How will the reversal of loose monetary policy affect UK housing?

Since the 2008 global financial crisis, central banks worldwide have responded with strong monetary policy measures to prop up economies and promote economic growth. Central banks have slashed interest rates to zero, some into negative territory, and embarked on a path of quantitative easing (QE). These policies, arguably vital at times to prop up confidence and avoid a catastrophic outcome, have finally induced the stated aim of increased inflation. For years economists had warned that these policies would result in runaway inflation, but the reality was that it just didn’t materialise in the way we see today. It mostly filtered into financial assets. Inflation is now more broad based and impacting all of our lives and central banks have had to respond.

In this article, I will focus on the UK housing market and the impact the above monetary policies had on the market.

Reduced Borrowing Costs and Increased Affordability

One of the primary effects of low-interest rates is the reduction in borrowing costs for prospective homeowners. When mortgage rates are low, monthly mortgage payments become more affordable, allowing more people to enter the property market. This increased affordability has driven up the demand for housing, leading to upward pressure on prices. Low interest rates also incentivise existing homeowners to remortgage or upgrade their properties, further contributing to increased demand in the market. The accessibility and affordability of mortgages, driven by low rates, have significantly boosted UK house prices over the years.

Asset Inflation and Investor Demand

Low interest rates have created an environment conducive to asset inflation, with housing being a primary beneficiary. As traditional investment options like savings accounts and bonds offer minimal returns, investors seek alternative avenues with higher potential yields. Residential real estate, particularly in the UK, has become an attractive asset class due to its historical price appreciation and perceived stability. This increased investor demand, driven by low interest rates, has added further upward pressure on house prices. Investors, including domestic and foreign buyers, view UK property as a valuable long-term investment, leading to heightened competition and bidding wars, particularly in desirable locations.

Quantitative Easing and Wealth Effect

QE is a monetary policy tool that injects liquidity into the financial system by purchasing government bonds and other assets. The Bank of England’s (BoE) QE program, initiated in 2009, aimed to stimulate economic growth and boost lending. One of the intended effects of QE is the wealth effect, wherein the increase in asset prices, including housing, leads to a sense of increased wealth among homeowners. This perception often prompts individuals to spend more and borrow against their properties, further stimulating economic activity. The wealth effect resulting from QE has indirectly contributed to rising house prices. As homeowners feel more financially secure and perceive an increase in their wealth, they may be more inclined to invest in their properties, leading to renovations, extensions, or even further property purchases, thereby adding to the demand and driving up prices.

Regional Disparities and Unequal Impact

While low interest rates and QE have broadly impacted UK house prices, their effects have not been evenly distributed across the country. Regional disparities are evident, with areas such as London and the Southeast experiencing more pronounced price increases than other regions.

The concentration of economic and employment opportunities in these areas and the influx of foreign investment have amplified the impact of low interest rates and QE. The demand for property in prime locations has surged, pushing prices beyond the reach of many aspiring homeowners and exacerbating affordability challenges.

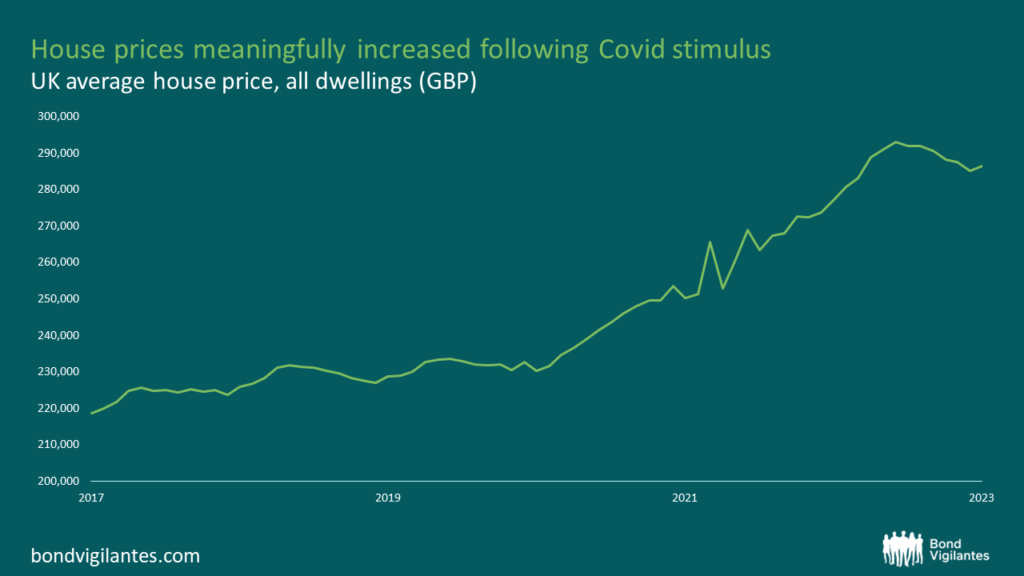

COVID Bounce

When COVID struck in 2020, monetary policy was eased even further, and the government reduced stamp duty to prop up the housing market; we saw a surge in house prices as people flocked to areas away from cities in search of more space as the work dynamic changed to a more flexible work from home approach. Since 2020, the average UK house price increased by 25%, with significant variability around that figure. In some areas, it was meaningfully higher.

Source: Bloomberg (July 2023)

So what happens when these factors go into reverse? The natural conclusion would be to assume that house prices should fall. Surely a simple answer?

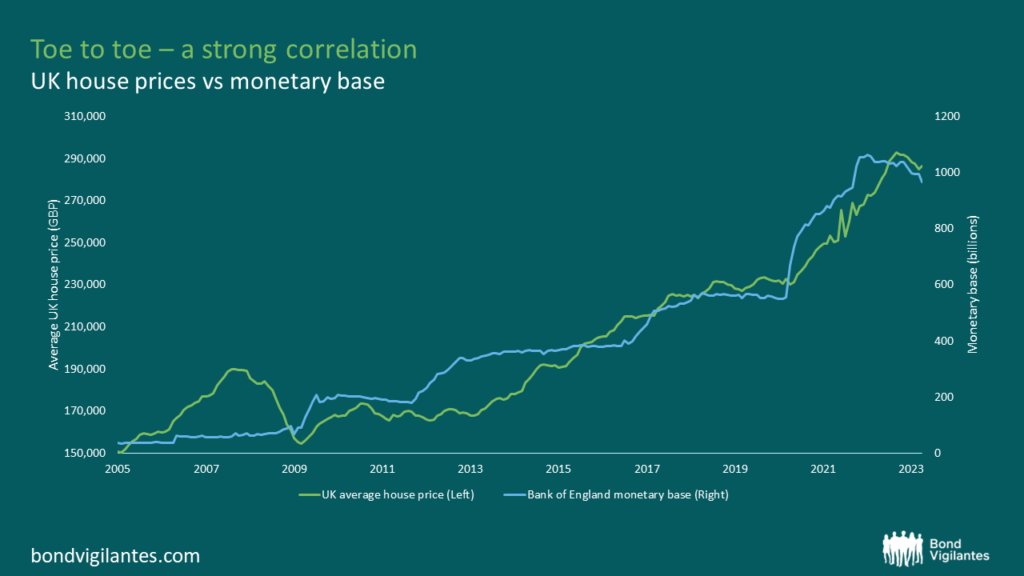

The below chart shows a strong correlation between the monetary base and house prices. The BoE is no longer purchasing bonds; it is selling bonds. The plan is to reduce the balance sheet by £80 billion by November this year and then reassess. However, a fair assumption is that we should see roughly this amount annually.

Source: Bloomberg (July 2023)

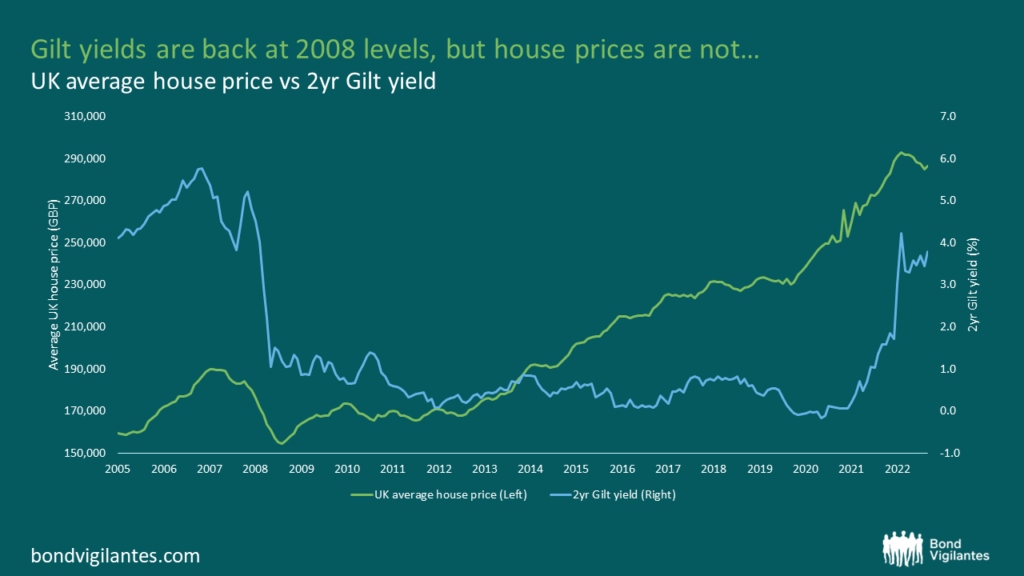

The final chart shows house prices vs two-year fixed-rate gilts. Since 2008 interest rates have been close to zero, this has unwound in 15 months, and rates are largely back to where they were in 2008. Throughout this period, homeowners had been taking out more debt as affordability improved. However, affordability has now turned rapidly in the other direction. At current levels of pricing and increased levels of leverage, this level is equivalent to an interest rate of 20%, such as in the early 1990s.

Source: Bloomberg (July 2023)

This poses some real challenges for the housing market. House prices just getting back to the level before COVID would mean prices falling to 20% below where we are currently. Don’t forget, people weren’t happy with how unaffordable houses were in 2020.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.