Tokyo Drift(ing away) – the BOJ’s struggle to bring flows home

There has been endless talk about the Bank of Japan’s (BOJ) brutally slow exit from yield curve control (YCC) and/or negative interest rate policy (NIRP), and what this might mean for global bond and currency markets. This week, the BOJ further tweaked policy by turning the 1% trigger for bond purchases into a blurrier reference point. Broadly, YCC is slowly being dismantled, but it is clear that markets were expecting a larger shift away from the current framework. Have they done enough to support the Yen, and pull flows back into Japan? So far, it seems not. A few thoughts below.

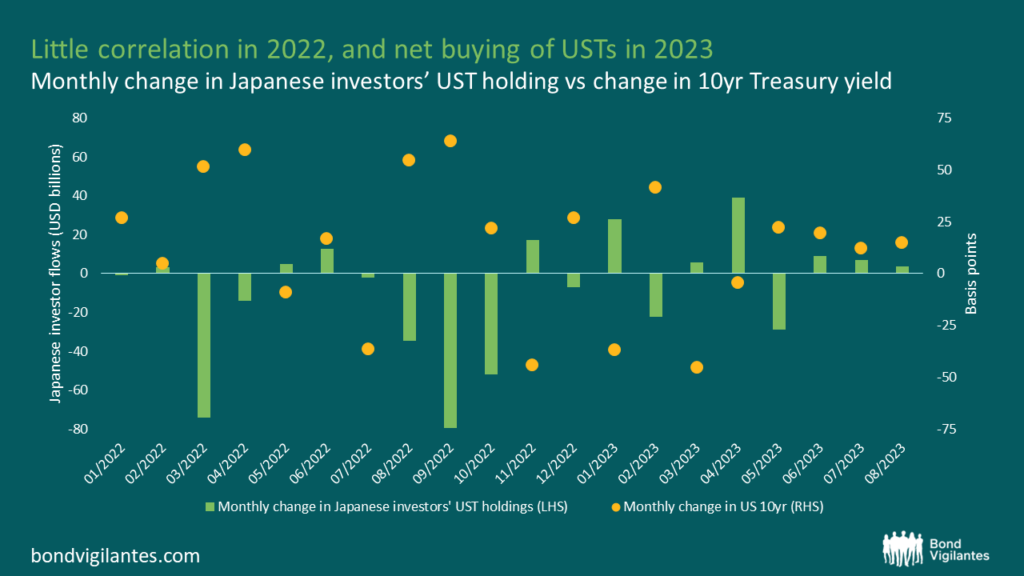

Little correlation between US Treasury yields and flows, but more net buying this year

After super easy monetary policy sent a flood of money overseas, a large implication of tighter BOJ policy is the expectation of flows repatriating back to Japan as Japanese Government Bond (JGB) yields creep up to 1%. The chart below maps the monthly change in 10y US Treasury yields vs the monthly change in Japanese investors’ Treasury holdings. Broadly, during 2022 there was very little correlation between higher/lower yields and corresponding inflows/outflows, but through 2023 we are seeing more net buying of USTs from Japan, even with JGB yields creeping higher. Remember that Japanese investors are the largest foreign holders of US Treasuries already, having overtaken China in 2019.

Source: Bloomberg, HSBC, M&G (August 2023)

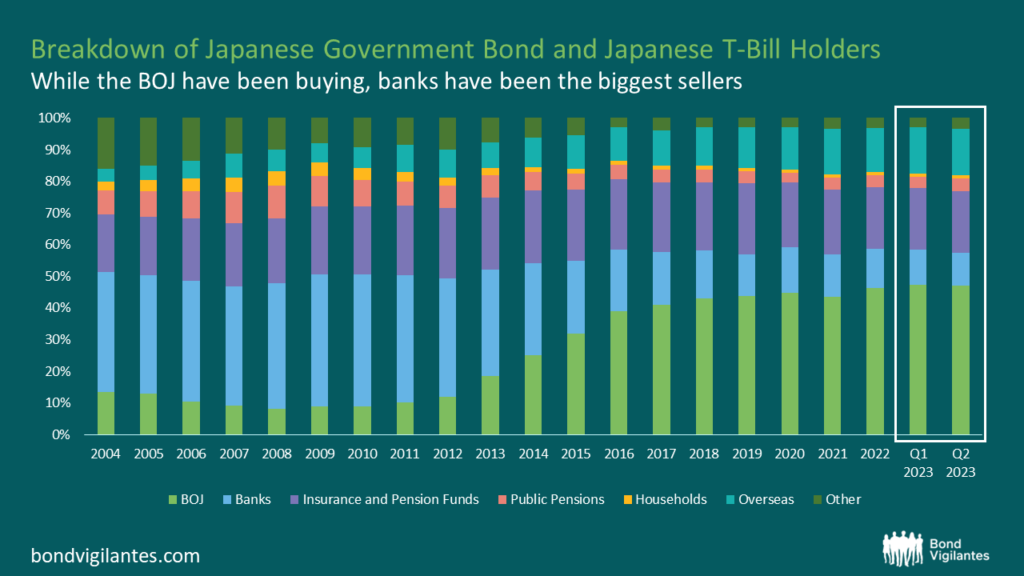

The buying is coming largely from Japanese banks

As expected, the buying is coming largely from Japanese banks and not Japanese insurance companies. This possibly explains some of the curve steepening momentum, as the banks will buy more front end than long end, where the life insurance companies like to sit.

Source: HSBC

Worth remembering a couple of things here. Firstly, the Japanese banks have been the biggest sellers of JGBs by far over the last 10 years, so if there is a big change in demand for Japanese assets, the most dramatic flows will come from them. But, as mentioned in my blog from May (https://bondvigilantes.com/blog/2023/05/tokyo-takeaways-macro-fms-in-japan/), the big national banks are able to manage their offshore and onshore portfolios separately. They can access foreign bonds via repo markets, and so aren’t faced with the higher hedging costs associated with a potentially stronger JPY (which we aren’t seeing yet anyway).

Source: Bloomberg (June 2023)

Real yield differentials remain elevated

It’s clear to me that while US yields are relatively much more attractive than JGBs Japanese investors continue to be net buyers, and won’t be repatriating unless there’s a meaningful narrowing of those yield differentials. The insurers/pension funds have some dry powder, but the banks aren’t moving yet.

Source: Bloomberg, Deutsche Bank (October 2023)

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.