To call or not to call – Implications of Heungkuk’s flip-flop on Asian financials

On 3rd November 2022, Heungkuk Life (HUKLFI), a Korean insurer, announced on that it would not exercise the call option to redeem its USD500mn perpetual, HUKLFI 4.475%, on the first call date of 9 November due to “extremely unstable financial market conditions” both domestically and internationally. While the non-call of the perpetual does not constitute an event of default, the decision surprised markets as the issuer had previously stated that it would call the perpetual. It also marked the first non-call from Korean financial institutions since 2009 (Woori Bank).

However, in a twist of events, Heungkuk Life subsequently reversed its decision on 7 November 2022 and decided to proceed with the call on 9 November.

Market impact due to the episode

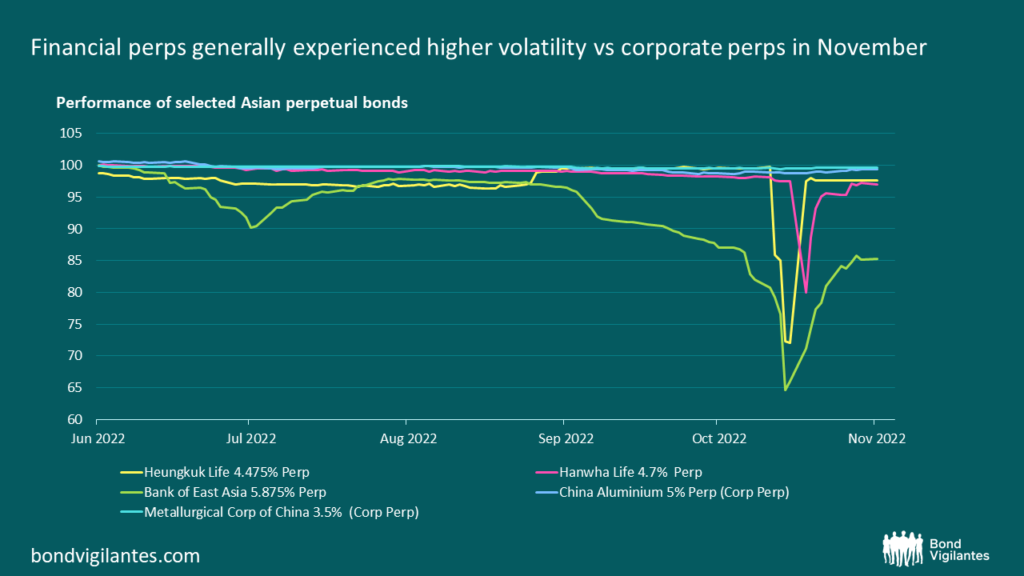

The surprise announcement by Heungkuk sent ripples across the region, causing significant price drops in similar instruments issued by financials as investors reassessed how they should price extension risks. Perpetuals of Korean insurers were understandably the hardest hit given concerns that there were sector-specific factors that contributed to the decision. The sell-off was also exacerbated by other market developments, such as Australian Prudential Regulation Authority (APRA)’s letter on 1 November[1] , as well as the tight liquidity conditions in the onshore Korean market.

While prices have since mostly recovered following Heungkuk’s reversal of its non-call decision, it is worthwhile to note that perpetuals issued by corporates, as opposed to financials, were less impacted in this episode as investors understood that corporates tend to place greater importance to call economics[2], rather than the reputational risks of not calling. As such, corporate perpetuals with higher extension risks are more likely to have already been priced to their maturity, rather than to their call dates, prior to this episode.

Factors driving Heungkuk’s call decision

While the exact rationale behind Heungkuk’s non-call decision is not known, a possible factor was the issuer’s need to maintain capital levels in accordance to the bond indenture requirements; one of the call conditions in Heungkuk’s bond indenture was that the issuer’s solvency margin ratio has to be at or above 150% immediately after the call (the regulatory requirement is 100%). This would mean that HUKLFI would likely need to issue new perpetuals in the current choppy market environment if it chooses to redeem the old perpetuals as its solvency margin would have fallen below the 150% mark without having new replacement capital.

What is also of note was the issuer’s subsequent reversal of decision. We are of the opinion that the Korean authority has indirectly intervened in this case. It was reported that Heungkuk will now fund the redemption via repo issuance and that the major banks in Korea as well as affiliates of Heungkuk will be purchasing these. This is in line with the government’s encouragement of big banks to provide liquidity to smaller banks earlier. The likely intervention underlines the authority’s inclination to maintain market stability and is an acknowledgement that reputational risk is an important factor that can significantly impact the future market access of financial institutions. Given this, we think that the higher propensity for regulator support in the short to medium term will be technically supportive of the other Korean financial perpetuals which have a near call date, barring any idiosyncratic risks.

Implications on other financial perpetuals in Asia

Despite Heungkuk’s flip-flop on its call decision, bank capital instruments in the Asian region continued to be called in recent weeks. For example, Bank of Jinzhou redeemed US$1.5bn of its Additional Tier 1 papers on its first call date, despite its most recent financials showing that redemption would cause a breach of the capital conservation buffer. Chiyu Bank also managed to issue new perpetuals last month, presumably to redeem its 5.25% Additional Tier 1 papers, which is callable on 29 November. Even a non-bank financial institution like Far East Horizon Ltd has stated that they will call back their perpetual FRESHK 5.6% perp on 4 December.

In view of the above developments, we view that the risk of a spill-over impact of the Heungkuk episode on the sentiment towards the broader Asian financial sector is likely to be contained for now. For Asian banks, in particular, governments in a number of Asian jurisdictions are likely to remain supportive of banks’ call decisions in the short to medium term, as there is a higher tendency for Asian governments to support banks, either given the fact that the government has stakes in these banks, or that stability in the financial system remains critical. While most banking regulators, including within Asia, would stress that banks should not call existing capital securities and replace them with more expensive replacement capital, Asian banking regulators have so far not prevented them from making “uneconomical calls”. One example was Hong Kong’s CMB Wing Lung Bank, which recently announced to call USD500m of CIMWLB 3.75% 2027c2022 (Tier 2) despite their relatively low coupon reset spread of 175bp (as compared to similarly-rated DAHSIN whose 3% 2031c2026 (Tier 2) are quoted around ~T+280bp) at the time of writing.

That said, we think that the longer-term trend for Asian banks will eventually be towards alignment with global norms, which would be to place a greater emphasis on call economics rather than reputation. It will thus be prudent not to paint the entire segment of perpetuals with one broad brush and expect all banks to call back their perpetuals. Factors, such as the banks’ systemic importance and balance sheet strengths, are important in assessing the perpetuals’ extension risks. We would also prefer perpetuals where reset levels are sufficiently high enough to lower the risk of the issuer placing greater emphasis on short term economics and ignoring future pain when they need to raise financing at higher costs. This is also necessary to “convince” banking regulators that future replacement capital is going to be much more costly than current capital, if the bank decides not to call their perpetuals. Other supporting technical factors includes onshore funding conditions, for example, in countries such as China and India where onshore financing is currently substantially lower than offshore. Hence, it is beneficial for the issuer to issue domestically to replace these offshore perpetuals.

In conclusion, we view that the propensity for Asian banks to redeem their perpetuals remains high given the reasons stated above, but we will continue to tread with caution in selecting USD perpetuals of Asian banks, with preference for issuers which i) are systemically important, ii) have better balance sheet health, in particular good capitalization and wider buffers, iii) requiring USD offshore market access as an important source of funds, iv) have higher reset spreads and v) have demonstrated a good track record of redeeming on call dates. While this is, by no means, an exhaustive list of factors, this also serves to illustrate the importance of a multi-faceted, bottom-up analysis in the current volatile environment.

[1] Banks and insurers “should not call an AT1 or T2 capital instrument and replace it with an instrument with a higher credit spread”, except when they can satisfy economic and prudential rationale of the call, and not create an expectation that other instruments will be called in similar circumstances

[2] An assessment of whether it makes economic sense for the issuer to replace the callable instrument with another capital market instrument at prevailing funding rates, or to extend the callable instrument beyond its call date based on the instrument’s terms, such as, coupon reset (to the benchmark reference rate + initial spread with or without a step up spread at call dates).

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.