One Chart Lunch – which FM brought the best chart?

Once or twice a year, a dozen of us get together for a One Chart Lunch. As the name suggests, attendees are tasked with bringing a single chart of some description and presenting it to the table. Lunch is provided in return. The eagled eyed reader will notice some of the team failed the brief.

The content was varied, covering everything from Central Asian currencies and energy security, to Chat GPT and the growth in private credit. This year’s winner was Gareth’s submission, proof if ever it was needed that you can win by appealing to the lowest common denominator. Claudia’s submission showing that EM inflation is lower than the UK for the first time in 20 years, grabbed second place.

Take a look at the contenders below:

Richard Woolnough – Credit spreads to ‘MOVE’ tighter

Source: M&G, Bloomberg

- The Move index is highly correlated with spreads – if this measure of interest rate volatility moves then credit reflects this

- If you believe interest rate policy will become more or less stable this has implications for the credit market based on this relationship

Stefan Isaacs – Private credit to face pressure when refinancing

Source: Preqin, Bloomberg

- The near fivefold growth in private credit will almost certainly have led to poor underwriting standards

- Levered floating rate borrowers will face significant challenges in a higher interest rate environment

- Private assets held at par are likely to see pressure on valuations as liquidity and refinancing challenges hit home

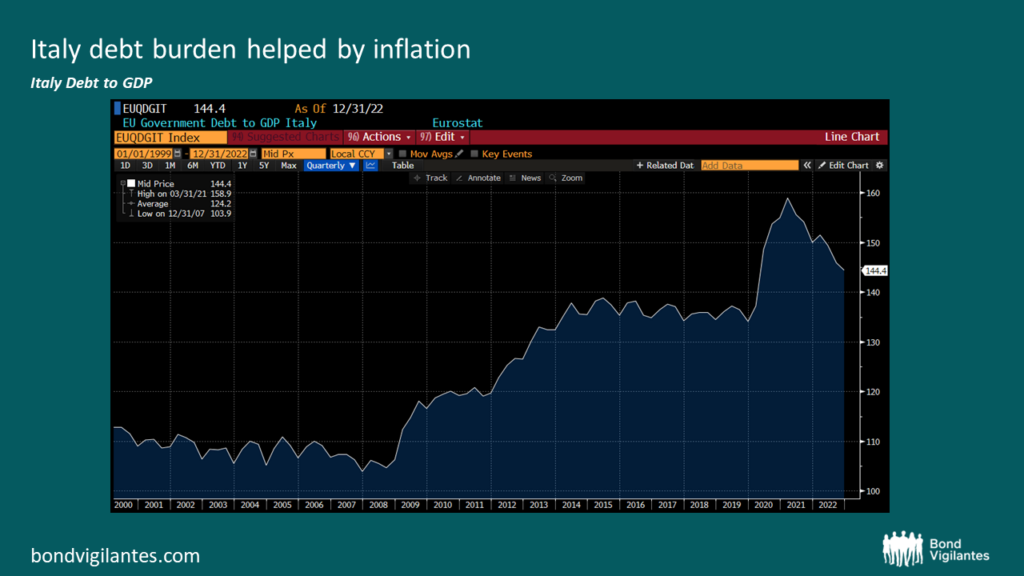

Matthew Russell – Italy debt burden helped by inflation

Source: Bloomberg

- Elevated inflation is having a positive effect on the finances of most governments across Europe (the notable exception being the UK)

- Italian debt/GDP, for example, has dropped by approximately 15% from its peak

- All else equal, lower debt burdens in peripheral Europe should lead to sovereign yields trading at tighter spreads to bunds

Eva Sun-Wai – equities v Treasuries

Source: FT, Pictet, Bloomberg

- The yield on cash, bonds and equities are now the same

- There is no longer incentive for investors to take on the risk of equities or even corporate bonds as they are yielding the same as short dated risk free assets such as 3 month Treasuries

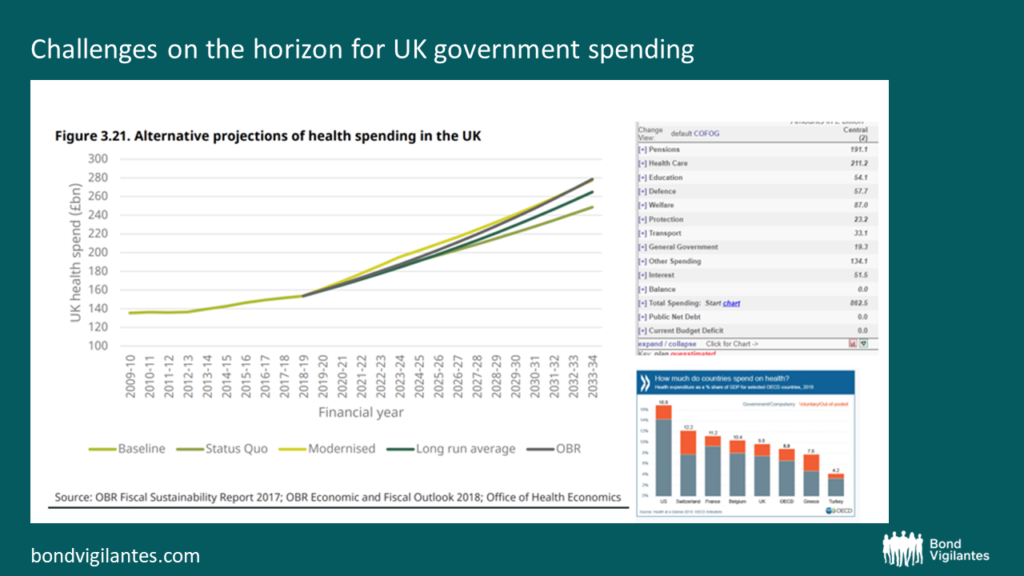

James Tomlins – Challenges on the horizon for UK government spending

Source: OBR

- UK central government spending is dominated by Pensions and Health, both of which will accelerate with demographic trends (older people vote more too and get rewarded by the system)

- Productivity enhancing spending (e.g. Education and Transport) is comparatively very small

- Projected rises in healthcare spending will make this situation even worse

- Bad news for the fiscal situation, bad news for tax payers and bad news for UK productivity, irrespective of who runs the country

Eva Sun-Wai (2) – Mortgage misery

Source: Bloomberg

- The average 2yr fixed rate loan has just hit 6% in the UK

- Current loans indicate around 70-80% of monthly payments are purely the interest cost, with monthly payments for first time buyers now representing around 40% of income (a level not seen since the Global Financial Crisis)

- Using the parameters in the chart, with a £2k monthly payment, the same loan could have bought a house value of £805k – a drop in affordability of around 40%

- Lenders are starting to withdraw deals once again, and the Bank of England thinks less than a third of rate hikes have fed through to mortgage holders

- With over 1.3million borrowers needing to refinance before year-end, this smells like trouble. Could a strong labour market help limit the damage? It didn’t help Sweden…

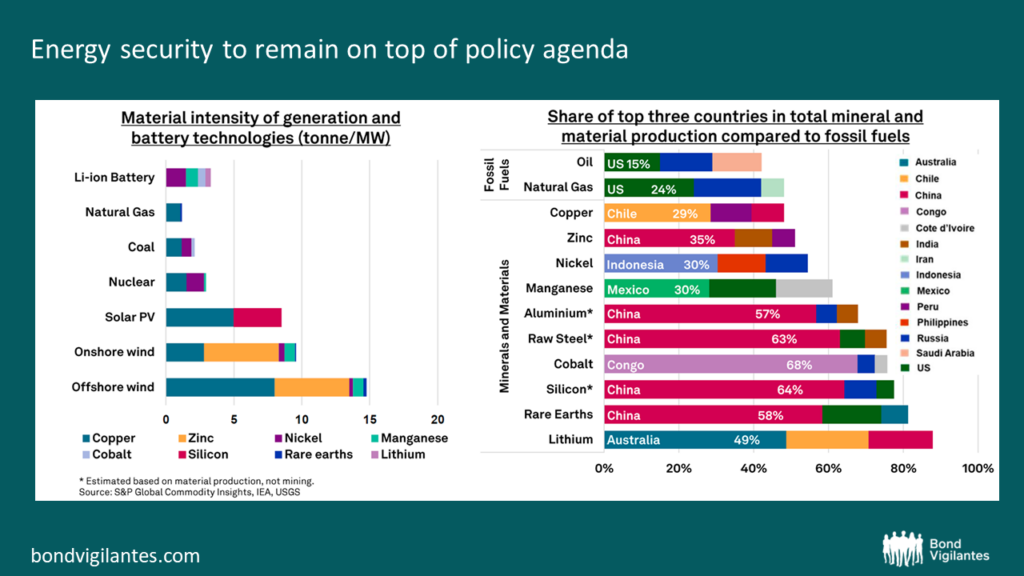

Mario Eisenegger – Energy security to remain on top of policy agenda

Source: S&P Global Ratings

- With the energy transition in full flight, it’s important for bond investors to stay ahead of sector trends as well as macro drivers

- On a sector level, given the importance of copper and zinc, it can be expected that diversified miners will continue to be on the hunt to increase exposure to green metals to make sure they are well set up for the secular growth. With copper supply expected to drop from 2025 onwards, it opens up increased M&A risk in the space in 2024

- From a macro perspective, we believe that the concentration of those minerals and materials will drive geopolitics considering China’s heavy share of total material production

- Certain EM countries are set to experience a material potential GDP tailwind given heavy exposure to green materials

Ben Lord – Heading for 6? I’m not so sure

Source: Deutsche Bank, Bloomberg Finance LP

- The front end of Sterling market is pricing in a 6% base rate being seen at the end of 2023/beginning 2024

- I don’t think they will get there, I don’t think they need to get there, I don’t think they should go there

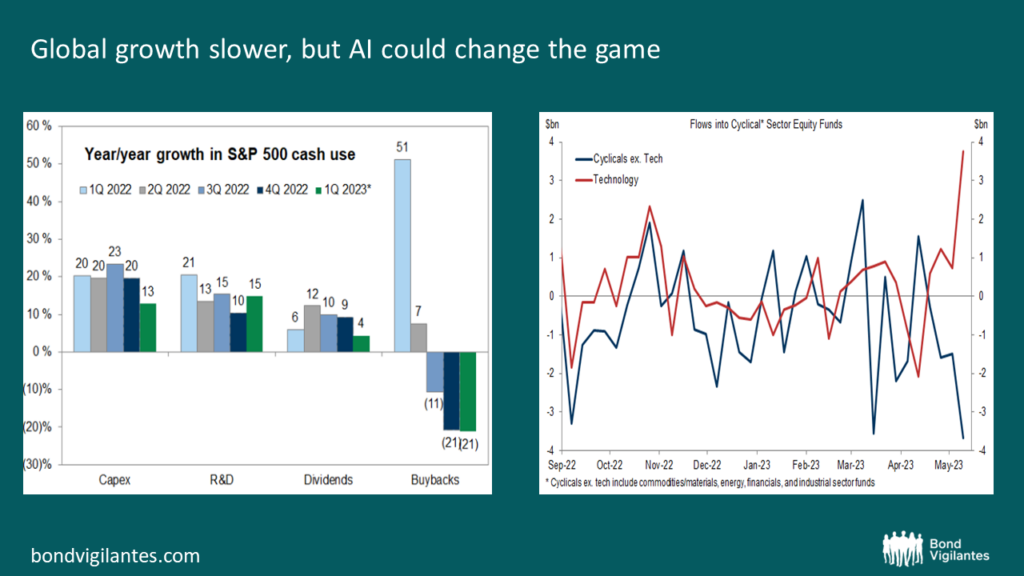

Lu Yu – Global growth slower, but AI could change the game

Source: (LEFT) Datastream, Goldman Sachs Global Investment Research; (RIGHT) EPFR, Haver Analytics, Goldman Sachs Global Investment Research

- Since 2022, we have seen big changes in rates/macro and industry cycles also moving on – it’s interesting to see, on the micro level, how corporates behaved

- In the left chart, it makes sense to see most categories showed slower growth year on year

- It’s very comforting, as a bond holder, to see that the biggest decline is in shareholder return, especially the sharp reduction in buybacks

- The exception is in R&D: corporates actually are growing faster on R&D spending, and I suspect this is driven by AI

- In the right chart, it shows from the investor side, how hyped AI is: while inflows into cyclical equity funds suffered a huge decline, inflows into Tech equity funds rallied recently – previously they were pretty close to each other

- What’s going to happen? 1. AI comes up in almost all industries – possibly like EV was to the Automakers 10 years ago: it was a huge disruption, and whoever ignored it without investing enough suffered later and had to catch up with a bigger cost; 2. It’s also possible a huge AI bubble will form, or has already formed

Nick Smallwood – EM AT1s less risky than DM AT1s?

Source: M&G, Bloomberg

- These bonds have broadly similar ratings (IG or crossover). EM AT1s have traded inside similarly rated Western counterparts for quite some time as call risk is perceived to be lower. Reputation matters more than economics in EM, particularly as investor bases are more localised and regulators see calling on time as a matter of financial stability. Bail-in is also less likely as there is less of a political imperative to protect taxpayers ahead of investors, while regulators/governments are more supportive of their national champions.

- This explains why EM AT1 widened less than Western counterparts following the Credit Suisse event. It’s also true that EM AT1s are a much smaller part of liabilities than is the case in the West (e.g. CS alone had $17bn of AT1s, whereas all of LatAm has just $12bn), so there is greater technical support.

- The recovery in DM AT1s has really lagged, so arguably this is where the value now lies. Some EM AT1s are now trading inside higher-rated T2s (BNKEA), a clear sign to sell if involved.

- Finally, interesting to note that PNC’s AT1 didn’t react at all to the stress amongst US Regionals. It only widened with the rest of the market following CS.

Eldar Vakhitov – Central Asian and Caucus currencies have performed better following the outbreak of conflict in Ukraine

Source: M&G, Bloomberg

- In Central Asia and the Caucasus region, local currencies have mostly outperformed the EM average in 2022-23, as the region has benefitted from the conflict between Russia and Ukraine. It has absorbed a significant share of skilled labour and financial outflows from the two countries.

- In addition, countries of the region have increased their share of trade with Russia on preferential terms, working as a partial substitute given the Western sanctions (while also rigorously observing them at the same time).

- Faster-than-expected tourism recovery and commitment to robust policies have contributed to the positive trends, resulting in significant improvement of all macroeconomic indicators.

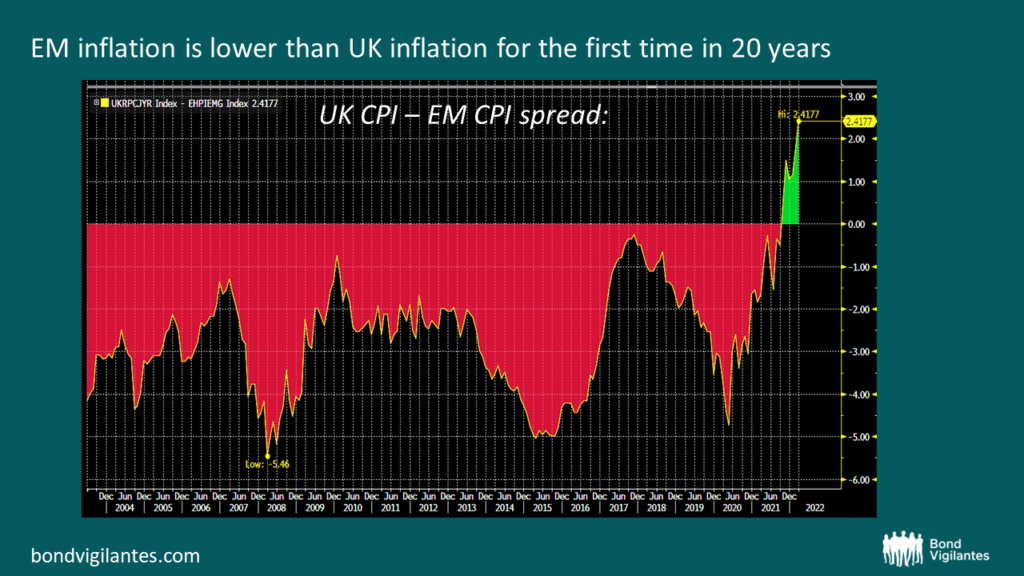

Claudia Calich – EM inflation is lower than UK inflation for the first time in 20 years

Source: Bloomberg

As Claudia blogged last week, with concerns about sticky inflation in the UK and following the Bank of England’s surprise hike to 5% today (versus 4.75% expected), here’s a surprising chart: EM inflation is lower than UK inflation for the first time in 20 years.

Drivers on the EM side:

- Proactivity of EM Central Banks – some (e.g. in Latin America) have been hiking since 2021, well ahead of developed market central banks

- Less monetary overhang than DMs as there was less (or no) QE in most countries

- Caveat on the graph above: this is GDP-weighted, so approximately 40% of the EM weight is China, where inflation is currently at only 0.2%. China, and to some extent Asia, saw much lower levels of inflation than the rest of EM (and DM), as there has been less energy price pressure and fewer supply side bottlenecks. The region was operating below potential growth in some countries and/or had more scope for some fiscal subsidies or price controls than other countries

Drivers on the UK side:

- The index in the chart above includes food and energy, which have been under particular pressure in Europe

- Rental prices are also a factor and have been elevated

- Brexit-related factors influencing supply chains / labour market?

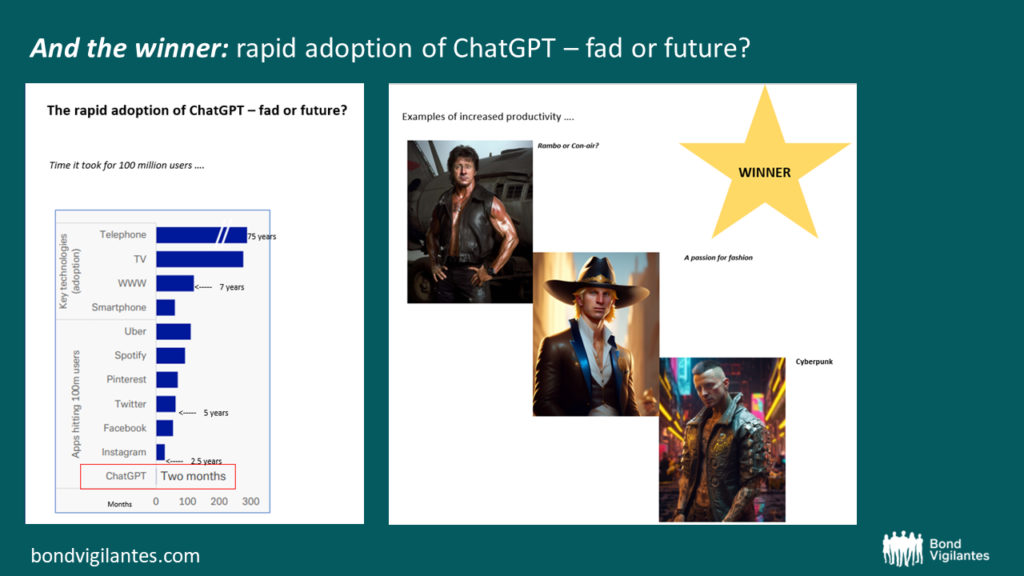

Gareth Jandrell – AI: a whole new world

Source: (LEFT) Deutsche Bank; (RIGHT) Gareth Jandrell / AI

- Estimates suggest that ChatGPT gained 100million users in 2 months, smashing the previously held record of 9 months by TikTok.

- So why all the hype? Advocates of generative AI, such as chatGPT, claim that the technology will create a boom in labour productivity, an economic measure that has remained woefully low across developed economies for the past decade.

- Lots of attention has been given to those companies closely linked to AI technology, such as Nvidia (for which the share price has gained over 200% since November). But instead, should investors be focusing more on high labour firms, which have historically underperformed low labour firms, given the former has more to gain from an increase in productivity per unit of labour?

- The BV team gave it a go and was able to produce these fine AI generated images in under 5 minutes. Can you guess the BV fund manager?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.