Japan – the land of the sinking sun

JAPAN – this won’t end well

Japan has one last strategy – HOPE.

Let’s quickly recap the last twenty-odd years of Japanese monetary and fiscal policy and look at where we find ourselves today.

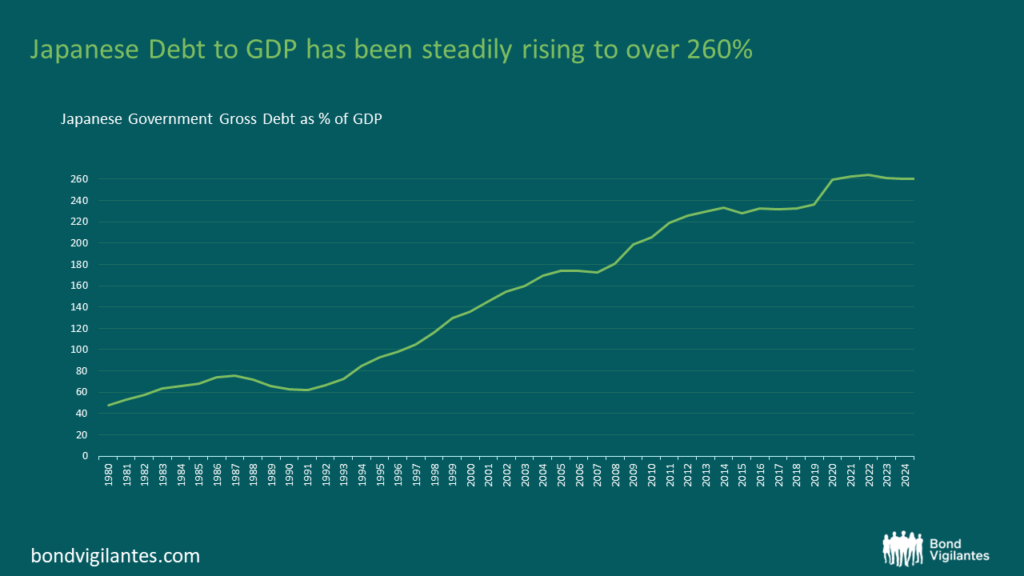

The fiscal numbers don’t look pretty, with debt as a % of GDP at 260% versus other major countries at circa 100%.

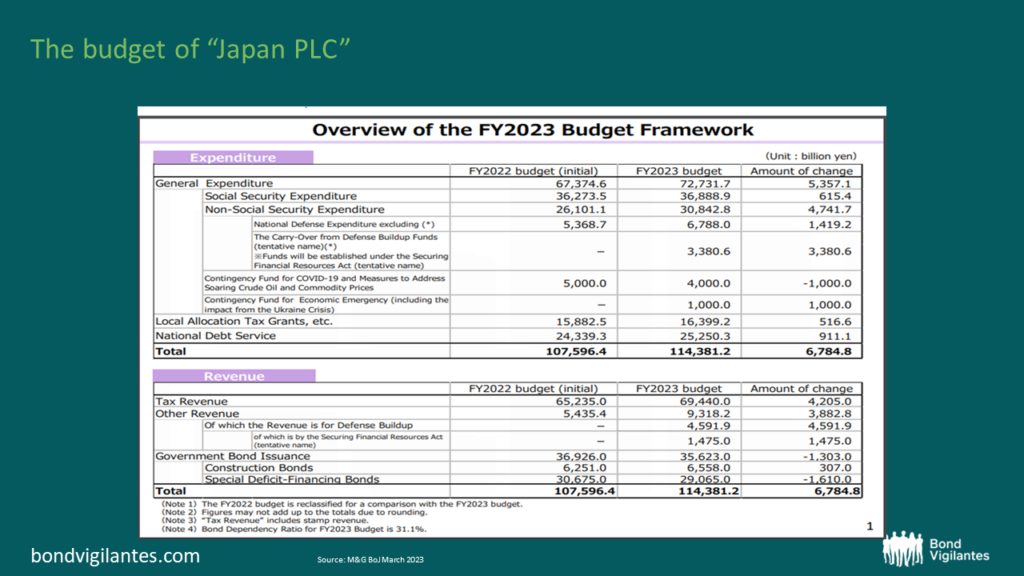

The below table reads like a Stephen King Novel but is, in fact, the budget of Japan PLC.

The issuance of Government debt finances 40% of annual expenditure (less servicing cost), and debt servicing costs account for 32% of Government revenue. Any meaningful increase in interest rates will have a devastating impact on the country’s finances.

Real GDP growth hasn’t been terrible at an average of 0.7% YoY for the last twenty years but has lagged behind its western peers. Arguably that growth has been funded by the constant expansion of debt.

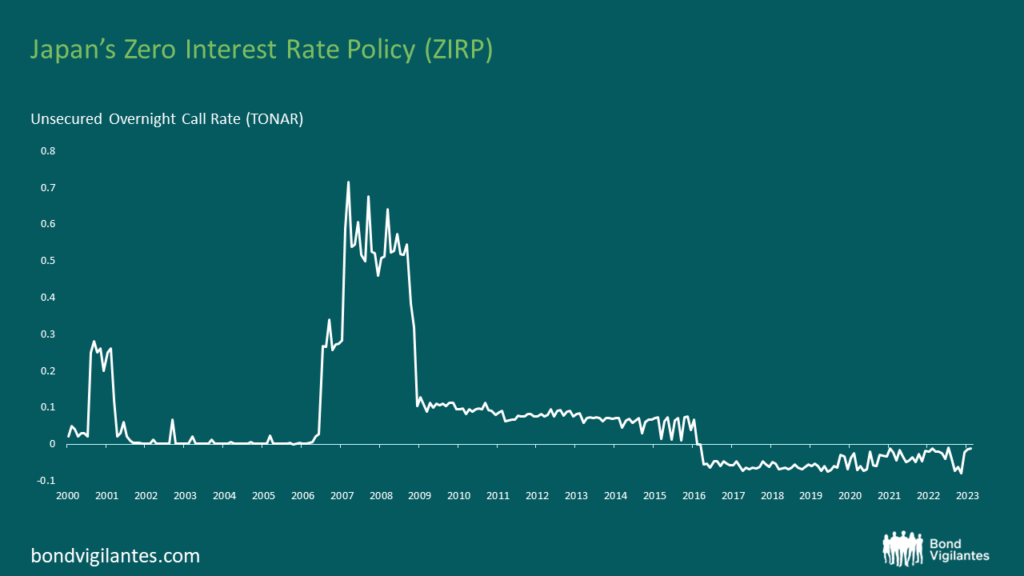

Now onto the monetary policy, which has supported the above fiscal position; however, rest assured, this is not monetary financing of a fiscal deficit (Helicopter money). We know this as the Government has promised to pay it all back at some point in the future. Fingers crossed.

- ZIRP (zero interest rate policy) has been in place for the best part of 20 yrs.

- The BoJ now owns circa 50% of ALL Government bonds outstanding, resulting in a balance sheet that is circa 90% of Japan’s GDP.

- The BoJ is a top 10 shareholder in 40% of Japan’s publicly listed companies. Admittedly this is through ETF holdings. Still, the BoJ should have no say over the flavour of a soy sauce or what this year’s latest fashion should be.

- Last but not least, we have YCC (Yield Curve Control), which initially capped 10yr yields at 0.25bps; the BoJ has said it will defend this level with unlimited purchases of Government Bonds, which has contributed to the enormous expansion of the BoJ balance sheet.

With monetary and fiscal covered, let’s look at where we find ourselves now.

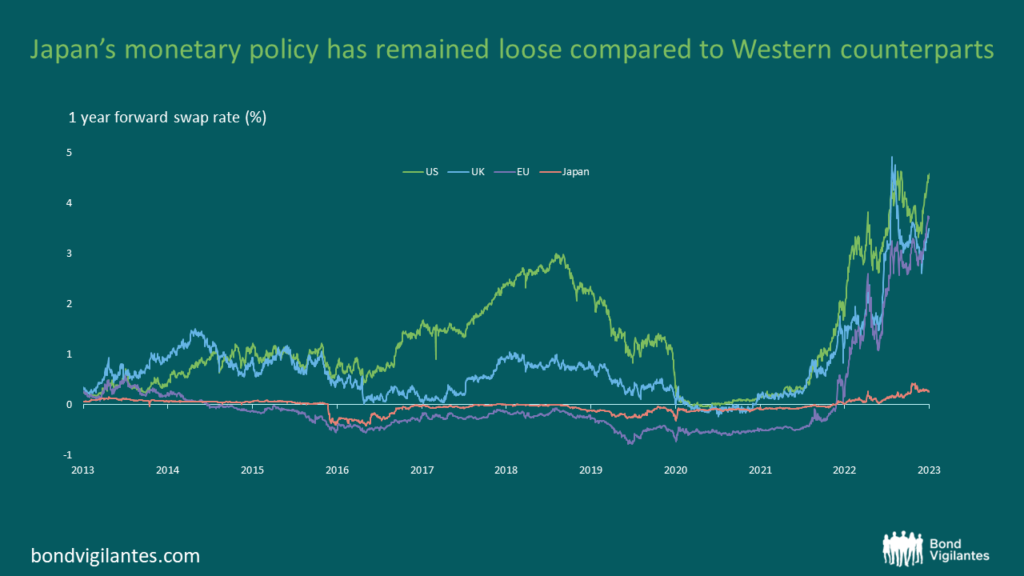

Western central banks are rapidly reversing course to combat elevated inflation spurred by the Covid Pandemic and the Russia/Ukraine conflict. Loose monetary policy is now ending with aggressive hikes in Interest rates and Central banks beginning to sell down the enormous stock of debt they have accumulated over the last 15yrs.

This change has put Japan in a very difficult position and the cracks are appearing.

The divergence in monetary policy has resulted in a rapid depreciation in the Yen to levels not seen since the early 1990’s

This repricing has forced the BoJ to choose between defending the currency or keeping yields low. You can’t have both.

At this juncture, the currency was deemed more important, and the BoJ stepped in to defend the currency. The YCC ceiling was raised to 50bps signalling to the market that monetary policy is on the turn. A quick retracement of the currency occurred, signalling a degree of success. Whether the currency retracement resulted from slightly lower US yields or the slight change in the YCC ceiling is debatable. A combination of the two would be a fair conclusion.

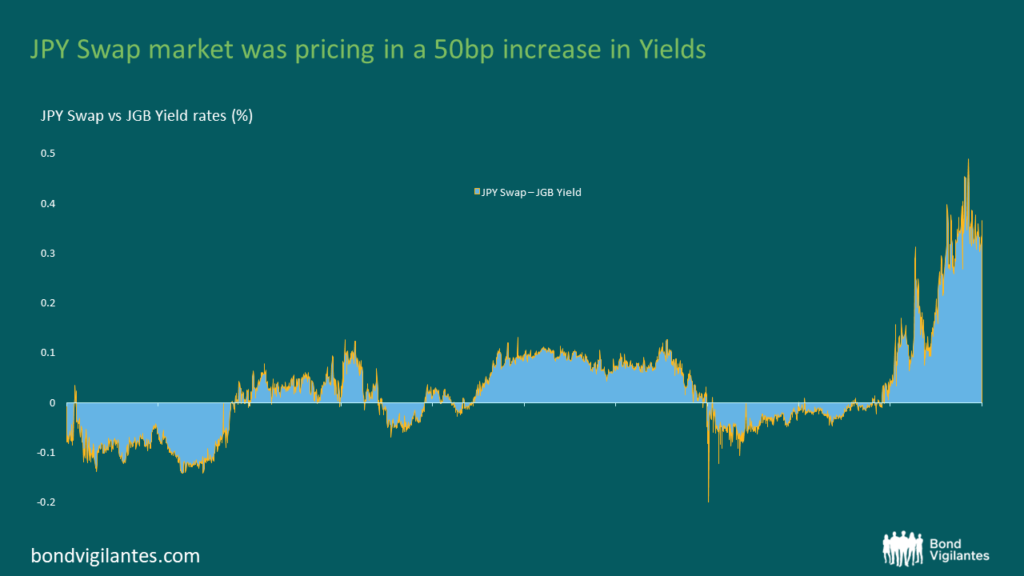

Now the market wants a more significant adjustment to monetary policy, which is illustrated in the chart below. We can see the pricing differential between the manipulated JGB and the free-to-trade swap markets. The swap market was pricing a further 50bps increase in JGB yields at recent highs.

So the problem is this. As yields rise, the BoJ is forced to defend its YCC ceiling resulting in ever more QE purchases to cap yields at 50bps. If the BoJ continues down this path, the Currency will continue to depreciate, further stoking inflation.

On the other hand, if the BoJ defends the Currency by raising interest rates, stopping QE or some combination of the two, bond yields will have a first-class ticket to the morgue and soar higher. Japan will become insolvent and be unable to service its debts.

What is the solution? There is no easy solution. All Japan can do now is hope for a swift global GDP growth and inflation downturn to give Japan a stay of execution. The terrifying part of all this is that Japan is the third largest economy in the world, which will profoundly impact global financial markets.

The only outcome to this difficult situation is either default or inflation. With Japan’s debt primarily domestically owned, the Government can’t realistically default on its citizens. This leaves inflation which is essentially the same as a default. The pain is either felt all at once or over the longer term with a significant reduction in purchasing power. Neither are pleasant. Investors have tried to play this theme for many years but have been burned in the process, hence the name – the widow maker. However, I think we are getting closer to the point where this finally breaks.

What comes of Friday’s BoJ meeting remains to be seen, but increased volatility from the land of the sinking sun will surely increase.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox