The interest rate cutting race – Ready, set, go!

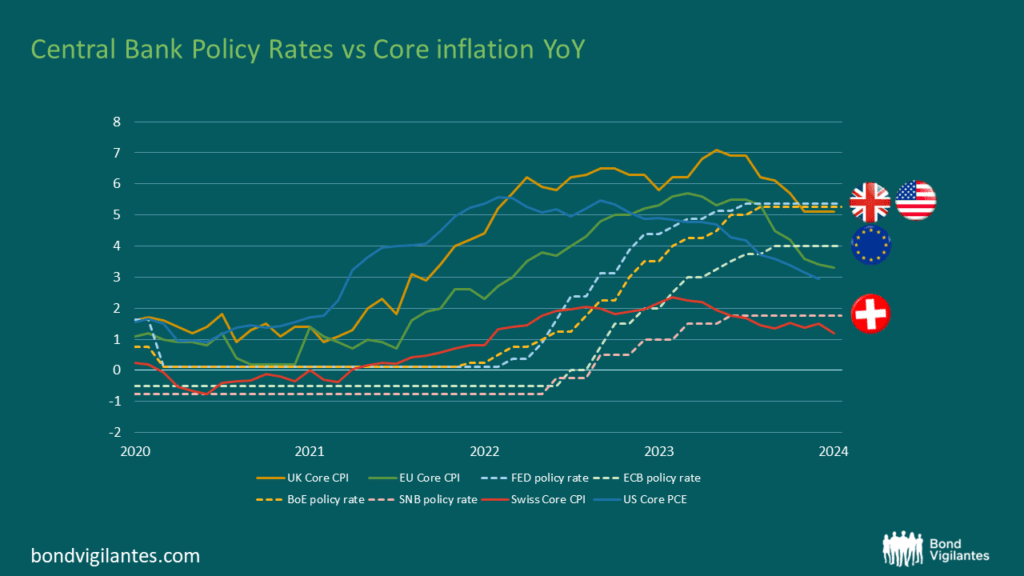

As we step into 2024, inflation figures have significantly decreased from their peaks, and inflation is continuing to make progress towards central banks’ inflation targets. With current interest rates kept in place, real policy rates are beginning to pose constraints on economies. Consequently, there is an anticipation of substantial interest rate cuts by major central banks in the developed world this year, opening the door for additional volatility in bond markets. There is a divergence of opinions on the timing of these cuts, and the initial two months of 2024 have prompted a significant reassessment, causing expectations for rate cuts to be pushed back. The first rate cut in 2024 will signal the beginning of a new phase in this economic cycle and has the potential to impact markets on a broader scale. So, which central bank is most likely going to kickstart the cutting cycle? Here is my best estimation.

Source: Bloomberg, February 2024.

The Fed:

The latest FOMC core Personal Consumption Expenditure (PCE) inflation forecast anticipates significant disinflation in the coming year, with core PCE expected to decline to 2.4% by the end of the year. However, the new year began with higher-than-expected inflation data, raising doubts about the future trajectory of US inflation. Some of this increase might be attributed to seasonality, but Powell’s closely watched Consumer Price Index (CPI) core services, excluding shelter, rose to 0.85% in January, showing a re-acceleration across all sectors. This has pushed the 3-month and 6-month trend of Powell’s preferred CPI measure to 5.55%. When combined with a US real GDP growth rate north of 3%, an economy operating at full employment, and significantly eased financial conditions in the last quarter, the Fed has gathered enough economic indicators to maintain current interest rates until core PCE data confirms the disinflation path. However, it is important to note that some of the robust economic data are lagging indicators, and there are risks associated with the waiting game, as recent events in the banking sector, commercial real estate losses, and increasing consumer delinquencies have shown. While the likelihood of a rate cut in March has diminished, I believe there is a strong argument for the Fed to begin the process of gradually reducing monetary restraint by mid-year.

The BoE:

Shifting our focus to the next player in the race, the Bank of England. Recent reports have unveiled that the UK economy slid into a technical recession in the second half of last year. Additionally, it is common knowledge that the UK has limited fiscal leeway to reinvigorate economic growth. UK policymakers vividly recall the events of September 2022 when the Truss-led government proposed additional unfunded tax cuts on top of already high borrowing levels, sparking strong opposition from bond markets and the British pound. The BoE now faces a dilemma as inflation persists at elevated levels while growth remains subdued. Unlike the other contenders, the UK is the only economy where core inflation has not yet significantly dropped below the policy rate. Wage inflation, a crucial indicator, has not decelerated as swiftly as Bailey and his team had hoped. Recent data on the 3-month trend for regular average weekly earnings, showing a 6.2% increase year-on-year, surpassed economic forecasts. Compared to the other “racers”, I assign the highest stagflation risk to the UK. To pave the way for its first rate cut, inflation must further moderate, making it unlikely for the UK to win the cutting race. Nonetheless, while they might not be the first to cut, the BoE could implement more aggressive rate reductions at a later stage to bolster economic recovery, especially considering the limited fiscal space available.

The ECB:

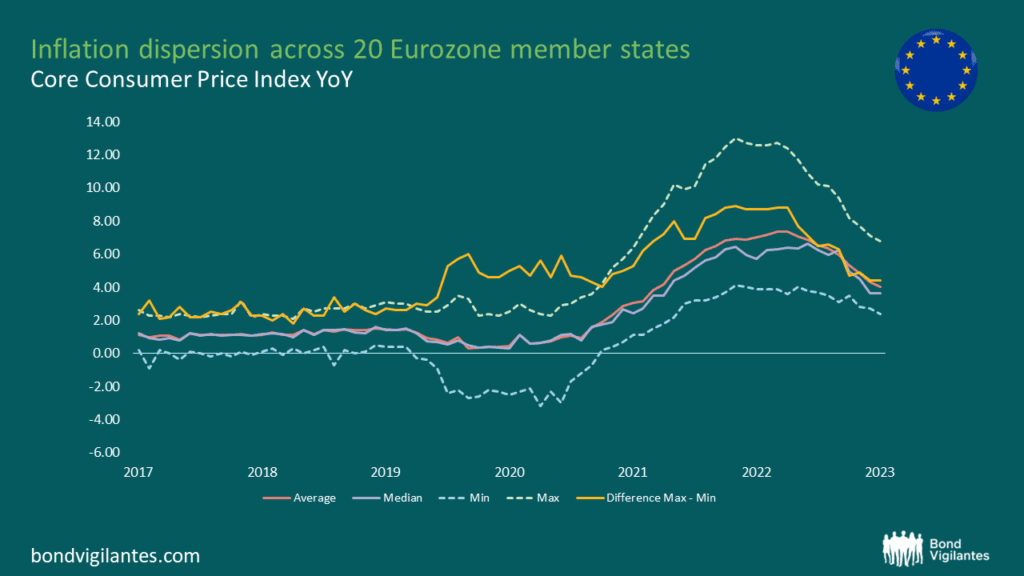

The European Central Bank is an interesting one. ECB President Lagarde remains steadfast in her stance that it is premature to discuss rate cuts, yet market watchers increasingly disagree and anticipate a shift in the ECB’s narrative in the near future. This shift is primarily driven by economic data trends. Recent inflation prints slightly fell short of projections, confirming an underlying disinflation trend which, if sustained, would likely come short of the ECB’s end-of-2024 forecast of headline CPI at 2.7%. Furthermore, the chart below illustrates that the divergence in core inflation readings among the 20 member states has halved since September 2022.

Source: Bloomberg, February 2024.

The ECB is certainly welcoming the widespread decline in inflation prints across the Eurozone. While the rise in geopolitical tensions in the Middle East poses a potential threat to the positive inflation outlook, it currently remains a tail risk. However, the persistent weakness in economic activity extending into 2024 is a more pressing concern, as it could further add downside risk to the inflation outlook. Germany, the economic powerhouse of the Eurozone, continues to disappoint, with the German government recently revising down its 2024 real GDP growth forecast from 1.3% to 0.2%. Considering these factors collectively, I view the ECB as a strong contender in the race for the first rate cut, and I believe the ECB’s hawkish rhetoric will need to adapt soon to better align with economic realities.

The SNB:

Moving on to our final contender, the Swiss National Bank. In all fairness, it appears that the SNB had a head start in this race. Swiss core inflation never surpassed 2.2% in this cycle, whereas the other contenders grappled with core readings above 5%. This can be attributed, in part, to the strengthening Swiss Franc, which once again served as a safe-haven currency during uncertain times, mitigating imported inflation pressures. Additionally, Swiss headline inflation was less affected due to a favourable energy mix, with local hydro power playing a significant role in the energy supply of the mountainous nation. Despite economists’ predictions of a rise in core inflation for January, the actual core inflation rate decreased from 1.5% to 1.2% year-on-year, now well below the SNB’s 2% target. In a recent interview with the Swiss newspaper NZZ, SNB President Jordan acknowledged that the Swiss Franc had begun to appreciate in real terms by late 2023. He highlighted the impact of this appreciation, which lowered the inflation outlook and posed challenges for some Swiss companies. The most direct tool to address the strength of the CHF would be interest rate cuts. Therefore, I perceive the SNB as the frontrunner most likely to implement the first interest rate cut among our four contenders, possibly as early as March this year.

As the four central banks near the finish line of our race, the question arises: which central bank has the endurance to deliver the inaugural rate cut? The stage is set for a thrilling finale, with hopes that inflation does not disrupt the outcome of the race.

Source: M&G, February 2024.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.