US inflation: 3 positive takeaways from this week’s report

Inflation remains one of the most important topics for investors and consumers. The sharp increase in prices we experienced after Covid has put enormous pressure on households, while financial markets generally sold off as Central Banks started to engage in an aggressive tightening cycle.

In a blog I wrote in November, I stated that we were starting to see some light at the end of the inflation tunnel, but we were not there yet. Since then, things have improved and I believe we are now making some real progress towards the inflation target. Yesterday’s CPI report showed that US inflation dropped to 4.9% in April, continuing its disinflationary trend. Core inflation also moderated to 5.5% year-on-year (YoY). There were 3 key themes from this report which make me feel more comfortable about inflation over the next few months:

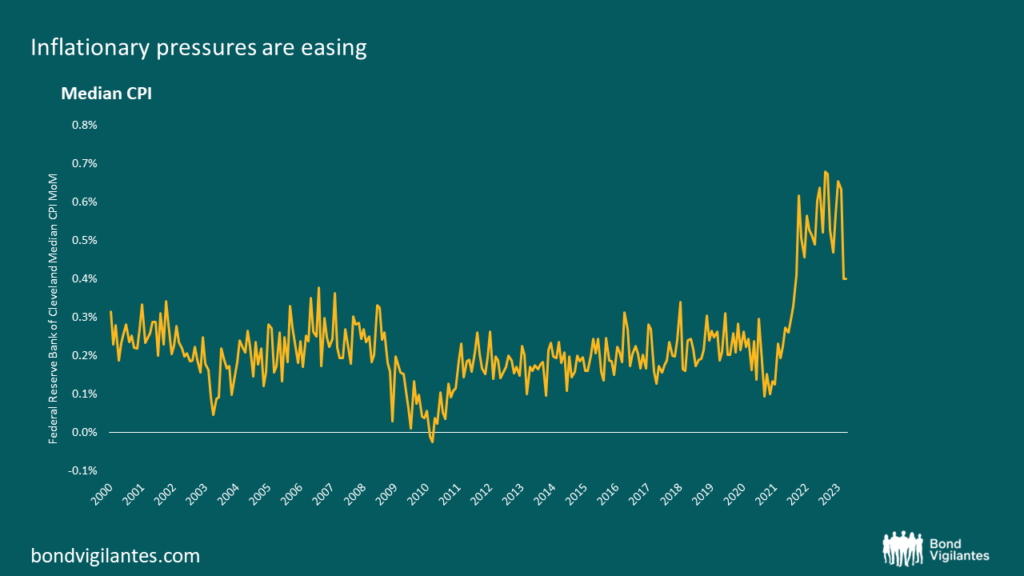

1. Inflationary pressures are easing: the core of the distribution is moving to the left, meaning it is not just a few items which are pushing overall inflation lower, rather, it is a broader trend. An increasing number of categories are coming off the boil and starting to move in the right direction. This is particularly evident looking at median CPI, which focuses on the core of the distribution, avoiding all the noise caused by outliers.

Source: Bloomberg, Federal Reserve Bank of Cleveland, 30 April 2023

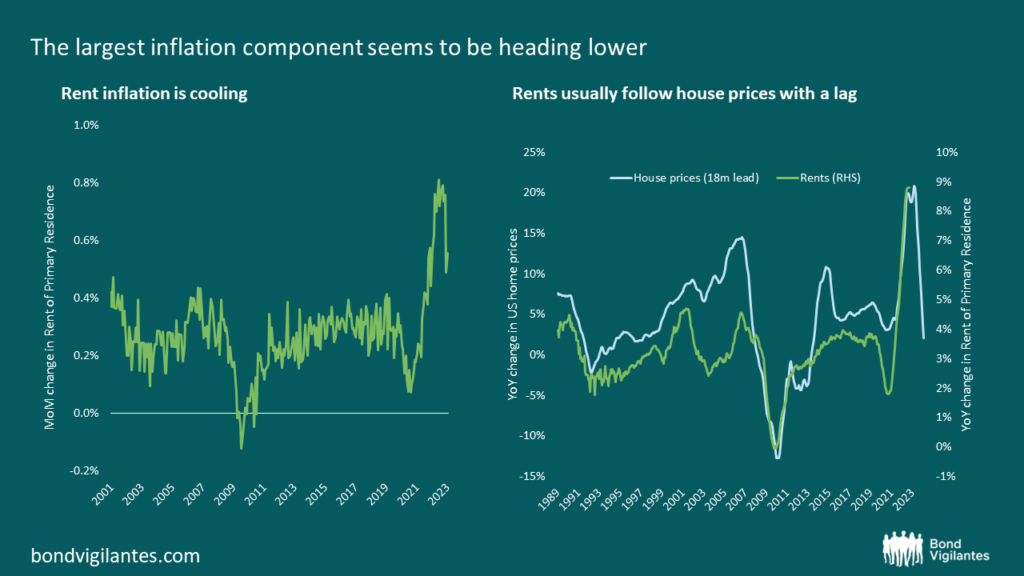

2. Rents seem to have peaked: this report confirmed the deceleration in rent prices. This is important as rents represent by far the biggest component of the inflation basket and as a result, are its main driver. If they fall, inflation will likely fall as well. It is still unclear how low rents can actually go given the increase in wages, however, the softness in the housing market will likely keep them on the right trajectory for some time. As you can see from the right hand side (RHS) chart below, house prices usually lead rents by about 18 months.

Source: Bloomberg, BLS, S&P CoreLogic Case Shiller, 30 April 2023

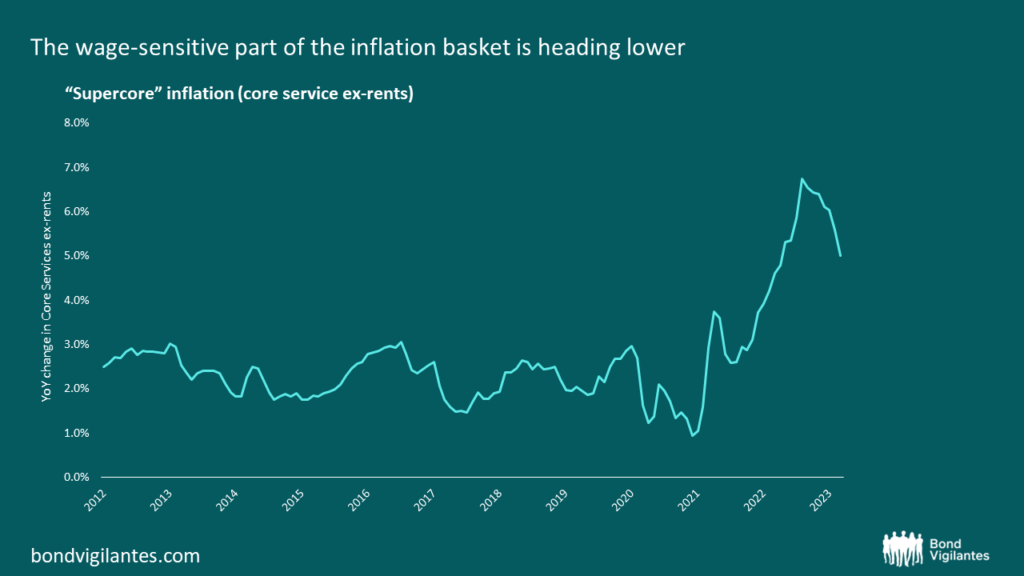

3. Powell’s preferred indicator moves lower: “core service ex-shelter” declined further. This is the most important indicator for Powell as this is where we could see a wage-price spiral. Most of the items in this sub-category are heavily impacted by wages. So far it seems the wage-price feedback is weakening and this is really good news as it reinforces the idea that the Fed is finished hiking… at least for now.

Source: Bloomberg, BLS, 30 April 2023

In conclusion, while inflation around 5% is clearly not good, things are moving in the right direction. Inflationary pressures are easing, a wage-price spiral seems to have been avoided for now, and rent inflation, the largest component of the CPI basket, appears to have peaked and will likely be on a downward trajectory for the next few months.

It might take a little longer than expected to return to target, but we are definitely on the right track and disinflation will likely remain the theme for some time.

I should warn investors that getting back to target is one thing, remaining around that target is a completely different story. Inflation usually comes in waves as it causes issues which tend to be resolved with more money being created and this in turn will cause inflation to reaccelerate.

But that’s a story for another blog. For now, let’s enjoy this disinflationary trend.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.