Financial Distress and the Itch for Corporates to “Finesse the Corporate Structure” – Part I: Unrestricting and Transferring Assets

With the macroeconomic outlook uncertain on elevated inflation and recessionary fears, companies are feeling the stress as growth expectations are tapered, margins are pressured and refinancing ability gets called into question. Even more troublesome, lower-rated companies with floating-rate instruments will experience higher borrowing costs. This means any unexpected operations/financial turbulence may force companies to participate in well-designed financial engineering activities, or said another way, to “finesse the corporate structure” – providing covenant cushion, new cash injection and corporate spin-out ability alleviating credit distress and default concerns at the expense of the existing creditors.

Now, financial engineering is not revolutionary in the world of high finance and investing; however, with current economic conditions and rates at their highest level since the GFC, it is worth highlighting recent corporate activities that may assist investors in recognizing red flags before taking one on the chin.

In Part I of the “Finesse the Corporate Structure” Series, we will focus on the unrestricting of assets via covenant/credit agreement amendments and related asset transfers removing value from the creditor supporting entity to other parties. To start, we provide a brief overview of covenant/credit agreement amendment process.

Covenant/Credit Agreement Amendments

There have been countless instances over the last 15 years in which companies in financial distress have been forced to contact their lenders – whether it is their banks, institutional investors or activists – to grant covenant/credit agreement amendments for various reasons. Covenant amendments for additional coverage cushion or financial leverage flexibility are common and often more or less innocent in nature. However, some covenant/credit agreement amendments may lead to unwanted or unforeseen consequences for smaller existing holders while benefitting large existing holders, new investors/lenders and/or other asset classes.

Covenant/credit agreements do have creditor protections where the issuer must obtain the amendment a 50%-majority, 66.67%-majority or a 90%-majority. This seems great, and to some extent unimaginable as being required, when operations are performing and credit markets are strong. However, this may not be so in the event of operational turbulence or a rising yield environment. We have seen several examples just this year in which the required majority was met with large existing creditors or new strategic money being injected into the structure, putting the smaller creditors at a disadvantage.

Unrestricting and Transferring the Subsidiary/Assets

Companies can amend the credit agreement to designate a restricted subsidiary as an unrestricted subsidiary in preparation for an event effectively moving the subsidiary away from the creditors. The obvious negative in allowing this amendment to be completed is value leaving the “creditors’ box”, forcing the existing creditors to put their faith in management that the value-creation or proceeds will benefit the company as a whole and not just the shareholders/other parties.

Having successfully completed this process – the subsidiary/asset may be primed to either be sold, spun or go through the IPO process. However, there is a fourth option, transferring the subsidiary/assets for no consideration under loose restricted payments covenants, where the financial engineering becomes juicy and more detrimental for creditors, as that transfer does not typically involve a remit to the credit supporting entity.

Case Study

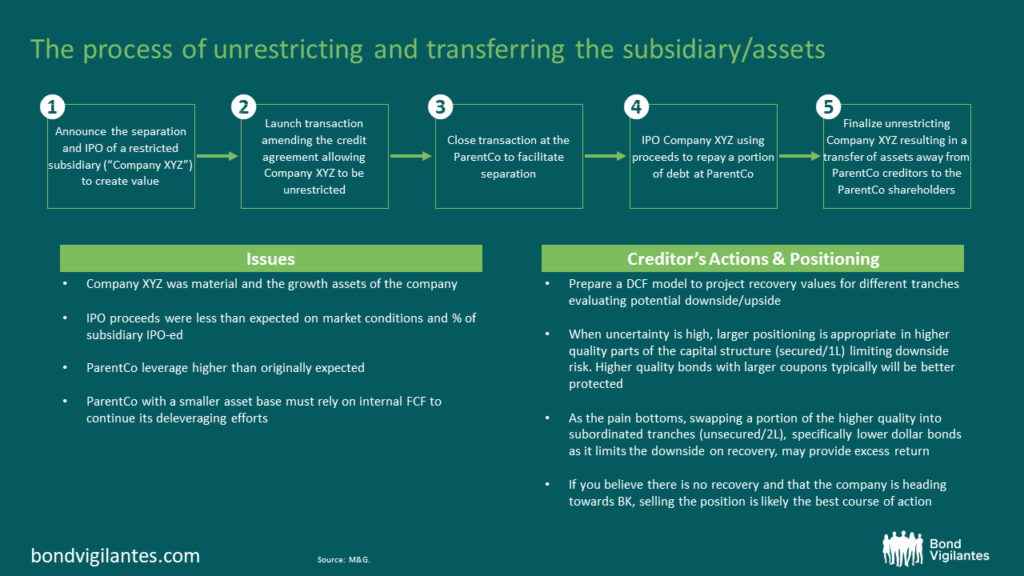

Below is a case study of a healthcare company that went through the process of unrestricting and IPO-ing a subsidiary to create value by achieving a higher multiple compared to the ParentCo.

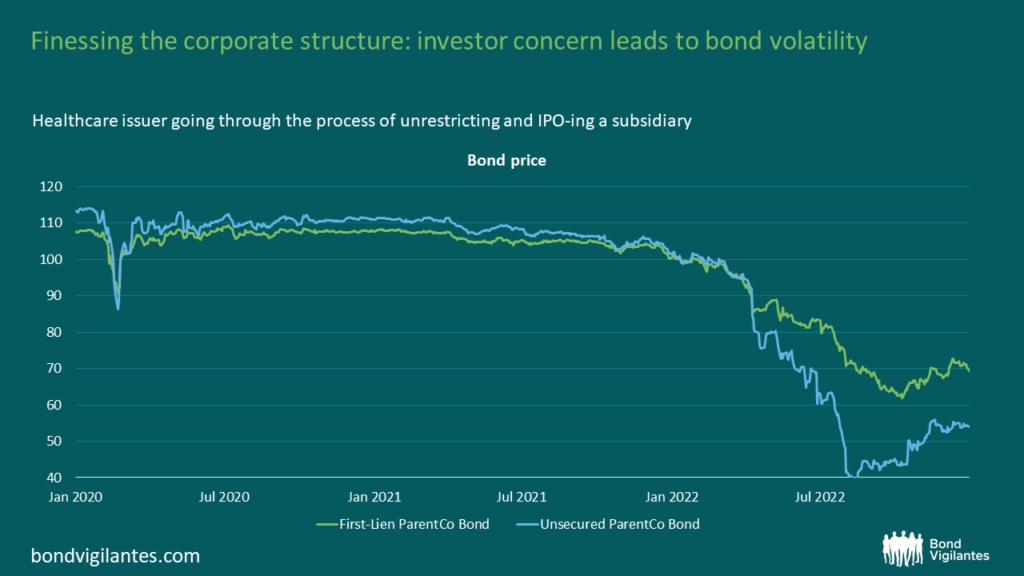

The chart below shows the volatility in bond price, illustrating investors’ concern during the process. It is important to note that the company did experience adverse patent/trial outcomes among other events that exacerbated the volatility.

Source: M&G, Bloomberg (February 2023)

As explained in the graphic below, the first-lien bond outperformed on the way down while the unsecured bond has outperformed once bond prices bottomed around Q3 2022.

Source: M&G

Conclusion

Not all asset sales, spins or IPOs are detrimental to the credit. There have been several over the last couple of years that have been positive for bondholders, such as Acadia Healthcare (ACHC). In early 2021, the behavioural hospital operator sold its UK operations for more than $1.0B, utilizing proceeds to reduce indebtedness and resulting in improving credit metrics and earning credit upgrades from the rating agencies.

Additionally, a number of spins have recently been completed (e.g. GE Healthcare) or are forthcoming (e.g. Johnson & Johnson) as they refocus and streamline operations. We believe event risk is high in the market, generally speaking, as macroeconomic dynamics put pressure on company performance while market expectations influence management teams to create value and refocus/streamline operations while maintaining strong credit metrics. Thus, we think it is imperative for investors to consider credit-positive and credit-negative events that may affect credit ratings and prompt material bond/spread volatility.

It is key to have an understanding of management’s strategy, tendencies and execution track record as well as an understanding of their financial policies and rating commitment (such as IG aspirations, credit rating target, etc) to anticipate and mitigate event risk.

In Part II of the “Finesse the Corporate Structure” Series, we will focus on coercive exchanges.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.