Thailand: outlook under new political leadership

Political developments gain centre stage

2023 marked a year of significant political developments in Thailand. The winds of change started with the general elections in May, which saw the opposition Move Forward Party securing electoral victory. Move Forward’s lead over another opposition party, Pheu Thai, was another surprise given that Pheu Thai has won every election since 2001 and was among the front runners in the 2023 election polls.

The victory of Move Forward Party signalled a paradigm shift in voter preference towards reforms and reflected their dissatisfaction with the level of government support in the recent years. Since 2020, the outgoing, military-backed government was viewed to have not provided sufficient support to businesses that were severely impacted by COVID-19, particularly tourism-related businesses.

Despite winning the popular vote, however, Move Forward Party was unable to gain sufficient votes in the senate to elect its leader, Pita Limcharoenrat, as Prime Minister in July. Pheu Thai, with the second highest number of seats, then sought to form a government through a new coalition which includes pro-military parties, United Thai Nation and Palang Pracharat. With the support of these conservative parties, Pheu Thai also managed to garner sufficient votes from senators to appoint its nominated candidate, Srettha Thavisin, as the Prime Minister. Srettha himself has taken on both the Prime Minister and Minister of Finance roles to fix the flagging economy.

Implication for the Thai economy

The parliament and royal endorsement of Srettha’s cabinet ended months of political gridlock, which had weighed on market sentiment. The reduction in political uncertainties, as well as expectation of market-friendly policies by the Pheu Thai Party, will likely be supportive to the Thai economy and financial markets.

However, Pheu Thai will unlikely be able to pass all of its policy promises in the parliament given that it would have to garner support from its new coalition partners. Delays in the formation of government also means that the fiscal policy outlook is expected to remain unclear until potentially April 2024, after the new budget is approved. This is expected to result in delayed capital disbursement for new public projects, while government bond issuances will be muted with only existing projects and old bonds being refinanced over the next two quarters. Following that, government bond supply is expected to pick up, driven partly by Pheu Thai’s populist policies, although the resultant rise in government debt will remain within the country’s debt limit of 70% of GDP.

Moreover, risk of renewed political turbulence cannot be totally dismissed: there remain uncertainties over how long the Pheu Thai-led government can last given the fraught history between the party and its military-backed coalition partners. The formation of the new coalition goes against Pheu Thai’s pre-election campaign promise to not ally with these military-linked parties. This could result in an erosion of its voter base in future elections.

Economic headwinds remain

Apart from political uncertainties, other factors have weighed on the Thai economy this year. Thailand’s economic growth relies on three main drivers: manufacturing exports, tourism, and agricultural exports. Exports this year have been dragged down by a slowdown in global growth, especially in China and Europe. Significant contraction was seen in the export of computer parts, hard disk drives, refinery oil, and plastic products, although jewellery and chemical products performed well in the first half of 2023.

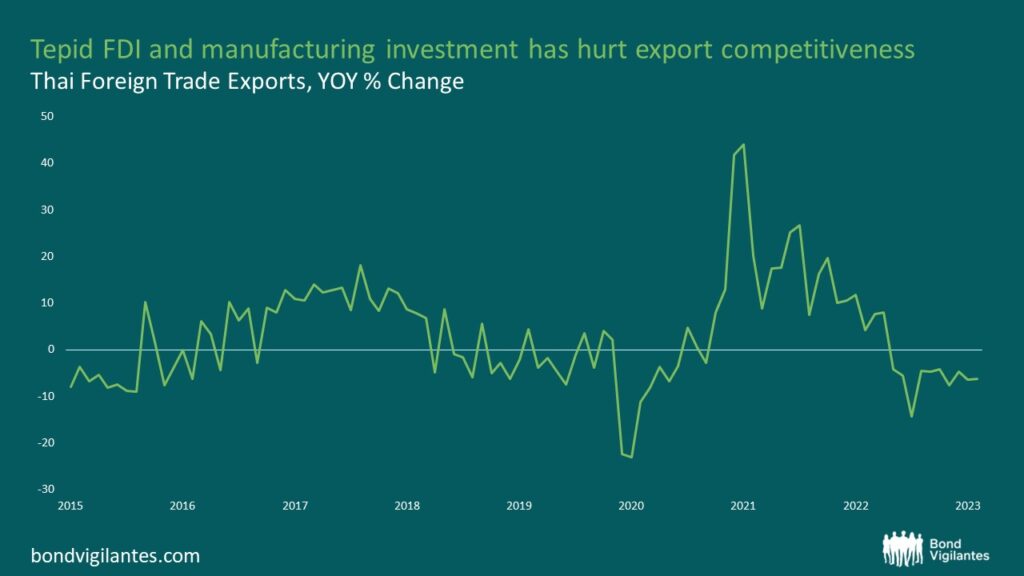

Over the past decade, manufacturing investments and foreign direct investments into Thailand, which typically drive manufacturing exports, have also lagged its regional peers such as Vietnam and Indonesia. Lack of support from government agencies around policies, tax breaks, grants, reduced tariffs and high labour costs have eroded Thailand’s competitiveness in Southeast Asia.

The government’s support in re-energising its manufacturing sector will remain key in sustaining growth. Thailand is currently the Association of Southeast Asian Nation’s (ASEAN) largest car manufacturer thanks to its various policy reforms and infrastructure investments following the Asian Financial Crisis in 1997. However, as the competitive landscape changes over the years and without further policy reforms and investments, the rising ‘Electric Vehicle’ (EV) trend could cause Thailand to lose out on this new battlefield in the sector. The Board of Investment Thailand (BOI) and government agencies appear to be supportive of foreign direct investments in EV manufacturing and have expressed desires to make Thailand an EV manufacturing hub for ASEAN. However, the likes of Mercedes and BMW have indicated that the government and BOI have not coordinated the efforts to achieve such objectives. There has also been news of investments of around $15 billion by MG, Great Wall Motor Company, BYD, NETA and Foxconn but these investment flows have yet to materialise.

Source: Bloomberg, Thai Customs Foreign Trade Exports (August 2023)

Moreover, domestic consumption in Thailand has been held back by high household debt and higher interest rates. Household debt to GDP in Thailand has reached above 90% and this has weighed on loan growth and non-performing loan (NPL) numbers. Notably, the NPLs are not reflected in the banking loan books but through Specialised Financial Institutions (SFI) and consumer lenders. Most major banks have pre-emptively reduced loan book risks since 2020, while SFIs have been more complacent given that they are able to charge much higher interest rates than banks, thus somewhat compensating for the risks. While banks and non-bank loan books saw a growth of 9.8% yoy in Q1 2023, much of the growth came from restructured loans and a reclassification of existing loans. This also points to a deteriorating quality of consumer loans. At the same time, broader loan growth slowed by 0.5% yoy in Q1 this year due to sluggish demand for private investments, slower manufacturing sector, and cautious lenders.

Source: Bank of Thailand (30 June 2023)

Expected pick up in tourism to help mitigate the headwinds

Despite the economic headwinds, the continued recovery in tourism, albeit slower than expected, should provide support to the economy and contribute to a small surplus in the current account this year. The Tourism Authority of Thailand has diversified its target tourist segments in 2023, with stronger focus on markets such as India and the Middle East. Thailand has since seen tourist arrivals from these two segments growing to 80-90% of pre-COVID levels.

Chinese tourist arrival numbers, however, have disappointed, reaching only around 30% of pre-COVID levels. This has been driven by several factors such as the delay in obtaining/renewing passports, limited outbound flights from China, a limited number of approvals granted for outbound travel and more complex visa on arrival application for China nationals since 2022. Slowing economic recovery in China has also been a drag on consumption and tourism spending in general. Some of these hurdles have since been eased. High-end hotels in Bangkok, Phuket and major tourist destinations are also seeing significant recoveries from Chinese tourists in recent months. However, more affordable accommodation, for which Chinese tourists make up the majority of its demand, is still facing difficulties. This points to an uneven recovery of Chinese tourist segments and a broader recovery will likely also hinge on China’s economic improvements.

Source: Bloomberg (August 2023)

Conclusion

To conclude, the appointment of the new government following the May general elections has addressed a key source of uncertainty on the Thai economy. This, coupled with continued tourism recovery, should help offset the economic headwinds that the Thai economy is facing, while providing support to financial markets. Further out, there remains much work to be done to bolster the growth prospect of the Thai economy. Deteriorating external demand, sluggish domestic consumption, and the increasing erosion of competitiveness has weighed on growth. The potential for increased spending from the government both in terms of populist measures and public projects would be much welcomed and help boost domestic consumption. Longer-term, there is a need for the government to re-invigorate its economy and encourage foreign direct investment to make up for lost ground caused by the erosion of Thailand’s competitiveness. As such, the effectiveness of the new government in implementing its policy measures to help the economy and risk of renewed political turbulence will remain keenly watched by investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.