A Royal Ascension (of Prices)

Seventy years on from the crowning of Queen Elizabeth II, her son Charles III will ascend to the throne on Saturday 6 May. The coronation will mark the beginning of a reign that looks far different at the start to that of his mother’s, as we look at some of the key economic markers and graphs.

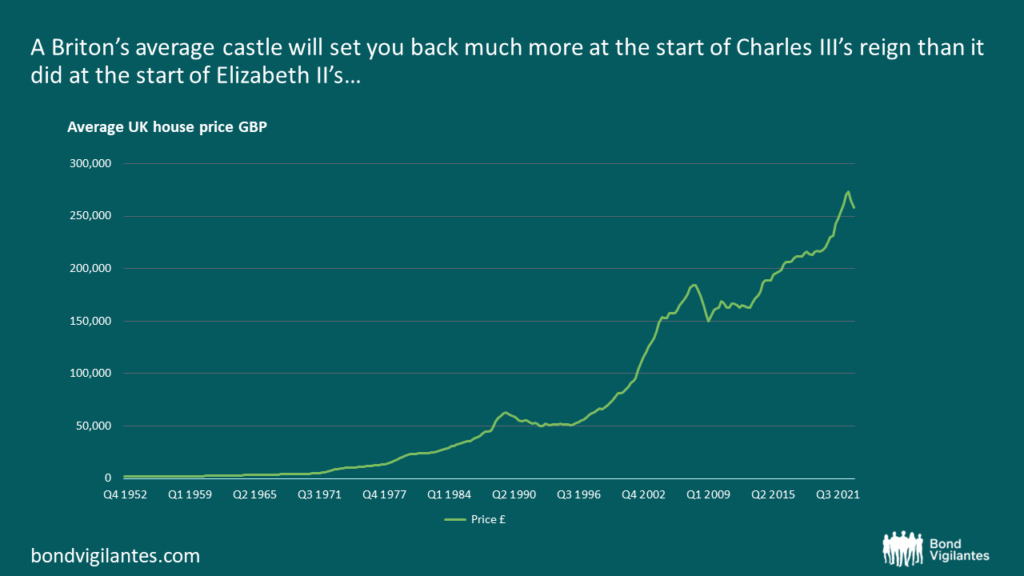

Fit for a King – The cost of your castle

Source: Nationwide, M&G (March 2023).

House hunters on the eve of King Charles’ coronation will be paying a princely sum for their new home in comparison to those 70 years ago. The average house price today is 130x higher than in 1953. The chart shows that prices maintained relatively flat for the first 10 years of the Queen’s reign, but have seen sharp rises in the last 30 years. Home ownership is also considerably higher than the last time that Britain had a king. The nation has been transformed from a nation of renters to a nation of homeowners, broadly, with 15 million of us owning our home compared to 4 million in 1952. However, to go back to the last time homes were as expensive relative to wages as they are today, you would have to travel back in time to 1876, when Queen Victoria wore the crown. Currently, the average British home is approximately 9x wages, which is more than double the ratio in 1952.

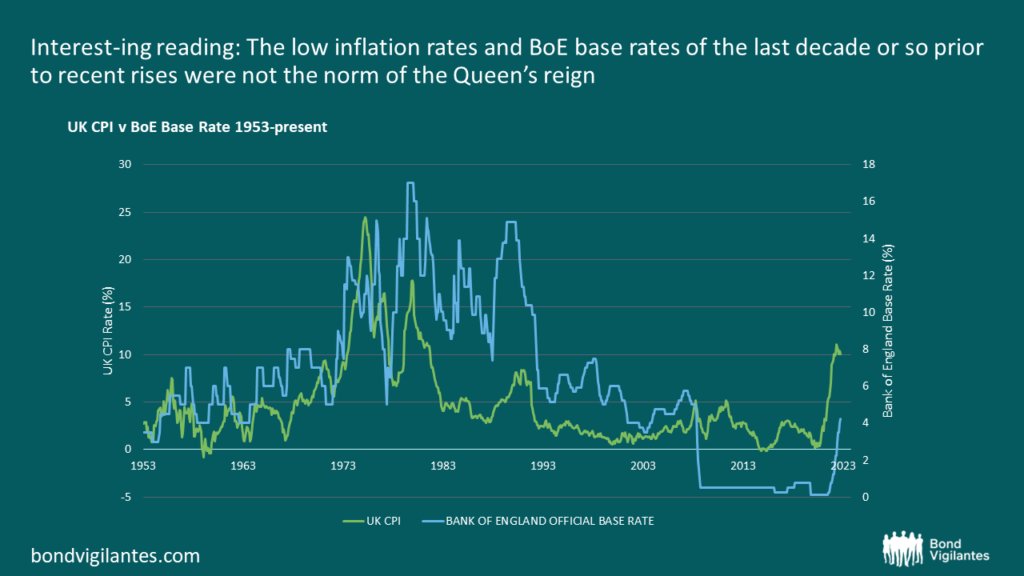

This could be of interest, your majesty

Source: Bloomberg (April 2023).

Up until the last year or two, many of us have become used to low, 2-3% inflation around the developed world. Following the bout of fiscal and monetary stimulus during and following the Covid pandemic things have changed of course, with CPI inflation currently in double digits.

As the chart above shows, however, while we may have become used to a relatively benign inflation environment for some time, periods of low inflation are perhaps the exception rather than the rule. The UK saw a number of more challenging inflation environments during parts of Queen Elizabeth’s reign, particularly in the 70s, 80s and 90s.

And, while a Bank of England interest rate of 4.25% is the highest we have seen in a while, over Elizabeth II’s reign interest rates hit a high of 17% (1979). The low was 0.1% (2020).

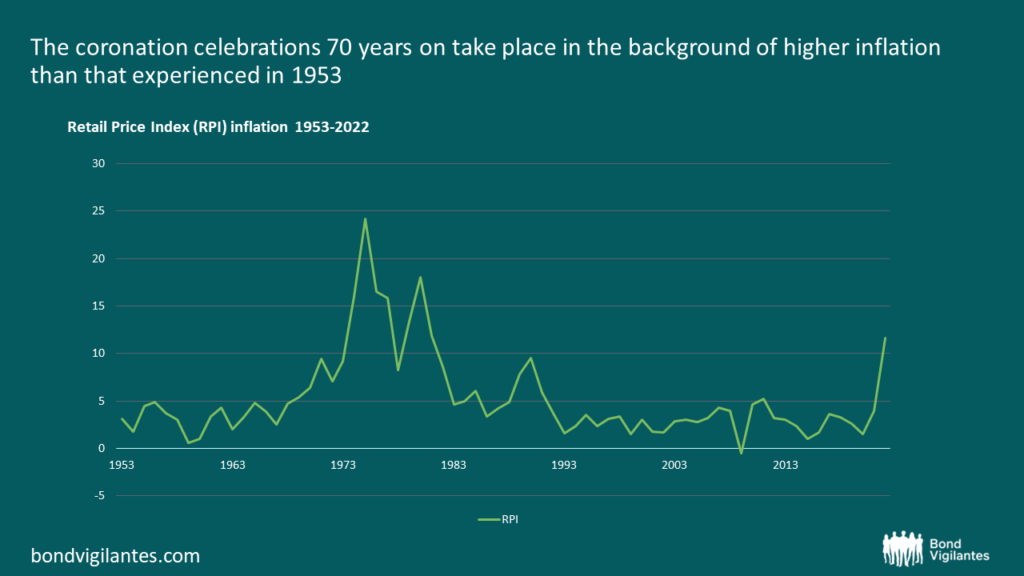

Source: ONS (April 2023).

The important question now is where will inflation go from here? There are a number of long-term trends, such as technology (e.g. better price discovery through online shopping, which provides some downward pressure on prices), globalisation (e.g. the flow of cheaper labour and goods into developed economies) and demographics (ageing populations) which have helped keep inflation low for the past few decades. These forces still remain strong. Then again, could something be changing? Globalisation, for example, is one of these macro trends which could be reversing, with geopolitical tensions running high, and an effort in many economies to relocate to jobs closer to home.

The Royal Household

Sources: This is Money (May 2022), ONS (Feb 2023)

Household costs have also seen a rise, but spending patterns have also changed. Britain is no longer a nation of smokers, with only 1% of spending going on tobacco in comparison to 6% in the 1950s. However, drinking habits have largely remained stable, with spending on alcohol only dropping 1% to 2%. Those still enjoying a pint of beer are paying a lot more for it though. The graphic above demonstrates the relative costs of a pint of draught lager. Although Britain may be more fashion conscious today, Britons are spending less of their income on clothing. Clothing accounted for a tenth of spending in 1952, but this has now fallen to 4% as clothing has become more affordable.

The basket of goods used to calculate the inflation rate has changed over the past 70 years as life in Britain has embraced strides forward in technology. It has been out with the sowing machine, table wringer, writing paper and ink. Meanwhile, it has been in with the fridge/freezer, security camera, smartphone handset and PCs. There have also been changes in views on health. Pipe tobacco was a staple with which Brits would have celebrated the coronation of the Queen, but now the e-cigarette has taken the spotlight. There have been changes in fashion sense too – no longer are the corset and smocked frock components of the basket! There are many items in the basket that would have seemed to be the stuff of make believe had you described them to those constructing the basket in 1953. Television subscription packages, package holidays and various takeaways comprise the 2023 basket, along with university tuition fees!

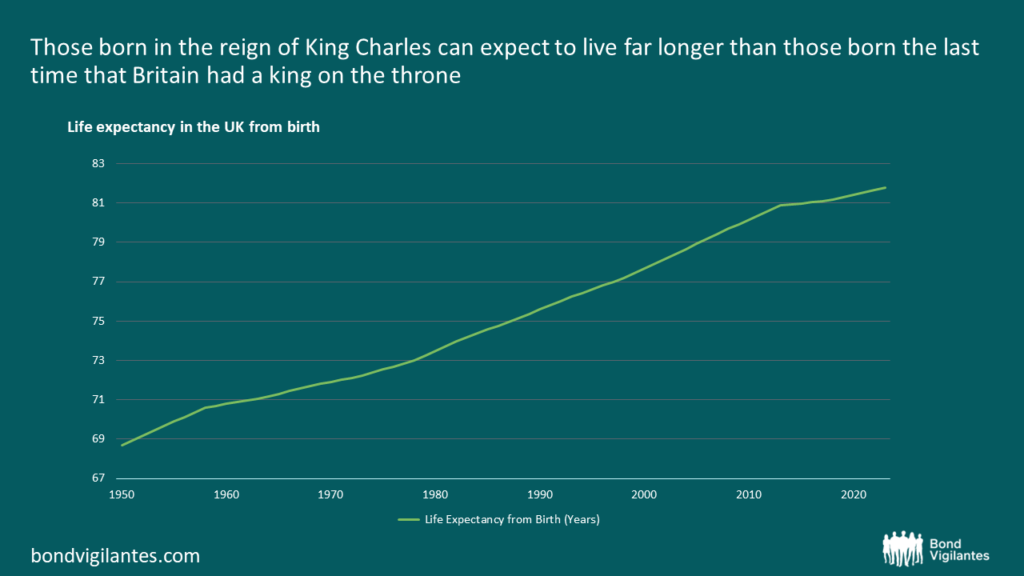

Long live the King, and his subjects

Source: United Nations (April 2023).

Long live the King – well most people in Britain today can hope for the same. Life expectancy has risen by more than 13 years over the reign of Elizabeth and now stands at 81.77. The increase in life expectancy as well as medical advances has created the ageing population that the UK has today. This has knock on implications onto the economy and brings political decisions into question such as where to set the state pension age, which recently came under the spotlight in the background of the cost of living crisis. At the last coronation, the average person would only be able to enjoy their state pension for just over three years. By comparison, those just beginning their retirement today would on average draw their state pension for about 16 years. This large increase bears heavy on the welfare state, particularly given that the state pension accounts for approx. 42% of welfare spending

A Not so Royal (Strong)Mint

Source: Bloomberg (May 2023).

£1 invested in gold would be worth £5593 today. It is noteworthy that gold prices remained very stable until 1971 when Nixon abandoned the Bretton Woods system, whereby the Dollar was pegged to the price of gold. As shown in the chart, the price of gold subsequently increases significantly over the following 50 years, so it could be argued that gold investors have President Nixon to thank for their healthy returns! Interestingly, there is a clear correlation in the stability of the GBP-USD rate until the collapse of the Bretton Woods system, showing the impact of this global arrangement. After the fall of Bretton Woods, the chart shows that the Pound is a currency that has been waning as a currency of global importance. If Charles III were to sell the Imperial Crown today and spend the proceeds on a holiday to the US, his Sterling wouldn’t go as far as it would if his mother had done the same after her coronation!

Source: Bank of England/Bloomberg (April 2023).

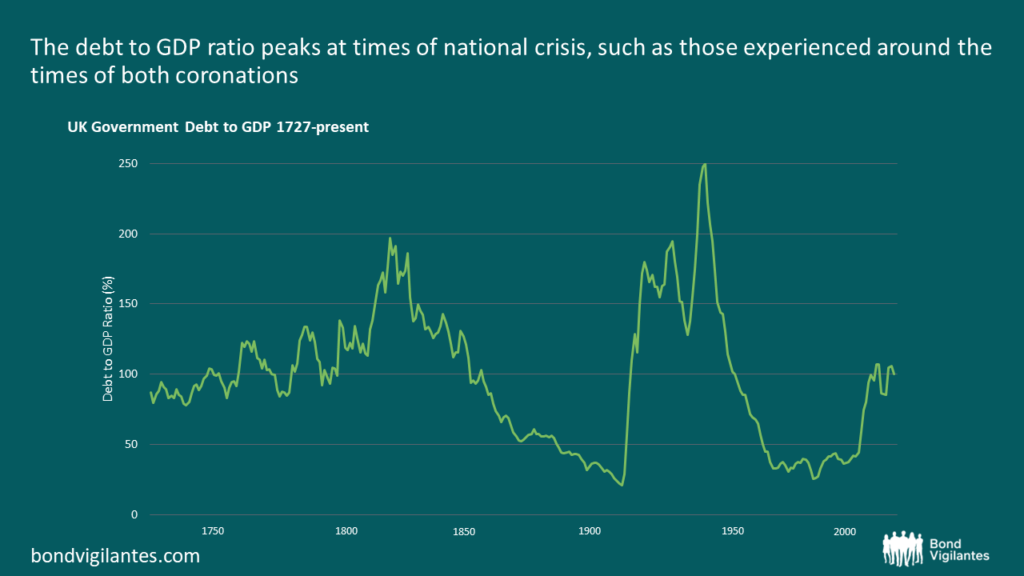

Indebted to the King… or rather the government indebted to investors!

This chart shows that both monarchs ascended to the throne with the Debt to GDP ratio in a similar position. However, the trends are in opposite direction, with Debt to GDP coming down sharply following very high levels of indebtedness in the wake of World War II. History shows us that the ratio rises following times of national crisis which dictate a need for a significant increase in government spending. We see in the chart that prior to the World Wars, debt to GDP was highest during the period of the Napoleonic Wars. War is expensive, and historically this is what prompted large increases in the ratio. Charles III is coronated following a national crisis of a different kind. The Global Financial Crisis and Covid have caused the national debt to increase sharply and recently the ratio has surpassed 100% once again after 55 years with the ratio in double digits.

Source: ukpublicspending.co.uk (May 2023).

Conclusion

In conclusion, Charles III is to be crowned King of the United Kingdom in a nation that is very different to the country his mother became monarch of in 1953. Indeed, judging by some economic indicators, the UK may look in a similar state. Debt to GDP is in a similar condition, albeit the trends are in opposite directions, and the base rate is akin to that of 1953. However, 2023 sees a UK where the citizens are living lives that are completely different to those walking the streets 70 years prior. The basket of goods which drives the inflation measure is a much larger and vastly different basket including goods and services that our predecessors could not possibly envisage. We are living longer and healthier lives, but the roofs over our heads are costing much more than they once did. Not to mention that a pint of beer in the pub to celebrate on Saturday will cost you much more than it did in 1953! The coronation will be a national celebration, although it is clear that the UK is not the global superpower that it once was. A country that was losing its influence when Elizabeth came to the throne, but the evidence demonstrates that sterling is not a formidable force and that the Dollar is the currency of the day. What will these charts show by the time the next coronation comes round?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.