When US borrowers amend the “sacred rights” of a bond

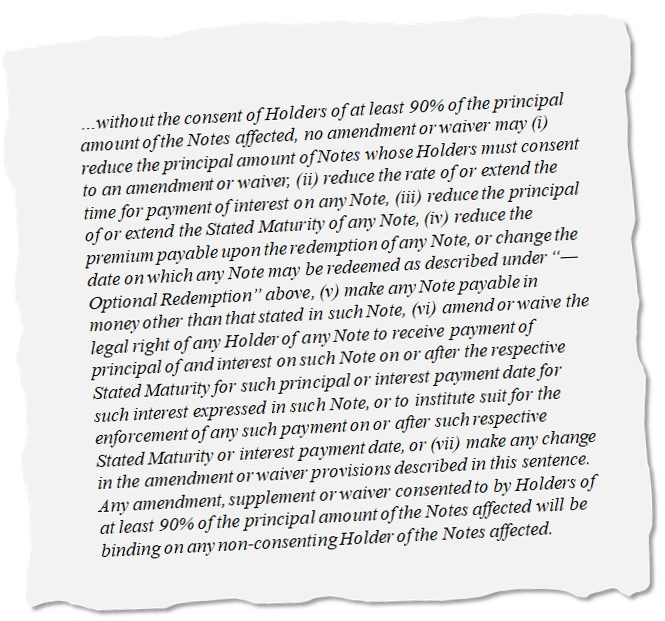

A US high yield bond issued this summer for a LBO of a building product company contained a particularly nasty provision with significant implications:

If you just skipped over the above, don’t feel too bad, most investors did too. Bond indentures are boring, long, and dense. Additionally, given the ever-increasing speed of the new issuance process, it’s not unreasonable to expect important issues to be overlooked. However in instances like the above, the provision should have been called-out.

To summarise, it says that the borrower can amend the “sacred rights” of the bond – the principal, coupon, and maturity – with just 90% of holders consenting. For sacred rights, the US standard is unanimous consent and anything less is problematic.

As an introductory example as to why, imagine that the building products company later offers a new and better bond to 91% of holders of the existing bond – but does so on the condition that prior to exchanging into the new bond, exchanging holders agree to, say, extend the maturity of the existing bond to 2099. This results in 91% of holders getting a shiny new valuable security, but leaves 9% in the dust with a piece of paper that won’t be repaid in our lifetimes (this and similar constructs are known as “exit-consents”). While this seems draconian, there is nothing in the indenture to prevent it; and as I will illustrate, this hypothetical just scratches the surface of how bad things can get.

For UK corporates, while we do see sub-unanimous sacred right consent thresholds more frequently, it has been less of an issue as the structure of UK documents, the approach of UK courts and reputational concerns of market participants have, to date, better served to protect against coercive exit consents of any nature.

For emerging market sovereign debt, similar provisions are also quite common. They appear in the form of collective action clauses (CACs), with the rationale being: sovereigns cannot resort to bankruptcy courts and must therefore rely on garnering sufficient bondholder support to restructure sacred key terms (i.e. principal, coupon, and maturity) for debt relief.

For US corporates, however, these provisions are wholly unnecessary. US corporates do have access to the US bankruptcy system where sacred rights can be restructured via a fair and orderly process. As this avenue is available and court protections outside of bankruptcy are limited (more on this below), given the lack of alignment/coordination/communication among the disparate group of syndicated bond market participants, anything less than unanimous consent for sacred rights carries with it significant potential for abuse by issuers at the expense of creditors.

In this context, what could happen next has unfortunately already been played out, with some high-yield borrowers having had an absolute field-day over the past decade, taking advantage of creditors by exploiting the non-sacred right amendment voting thresholds to extract value via exit-consents. The standard borrower playbook for extracting value from unsecured bondholders is to offer bondholders a new and better bond, likely with a large principal haircut, and in return, requiring exchanging holders agree to vote away all 50%-threshold covenants – such as incremental debt, incremental liens, restricted payments, dividend stoppers, affiliate transactions – prior to leaving the old bond, as a coercive threat to potential holdouts.

As a recent example, a struggling Bausch Health (formerly known as Valeant Pharmaceuticals) was largely successful in its effort to force haircuts on its $11.8bn of unsecured debt in its nearly $20bn capital structure. In return for new secured paper, Bausch unsecured creditors were asked to take a c.59% haircut as well as agree to vote to strip all 50%-threshold covenants prior to exchanging. Exit-consents, like Bausch’s, are intentionally coercive in order to extract the maximum value from bondholders, forcing bondholders to ask if they are comfortable (1) holding a bond without covenants, (2) in a capital structure where you are about to be primed by several billion of your ex-compatriot unsecured bondholders, and (3) invested in a company that has a much-greater-than-zero probability of going belly-up in the next several years.

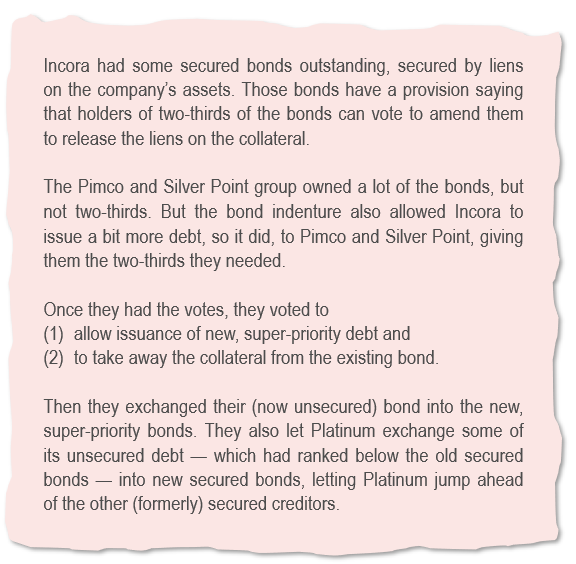

For secured bonds, the playbook looks similar, but also typically involves a threat to strip the existing liens and hand them over to cooperating/exchanging bondholders (leaving non-exchanging secured bondholders now unsecured). The threshold for this type of amendment is often at 66.67%, creating a higher hurdle. However, as we recently learned with the distressed aerospace supplier Incora’s latest manoeuvre, not having the actual votes doesn’t need to be a show-stopper. The setup is that Incora needed $250mn cash, but had no more assets to lien-up, nor the 66.67% votes necessary to strip the liens on the existing debt (to unencumber assets for new liens to support a new loan). As described by Matt Levine, a columnist at Bloomberg News:

Incora, Pimco, Silver Point and Platinum’s moves here demonstrate that, so long as indentures have incremental issuance capacity, any voting threshold less than 100% carries significantly less weight – as issuers have the ability to dilute the issuance to generate the votes and get their way.

Hopefully you can see where I’m going here. For the building product company first detailed, it’s no longer inconceivable that when stressed financially, the issuer could issue enough additional debt under the indenture to game the 90% threshold and change sacred rights, such as principal amount, prior to exchanging the cooperating creditor into a better bond and leaving the old bondholders with little or nothing.

As aggressive as the above sounds, it’s difficult to put faith in any default protections to prevent these actions other than specifically spelling it out in the indenture. While we should theoretically be able to rely on US courts and the “implied covenant of good faith and fair dealing” to prevent such opportunistic behaviour and impute fairness, history has repeatedly shown that sophisticated contractual parties will be out of luck in reliance on that implied covenant. As explained by Elisabeth De Fontenay in “Norms, Law and Contract in the Loan Market”, “when in doubt judges will (1) favour borrowers over creditors and (2) assume that all borrower conducts permitted unless it is expressly and specifically prohibited in the contract.”

Speaking with attorneys and investors regarding the sacred rights thresholds in the building product company LBO debt, most assume that if the “implied covenant of good faith and fair dealing” were to ever be implicated, protection for creditor’s sacred rights would be at the top of the list. However, because the long-enduring norm for US corporate debt had been unanimous consent for sacred rights – and this provision represents a clear and intentional departure from that norm as negotiated by sophisticated parties – any reproach by creditors for an issuer’s opportunistic behaviour under with this language seems unlikely to hold water.

De Fontenay goes on to discuss the dichotomy of contracts being necessarily incomplete (“It is impossible to predict all possible future states of the world, and even if it were, it is either too difficult or too costly to address each one through enforceable contract language.”) versus the expectation (and subsequent interpretation by generalist judges) that sophisticated parties are fully intentional in their documentation, taking into account all foreseeable risks and opportunities. “The first time a borrower employs an aggressive restructuring technique, lenders can perhaps be forgiven for failing to predict it. After that, however, if underwriters and lenders fail to request changes to the documentation, judges will deem that they are implicitly making a trade-off between (1) the risks they face in a downside scenario and (2) the opportunity cost of missing out on the current deal. As a result, they will find little sympathy in the courtroom.”

Unfortunately, to her point, creditors will likely have to endure some real pain from this or similar provisions before giving appropriate attention to the issue. Going forward, I suspect that we will see more of these sub-unanimous sacred rights provisions snuck into indentures and credit agreements (this is already at least the second instance by the abovementioned LBO private equity sponsor). Until there is a turning point, as investors, it is imperative that we are keenly aware of this issue when it appears, give pushback where we can, and ensure we are fully compensated for the risk, if we choose to take it.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.