UBS AT1 issuance – a clearing moment for the asset class

The (wildly) successful issuance of the UBS Additional Tier 1 (AT1) earlier this month has given the green light to the wider European bank AT1 asset class. Following the controversy surrounding the bail-in of Credit Suisse’s AT1s before a full write-down of its equity earlier this year, investors were rightfully spooked. Regardless of the strict legality of the issue – the matter is still being debated in courts – the weekend pronouncements from the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss Parliament, alongside the apparent breach of creditor hierarchy, has led to a meaningful underperformance in the asset class. AT1 issuance over the following nine months saw a decline in excess of 50% compared to the same period in 2022, in terms of both of both issuance volume and number of issues.

Then the much expected new UBS AT1 happened, where its two tranche $3.5bn reportedly attracted a whopping $36bn in orders. This represents around 30% of all existing USD AT1s for European banks currently outstanding. Following the issuance, some press discussion referred to the supposed “short memory” of investors when rushing back to the asset class; we think that the superficial pronouncement misses a few meaningful developments across the fundamental picture for UBS, the new bond format and the wider asset class. The three main risks when evaluating any AT1 instruments are the probability of default, loss given default and extension risk. Let us take them in turn.

- Probability of default lower from a fundamentally stronger, global wealth management led franchise

Fundamentally, UBS was, even prior to the Credit Suisse shotgun marriage, a much stronger name: a more profitable and less volatile business partly owing to better diversity of business, being better capitalised and much less prone to regulatory and business accidents than its Swiss peer. The Credit Suisse acquisition has further strengthened its profile, despite some obvious near term heavy lifting on integration. Post-integration, however, the bank will be better capitalised, more profitable and larger scale – indeed, the premier global wealth management franchise with only a relatively small trading operation.

- Loss given default (LGD) – tweaks to terms should alleviate (some) concerns

One of the more controversial aspects of the Credit Suisse AT1 bail-in remains the apparent breach of creditor hierarchy when AT1 holders got zeroed while equity holders did not. To address that, and to lower the LGD of the bond, UBS has introduced an equity conversion feature in its new AT1s, which still needs a full AGM approval in 2024. While there’s been a lot of discussion on this in the industry, we find in practice that this has more of an optical benefit with only a marginal benefit to LGD, given the value of a an AT1 in a failing bank/resolution scenario. Questions remain, in our view, around the potential trigger of the bonds. The “conversion event” of the bond is linked to either a drop below 7% in CET1 (normal and unlikely to be reached before regulatory action) or, as in the case of Credit Suisse, a FINMA (Swiss regulator) decision around a viability event – which includes direct and indirect public sector support. However, the prospectus also notes that FINMA has the power to order the write-down of these instruments even “before a trigger event or a viability event has occurred”. Notwithstanding these clauses, we would consider the possibility of such an event from FINMA as very low – UBS remains, after all, the only globally systemic bank (GSIB) headquartered in Switzerland, where the financial services industry still represents a meaningful part of its economy.

- Extension risk – a good history of creditor friendly calls and self-interest point to relatively lower probability of non-calls

UBS has a long history of creditor friendly calls, including the December 2022 call of its USD 5% AT1 which has a low 243bps reset. Following the Credit Suisse acquisition, the bank has also called two of its existing AT1s without pre-issuing. However, we believe it is also in its interest to continue calling its existing AT1s, beyond the appealing, but difficult to quantify argument that some of its AT1s are distributed to its Wealth Management clients who are unlikely to appreciate a negative price reaction from a non-call. Specifically, the Credit Suisse AT1 bail-in has left the merged UBS Group with a meaningful AT1 deficit when considering an optimal capital allocation, which the bank defined at >CHF10bn as at 3Q 2023. We believe given both dynamics, UBS will have a strong incentive to call and thus – as much as possible – lower the extension risk of its AT1s.

What next? Investors warming up to the asset class again

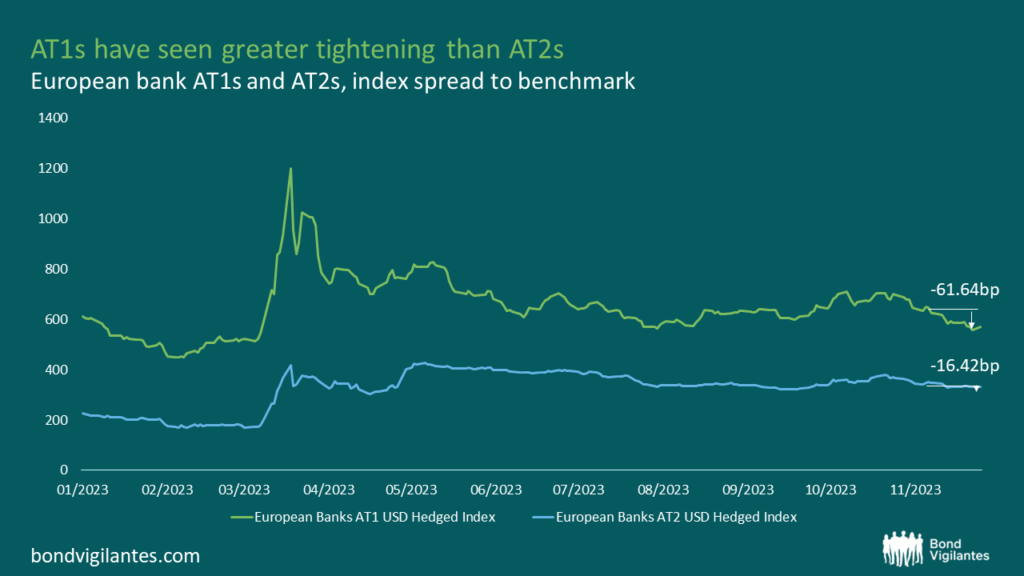

In the two weeks following the UBS AT1 issuance, European banks have issued more (in terms of both volume and number of issues) than in the previous (almost) nine months combined – see bar chart. In addition, AT1s have generally outperformed other parts of the capital stack, with the spread on the Bloomberg USD AT1 tightening by some 61bps vs only 16bps for the USD Tier 2 spreads over the same period – see line chart. The technicals should remain supportive for the broader asset class, with relatively low net new issuance requirements at the sector level owing to low growth in risk weighted assets (both driven by low loan growth regulatory driven inflation). In addition, peak rates – broadly signalled by both the US Fed and the ECB – should mean the asset class becomes increasingly attractive given its higher duration nature.

Source: Bloomberg (22 November 2023)

Source: Bloomberg, M&G (28 November 2023)

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.