Inflation goes on holiday too, but is it just a summer break?

It’s not just us: inflation needs a rest from time to time too. So far this summer, US inflation has been surprising to the downside and last week we got another encouraging report. Headline CPI rose 0.17% MoM while core was up 0.16% MoM. These numbers are consistent with 2% annual inflation.

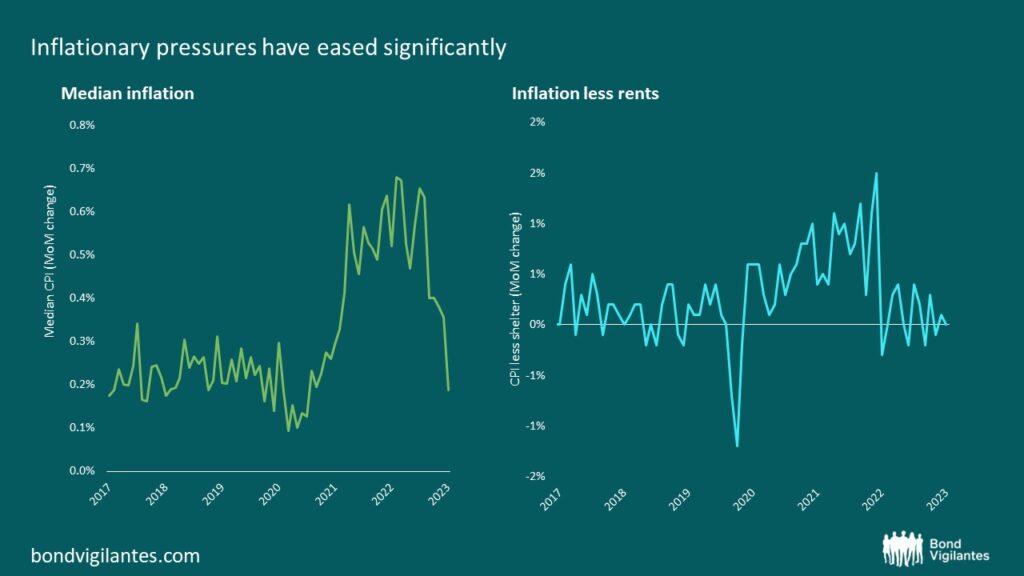

What is important is that inflationary pressures continue to ease. The relatively low inflation print was not a function of a few outliers; rather it was a broad-based trend. Most categories rose little in July. This is evident when looking at median inflation (left chart below), which is now back to pre-Covid levels. Interestingly, excluding shelter, which tends to lag other items due to the way it is constructed, inflation is already at 0% (right chart). Essentially most people in the US are currently experiencing no inflation!

Source: Bloomberg, BLS, Federal Reserve Bank of Cleveland, 31 July 2023

So even inflation goes on holiday, but is this just a summer break?

Inflationary pressures are clearly easing and will continue to do so for some time; however, going forward there are some risks to the upside which are worth monitoring. In particular I’m keeping an eye on three things:

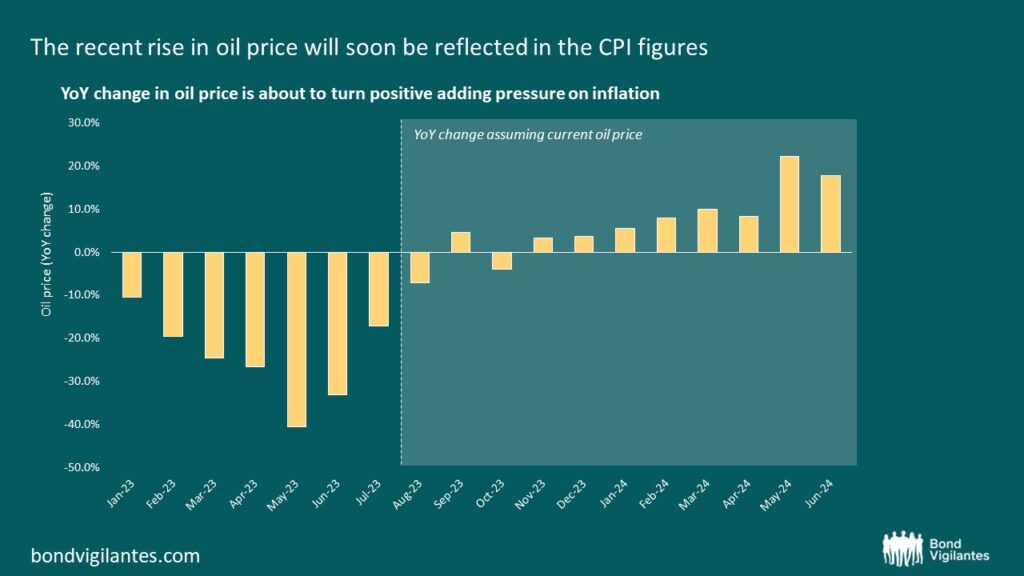

1. Energy

The production cuts by Saudi Arabia and its allies caused the oil price to rise by more than 20% since mid-June. At these levels, energy, which recently has been a key detractor to inflation, will soon reverse its course, adding pressure on headline inflation. Other commodities are rising too, supported by increasing demand from hedge funds. If this trend continues, inflation expectations will likely have to be revised higher.

Source: Bloomberg, 11 August 2023

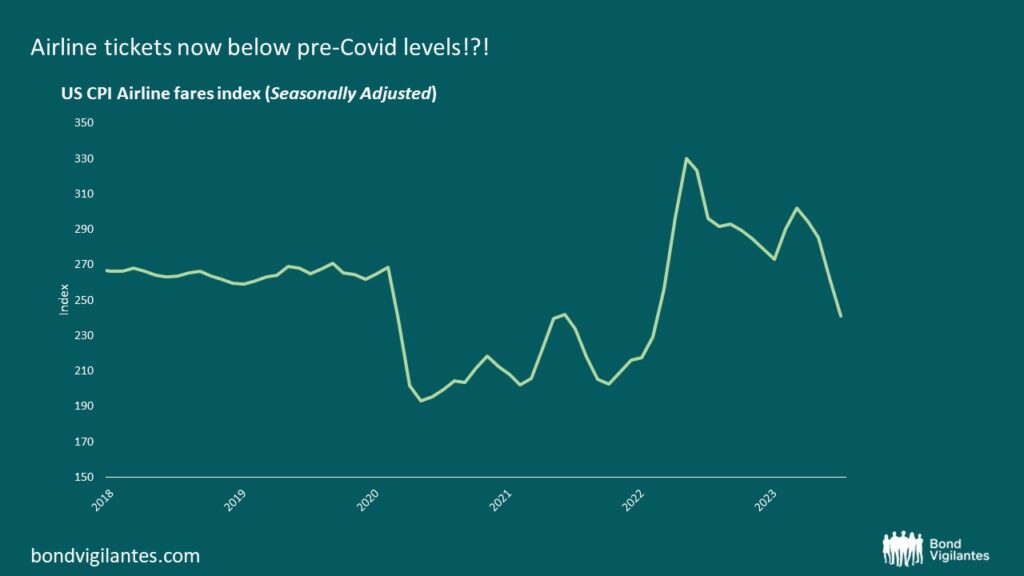

2. Airline fares

Airplane tickets continue to be a drag to inflation, down another 8% in July and-18% YoY. Incredibly, they now are below pre-Covid levels (see chart below). That’s somewhat surprising if you have taken a plane recently. It doesn’t really feel like prices are going down in this space. I’m not entirely sure what is happening here, but it’s highly unlikely airfares will continue to be a drag going forward. If anything, they will probably start to move into positive territory, driven by the cost of jet fuel which will rise reflecting higher oil prices.

Source: Bloomberg, BLS, 31 July 2023

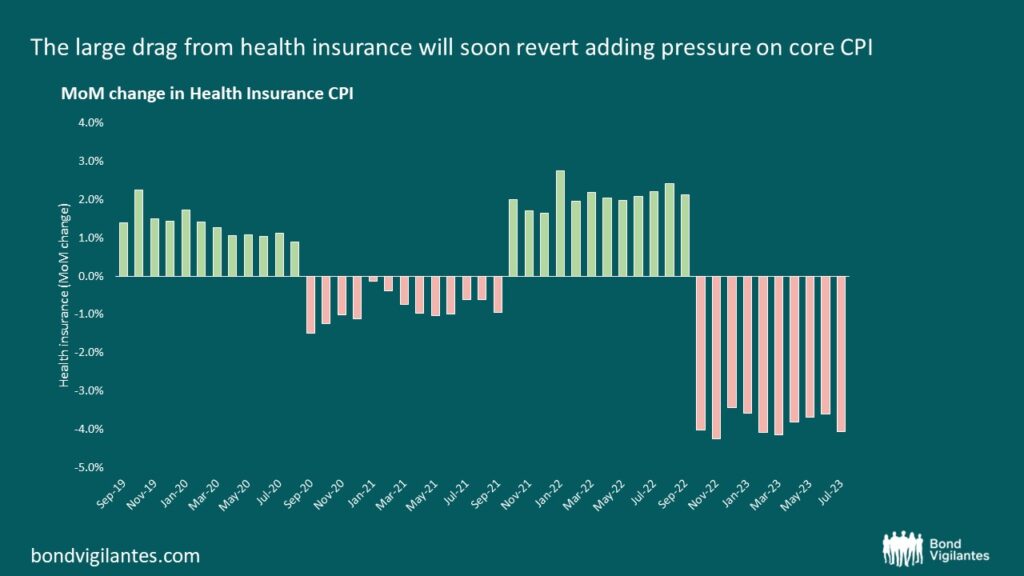

3. Health insurance

Health insurance is one of those costs that the Bureau of Labor Statistics (the entity responsible for producing the inflation report) struggles to properly calculate, due to the difficulty in making quality adjustments. So instead of directly looking at the price change of insurance premiums, the BLS uses an indirect methodology based on retained earnings by insurers (see here for more details). Essentially, the greater retained earnings, relative to the benefits paid out, the higher inflation health insurance is going to be. Usually this is not a category that really affects the overall inflation number, however Covid disruptions have caused some really large swings in health insurance CPI. Currently the impact is negative: as economies reopened, people started to utilise their policies again pushing insurers retained earnings lower. However things are now back to normal and the large negative impact will soon disappear, likely turning into a positive number. This should happen around October, after the new retained earnings will be reported, and will have a fairly consistent impact for the following 12 months as this number is calculated only once a year.

Source: Bloomberg, BLS, 31 July 2023

Taking a step back: the big picture

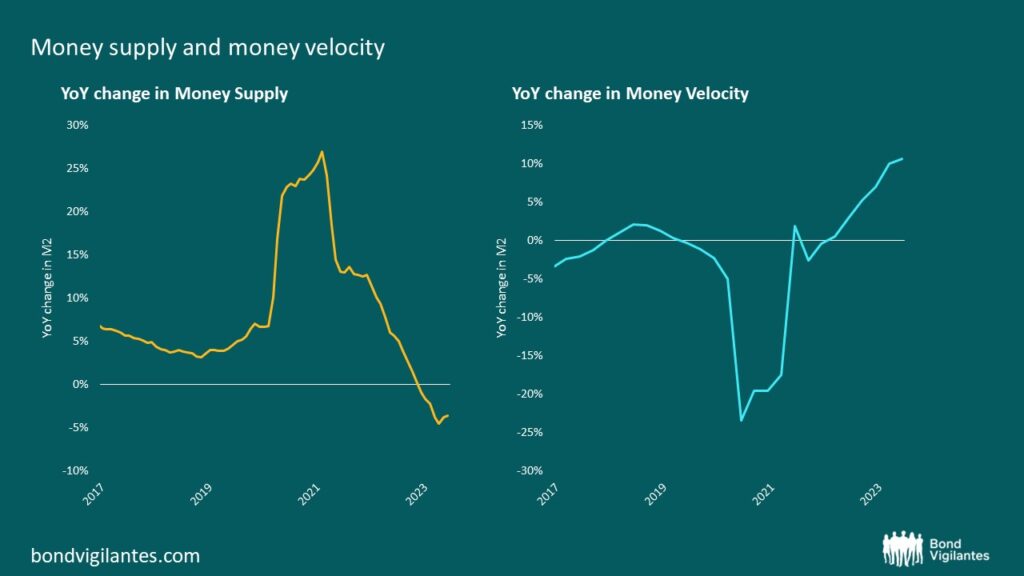

The huge increase in money supply which happened during Covid caused inflation to rise as economies reopened and people had more money to spend. Now the reverse is happening: money supply is shrinking and inflation is falling as a result. As long as money supply remains constrained, inflationary pressures will likely remain low. However, there might be a limit to how far inflation can fall as velocity (how frequently people spend their money) is rising. This is in part fuelled by still relatively high wage growth.

Finally, it is important to recognise that inflation usually comes in waves. This is because inflation always causes issues that tend to be resolved with more money printing (either through credit creation or fiscal stimulus, financed by central banks). If the money printing machine turns back on, inflation will likely make a comeback. This is not a story for the next few months, but something to keep in mind over the next few years.

Source: Bloomberg, 30 June 2023

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.