The double-edged sword of good covenants in corporate credit

In periods of market stress, strong bond and loan covenants protect debt investors from company actions that would be adverse to creditors’ interests when it matters most. Yet, relative to their weaker covenant counterparts, bonds with strong covenants often see more pressure than would be expected or warranted in difficult market environments.

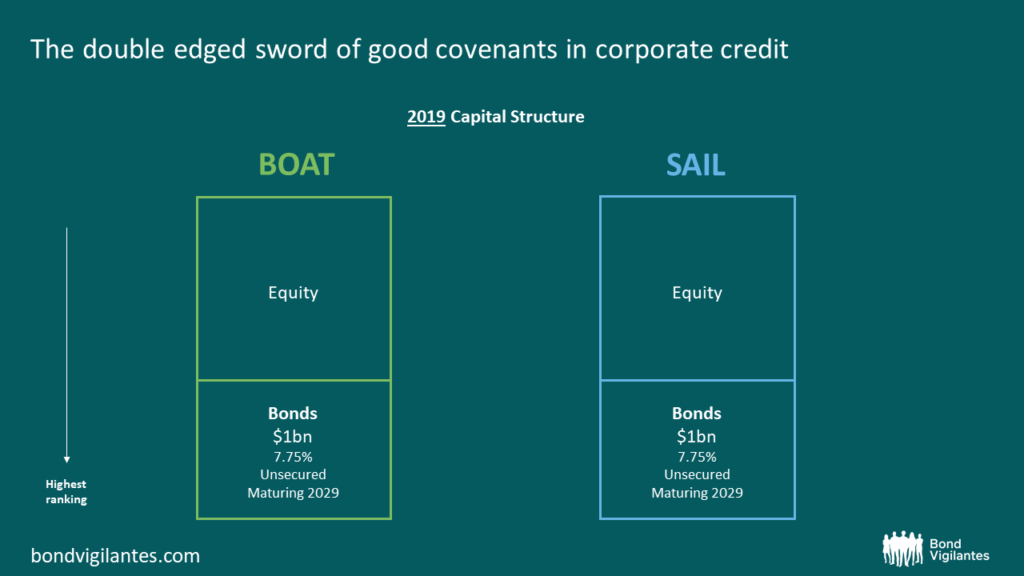

Flash back to 2019

Suppose I were to gift you $1 million of new issue bonds for one of two hypothetical travel companies – BOAT and SAIL:

1. BOAT 7.75% coupon, unsecured bonds, maturing 2029, priced at par

2. SAIL 7.75% coupon, unsecured bonds, maturing 2029, priced at par

Both BOAT and SAIL have identical capital structures and enterprise values. Their only debt outstanding is the bonds shown above, each totalling $1 billion. Both companies are in the same business and have the same healthy profitability and liquidity.

The only differentiating feature is that the BOAT bonds’ covenants prohibit BOAT from raising any secured debt, whereas the SAIL bonds’ covenants allow SAIL to raise an incremental $500 million of

secured debt.

Which bond would you pick?

The choice here is straightforward: the BOAT bonds are the better choice because they have stronger covenants, limiting BOAT’s ability to take out debt that would rank higher than the BOAT 7.75% bonds due 2029.

Fast forward to today – If I gifted you another bond now, which would you pick?

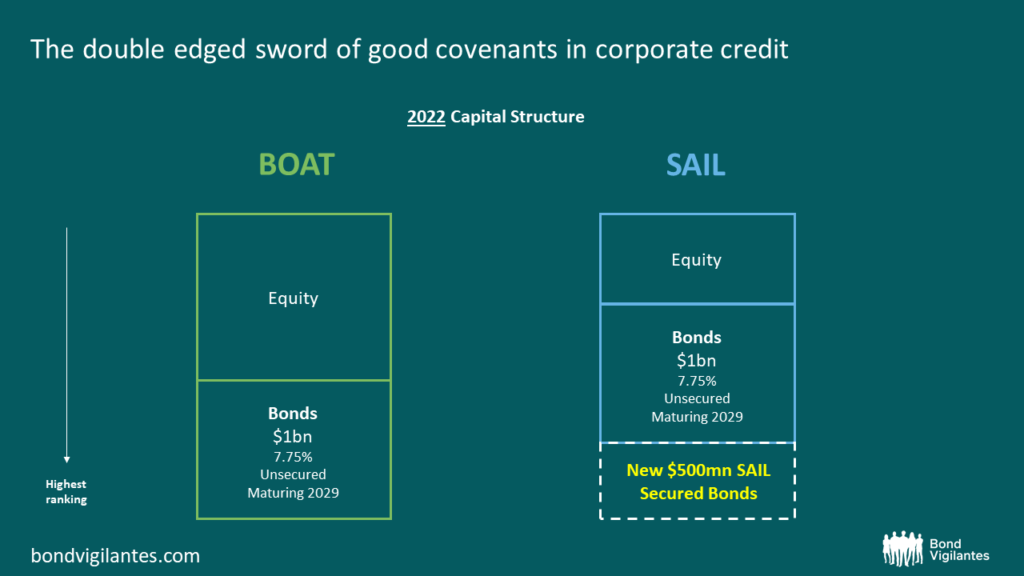

Since the end of 2019, let’s assume both companies have been severely impacted by the pandemic, seeing two years of zero profitability and pushing both bond prices from par down to 70 cents on the dollar (or 15% yield).

Fortunately, with global travel normalizing, there is a light at the end of the tunnel. But there is one last hurdle: the recent pandemic-induced stress eroded both companies’ liquidity and both need a cash injection to bridge the gap until profitability fully recovers. Neither company can access the unsecured debt or equity markets given where their existing securities are trading. Accordingly, the two companies start exploring alternate paths:

- SAIL, with flexibility under their debt documents (and a market receptive to lending only on a secured basis), hires bankers to help raise $500 million of secured (and priming) debt to raise their cash. Case closed, liquidity hurdle bridged.

- BOAT, on the other hand, does not have the same flexibility as SAIL under its debt documents. Therefore, BOAT starts reaching out to creditors to negotiate some covenant relief and even goes as far as hiring bankruptcy advisors to prepare for a potential Chapter 11 reorganization. Enter market anxiety.

In this context, it’s helpful to imagine the relative market sentiment. SAIL gets maybe a few headlines regarding their debt raise and rating agencies stay at bay. Meanwhile, news articles on BOAT are discussing the need for a covenant waiver/distressed exchange/bankruptcy (with headlines probably in all caps), agencies are downgrading BOAT’s debt to CCC, it’s dropping out of indices, and clients are calling managers asking for updates. While BOAT is still the right choice, it’s now the contrarian choice and just became significantly more difficult against the backdrop of this negative narrative.

The moral here is that while we love and push for good covenants on new issuances, it’s easy to see how the same tight covenants can cause knee-jerk market reactions when fundamentals take a negative turn and debtors’ options are pushed to the threshold. In the example above, the SAIL unsecured bonds are now in a worse position as they sit below $500 million of secured debt, thereby increasing the 7.75% unsecured bond’s risk. In contrast, the BOAT bonds – despite facing a serious liquidity issue – are actually in a better position at the top of the capital structure, with correspondingly greater asset coverage and less risk.

When things go wrong it is strong covenants that get us a seat at the table and allow us to protect our position – and, in instances like the above, potentially serve as identifiable pockets of investment opportunity with favourable risk/reward dynamics. This isn’t to say that covenants should be so tight that a company can’t manoeuvre, but there is definitely a reasonable medium. Fortunately, given market conditions right now, I would expect the negotiating leverage to start tipping more in favour of bond investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox