The liquidity ‘haves’ and ‘have nots’

Following on from Jim’s blog on Tuesday and yesterday’s extraordinary market events, I wanted to shine a light on the various actors in the collateral and liquidity markets and why we are in the eye of what I term as the liquidity ‘Haves and Have Nots’ storm.

The ‘Have Nots’

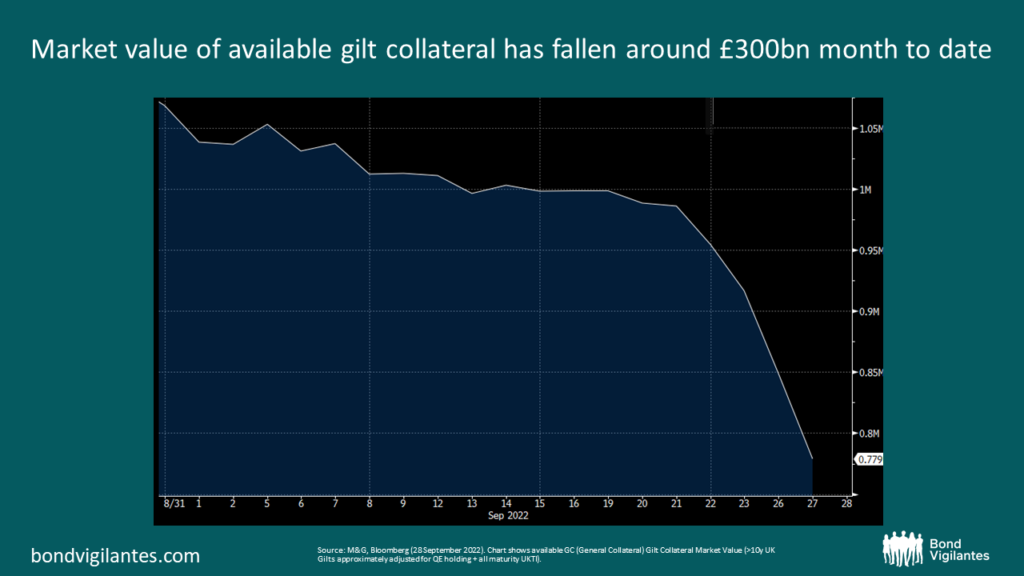

As Jim explained, pension funds are/have been servicing ever increasing margin calls driven by the extreme moves in real and nominal rates. They are on a hunt for liquidity (cash) to service these calls at the same time the liquidity (bid offer spread) of asset markets is extremely fragile. A sub layer to this dynamic is that pension funds are also a significant provider of gilts to the repo market (which they repo out to fund levered investments) and where we are now seeing some strain as these gilts are either withdrawn from repo programmes (to sell, as of yesterday to the BOE) or repo’d out to raise cash to fund said margin calls; see graph below showing the overall market value of available gilt collateral which has fallen sharply over recent days.

The timing could not be worse with quarter end looming, increasing demand for bank balance sheet from non-bank market participants and an ever increasing war chest of cash from the liquidity ‘Haves’ chasing collateral.

The ‘Haves’

However, it is also important to shine a light on the market participants that have significant war chests of liquidity in the form of cash and have, for various reasons, been holding this as a defensive strategy and or as part of a strategic asset allocation. This feels like a great position to be in right now and we have observed even more shoring up of cash buffers by these prudent cash managers over the past few days via shortening cash lending tenors, not extending term funding transactions and restricting liquid (collateral) assets such as gilts from lending programmes. Whilst unlike the pension fund example above they do not need to create liquidity (lucky them) this does need to be managed on a daily basis either via Money Market Funds (MMFs) or against repo collateral – again see the graph of decreasing gilt collateral. As we know, cash is also hoarded in MMFs and at the time of writing MMFs have shortened their Weighted Average Maturities (WAMs) in anticipation of redemptions (see the March 2020 Dash for Cash). We are watching this dynamic extremely closely.

In summary, there are very clear collateral strains for some sterling market participants and demarcation of the liquidity ‘Have and Have Nots’. The urgent question (with an unclear answer at the moment in my view) is whether this could spill over into a broader liquidity breakdown as the various actors seek to right-size or further shore up their defensive cash stocks during these unprecedented markets. One thing that goes without saying is that cash really is king at the moment.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox