A bond investor’s perspective on the UK

Economic backdrop: high inflation, low growth and lots of debt

As with many countries right now, the UK is suffering from higher inflation and the prospects of lower growth. Rishi Sunak’s wish to halve inflation this year to circa 5% isn’t exactly earth shattering being that is what is currently being priced into the forward curve. Anything further would be welcomed yet seems doubtful as inflation is sticky, especially in parts of the economy that that cannot be controlled quickly (like rents and services).

However, consumers are still willing to pay the higher prices and companies can pass through inflation. But the stress in the mortgage market leaves many questioning, for how long is it sustainable for their spending on a mortgage or rent continue at this level? This reality is putting huge pressure on the government to help bring down rates. The banking system could potentially play a role by considering to offer slightly different product structures, even for a short period of time, as this would certainly ease the pressure on households, keeping the housing market liquid even as prices fall. However, there is no quick fix or magic bullet and we will most certainly enter a housing lead recession this year (if not already).

The UK isn’t in a unique position – the economic backdrop of falling GDP growth and higher for longer inflation is seen all over the world. Costs of borrowing are soaring for all as yields rise and central banks don’t seem done with hiking just yet. Focus this year will be on the amount and type of outstanding debt, new issuance and Quantitative Tightening (QT). Whilst Quantitative Easing (QE) created inflation, you would expect QT to some extent to dampen it. The UK government is expecting mammoth gilt issuance this year, this will weigh on prices and we will certainly be challenged by who is the ultimate the buyer of the debt. The Bank of England (BoE) are not buyers anymore, having embarked on QT. You may expect many insurance companies (having reduced their holdings of gilts in October and November 2022) to be reluctant to increase their holdings again.

Historically the UK has relied on the kindness of strangers for debt purchases, the bright light here is that with weaker GBP and yields of circa 3.5% this might ultimately end up a decent carry trade for many overseas investors.

The type of borrowing is also important. The UK has too many linkers which reduce the benefits of high inflation on overall indebtedness. This is being addressed with annual percentages of gilt issuance in linkers down from a peak near 30% a year to a new level of 11%. It will take time for this to help, but it will eventually.

Credit markets: the bright spot in UK investing, dispersion means sector active management is key

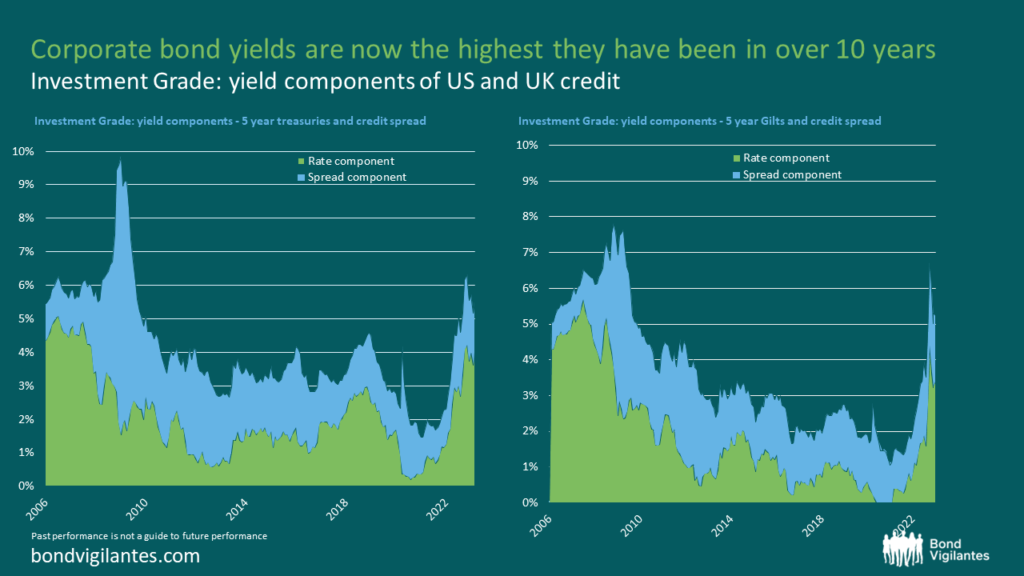

GBP credit hasn’t been this cheap since the Global Financial Crisis (GFC). In October and November 2022 we hit yields of +7% for BBB rated names. Currently yields are in the 5-6% range, therefore we are witnessing much more interest in corporate credit right now vs the last decade.

The risk free rate rising, plus spreads widening (which provides the juice) has meant that the relative proportion of yield coming from risk free and spread is much more even than it has been for years. One providing a natural hedge for the other. Thus in a growth environment you’d expect spreads to narrow and government rates to rise, in a recessionary environment you’d expect the reverse; spreads widen and government rates fall. Either way the properties of corporate credit has not been better in over a decade. Not to say spreads cannot go wider, of course they can, but implied default rates are well in excess of the worst ever default period we have witnessed, thus we are at least being paid to take this corporate risk once again.

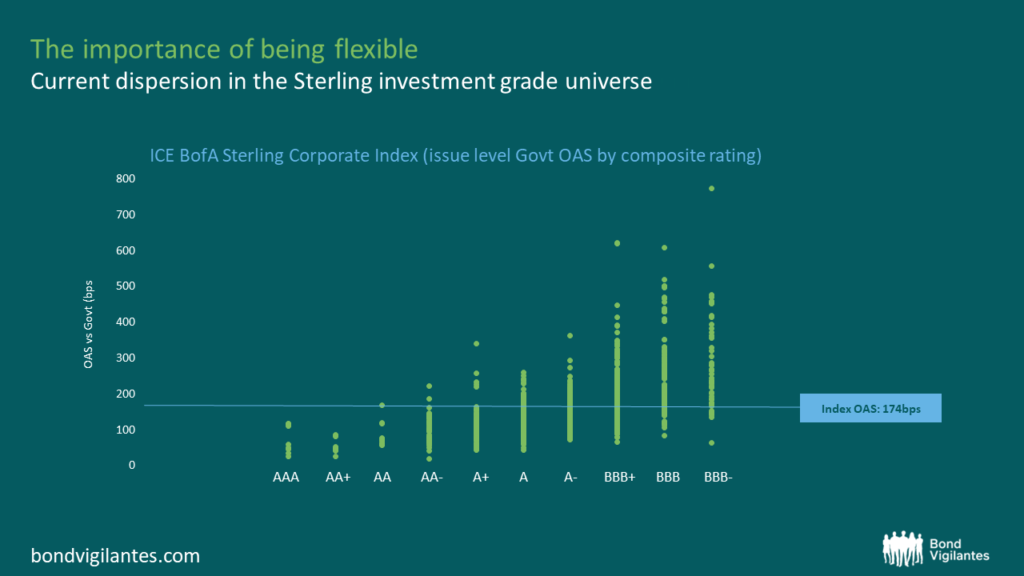

Diversification at index level and within individual sectors is huge. Our internal credit analyst team are pivotal in helping us find the good companies out there and selecting the best bonds, whether they are UK issuers in USD or EUR, and at different points along the credit curves. The key in this environment is flexibility and with that the need for active management.

Sector wise it does seem in parts a “close your eyes and invest” type of market. Banks are ridiculously cheap on every level, and although a recession driven by the housing market seems evident, the banks are so much better regulated, better capitalised, more transparently run, and also much simpler businesses than in 2007. We like UK banks and non UK banks, we favour the simpler business models over the complex global banks and our analysts have led us to feel comfortable owning financials, especially banks, across our credit strategies. We also like utilities (used as bond proxies in 2020 and onwards), they will do a decent job (and provide a hedge to the banks position) in the event of another inflationary episode. So it’s a very balanced and sensible hedge, again supported by the credit analyst team.

Managers differ in their responses to volatility, some invest on contrarian views on a macro top down, whilst other favour value driven bottom up. Many have taken the opportunities given over the past 6 months and added to credit exposure. Our internal team of analysts have been excellent here in advising which banks to buy and where on the curve. Our range is extensive and enables investment in all types of market with a huge variety of fund drivers.

Companies are well capitalised, they still have cash on their balance sheets. So longer term if the BOE decides to bring rates down on account of a recession (rather than worsen the recession in their plight to control inflation), then inflation can be good for companies, and companies doing well are good for recessions. It’s a circular argument after all. We would be buyers of credit over gilts right now, especially in the event of recession, as, if there is limited appetite for government debt, it results in more inflation and higher debt interest payments. At this point GBP may come under even more stress and weaken further. Taking an every cloud approach, this also means cheaper investment into UK companies, therefore the outlook may not be as dismal as originally assumed.

Investor sentiment: bonds are back, market desperate for the duration trade

The diversification properties of corporate debt are very compelling right now and many investors, having come from an underweight position, are now making significant allocations to corporate credit (and indeed the broader fixed income universe). Yield is back, the income in fixed income now exists once again with zero negatively yielding debt. If 2022 taught us one thing, it is that although bonds have a fixed income over time, this does not make them risk free.

The market – having spent 2022 grappling with central banks playing catch up, soaring inflation and therefore significant yield increases – is in 2023 so far dominated by efforts to predict central bank pivots, the end of the hiking cycle and forward inflation numbers. As a consequence the market has pounced on anything “relatively positive” that increases forward growth and/or reduces forward inflation. Yields have fallen at each positive milestone, only to sell off on every negative tilted set of data. The market is obsessed with pivots, a soft landing and an economy that might just escape recession (at least in the US). Desperation for the duration trade for the short term seems rationale, but over the longer terms the “higher for longer” rates and “sticky inflation” narrative suggests yields should be higher than they currently are.

For now, though, with all that we know in the UK, the core near term scenario remains one of sterling weakness, low economic growth, high inflation, high government borrowing. This looks distinctly bad for UK domiciled assets (no matter what the internationally dominated nominal FTSE 100 level suggests in price terms! This is surely more about international businesses domiciled in UK with a sterling base currency). But the UK is not alone in this, with large swathes of the developed world looking mightily similar. The US has the same problems in terms of unfunded welfare costs in an ageing demographic world, but at least it is not in the same situation as the UK with extreme government borrowing figures as far as the eye can see.

On the flip side, company fundamentals are in good shape – the opportunity of a decade for investment grade credit, and with weaker GBP there is a definite reason for additional foreign investment in this area of fixed income right now – especially in actively managed funds. Beware the indices and the passives – dispersion is high and static duration may not be your friend going forward.

Conclusion: active over passive, flexible over benchmark and corporate over government.

High dispersion means stock selection is key and only active management can split the good from the bad, the expensive from the cheap. Favouring companies over governments – especially in the UK – and from a domestic perspective, with GBP at these levels, investment into UK companies will probably prove fruitful this year.

In terms of fixed income, bonds are back…….. with less volatility and more yield.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox