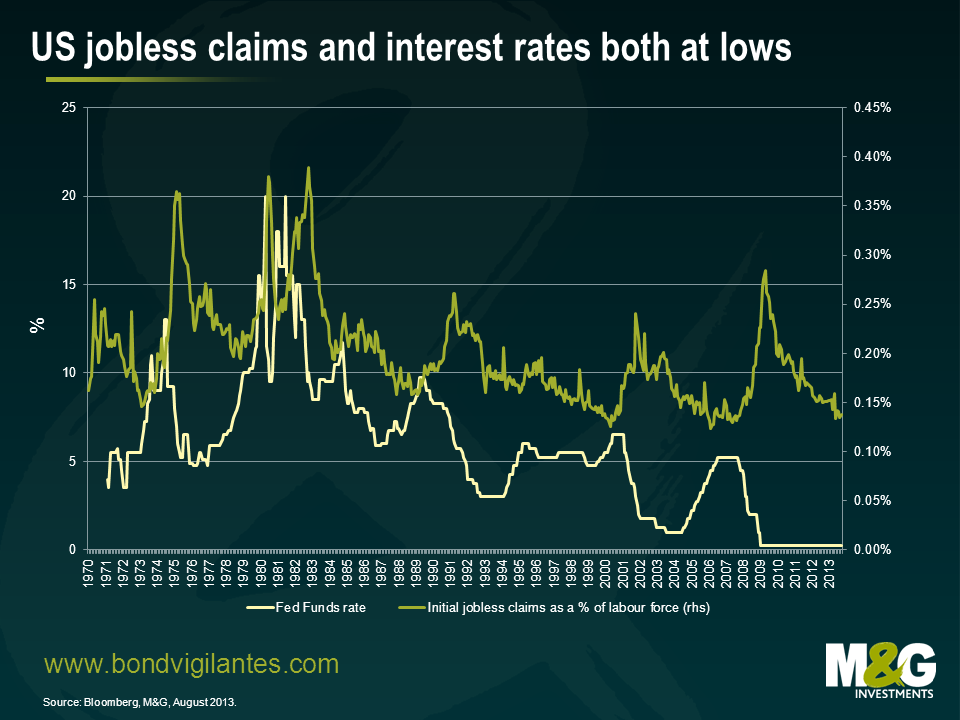

The fact that the economy has thankfully responded to low rates is good, though not new, news. However, the one thing that is very different this time is where we are in the interest rate cycle. At previous lows in jobless claims the Fed has typically been tightening to slow the market down. This time they are still in full easing mode with conventional and unconventional policy measures. This contrasts dramatically with the lows in jobless claims in the late ’80s and the beginning and the middle of the last decade, when the Fed was already in full tightening mode. This is highlighted in the chart below.

As you would expect to see, interest rate policy works with a lag. Given that we are unlikely to see conventional tightening for a while, one would expect the US economy to remain in decent shape.

A bear market in bonds can be seen as predicting a future normalisation of rates. If, like the Fed, you recognise that this time around things are not all normal, then you could expect short rates to stay low and employment growth to continue. The extent of the current bear market in bonds is therefore limited by the new environment we are in, where conventional economic systems have been amended and changed by the financial crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox