Challenges and opportunities in Asian Investment Grade Corporates

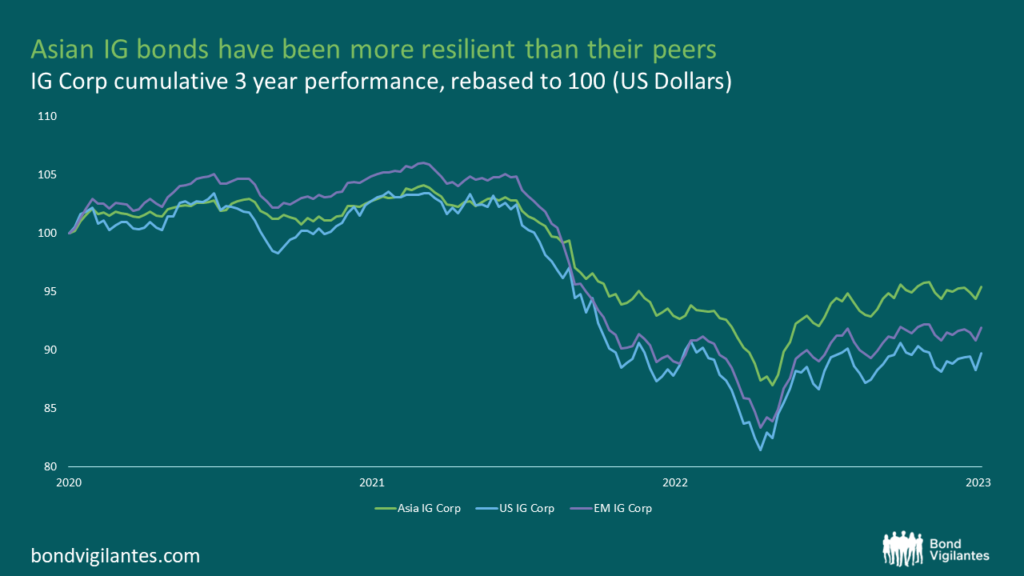

Amidst macroeconomic uncertainties and policy headwinds, Asian investment grade (IG) corporate bonds have demonstrated remarkable resilience and relatively benign drawdowns compared to peers in other regions, despite interest rate volatility and credit challenges in the recent years. This year, Asian IG corporates have also performed largely in line with the US IG corporate bond market, while modestly outperforming the Emerging Market (EM) and Euro IG corporates (in local currency terms).

Source: Bloomberg (July 2023)

Navigating the path ahead

While credit-specific challenges exist, the fundamentals of Asian IG corporates remain largely stable. The stronger growth outlook in Asia relative to the rest of the world, combined with room for policy accommodation, is expected to provide support to the operating environment of Asian companies. The credit migration trend of Asian IG corporates has also shown signs of stabilising, with the pace of downgrades having slowed compared to 2H 2022. Additionally, the sound economic fundamentals and post-pandemic recovery contribute to the credit stability of government-related entities, which make up a significant portion of the non-sovereign IG credits in Asia.

However, a global growth slowdown may limit the extent of spread compression driven by fundamentals, particularly in sectors vulnerable to global demand fluctuations. Credit selection also remains crucial in segments beset by sector specific concerns, such as the China property sector and among China’s Local Government Financing Vehicles (LGFVs).

Market dynamics

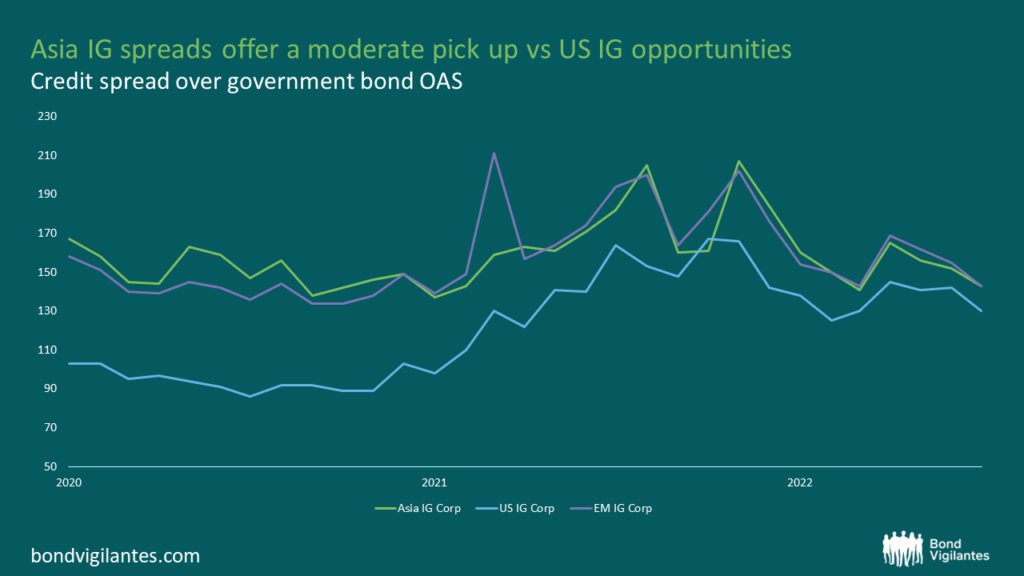

While valuations of Asian IG corporates are not cheap relative to history, all-in yields of Asian IG corporates are at historically elevated levels, providing investors with a good source of carry. The risk premium of Asian IG corporates, which investors are compensated for, also remains moderately higher compared to similarly rated US IG corporates. Further, opportunities for value enhancement exist by delving into individual credits and sector opportunities.

Source: Bloomberg (July 2023)

Hidden gems in the Asian IG corporate space

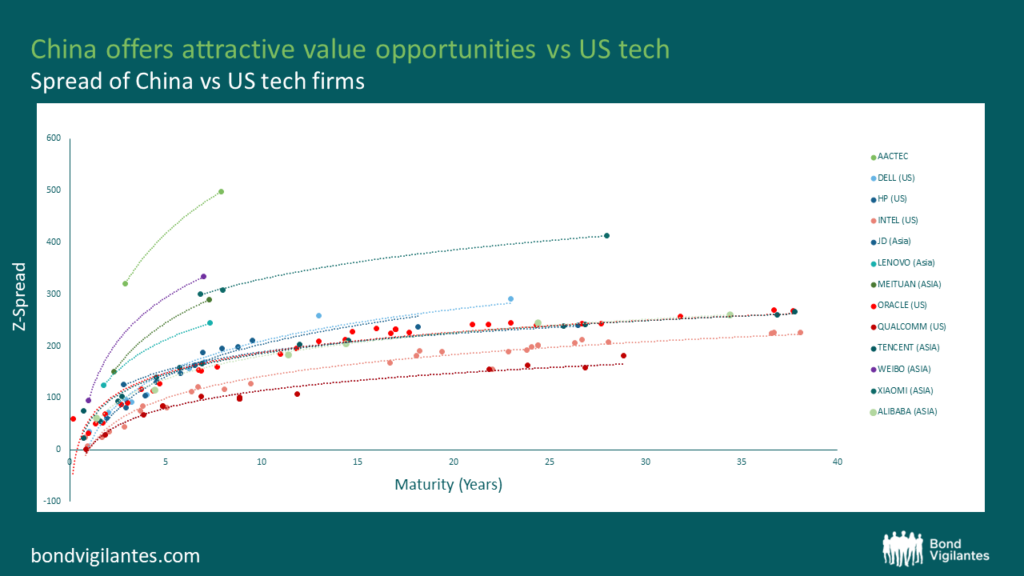

There are hidden gems within the space that offer potential value enhancement. By conducting in-depth analysis of individual credits and sectors, investors can identify opportunities that may have been overlooked. For example, certain IG companies in the China technology sector , not only trade at higher yields compared to their US peers, but also boast robust balance sheets and net cash positions, making them attractive prospects for investors seeking value within the sector.

Source: M&G, Bloomberg (18 July 2023)

Underappreciated segments in 2023, such as China asset management companies (AMCs) , technology names and Asian bank capital, present potential value opportunities. Additionally, credits benefiting from domestic growth trajectories, particularly in India, offer avenues for value enhancement. Active positioning across the Asian IG curve can serve as an additional source of alpha, particularly when US interest rates remain at elevated levels.

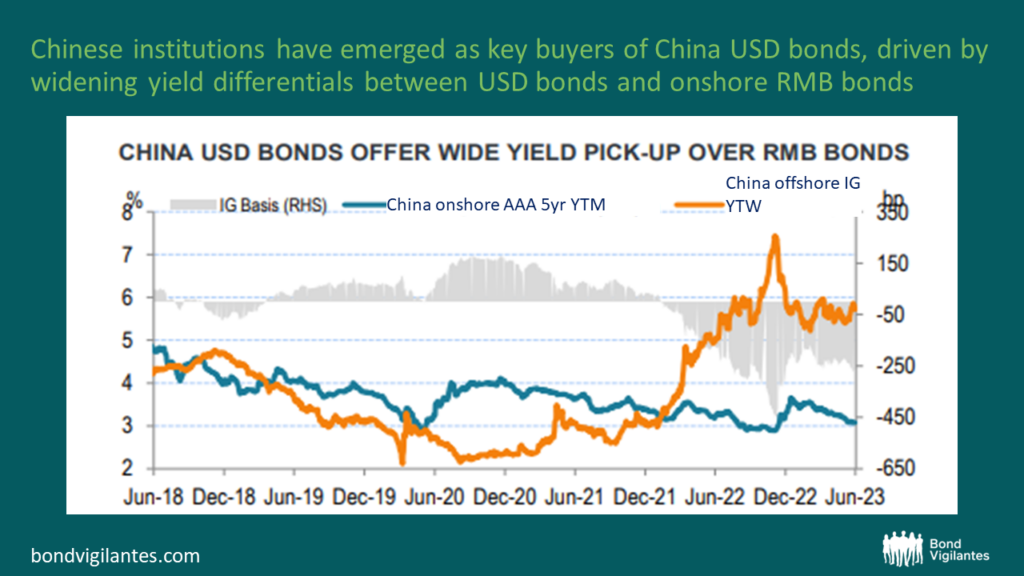

Market dynamics driving Asian IG corporates

The appeal of Asian IG corporates is enhanced by positive supply-demand dynamics. The volume of Asian USD IG corporate bonds being issued has notably declined as issuers shift towards more cost-effective domestic funding sources. Simultaneously, investor demand remains robust due to the availability of cash among investors, leading to well-subscribed new issuances. Notably, Chinese institutions have emerged as key buyers of China USD bonds, driven by widening yield differentials between USD bonds and onshore RMB bonds.

Source: Wind, JPMorgan, Bloomberg (June 2023)

Resilience and stability of Asian IG Corporates

Asian IG corporates have exhibited resilience and steadfast performance, supported by stable economic fundamentals and strong government linkages. Despite prevailing macroeconomic uncertainties, Asian IG corporates continue to provide a compelling mix of quality and yield; credit spreads are expected to remain supported, with widening pressures limited by the region’s favourable growth prospects, companies’ access to cheaper onshore funding, and strong technical support in the credit market.

While valuations may not be cheap at present, the relatively stable fundamentals of the sector, coupled with historically elevated all-in yields, make them an attractive credit segment for investors seeking a steady source of income. Opportunities for value enhancement also exist by delving into individual credits and sectors opportunities, such as those mentioned above.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.