Japan, the steep climb that’s about to flatten out

Source: M&G, AI-Generated Photo

The yield curve in Japan is reaching intriguing levels. The Bank of Japan (BoJ) has remained resolute, maintaining an ultra-accommodative monetary policy in a world aggressively hiking interest rates to stem inflation. Fearlessly forging ahead with Quantitative Easing, the BoJ has maintained its negative interest rate policy (NIRP), and this monetary divergence has caused a meaningful weakening of the Japanese Yen (JPY) on the back of interest rate differentials:

Source: M&G, Bloomberg as at 30.01.2024

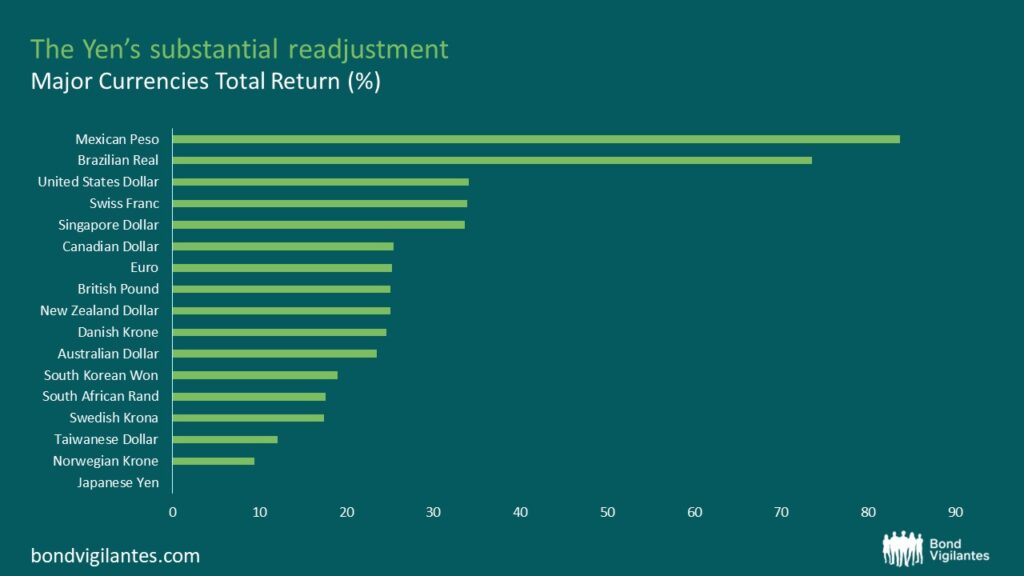

It has also undergone a notable repricing against all major currencies:

Source: M&G, Bloomberg as at 30.01.2024

The Japanese Yen is also arguably very cheap, having gained an advantage given its mercantilist leanings, which is reflected in the strong performance of the Nikkei 225:

Source: M&G, Bloomberg, CNBC as at 30.01.2024

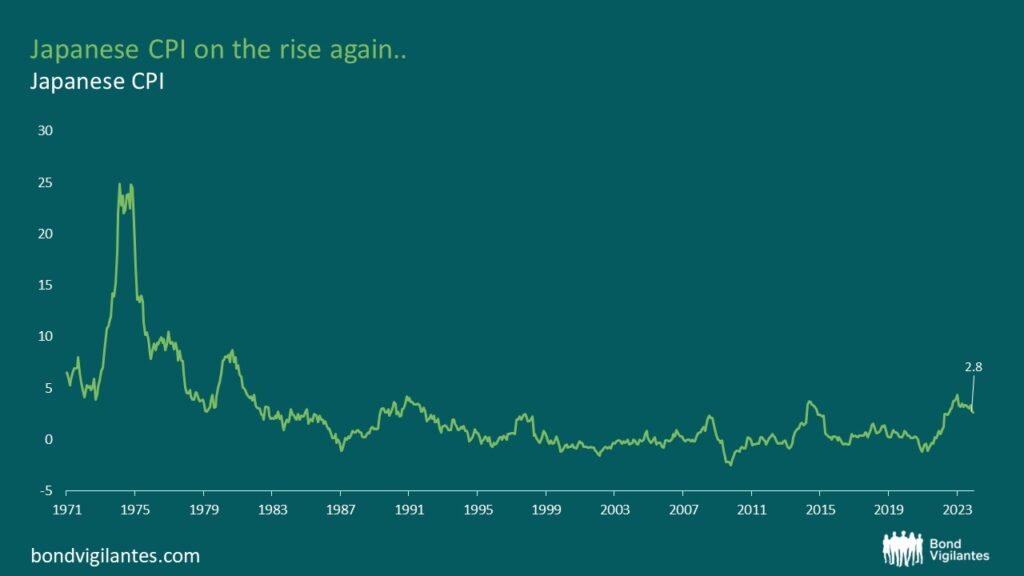

Japanese GDP growth has been solid, unemployment levels remain extremely low, and inflation remains in check, albeit rising from an extended period of very low levels:

Source: M&G, Bloomberg as at 30.01.2024

The Shunto wage negotiations will be keenly watched in the coming months, where various unions unite to enhance their wage negotiating position for the following fiscal year. After two years of negative real wages, workers will hope to see another substantial nominal wage increase, bringing about a virtuous cycle: higher wages beget higher prices.

A backdrop of continued price rises will also allow the BoJ to move away from its extreme monetary support. That’s the hope anyway, with the reality being that Japan has far too much debt to allow any meaningful increase in interest rates, as the country would be crushed under its debt interest burden — a problem shared by many countries, but is more acute in Japan given its 250% debt to GDP level.

Why is all of this of any interest?

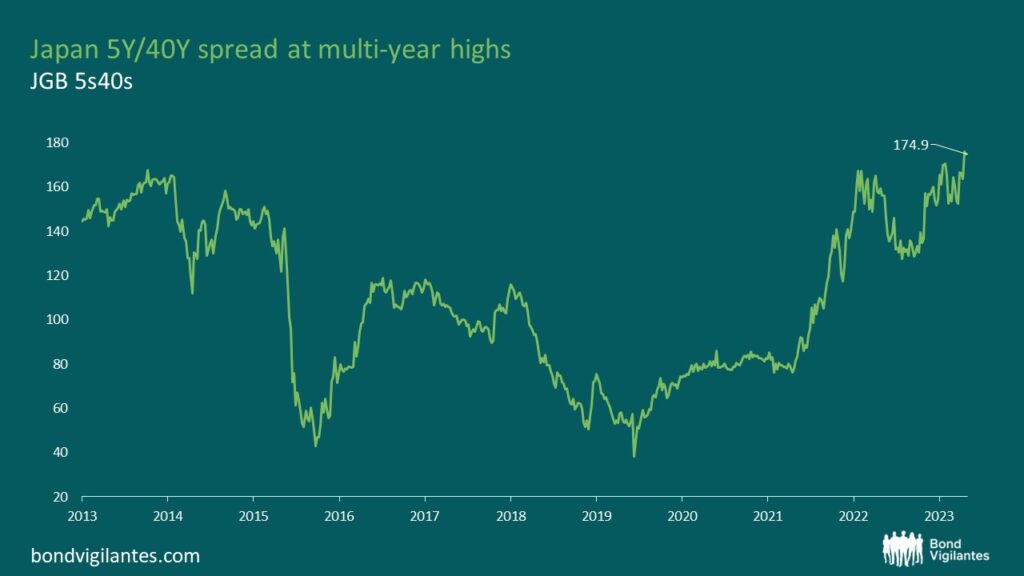

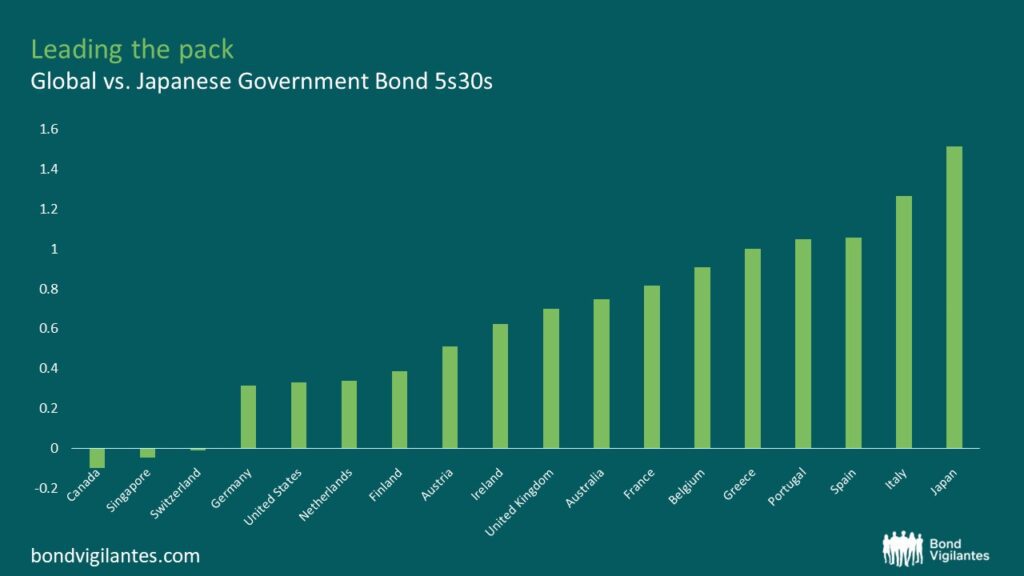

The BoJ has been manipulating the bond market through Yield Curve Control and has glacially loosened its grip on the back of relatively strong data and rising inflation. The most recent change has been to remove the hard ceiling of the ten-year rate, which now suggests that 1% is more of a reference rate. Longer-dated tenor points are less manipulated, or ‘freer to trade’, and are seen as a release valve for Japanese Government Bond (JGB) weakness. With the BoJ considering an increase in base rates on the back of solid data, it’s no wonder we have seen the long end suffer. As a result, the curve has become very steep and looks enticing. The curve trades at a decade high and stands out from global markets:

Source: M&G, Bloomberg as at 30.01.2024

Source: M&G, Bloomberg as at 30.01.2024

Compounding the weakness in the long-end has been the noticeable absence of long-dated demand from the Japanese life insurers, which could be seen as a source of pent-up demand. A c.1.8-2% yield is considered an attractive entry point for these firms to reengage, and as we are now at these levels, the insurers have been noticeably absent. Perhaps they have been waiting for the expected base rate hike, or getting their houses into order as the financial year-end approaches?

Another significant consideration is the pending change to Japanese life insurance regulations. This change has been discussed for many years but is creeping towards its 2025 implementation date. The new Economic Value Based Solvency Regulation will significantly impact the life insurance industry as schemes are required to mark-to-market the valuation of insurance liabilities, introducing added volatility. To mitigate this mark-to-market volatility from interest rates, life insurers will need to increase duration exposure to hedge these liabilities more accurately.

Source: M&G, Bloomberg as at 30.01.2024

In conclusion, the tide is likely to turn in favour of a flatter JGB curve. Most western economies expect rate cuts throughout 2024, and the pressure on JGBs (particularly long-dated bonds) will likely benefit from lower global yields. The date of regulation change is creeping closer, and the valuation is at a decade’s high.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.