We need to talk about the 61s

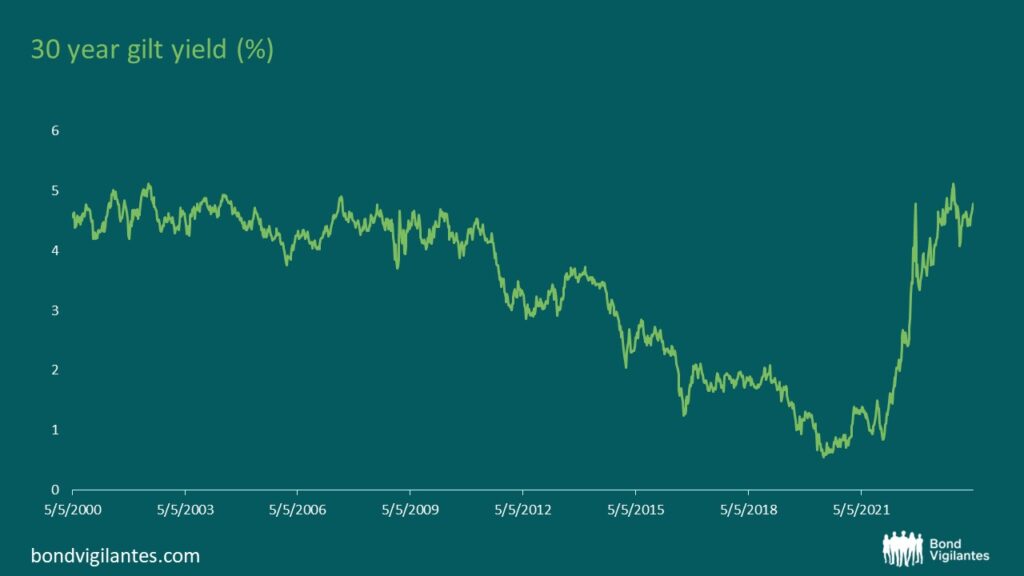

With interest rates having moved meaningfully higher over the last two years, fixed income investing has moved front and centre for investors. A favourite bond has been the low coupon 2061 maturity (UKT 0.5 2061). Why is this?

Firstly, the low coupon and long maturity means the bond has a very high duration (29 years). Duration is a measure of a bond’s sensitivity to changes in interest rates. A textbook would say that for a given change in interest rates, say 1%, a bond with a duration of seven would see its value change by circa 7%. In the case of the 61’s, a 1% change in interest rates would change the bond value by circa 29%.

Secondly, tax efficiency. Capital gains on government bonds are tax exempt. So, a bond trading with a cash price of 28 and guaranteed to mature at 100 means that all these gains will be tax-free. Realistically, a retail investor will not put their money into this bond and wait for 37 years to enjoy a tax-free pull-to-par return of 257%. They will be looking to exploit volatility or hope that they have called the top of this interest rate cycle.

Given the rapid upward move in yields since 2020, the desire to invest is understandable, and tax efficiency is an essential consideration for anyone investing outside of a tax wrapper.

Source: Bloomberg, M&G as at 26 April 2024

The attractive characteristics of the 61s have not gone unnoticed, and as a result, they trade expensive compared to surrounding issues. Take the example of a bond that matures one year earlier in 2060, as shown below. The chart shows the spread differential between the two bonds, and the 61s trade almost 30bps lower in yield:

Source: Bloomberg, M&G as at 26 April 2024

Some would look at this and come to the simple conclusion that they would rather own the 2060 maturity and get an extra 30bps per year until maturity, which over the long term is, in fact, not insignificant. However, when we circle back to the tax efficiency argument, the 61s are still better value. We need to adjust the bond yields to consider the tax element. A simple tax adjustment on the yield makes these two bonds comparable:

Source: Bloomberg, M&G as at 26 April 2024

The table above showcases the tax efficiency of the 61s vs. the 60s. The conclusion is that, on this basis, the 61s are still relatively cheap to a theoretical individual investor. On the other hand, an institutional investor who doesn’t have to factor in tax would consider this bond expensive. The two investor bases are in conflict, and it remains to be seen which will win out.

Since COVID-19 and the period of ultra-loose monetary policy and fiscal largess, many bonds have been issued with low coupons. As a result, we have a two-tier market: bonds with low coupons, which are tax efficient, and bonds with ‘high’ coupons, which are tax inefficient. The tax-efficient low-coupon bonds generally trade richer than the others. The chart below nicely illustrates this:

Source: Bloomberg, M&G as at 26 April 2024

Another reason for the two-tier market dislocation is the cash efficiency of low-coupon bonds. Institutional investors can get the interest rate exposure they are looking for with a lower cash outlay, and this is an attractive option that comes at a cost.

The two-tier market above is clear when charting the bonds against yield and duration. The solid green line shows the high coupon issues, and the orange dots show the low coupon tax-efficient gilts. Now that we have identified the two-tier market and understand why it is the way it is, is owning the 2061 maturity the most efficient bond to own?

Bonds with a similar tax efficiency and durations of circa 20 years would be interesting to take a closer look at. This is the peak of the curve which benefits from positive carry and roll. Compared to high-coupon bonds, this part is also cheaper than other low-coupon bonds. The expensiveness of the 61s is clear when making a similar comparison with the 2050 maturity, which can be seen in the chart below. Both relationships were very similar back in 2020 and 2021. It’s the 61s that have pushed on to very expensive levels:

Source: Bloomberg, M&G as at 26 April 2024

Owning the tax-efficient, low coupon, 20-year duration issues is far more efficient, and in this case, there is no conflict between the institutional investor and the retail investor base. Their interests are aligned.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.