Are ESG-themed Bonds Compatible with Junior Debt?

The growth of ESG-themed bonds continues with no slowdown in sight. While project style financing for named projects or defined activities, particularly around environmental improvements via green bonds continues to see high demand, newer concepts such as Sustainability-Linked Bonds (SLB) show very high growth rates. SLBs offer an issuer far greater flexibility over how debt capital raised is used. As long as the company achieves certain stated group-wide sustainability improvements over the lifetime of the bonds, the money raised is available for general corporate purposes and is not restricted to defined investments. As a result, an increasing number of companies have been able to state that going forward, all their bonds will come in form of ESG-themed bonds. We have written in the past about the different flavours of ESG-themed bonds here.

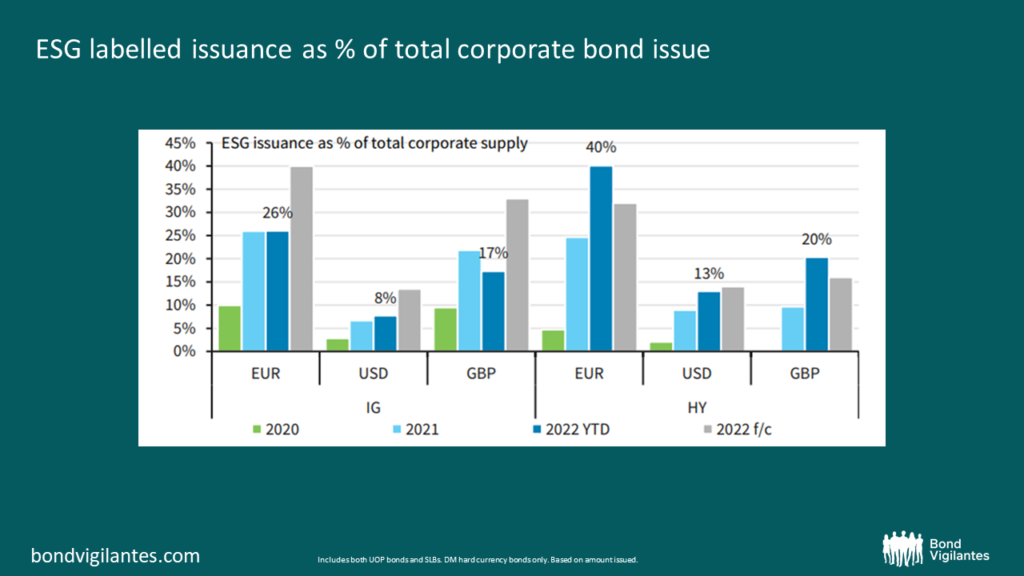

With company capital structures being financed more widely through ESG-themed bonds as shown in the chart above by Barclays, the question arises on how compatible ESG-themed bonds are with certain parts of the capital structure. In general, ESG-themed bonds are debt issuances where the credit-risk of the themed issuance is pari-passu with same seniority of ordinary bonds from the same issuer. The fact that bonds are issued with a subordinated payment rank is not causing a conflict of interest here, but in my view, subordinated debt with equity-like features requires a closer look. Corporate hybrids and subordinated bank paper in the form of Additional Tier 1 bonds (AT1) are good examples to determine if bonds with deeply subordinated payment ranks, can be married with ESG-themed bonds concepts.

Financials

Let’s start with junior subordinated bank paper, which often come in the form of Basel III compliant AT1 bonds. Such instruments are issued to meet regulatory capital requirements and include a feature whereby the bonds can be converted to equity or written-down should the Core Equity Tier one (CET1) ratio fall below a certain predetermined level or the financial institution be considered non-viable by the regulator. We would argue that bonds with an equity conversion or write-down feature show limited compatibility with the pre-defined project financing standards of use of proceed bonds such as green, social or sustainability bonds. Financial institutions issuing AT1s receive capital benefits, i.e. an improvement in regulatory capital ratios, which do not have any requirements from a green or social perspective. By design, AT1s are instruments to support the entire broader balance sheet at point of issuance and therefore run the risk that the intended green or social project financing is not followed through, should a conversion trigger or a write-down kick in.

The more flexible concept of SLBs comes with other complexities, particularly in subordinated situations, mainly related to the contractual financial penalty in form of coupon step-up and/or a redemption premium should the Sustainability Performance Targets not be achieved. In our view, a case can be made that the option of a financial penalty can provide an incentive to call, something that needs to be avoided when structuring equity-like financial debt. An opinion provided by the European Banking Authority (Report on the monitoring of Additional Tier 1 instruments of EU institutions.pdf (europa.eu)) supports this view as it suggests that sustainability-linked features do contradict the requirements of the Capital Requirements Regulation (CRR) for a security to count as AT1. Features like accelerated payment rights or incentives to redeem would not be allowed, amongst other things.

Corporates

Moving on to corporate hybrids. As a quick reminder, hybrid bonds allow the issuer to have choice over exactly how the instrument is presented in its financial accounts. Perhaps more important from a credit perspective, the instrument also receives partial equity treatment (typically 50%) from credit rating agencies under certain conditions. While not true equity as subscribed by shareholders, the equity equivalent recognition of hybrids supports the issuer’s credit rating and thus helps with debt market access. To receive partial equity treatment from credit rating agencies, hybrid bonds require loss absorbing qualities to protect senior debt, including the ability to conserve cash via coupon deferrals, and they also need to embed a permanence feature.

Similar to subordinated financial bonds, I believe that SLB features clash with the original concept of corporate hybrids particularly when aiming for credit agency equity treatment. In this case, the instrument’s ability to provide an additional cushion for senior tranches via cash conversion required by the credit rating agencies, interferes with the increased financing costs that can be triggered by not achieving the sustainability targets. One potential solution to this could be to structure an SLB with very ambitious Sustainability Performance Targets which, if successful, triggers a coupon step down. This would likely be seen as acceptable by credit rating agencies as it doesn’t work against the cash conversion features of hybrids. Whether issuers could secure demand from investors for such an instrument remains questionable, however. Even if so, I believe it is generally harder to marry a permanence feature prevalent in hybrids with Sustainability Performance Targets and related trigger points along the lifetime of the bond. Interestingly, we’ve seen examples where companies have committed to issuing only SLBs going forward only to issue hybrids the following year, neither of which included any sustainability-linked features.

Use of proceed hybrid bonds, whether green or social in nature, lead us to a different conclusion, as the financial terms will not change unexpectedly over the lifetime of the bond to the detriment of senior bonds. In addition, and opposed to subordinated bank debt, hybrid bonds do not have equity conversion or write-down features which is a key difference. Hybrids also do not come with any regulatory benefits compared to AT1s. As a result, the defined project financing cannot be derailed as is the case with convertible features prevalent in Basel III compliant AT1 bonds.

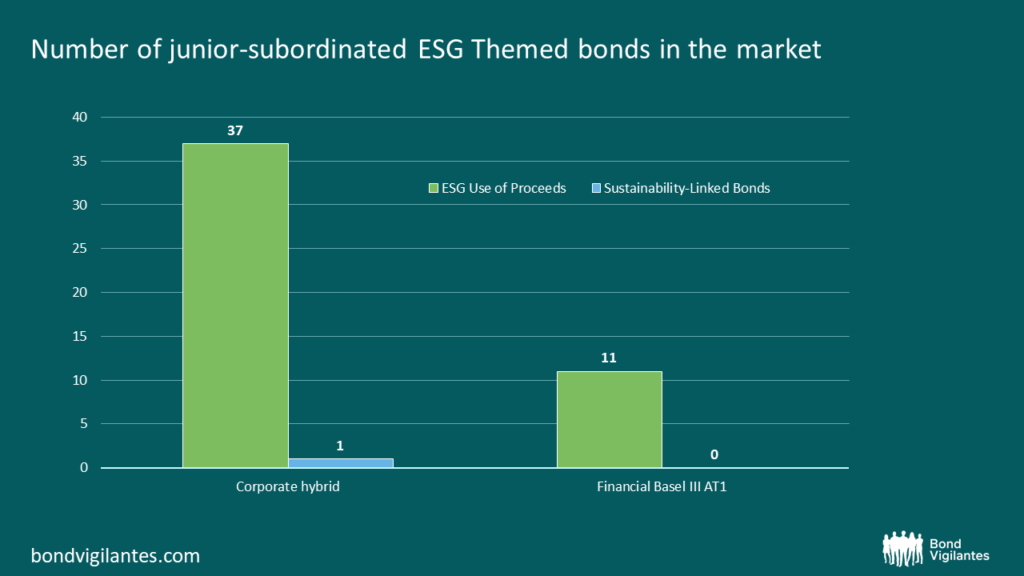

The question is “Do bond markets agree with our thinking?”. Looking at current market trends, we can see this pattern holding for now. Sustainability-linked features remain absent in the deeply subordinated bond space. One area where bond markets tend to disagree with us is on AT1s where financial institutions have been successful in issuing use of proceed instruments in the form of green and sustainability bonds. More evidence that views from market participants continue to differ, as the exciting ESG-themed bond market continues to take shape.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.