Staying afloat: how FRNs can offer an escape route from rising inflation

The world is coping with some extreme inflationary shocks as we speak. In addition to rising shipping costs and global supply chain disruptions that began last year, the ongoing strength in the labour market and the wealth effect resulting from the booming housing market, we now face the prospect of soaring food prices on the back of the sharp moves in oil and soft commodities triggered by the ongoing Russia/Ukraine conflict.

As a result government bond yields and spreads have had to readjust to rising yields and rising credit risk premia in the last few weeks, which has arguably been a double whammy for fixed income investors. Against this backdrop there’s still ways to mitigate away these risks, particularly in the context of higher inflation and central bank response, one being the High Yield Floating rate note (HY FRNs) market.

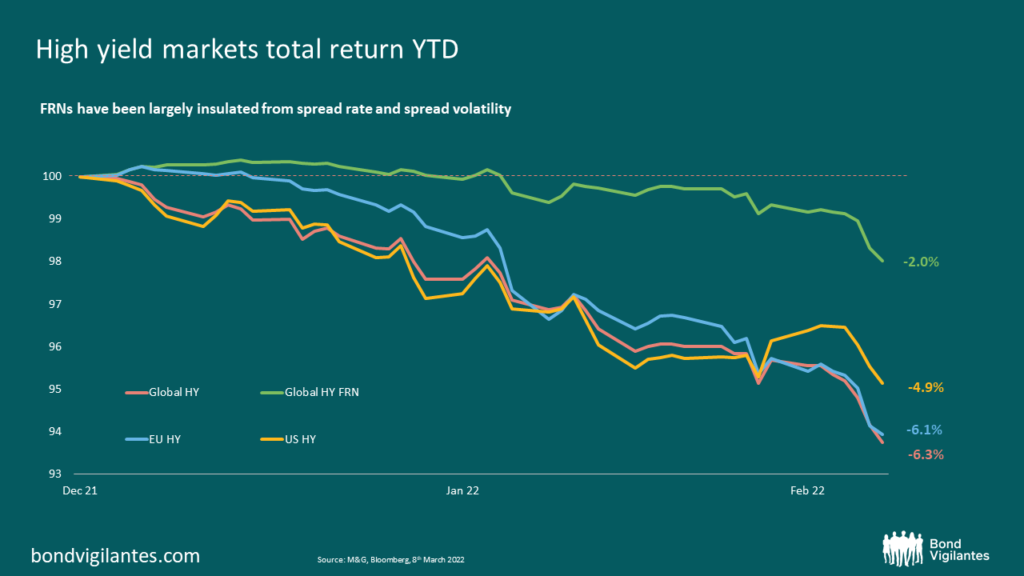

As we have previously discussed, HY FRNs have near-zero duration risk, floating coupons and lower market beta than conventional markets, which make them uniquely well positioned to deal with the current market environment. As shown in chart below this has held true so far this year. While conventional high yield markets have lost over 6% to date, HY FRNs have fared much better outperforming by circa 4%. The key differentiator has indeed been their lower duration and spread beta, which has largely insulated investors from recent volatility.

It’s probably fair to say that high yield assets have been in a bear market since August 2021 when inflationary pressures began to be more aggressively priced in by way of rising government bond yields. The main development in 2022, though, has been the sharp repricing of credit risk which has pushed high yield spreads out of tight ranges and offers once again a reasonably attractive entry point. With yields back around the 5-6% area, the asset class is more likely to warrant above-inflation returns over the medium term.

What’s the potential upside in FRNs today?

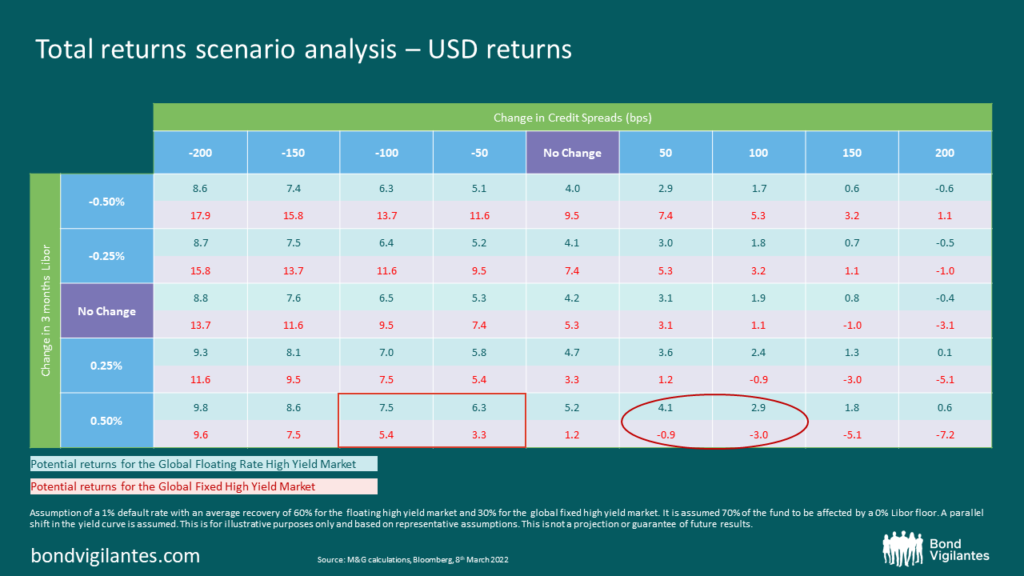

We try to answer this by looking at some total return scenarios for both floating and fixed rate high yield markets. Our analysis is based on changes to spreads and interest rates. For simplicity, we assume a 1% default rate, with an average recovery rate of 30% for the fixed high yield market and 60% for the FRN market due to their higher seniority.

What conclusions can we draw?

- In absolute terms, the risk-reward profile for both markets appears reasonably attractive. Spreads are hovering at around 500bps in the fixed market and 570bps in the FRN market, means a recession is arguably already reflected in prices. At current levels of yield floating rate investors would need to see another 200bps of spread widening before they incur a loss. For fixed rate investors, with higher sensitivity to spread changes, outright losses would come earlier, but still need spreads to widen by at least 150bps. All in all, this still suggests a reasonably attractive risk-reward pay-off for investors, consistent with potentially mid-single digit returns. Non-US dollar investors would need to bear in mind the cost of hedging currency risk.

- In a bullish scenario (rectangle), if bond yields continue to rise and are accompanied by some spread tightening, FRNs would experience a minimal price impact and will likely better protect capital, thanks to their marginal duration. Furthermore, if central banks decide to hike their rates, FRN coupons, which are pegged to short-term rates, would automatically adjust upwards, boosting coupons. Fixed rate high yield, instead, would underperform, seeing a far greater impact from rising interest rates that would significantly reduce any potential returns from carry or spread compression.

- In a bearish scenario (oval), which could involve a further repricing of credit risk due to second order impacts from inflation, the floating market would also play in favour thanks to their lower spread beta. FRNs are half as sensitive to credit risk repricing compared to the fixed rate high yield market, and have historically offered greater downside protection in periods of widening spreads.

The big unknown today remains the medium-term path for central bank response and interest rates. While in the short-term central banks may well prefer to take a cautious stance to deal with possible growth and employment implications arising from the ongoing conflict, the higher levels of latent inflation in the system compared to previous hiking cycles leaves them little time for reflection. Finding the right policy balance to deal with the potential downside risks to growth and higher inflationary outlook will be no easy task.

For the time being, and absent a full-scale recession, HY FRNs remain uniquely well placed to deal with the current environment through the combination of their low duration sensitivity, that protects against rising bond yields, and a reasonably attractive coupon level that will help mitigate the income erosion effect from inflation.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.