Musk vs Fisher

I am a new recruit to M&G. I trained as an Economist as well as a Data Scientist, but in previous lives I’ve worked in retail sales, fitness and consumer research. I’ve also been able to analyse data on everything from dog food to diamonds. I am fascinated by what data can teach us about human behaviour (dogs, by the way, don’t fill in questionnaires). So although I spent most of my time at University learning about inflation, inflation expectations and their importance in setting economic policy, what is less clear to me is how consumers behave once they think that inflation is eroding their wealth. So you can imagine how intrigued I was to discover an article in the Harvard Business Review entitled, “How price changes influence consumers buying decisions”[1]. The paper talks abstractly about something called, ‘Price Architecture’, which is a pricing strategy (deliberate or accidental), which influences consumer behaviour. A great example of price architecture in action would be the window display at your local watch dealer. We all lust after the shiny gold Rolex, but next to it, the lovely looking Tudor watch that looks identical, is a fifth of the price. A bargain! The HBR article looked at price movements in a number of goods like Bluetooth speakers and televisions. Not surprisingly, the study showed that the customer was more likely to buy them if the current price was demonstrably lower than in the past. Conversely, they were more reluctant to purchase if the price was higher because it seemed like, ‘a bad deal’. However, the picture changed when the frequency and intensity of the prices shifted. So, what sort of price changes make consumers spend?

According to the HBR, the seller who wishes to encourage a consumer to buy now should opt for either a single large price decrease to get the endorphins flowing; or, rather counter intuitively, engineer a series of small, incremental price rises which make the punter fear that the cost will continue to rise and they would subsequently lose out on a bargain. This all sounded very clear until I thought about it a bit harder. First of all, if inflation is rampant, why would you make a large price cut when you could simply, and more profitably, tweak prices in an upwards direction? Second, despite the internet price ‘transparency’, buyers rarely have perfect knowledge of the price history of a good, and most of us would suspect that pesky bots are playing with the price in the background anyways (looking at you there, online plane ticket platforms). Third, vendors are not increasing prices in a vacuum. They have to hope that online competitors and high street retailers aren’t doing the same thing, otherwise the consumer would shop at the cheaper supplier. So, nice though this article sounds in theory, this type of pricing architecture isn’t going to work in the real world and I can’t think of any real world scenarios where consumers know so well through repeated past falls in price that more are on the way.

But, the aforementioned experiment in pricing strategy does raise a different question. If you happened to be at an economic inflection point where inflation is well established, but economic activity appears to be slowing, you might choose the ‘swingeing cut’ strategy to clear the decks before the slowdown or recession hits. It may be that far from Pricing Architecture being a way for vendors to exploit an economic trend, Pricing Architecture, and the strategies being used by vendors, tells you something about the state of the economy itself.

Let’s consider some curious pricing strategies of late. Tesla just cut the retail price of its cars by 10%[2]. Now, I just so happened to be looking at Teslas two months ago before the price cut was announced. I was given a steady tale of, “supply shortages”, “demand for these is strong” and “get in the line mate, its going to be a while”. They punched my details into the Wurlitzer of PCP and out spat an APR rate of 10.9% on the car. Unsurprisingly, I walked. Days later I received an updated offer from my friendly local Tesla dealer. To supplement the new 10% price cut, the loan rate APR dropped to 7.9%. Who wants to bet that the number of Teslas sold this quarter is about to pitch upwards? But is it because of the capital reduction, or the reduction in the interest rate on the loan? Or is this an act of desperation because overstretched consumers are cutting back on purchases and electric cars are falling out of favour with recent declines in petrol prices and under investment in the charging-point infrastructure.

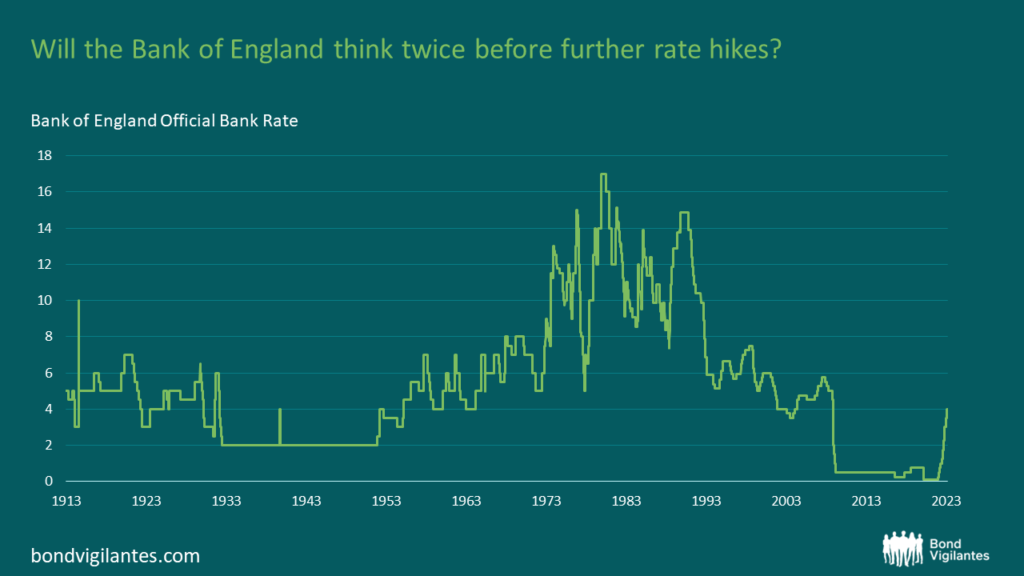

Consider this too: UK house prices have just had their fifth quarter of negative price growth[3] and the number of mortgage approvals is falling through the floor[4] as the mortgage interest rate pitches upwards. A few choice moments in history show us that this may cause central banks to think twice regarding rate hikes for fear that it will cause too much of an economic slowdown. The aggressive hikes in the UK in the early 1990’s generated not only a cooling of the average (mean) house price, but also a stagnation in Gross Domestic Product as did the later hikes in 1995. What I think we have just uncovered, Ladies & Gentlemen, is a core tenet of inflation psychology. Purchasing decisions these days are being driven by the underlying interest rates which are critical to demand in indebted consumers. Given the widespread prevalence of consumer debt products[5] (think Klarna), these underlying interest rate changes will have a far wider reach than has previously been seen and experienced in the macro-economy.

Economic boffins might now prick up their ears. This brings to mind the rather obscure Irving Fisher Debt-Deflation hypothesis which theorises that unexpected price falls raise the cost of collateralised debt, which lead to the potential for destructive fire sales. This is driven by prices and wages falling with the price level; where the nominal size of debts and interest payments are fixed. In turn, leading to an increase in loan defaults[6] which in extremis leads to bank insolvencies. Musk’s price cut works in tandem with Fisher’s theory here, but one assumes that Musk is trying to avoid Fisher’s end-game, involving customer and possibly corporate default.

So, we all now have a ringside seat to an interesting economic experiment. Will Musk’s price cuts launch Tesla sales into the stratosphere? Or will they, as Fisher suggests, end up crashing like Falcon9, and bring the Tesla share price with it. I’ll be keeping an eye on it for you.

[1] Research: How Price Changes Influence Consumers’ Buying Decisions (hbr.org)

[2] Tesla cuts electric car prices across Europe and US to bolster demand | Financial Times (ft.com)

[3] UK house prices fall for fifth consecutive month | Financial Times

[4] UK house prices fall at fastest pace since June 2020 | Financial Times (ft.com)

[5] https://www.finder.com/uk/buy-now-pay-later-statistics

[6] World Bank warns of mounting debt burden for poorer countries | Financial Times (ft.com)

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.