One for the road. Has the ECB just delivered its final rate hike of the cycle?

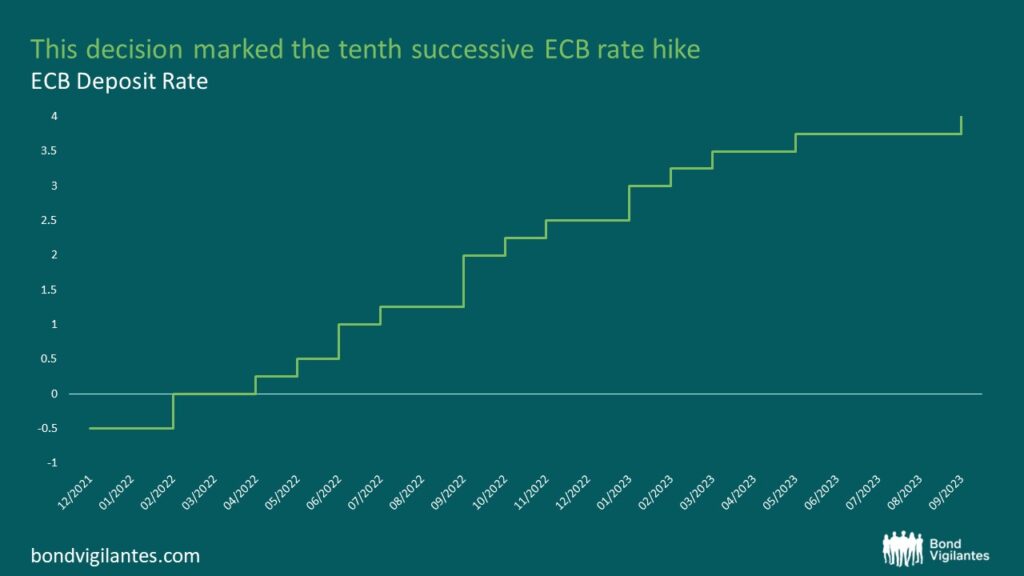

Against the backdrop of stubbornly high – albeit receding – European inflation, the ECB’s Governing Council decided yesterday to raise its policy rates by yet another 25 basis points. This marks the tenth consecutive hike and lifts the ECB’s deposit rate, which had been at -0.5% only in mid-2022, to a whopping 4%. The burning question on many investors’ minds is, of course, was this the final hike of the cycle?

Source: Bloomberg (15 September 2023)

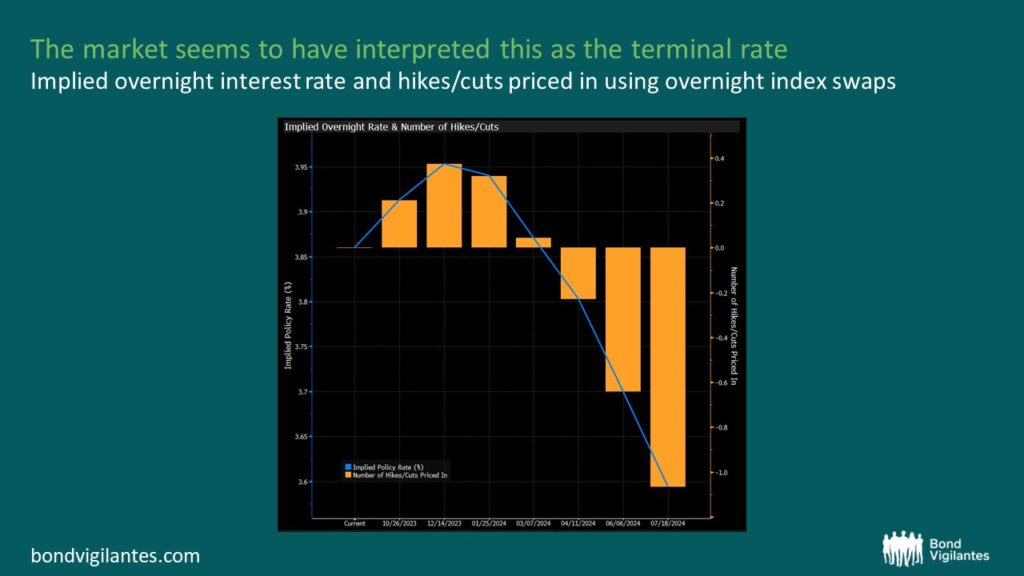

The answer is most likely yes. Admittedly, ECB President Lagarde carefully avoided any definitive statement. Otherwise, she would have needlessly given up optionality. But the passage, “key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target” in the official press release is probably as explicit as it gets in the world of intricate central bank speak. Unless European inflation stages an unexpected resurgence, the ECB has reached its terminal rate. That’s how bond markets interpreted the ECB’s decision, which was widely regarded as a “dovish hike”, sending bond yields lower across the board.

Source: Bloomberg (15 September 2023)

There are two good reasons for the ECB to take the foot off the gas. Firstly, it is estimated that it can take up to 18 months before the economic impact of interest rate decisions is actually felt. With European core inflation beginning to ease off, it might be prudent for the ECB to pause and observe the effects of its ten consecutive rate hikes unfolding over the coming months. Secondly, the macroeconomic outlook is getting noticeably bleaker. The ECB acknowledged that tightening financial conditions have dampened domestic demand in Europe. In combination with the weakening international trade environment, this has prompted the ECB staff to lower their economic growth projections significantly. Going forward, the euro area economy is expected to grow anaemically by 0.7% in 2023, 1.0% in 2024 and 1.5% in 2025. There is only a fine line between fragile growth and a “hard landing”, of course, a scenario which the ECB would like to avoid. Holding fire on rates for now might be the best course of action as delivering further hikes could push (parts of) the euro area into a recession.

If it’s really going to be all quiet on the rates front, what’s next for the ECB? I’d expect the focus to shift towards the asset purchase programmes. While I wouldn’t necessarily assume that actively selling bond holdings Bank-of-England-style will be seriously considered in Frankfurt, questions around reinvestments will continue to bubble up. As a reminder, the size of the ECB’s asset purchase programme (APP) portfolio is shrinking as, from July 2023 onward, the Eurosystem no longer reinvests the principal payments from maturing securities. This does not apply to the pandemic emergency purchase programme (PEPP), though. The ECB intends to carry out reinvestments of principal payments within the c. €1.7 trillion PEPP bond portfolio at least until the end of 2024.

Being asked about PEPP reinvestments at the ECB press conference yesterday, President Lagarde was quick to dismiss any speculations about a potential change of tack. And, from her point of view, a certain reluctance of scrapping reinvestments, which would shrink the PEPP’s size and importance, is understandable. Unlike the APP, which imposes strict capital key-based rules on how to allocate bond purchases across the euro area, the PEPP offers the ECB much higher degrees of freedom. Created against the backdrop of mounting pressures for the European periphery at the height of the Covid-19 pandemic, PEPP investments can, for example, be disproportionally directed towards peripheral bond issuers. If push comes to shove, the PEPP offers the ECB, in theory, enough flexibility and firepower to prevent the spread between peripheral and core European bonds from diverging beyond reason. In this sense, the ECB understands the PEPP as a spread management tool. It’s hard to let go of such a powerful instrument and see it slowly fade away by a discontinuation of reinvestments.

That being said, I still think the PEPP’s days are ultimately numbered. The dark days of the “pandemic emergency” – the clue is in the name – are long behind us. Carrying on with PEPP reinvestments feels like an anachronism. And it contradicts the ECB’s pivot away from an ultra-loose to a much tighter monetary policy stance in light of euro area inflation numbers running well above target, thus creating potential credibility issues. I, for one, would be surprised if PEPP reinvestments would really take place until the end of 2024.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.