2024 The Year of the Wood Dragon: Breathing Fire into the Asian Credit Market

The Chinese zodiac, a 12-year cycle that assigns animal signs to each lunar year, is a cornerstone of cultural tradition, intertwining with the five basic elements (wuxing 五行) of Metal (jin 金), Wood (mu 木), Water (shui 水), Fire (huo 火) or Earth (tu 土), to form a complex 60-year cycle. On February 10th 2024, we transitioned from the Water Rabbit to the year of the Wood Dragon. Unlike its earthly counterparts, the dragon stands as a celestial symbol of strength, power, wisdom, good fortune and success, with the Wood element accentuating growth, flexibility, and nurturing qualities. The combination of the “dragon” zodiac sign and “wood” element thus represents a balance of strength and adaptability, care and creativity.

With the Wood Dragon’s era as our backdrop and on the eve of the Chinese Lantern festival (yuanxiao jie 元宵节, which falls on the 15th day of the first lunar month), we offer a tongue-in-cheek take on the Asian USD credit market in the coming year. This perspective invites investors to embody the Wood Dragon’s attributes as they navigate the year’s potential challenges and opportunities.

Source: Image by macrovector on Freepik

Be courageous

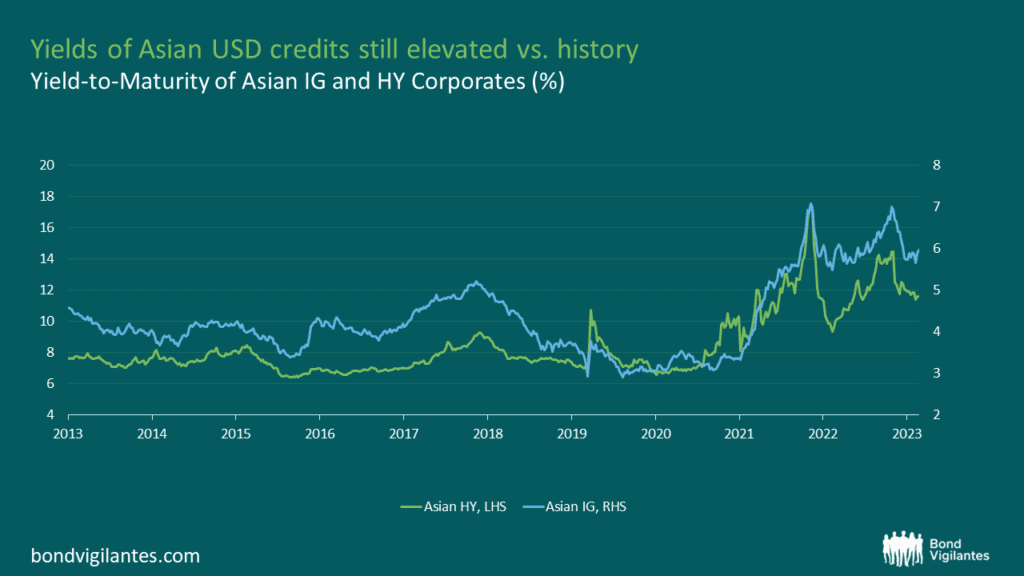

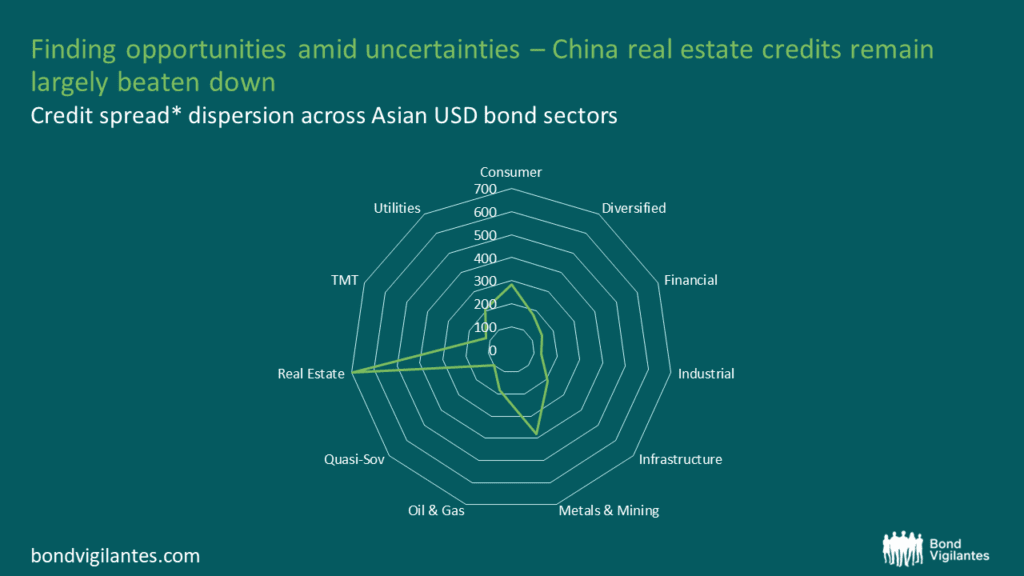

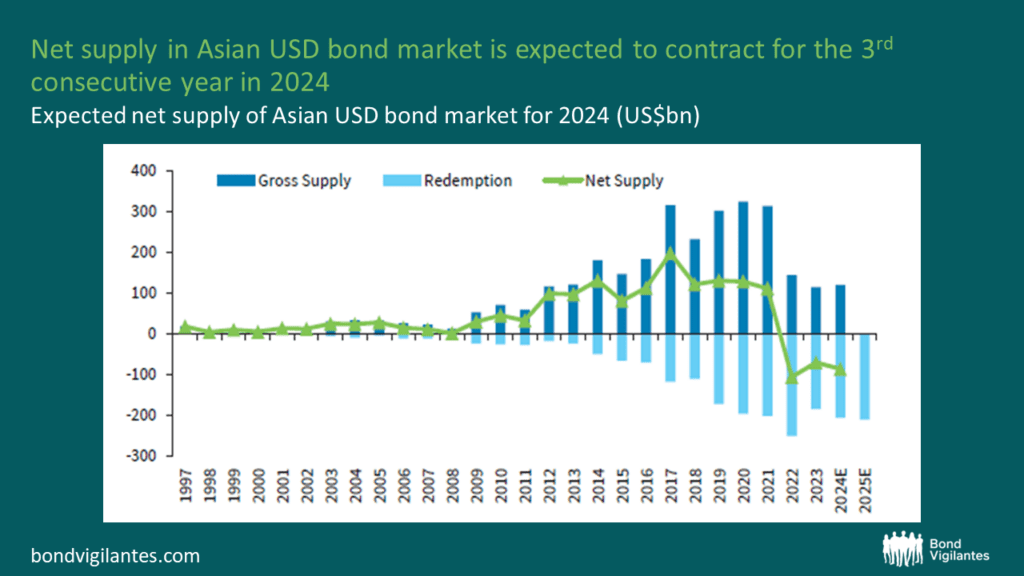

Recent years have seen the Asian credit market face much scepticism from global investors. Asia ex Japan hard currency bond funds saw outflows totalling more than USD 16 billion in 2022 and 2023 combined, as estimated by J.P. Morgan. Concerns over China’s growth and the instability of the Chinese property market have not helped investor sentiment either. Despite these challenges, we believe that fortune can favour the bold. Adopting the Wood Dragons’ courage and strategic insight reveals promising avenues for investment. Elevated yields, providing investors with carry opportunities, and a subdued new credit supply may provide a supportive backdrop for investors. Additional sources of alpha may also be derived by identifying pockets of value opportunities within the Asian credit market. The China real estate sector, for example, offers a case for courageous and discerning investment. After stringent funding restrictions led to a major shakeout, causing over 50% of high yield developers to default, the sector now comprises less than 2% of the Asian USD credit market. Notwithstanding these ongoing challenges, including tepid property sales, recent policy shifts towards more supportive measures (e.g. the loosening of home buying restrictions and targeted lending facilities to developers), and the intrinsic demand for residential homes hint at the potential for stabilization among selected healthier developers. However, let this be a fair warning: careful credit selection remains crucial in navigating this high-stakes landscape.

Source: M&G Investments, Bloomberg, as of 19 February 2024, based on yield to maturity of JPMorgan Asia Credit Investment Grade Corporate and High Yield Corporate indices

Source: M&G Investments, JPMorgan, as of 31 January 2024, using constituents and spread data of JPMorgan Asia Credit Index as a proxy. * Excludes distressed bonds with prices below 30 and excludes sovereign issuers

Source: Bloomberg, Barclays Research, as of 29 December 2023

Be adaptable

The year of Wood Dragon, symbolic of growth, progress and abundance, also ushers in the early stages of a fire era within the larger elemental cycle. As Wood fuels Fire, this transition hints at a year that could be marked by volatility, expansion and impulsivity, as the nurturing Wood element fuels the dynamic Fire. The adaptability inherent to the Wood Dragon becomes invaluable in navigating the complexities of the current financial landscape.

The start of 2024 has already witnessed significant market movements, notably the China equity sell-off, which underscores persistent investor caution towards the country and the region, while interest rate volatility remains high as investor expectations on the timing and extent of the Federal Reserve rate cuts fluctuate. These serve as a stark reminder of the uncertainties that still loom over global markets, including any negative geopolitical developments, unexpected election outcomes and/or policy decisions, as well as a hard landing of the global economy.

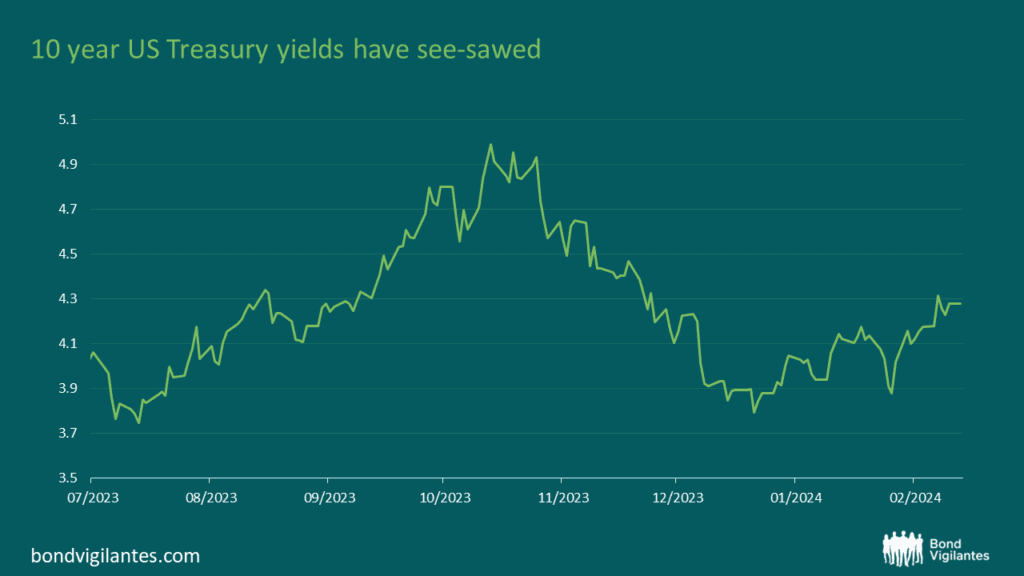

Similarly, at the time of writing, the 10-year US Treasury yields have experienced notable fluctuations, with a more than 40 basis point increase early this year following a period of dramatic yield declines over the November-December time frame last year. Such market volatility not only highlights the unpredictable nature of financial markets, but also underscores the need for investors to remain agile and responsive.

In this complex yet potentially rewarding environment, adopting the Wood Dragon’s adaptability to flexibly pivot strategies in response to market dynamics becomes key. This ethos encourages capitalizing on opportunities amidst volatility, such as taking active duration positions when interest rates reach overbought or oversold levels. However, by the same measure, investors, like the Wood Dragon, should also not be wedded to the same investment strategies and learn to let go should strategic changes in market conditions warrant it.

Source: M&G Investments,Bloomberg, as of 19 February 2024

Be innovative

The Wood Dragon’s creativity encourages exploration beyond traditional sectors, particularly in the evolving landscape of technology and digital innovation. Asia’s major technology names generally boast good fundamental strength, while offering some credit spread pick-up over US peers.

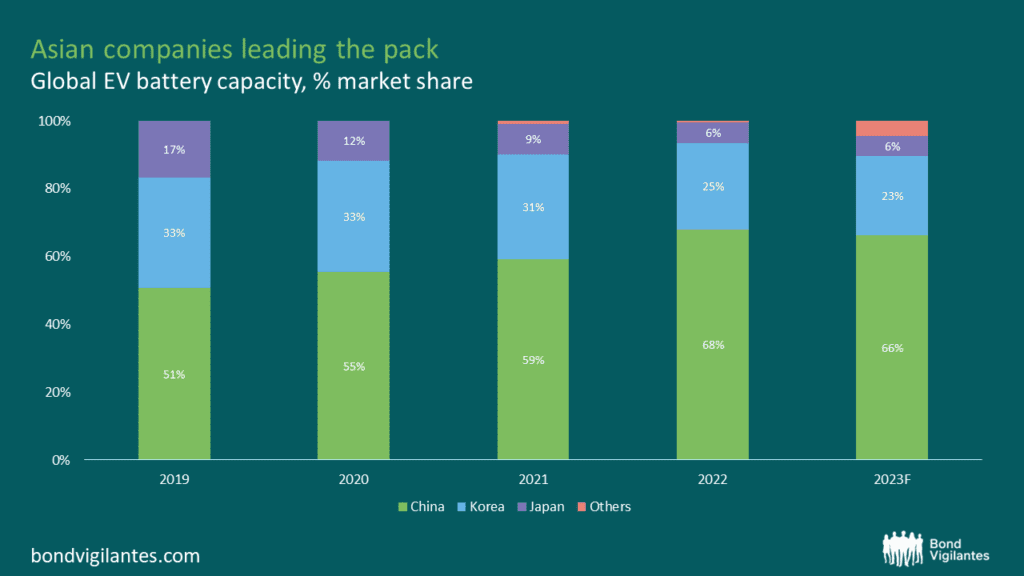

Asian companies are also at the forefront of various areas of technology, such as the production of technology components and digital finance, providing investors with the opportunities to diversify into bonds that not only offer financial returns but also align with future growth industries. Fun Fact: Asian companies are currently the dominant electric vehicle battery manufacturers in the world, representing more than 90% of the global capacity.

Source: Company data, Nomura estimates, M&G Investments, data as of 21 March 2023

Aspire to make the world a better place

Last but not least, reflecting the Wood Dragon’s altruistic spirit and aspirations to make the world a better place, there is a growing availability of bond investments that contribute positively to the world. These are investments in bonds issued by companies involved in green sectors, such as renewable energy companies, or in ESG-labelled bonds. The Asian bond market has shown robust interest in sustainable finance, with Asian issuers continuing to launch new ESG-labelled bonds, which have been generally well-received by investors. This underscores the desire to align financial returns with environmental and social good. In 2023, ESG-labelled bonds issued by Asian issuers increased by USD 19 billion to USD 256 billion .

Market interest in sustainable finance has also seen the emergence of Asian credit funds, classified as SFDR Article 8 funds – funds that promote investments or projects with positive environmental or social qualities, or a combination of such characteristics under the Sustainable Finance Disclosure Regulation (SFDR), established by the European Union (EU).

As we navigate the year of the Wood Dragon, embodying its strengths – courage, flexibility, innovation and commitment to positive impact – offers a guiding light. While acknowledging potential volatility, this approach champions a dynamic and thoughtful engagement with the Asian credit market. In doing so, we may uncover inherent opportunities and prosperity that the Wood Dragon year promises. After all, waste not a Dragon year with its promise of good fortune and abundance.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.