Trick or treat, QT or QE

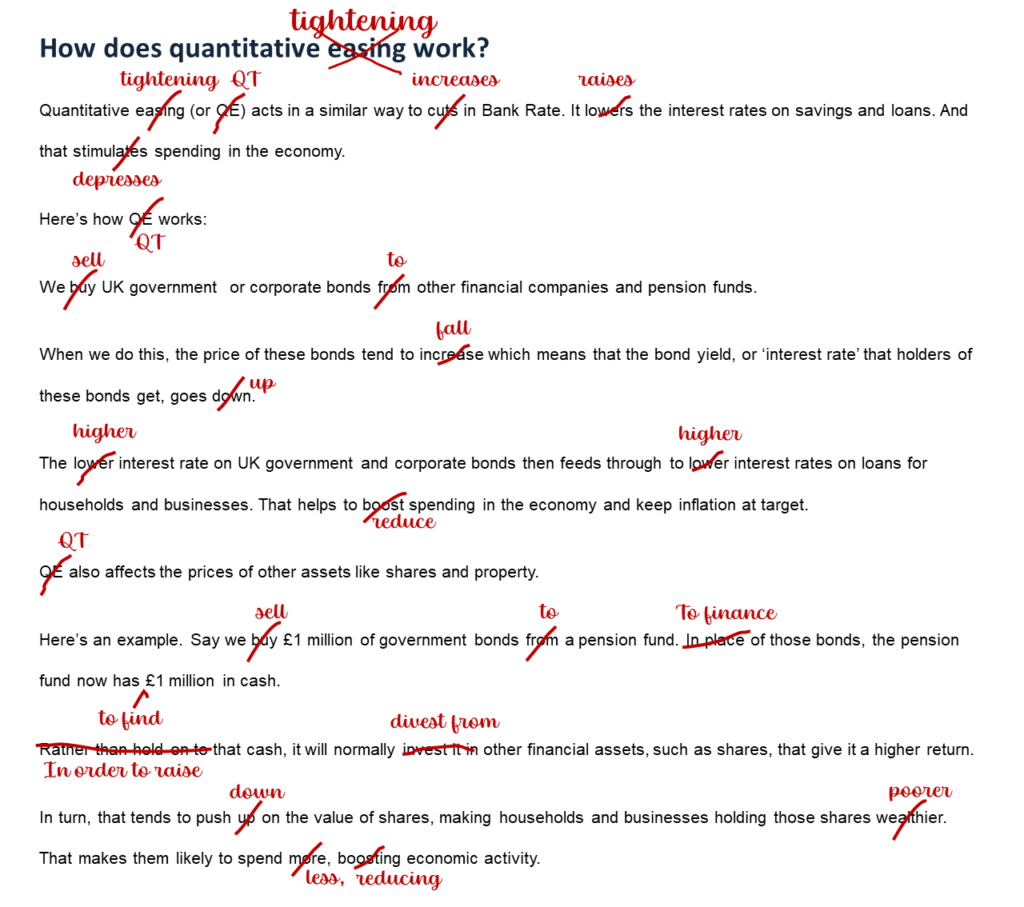

Quantitative tightening (QT) is due to start in earnest on the 1st November – just in time for Halloween! The Bank of England is scheduled to start a serious active sale programme of the assets it bought during QE, which was a ‘treat’ for the holders of the assets and was a policy measure they had to undertake to stimulate the economy as rates were at the lower bound. It is now time for the ‘trick’. The Bank describes on its own website why it engages in QE… let’s see how they would describe QT:

Edited extract from bankofengland.co.uk, “How does quantitative easing work?”

Source: https://www.bankofengland.co.uk/monetary-policy/quantitative-easing, M&G

QE was stimulative, QT is designed to restrict growth. We believe QE increased inflation – therefore, via reducing the outstanding stock of money, QT will act as an inflation dampener.

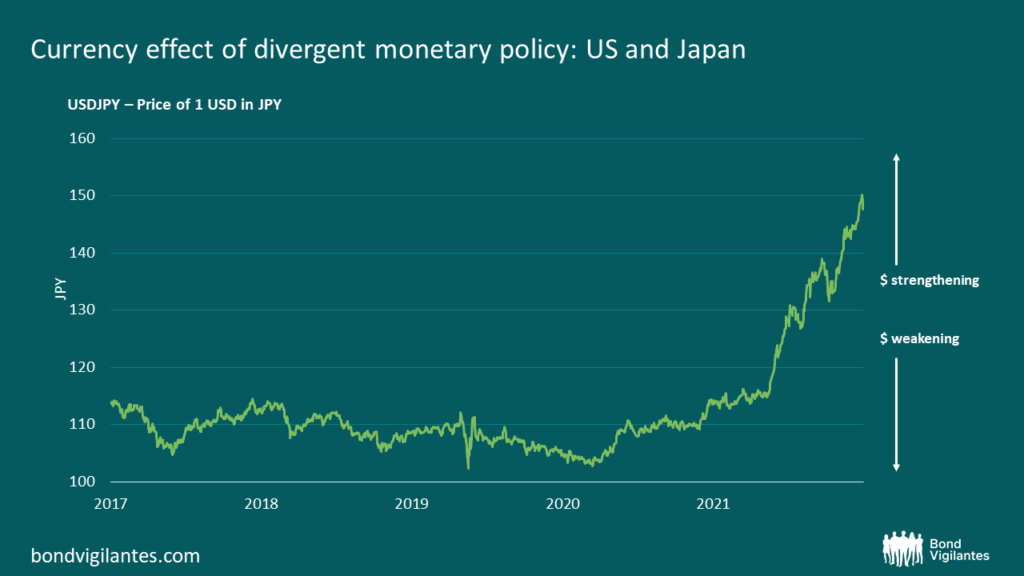

One of the potential side effects not mentioned in the Bank of England guide is the potential effect on Sterling. The transmission mechanism of interest rate changes affecting currencies is a potential catalyst for FX moves.

Another direct effect of QE/QT is that the excess supply of something reduces its value and vice versa. We would therefore expect currencies where the central bank pursues QE to have weaker currencies and currencies where the central bank implements QT to have stronger currencies. When all countries are printing or destroying money in unison then the effect is not noticeable. However, when one country is printing and the other is destroying its money, then the latter currency should be stronger. This explains the scary chart below.

Source: M&G, Bloomberg (24 October 2022).

QT will slow the economy and fight inflation for the reasons explained above. This policy aim could be further helped by subsequent strengthening of the currency.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.