USD: The King is Dead – Long Live the King

Is the dollar losing its status as the King of currencies? Dollar hegemony refers to the dominance of the United States dollar as the world’s primary reserve currency, which has been in place since the end of World War II. The dollar has been the world’s reserve currency for decades, meaning that countries around the world hold large quantities of U.S. dollars to facilitate international trade and finance.

The global dominance of the U.S. dollar has given the United States enormous economic and political power. The U.S. has been able to print money and borrow at low-interest rates because other countries have been willing to hold U.S. dollars in their reserves. This has enabled the U.S. to finance its large trade deficits and military spending, which have been central to its global power.

However, the dollar’s hegemony now faces increasing challenges, and its importance is waning. The rise of China and the European Union has led to the growing use of alternative currencies, which has weakened the dollar’s global dominance.

Declining Global Trade Dominance

The U.S. has seen its share of global trade decline over the past few decades. While the U.S. economy is still the world’s largest, other countries, particularly China, are quickly catching up. As a result, the dollar is becoming less important in international trade.

For example, China is now the largest trading partner of many countries worldwide. Many of those countries are increasingly conducting trade in their own currencies rather than using the U.S. dollar. The European Union is also a significant trading bloc, with the euro now a major international currency.

- China-Russia bilateral trade in 2022 increased 34% to $190b (1.3 trillion yuan), a new record high.

- China-Brazil bilateral trade hit a record $150b in 2022, a new record high

- China-India bilateral trade hit a record $135b in 2022, a new record high

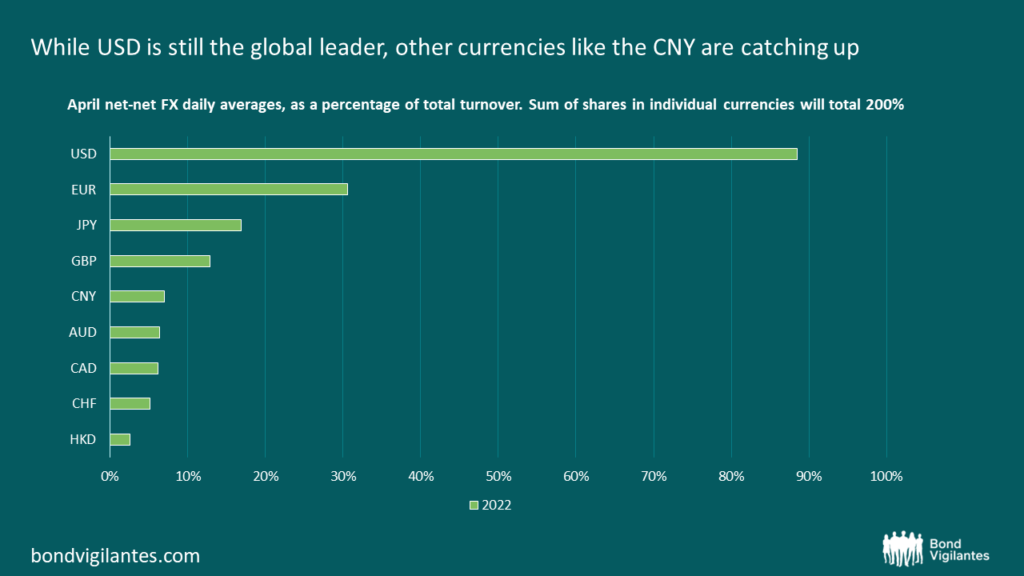

- The Chinese yuan (CNY) is now the fifth most traded currency after USD, EUR, JPY and GBP.

Reduced Confidence in the U.S. Economy

Another factor contributing to the decline of the dollar’s hegemony is the reduced confidence in the U.S. economy. The 2008 financial crisis and subsequent recession significantly impacted the global economy, and many countries lost confidence in the U.S. financial system. This has led to a shift towards alternative currencies, such as the euro and the Chinese yuan, as investors seek more stable and diversified assets.

Once again, debt ceiling concerns are coming into focus. As always, in the U.S., the opposition party will attempt to extract concessions from the other party, pushing negotiations to the limits. The two political parties are increasingly intransigent, and the possibility of a miscalculation is not unthinkable.

U.S. Sanctions and Geopolitical Tensions

Finally, U.S. sanctions have also contributed to the decline of the dollar’s hegemony. The U.S. has used its position as the world’s primary reserve currency to impose economic sanctions on countries that it disagrees with, such as Iran and Russia. This has led to those countries seeking alternatives to the U.S. dollar and conducting trade in other currencies.

Economic considerations

Dollar strength feeds inflation pressures abroad. When a country’s currency weakens against the dollar, the price of imports increase, resulting in inflationary pressures. With commodities like oil, gas, metals and food priced in dollars, any dollar strength will increase costs. This is particularly problematic for emerging markets as these costs comprise a large part of consumption.

The Rise of Digital Currencies

The rise of digital currencies, such as Bitcoin, also challenges the dollar’s hegemony. These currencies are in theory, decentralized and operate independently of any government or financial institution, making them an attractive alternative to traditional currencies.

For example, Bitcoin has become a popular way to conduct international transactions, particularly in countries with high inflation rates or weak currencies. While digital currencies are still a relatively small part of the global financial system, their rise represents a significant challenge to the dominance of the U.S. dollar. Countries the world over are attempting to suppress this alternative system

Examples of transactions outside of the dollar are on the up. Most recently, France completed its first yuan transaction for Liquefied natural gas (LNG), and Brazil has announced an agreement to trade directly with China.

Conclusion

In conclusion, the dominance of the U.S. dollar as the world’s primary reserve currency is waning. While the dollar is still the most widely used currency for international trade and finance, alternative currencies such as the euro and the Chinese yuan are becoming more important. In addition, the rise of digital currencies and geopolitical tensions are also contributing to the decline of the dollar’s hegemony. While the dollar is likely to remain an important global currency for the foreseeable future, its days as the KING of currencies is numbered.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.