Nice or naughty, coal is still part of the energy mix – how to have a positive impact on its phase-out via engagement versus divestment

With growing ESG headlines and many companies pushing for a coal phase-out, we take a closer look at United States coal power assets and how to navigate investing for an overall positive climate impact. The US Utility landscape differs from that of Western Europe as power assets are held in vertically integrated structures and government forced carbon penalties and policies are not as punitive.

Divest or engage?

Simply avoiding investing in any US utility with coal exposure can a) increase concentration on portfolios on the sector, b) ultimately have a negative impact on transitioning to renewables through increased cost of capital, and c) shift ownership of these assets to private owners who will run them to their economic full life. Far better is to engageeffectively to make an impact. A few examples of effective engagement include understanding the real issue, promoting affordable financing in Green Bonds with tight oversight, and potentially increasing engagement with state regulators via direct public letters.

The US energy mix

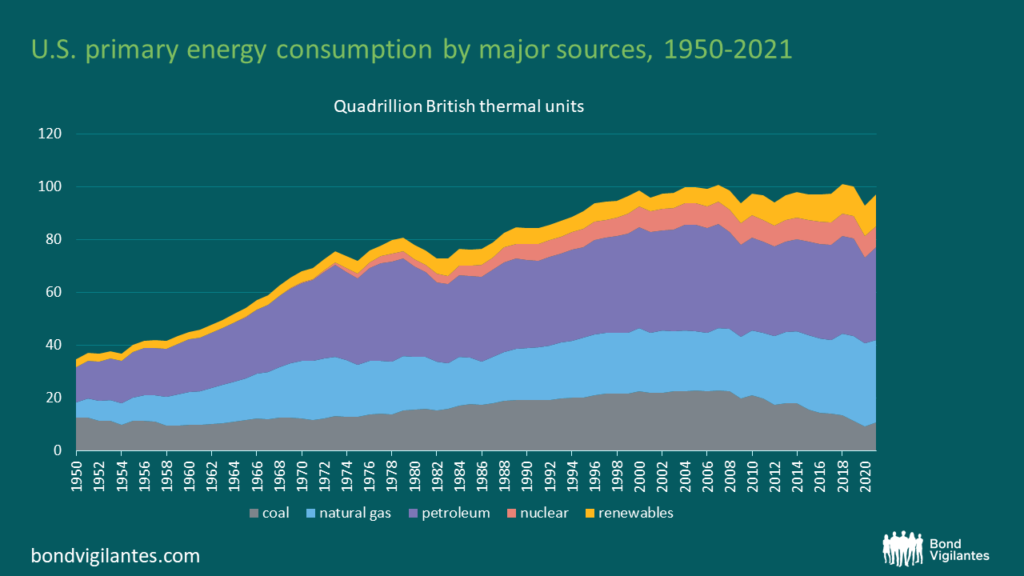

A brief picture of the energy mix in the US is depicted below. In 2021 US consumed 97.3 quadrillion Btu, 11% of it being coal generated.

Source: https://www.eia.gov/energyexplained/us-energy-facts/

At the same time, 546 million tons of coal were used in the US, with 92% of it used for power generation. While these numbers sound alarming, it is worth nothing that the US is in a steep trajectory of power plant retirement. Since its peak in 2007, coal usage has declined significantly, and we expect the decline to continue with ultimately seeing coal power plants disappearing for the most part.

Data source: U.S. Energy Information Administration, Monthly Energy Review, Table 1.3, April 2022, preliminary data for 2021. Note: Petroleum is petroleum products excluding biofuels, which are included in renewables. https://www.eia.gov/energyexplained/us-energy-facts/

So why do US utilities get a bad rep from the ESG community and are the key target for negative headlines?

The answer is simple: given the clear public disclosure and traceability of the operator in contrast with the state owned infrastructure in many other jurisdictions like China and India, they are an easy target and create headlines. Economics and regulation are the largest driver behind retirements and the ESG community being more of a second derivative which drives company’s ESG marketing material creativity, given the fact that the regulatory regime has already placed a burden via emission penalties on these plants and the owners are incentivized to retire them regardless, not to mention the incentive to grow capital expenditures for replacements that provide direct growth to earnings. What can the investment community do then to have an impact and how can we help these companies that share the same goals for their own benefit? We provide a quick summary how power is regulated in the US and how US Utilities are trying to replace this dirty and damaging fuel with cleaner substitutes.

How are US power assets owned and regulated?

To better understand where engagement can have an impact we provide a brief picture of how the power assets in US are owned and regulated. The US power market can be split into two buckets: regulated and unregulated. Arguably the unregulated market will still experience regulatory constraints with regards to emissions, grid reliability, and approval of asset sales.

In the regulated market, utilities are vertically integrated monopolies, which means they own the power plant, the transmission lines, and the distribution lines and have no competition in that territory, but are limited on how much they can earn on the equity invested. In the wholesale/merchant markets the power plants are owned by unregulated companies purely for profit. They can contract the power to a 3rd party, sell it in open market, or commit to regulated auctions for grid reliability for a fee. Very few coal power plants remain in the wholesale hands aside from Texas, where constancy of supply is an issue as over 28% of the power comes from wind and solar. Given the Texas grid is not connected with the rest of the US, renewables without installed storage and transmission connection cannot perform as designed in a diversified electrical grid and can expose the state to blackouts in extreme weather events.

In the regulated markets, shutting down the coal power plants to replace them with another fuel source is ultimately the decision of the state utility regulator after the company submits a proposal. The ratepayer covers the cost via bill increases. Reliability, cost, and adjacent industries play a big part in the decision and it can be highly political. Most of the power plants that investors target are in regulated markets and we will focus this paper on how investors can make a dent in the potential outcome.

How to have an effective engagement campaign

A few factors to consider before launching an engagement campaign or restricting investment in the company is understanding the local economy, the regulatory regime, and geography with regards to infrastructure. A poor local economy, with a related coal mining industry, and lack of other resources will be very unlikely to shut down coal swiftly without Federal government help. Examples would be West Virginia and Wyoming. Other states may have great intentions, but may be starting at a high level of coal as percentage of generation. In addition, these states invested heavily in the 90s to upgrade or scrub these plants after the Obama administrations emission standards were placed. Examples would be many midwestern states, like Ohio, Indiana, and Wisconsin.

We think the most effective strategy to help the energy transition as an investor is engagement, education, and proactive financing in project specific deals. Investors can take an active role in shaping the company’s future expenditures and steer them into efficient renewables by being part of the decision making with regards to lowering the cost of capital, partaking in profitable growth, and advocate with regulators, consumers, and companies to accelerate this shift.

- Engagement: Engage with issuers with a clear objective and outcome. Understand where the issuer sits with the plant specific decision. Separate out the company’s financial incentive that ultimately drives their decision to propose a replacement to regulators. Differentiate marketing spin from management intention with the help of our industry experts. Then target areas where engagement can have an impact.

- Advocacy and learning: Understand how the regulatory framework works and what drives their decisions. Is coal mining a big part of the economy? Can the local economy afford a large bill increase? What is the political affiliation of the commissioners and how does that translate to re-election? Understanding what we are advocating for and what is feasible can increase the impact of the investment community’s influence.

- Pro-active financing: Help the industry lower the cost of funds to make project more feasible. Understand the flow of money and separate project debt and greenwashing deals from companies that don’t have a specific aim. Ask for third party verification to link the funding to the green project.

We can all do our part in eliminating this toxic and inefficient fuel source and dream of a future where it is only used in for naughty kids at Christmas.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.