Debt Matters: Why It’s Time to Position Into Countries with Low Outstanding Debt

In an era of economic uncertainty and volatility, the importance of managing national debt has never been more evident. Investors seek stability and long-term growth opportunities, so the spotlight turns towards countries with low outstanding debt.

Understanding the Debt Conundrum

National debt, often measured as a percentage of a country’s GDP, reflects the amount of money a government owes to domestic and foreign creditors. While debt can be a tool for financing growth and development, excessive levels can pose significant risks to a nation’s economy.

High debt levels can impose substantial interest payments as yields rise, diverting funds away from essential public services and investments. Excessive debt undermines a country’s creditworthiness, potentially leading to higher borrowing costs and reduced investor confidence. Economic stability can be fleeting as excessive debt can trigger financial crises, currency depreciations, and recessionary pressures, hampering economic stability and growth prospects.

Household debt brings about many of the same issues through different channels, but can be closely linked. High levels of household debt make the consumer vulnerable to financial shocks and can crowd out consumer spending as consumption is taken away from goods and services, resulting in slowing economic growth. Household debt is often associated with a strong housing market, making the consumer extremely sensitive to interest rates and the price level of the housing market. The 2008 financial crisis was very much a function of excessive leverage in the private sector, which brought the system to its knees and was ultimately rescued by the state sector. In a sense, the government sector assumes many of the liabilities from the private sector.

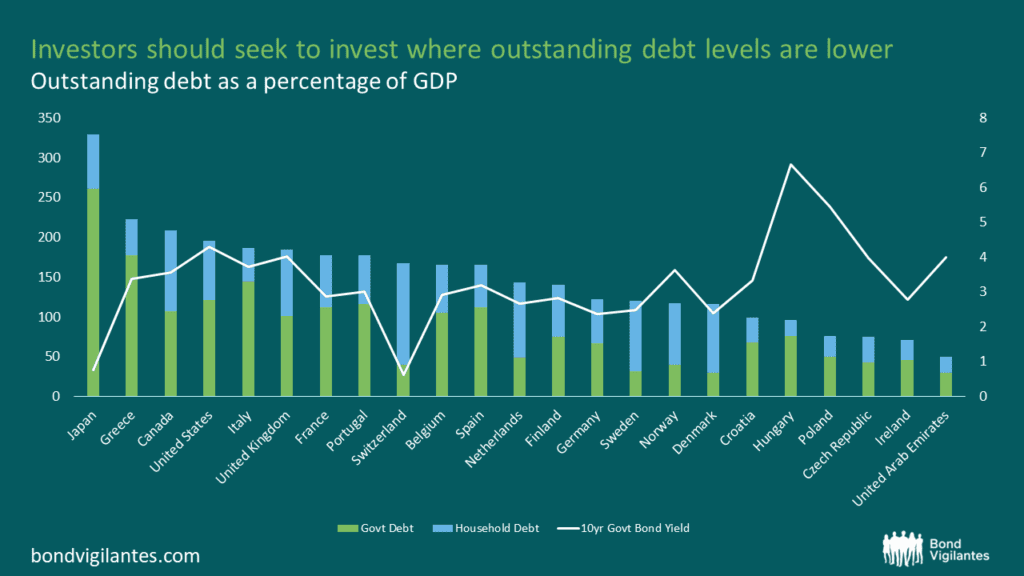

As a result, one cannot look at government or household debt in isolation. I have put together a simple chart from data provided by the IMF, which shows government debt and household debt as a percentage of GDP against the respective 10yr government bond yield.

Source: IMF, Bloomberg, M&G (April 2024 – IMF debt data 2022. Most recent data available)

On this very simple metric, it makes sense to position one’s portfolio away from countries on the left of the chart into countries on the right. Given its reserve currency status, the US is a special case; however, highly indebted countries are increasingly at risk of waning investor confidence. The recent mini-budget/LDI crises in the UK serve as prime examples of how fleeting that confidence can be.

Debt levels will continue to move into the spotlight as there is seemingly minimal appetite to bring debt levels down in any meaningful way. With elections front and centre this year, let’s take the US as a case study. From 2017 to 2018, the Republicans had the White House and controlled both chambers of Congress; they cut taxes. From 2021-2022, the Democrats were in control; they increased spending. Deficits rose under both administrations and both candidates want to continue down their respective paths: tax cuts vs. increased spending. Will US exceptionalism ever be questioned? Will investors tolerate a 6% deficit into perpetuity?

Europe, on the other hand, suffers a similar fate of rising debt levels and now has to contend with the Ukraine/Russia conflict. An increase in defence spending is becoming increasingly urgent, potentially even more so as US candidate for president, Donald Trump, threatens to pull away from NATO.

The climate crisis affects all countries’ budgets and is another major added strain on spending.

Why Low Outstanding Debt Matters

Investing in countries with low outstanding debt offers several compelling advantages:

Fiscal Resilience: Nations with prudent fiscal policies and low debt-to-GDP ratios are better equipped to weather economic downturns and external shocks.

Reduced Default Risk: Lower debt burdens lessen the likelihood of default, providing investors with greater confidence in the sustainability of government finances.

Policy Flexibility: Governments with ample fiscal space have the flexibility to implement countercyclical policies, stimulate growth, and respond effectively to emerging challenges.

Attractive Investment Climate: Low debt levels can signal sound economic management and attract foreign investment, driving long-term capital appreciation and enhancing market stability.

Conclusion

As global economic uncertainties persist, investors will increasingly recognise the importance of debt considerations in their investment decisions. Assuming the individual investment case stacks up, countries with low outstanding debt offer greater fiscal resilience and policy flexibility and present as an attractive insurance policy against a debt sustainability crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.