Europe’s energy winter

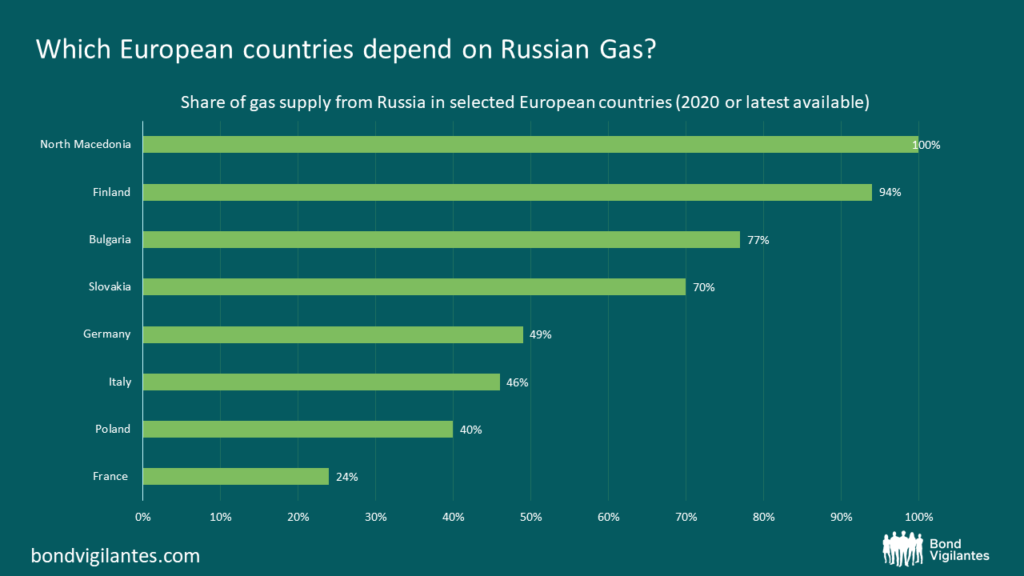

The restriction of natural gas flows from Russia into European countries continues to be a threat to European and global economies. The situation is most acute in Germany where the economy is more dependent on cheap and reliable energy to power its manufacturing industry.

Higher energy prices will have knock on consequences to food prices and business confidence

Having become reliant on piped gas from Russia, Germany does not currently have any liquefied natural gas (LNG) import terminals that could compensate for the reduced imports from Nordstream One. Germany’s IFO business climate index fell to 88.6 points in July, down from 92.2 points in June, to reach its lowest value since June 2020. This indicates that companies are expecting business to become much more difficult in the coming months.

German chemicals giant BASF paid an extra €800m to keep its plants operating in the second quarter compared with the same period a year earlier. The impact of higher energy prices has now forced the company to make the difficult decision to reduce the production of ammonia, which is used in the agricultural industry as fertiliser. This will have consequences for the farming and food industries and contribute to the ongoing cost inflation we are seeing in food prices.

European markets are already feeling the pain

European equity markets have been factoring in the negative implications of the gas supply disruptions. The S&P 500, which started the year at a much loftier valuation, has seen its value fall 15% year to date, but Germany’s main index, the DAX40, has seen its value fall 17% over the same period. The S&P 500 now trades at 20x price-to-earnings compared to the DAX40 at just 12x.

The Euro is also trading at a 20-year low versus the US dollar with the currencies now nearly at parity. This will provide some respite for European manufacturers as, whilst energy costs are rising, a depreciating currency will help keep their cost base competitive. While the US Federal Reserve has been much more hawkish in raising interest rates, the ECB – which is also facing high inflation in the Eurozone – has been much more reluctant to raise interest rates as its economy faces greater challenges.

Investors will look to companies with strong balance sheets to withstand the winter

Given the interdependence of global supply chains it is difficult to ascertain which companies will be most affected. While we may see some industrial production come offline during the winter period as governments prioritise energy to households and priority public services, this is likely to last only for one winter period. The key when investing in affected companies is to ensure they have strong balance sheets to get through this period that will likely see elevated costs and reduced revenues.

An example is European aircraft manufacturer Airbus, a significant user of energy which builds its aircraft fuselage in France and Germany and manufactures aircraft wings in the UK. While the energy disruption could cause production slowdowns for Airbus, its over 6,200 order backlog means investors will likely look through this uncertain period. Airbus also has a healthy balance sheet where it is in a net cash position, leaving it sufficient liquidity.

It is not just industry that will feel disruption: consumers across Europe will likely feel the burden both through rising energy bills and the increasing price of goods. While consumers in some countries will be harder hit, those in countries less dependent on Russian gas will also feel these pressures due to how the European grid works. This is already visible in today’s energy prices, for example in the UK.

Looking to spring

Germany is now in the process of building four floating LNG import terminals and two permanent onshore sites. The German economic ministry is hopeful that two of the floating sites can begin operations before the end of 2022. Contracts have been signed with Qatar, Azerbaijan, Canada and the US for LNG deliveries. The key remains how quickly the infrastructure can be put in place to start receiving the shipments. Italy, France, Greece, Holland, and Poland are also building additional LNG import capacity to compensate for reduced gas flows from Russia.

While this winter will likely be tough for consumers and industrial companies alike across Europe, we should be in a much better position this time next year as our energy imports will not be so concentrated from a single producer and the infrastructure is in place to provide for greater flexibility.

The long-term winners from these issues are the companies that can benefit from the European Commission’s REPowerEU Plan. RePowerEU will help boost energy security and also aid the EU’s decarbonisation goals. While the EU already had a decarbonisation plan in place, these goals will be brought forward due to the immediacy created by Russia’s invasion of Ukraine. As part of its plan to diversify its energy sources, the bloc is proposing to raise its clean energy target for 2030 to 45% from the current 40%. Capital of up to €210bn will be provided along with a plan to slash red tape to get wind and solar projects online much sooner. This will be beneficial to utilities that are focused on renewable energy and those companies that provide solar power and wind turbine equipment.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox