Sustainability-linked bonds: a growing market that will soon be too big to ignore

For public debt market participants, running a well-diversified portfolio with holdings that can be credibly classified as generating environmental or social impact can be challenging. One reason for that is that most of the sizable issuers in the public debt space are mature businesses as opposed to newer business disrupters that can be found more frequently in the equity space. In debt markets, it is private debt that is more naturally suited for project-based impact financing.

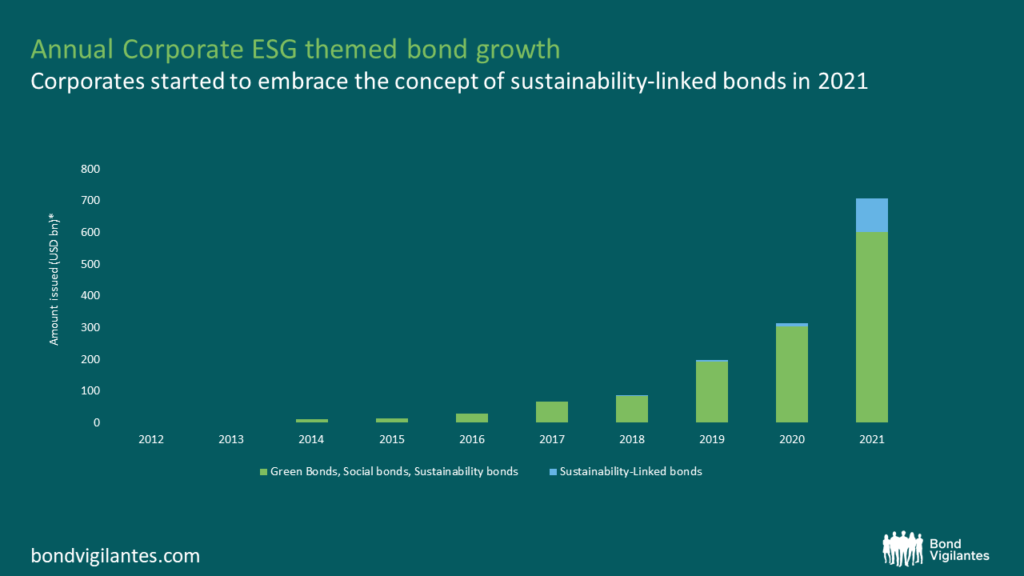

Having said that, the ESG-themed bond market, which is growing incredibly fast, provides a tool for public debt investors to achieve a positive contribution to environmental or social challenges. ESG-themed bonds are too big to ignore. To put some numbers on it, global ESG bond supply from corporate issuers totalled USD 707 billion in 2021, a growth rate of 225% versus 2020 issuance. Basically, every fourth euro printed in 2021 from euro investment grade companies has come with an ESG label to market.

Sustainability-linked bonds (SLBs) had their breakthrough in 2021 with more than USD 105 billion worth of paper issued, representing 15% of all ESG themed bond issuance. A year earlier, in 2020, the concept was hardly used, with SLBs representing only 3% of total ESG-themed bond supply in the corporate space. Going forward, I expect the SLB market to be the fastest growing segment measured in percentage year-on-year growth. There are good reasons for this, as I explain below. Investors who want to stay on top of public fixed income markets need to look at sustainability-linked bonds now.

SLBs versus classic green and social bonds

From a corporate perspective, the key advantage of SLBs versus classic green or social bonds is that proceeds do not necessarily need to be spent on defined environmental or social projects (which is the case for green and social bonds). Rather than committing to a specific use of proceeds, the company does commit to achieving certain sustainability improvements on a corporate level. Such improvements are often related to a reduction of the company’s carbon footprint or improvements on health and safety measures for employees.

This concept is particularly useful for issuers with smaller capital structures that might struggle to identify enough green investment projects that can qualify for a green bond issue. Unsurprisingly, the SLB structure has been embraced particularly by high yield issuers – typically companies with smaller capital structures, and therefore raising debt less frequently than investment grade issuers. Roughly 40% of total SLB supply last year was issued by companies with a high yield rating.

For bond investors, SLBs have potentially a much greater reach given that they directly address the corporate strategic alignment to sustainability. While green bonds give investors certainty about the proceeds spent, the proceeds might reflect only a small part of a company’s overall capital expenditure. In addition, Sustainability-linked bonds generally build in a financial incentive for the issuer to achieve certain ESG-related goals by a certain date; otherwise, a coupon step-up and/or redemption premium step-up will apply to the issuer’s bonds, compensating bond investors for a lack of sustainability progress.

While the ESG-themed bond market is still evolving, we can observe interesting price patterns. While investors are still paying a premium for owning green bonds (often referred to as “greenium”) – something which can be explained by supply/demand imbalances (e.g. efforts to increase EU taxonomy aligned exposure of funds) – SLBs do not show the same pricing patterns. Often SLB’s trade in line with the non-ESG bond curve, in rare cases even at a discount which makes them more attractive for relative value bond investors.

SLB sustainability-targets must be assessed carefully

The financial elements of those deals are typically straightforward and well flagged at point of issuance. However, there is an element of increased complexity in assessing the ambitiousness of the sustainability performance targets, as well as the relevance of any financial penalty that is triggered by a company not delivering on these targets. A key downside to the flexible structure of SLBs is that it is much harder for bond investors to define a market standard. A sustainability Key Performance Indicator (KPI) set in the company’s SLB framework should be relevant and material to the issuer’s underlying business model.

Sustainability Performance targets, which trigger a coupon step up should they not be met, need to be well-calibrated, ambitious and, should the company target climate-related KPIs, be aligned with a pathway to reach the Paris Agreement’s 1.5 degree goal. Coupon step up levels and trigger points need to be structured in a way to make them financially relevant to the lifetime of the bond. To assess the quality of sustainability-linked bonds, a full understanding of the issuer’s business model is required that goes beyond just financial metrics, something that requires credit research resource.

Watch out for greenwashing

Unfortunately we still see too many unambitious deals being priced in the SLB space. We have come across deals where not only the step-up date falls after the end of the non-call period for the bonds, essentially allowing issuers to call bonds before a coupon increase can take place, but also without a KPI-related redemption step-up built into its call schedule. We have seen an SLB deal of a pipeline business which focused on social targets, rather than committing to Scope 3 emission reductions and tackling pipeline leaks, which would be considered more material for the business model. We have also seen an SLB deal being priced from a high yield issuer where a failure to achieve a Sustainability Performance Target would have resulted in a minor coupon increase of only 0.125% per annum, with a trigger point relatively close to maturity – a step-up representing a fraction of the companies refinancing costs in the market, making the financial penalty almost irrelevant. In summary, the SLB market has to mature further and I am convinced its natural evolution is going to happen.

At the current stage, however, I consider the greenwashing risk to be bigger for SLBs than for green bonds. It seems that for now there is enough demand for SLB bonds from non-ESG minded investors, who can overlook the sustainability side of such deals. What is needed is more constructive dialogue between buy-side investors and Debt Capital Market desks, and push back from bond investors to issuers on insufficient deal structures. As with all ESG-themed bonds, we should always remember these deals are self-labelled and can fall short of expectations. Therefore, a quality assessment is needed to assess the potential greenwashing risk (or social-washing in regards to social bonds). While second party opinions help, they can be overly generous with the issuer at times. Further scrutiny is required too to assess the corporate strategic alignment of such ESG-themed bond deals.

The SLB market will soon be too big to ignore

As mentioned earlier, I am the view that the SLB market will soon become too big to ignore. We see an increasing number of companies announcing that all their future issuance will come in form of sustainability-linked bonds. It also allows companies for which the core of their business is not (yet) compatible with green financing (think about an oil & gas transportation business, which pursues energy efficiency programmes by installing heaters with more efficient technologies to reduce methane emissions) to tap into a growing sustainability-minded investor base. Bond investors will likely see much more SLB investment choice coming from various sectors with issuance across the whole credit quality spectrum, but those investment opportunities need to be carefully evaluated to assess greenwashing risks.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.