Inflation’s final destination

The Fed remains hawkish relative to the market, once again stating that rates are going higher than markets have priced, and that rates will stay there for longer than priced, so as to bring inflation back down ‘towards 2%’. It expects growth to be lower, and it expects inflation and unemployment to be higher than it previously expected. In short, recent moves lower in yields and risk premia are loosening financial conditions and this may well require, in the Fed’s eyes, tighter policy for longer.

How can we interpret this and invest with this?

We all have to admit, as the Fed has started to emphasise in recent meetings, that we are all in a blind spot economically. No one knows how and when the tightening in monetary policy that has been undertaken in 2022 will really start to impact the real economy, nor to what extent. It will, as the Fed states, bring growth down and unemployment up. But the key here for all central banks is inflation. The tightening in policy rates will bring inflation down, as will base effects and continued recovery of global supply chains.

Is the tightening so far enough?

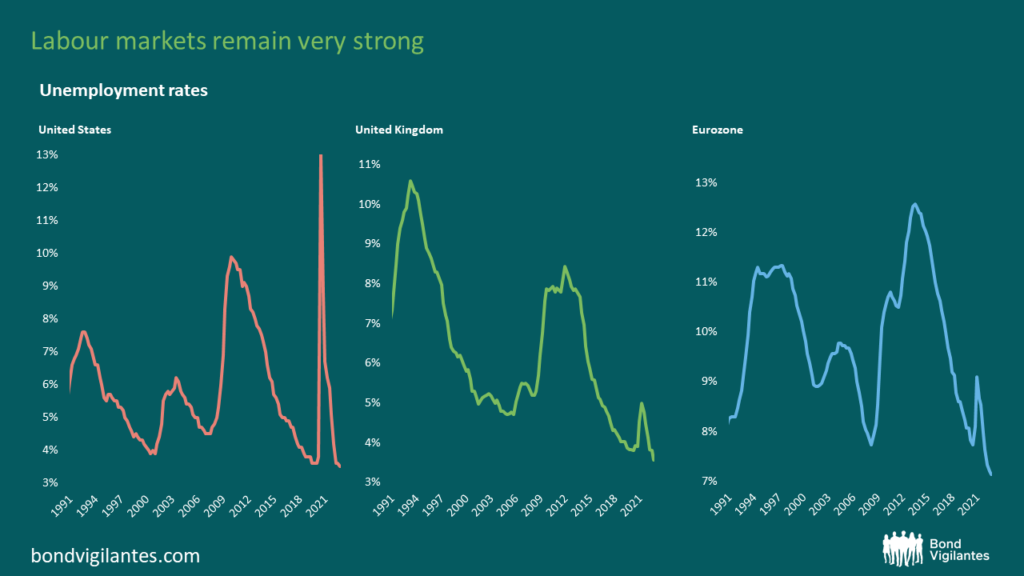

The essential question for markets though, is whether the tightening that has occurred and the slowdown that results will bring inflation down to 2-3% (where my hunch is central bankers the world over would be happy), or to a higher level of 3% plus. No one can know this in 2022, and perhaps not in 2023 either. The determining factor in all of this, and the major hurdle around the world for inflation to return to target, is the labour market. Labour markets are too strong for inflation at 2%: simply put, wage growth at 5-6% is incompatible with inflation at 2% target. Wages need to be at half these levels for the target to come into sight. At this moment in time, and with labourers this agitated for inflation-chasing wage rounds, I will not be positioning for a return to on target inflation.

However, as the monetary policy time lag passes and as we therefore observe the extent to which the labour market and wages react to the interest rate tightening we have seen this year, markets will be in a better position to evaluate the destination for inflation. We cannot know this now, and nor can the Fed. All they can tell us is that they are determined to bring inflation back down ‘towards 2%’, and that this might take higher rates for longer than markets expect. Why? Because they do not know how these currently strong labour markets will react and how long it will take to get wages down to levels that are consistent with near target inflation.

Inflation in 2023

My guess, in line with what seems to be consensus, is that we are now clearly facing a period in which inflation falls, and falls sharply. I think it is perfectly possible that in the next 6 months or so we see inflation in the US fall from 7% to 3-5%. And we might see UK and EU inflation fall from 11% to 4-6%. This will be a powerful and rapid move lower in inflation, and bonds will start to look (as indeed they already have) much better value as a result. Much more interesting will be what happens in the second half of 2023 and into 2024. Will the labour markets have weakened enough that public and private sector employers are facing down their workforces and taking wage growth to the required levels? Or will they remain strong and will wage rounds stay at elevated levels? If that’s the case, then as the Fed told us this week, rates will have to go higher than expected and stay there for longer than expected. But today, no one knows: not the markets (which are predicting a big hit to jobs markets to come imminently), nor the Fed (which is clearly concerned about the continued strength).

What area of bond markets should we be most focussed on as we head into 2023 and 2024? Well, if inflation is going back to target fast, I would be most focussed on long dated government bonds where yields are at around 3.5% in the US and UK and at around 2% in Europe. In the US and UK, if inflation is going back to 2%, then buying these bonds offers a real yield of 1.5%, and in Europe long dated bunds offer a real yield of around 0%. But if labour markets are too strong for this journey downwards in inflation to reach 2%, or if central banks show that in light of the economic slowdowns likely to come in the next two years and that they are happy with inflation to fall to 3-4% before they stop tightening in search of on target inflation, then I would be much less inclined to be buying long dated bonds at these yield levels. So, for now I will admit, like the Fed, that I do not know where inflation is going to end up in 2023 or 2024, other than lower than it is today. And like the Fed, we are all data dependent and need to watch economic developments and particularly labour markets, before we position our portfolios based on the final destination of inflation.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.