Cracks in the armour of the resilient consumer

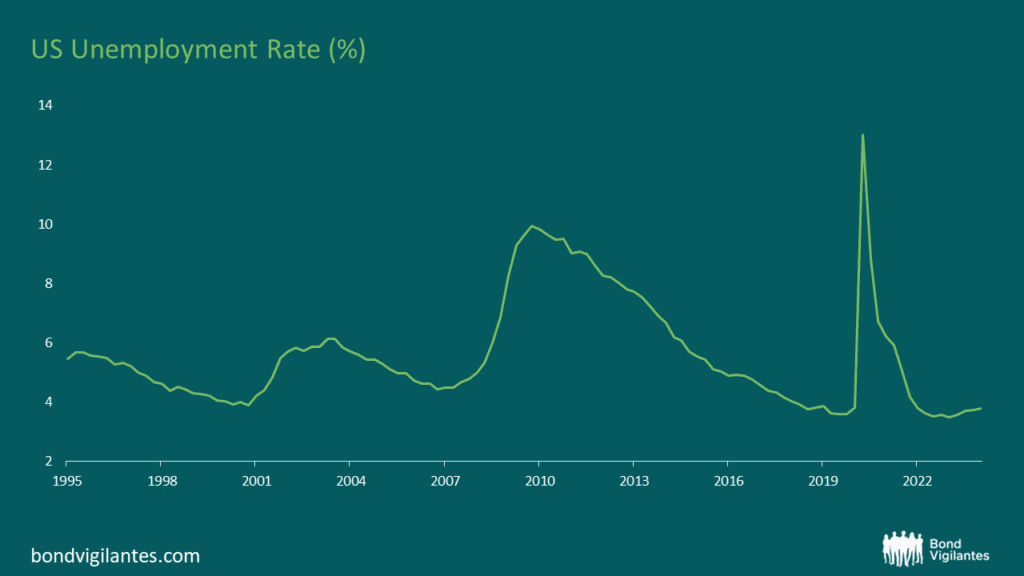

Consumption spending accounts for approximately two-thirds of the US economy. It is vital that we understand the dynamics of the consumer because if the consumer falters, so does the US economy, which has far-reaching consequences. The surprising resilience of the US consumer in the face of a pandemic and then rising interest rates has surprised many. This resilience is a function of multiple factors, including a strong labour market, accumulated savings, wage growth, and government support, to name a few. The first and most important factor is the labour market, which has remained robust with low unemployment and steady job creation.

Source: Bloomberg, M&G, May 2024

The pandemic brought about a worryingly sharp, yet short, increase in unemployment. With the relatively brief period (didn’t feel like it though) of lockdown and government support, the unemployment rate fell back extremely quickly as pent-up demand was unleashed on the economy. Unemployment now sits at the lows. A tight labour market is often a contributing factor to higher inflation. Interest rates were raised aggressively to combat and stem the recent rapid increase in inflation, for reasons we are all too familiar with. The expectation was that increases in interest rates would have a contractionary impact on corporates as the cost of financing increased. By and large, corporates have managed to term out debt and seemingly will not have to worry about higher rates for some time.

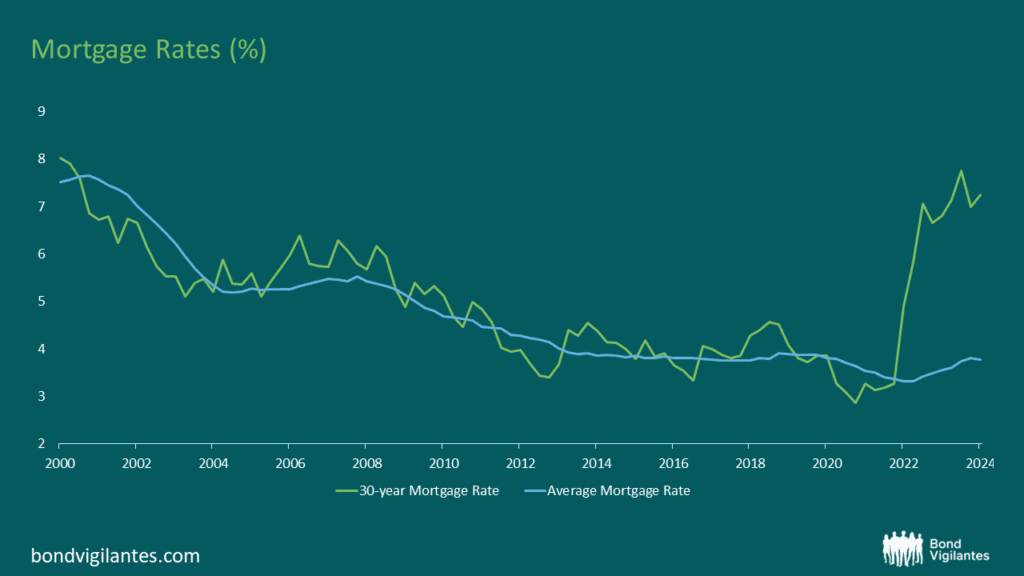

The high-yield market, which we have discussed before (here), has remained incredibly resilient. Despite the rate increases, high yield credit spreads trade at multi-year tights and are only about 100bps higher in absolute yield than before the pandemic. Most companies should be able to absorb 100bps in increased financing costs. As a result, firms have not needed to lay off staff, keeping the unemployment rate low. With a tight labour market, employees have been in a good position to demand pay increases, which has helped to offset the pernicious effects of inflation. However, policymakers need to be careful as increasing wages ultimately leads to ever-higher inflation. Trying to find the balance is critical. The consumer has been in a very similar situation to corporates which have termed out their debt. With the mortgage market being fixed for 30 years, increasing interest rates have little effect on existing homeowners. The average mortgage rate has barely budged from the lows. Only those who wish to move or get on to the housing ladder for the first time suffer at the hands of a higher mortgage rate. The inability to port one’s mortgage could lead to interesting developments, both good and bad, and will be worth keeping an eye on in the coming months and years.

Source: Bloomberg, M&G, May 2024

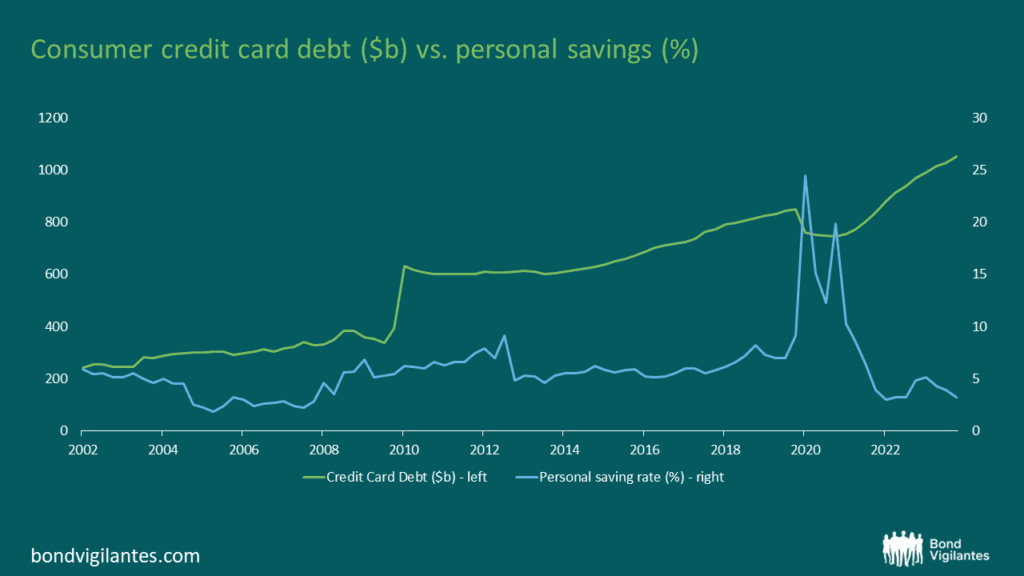

Savings accumulated during the pandemic, courtesy of government stimulus programs and reduced opportunities to spend due to shutdowns, have also contributed to the strong growth in recent quarters. Overall, this is a relatively positive backdrop for the consumer.

Is this all about to change?

The above-mentioned savings rate has indeed been run down, as expected. In times of hardship, we run down our savings and then accumulate them again in better times. However, if savings have been run down, are we increasingly vulnerable to further shocks?

Source: Bloomberg, M&G, May 2024

While savings have been run down to the lows, there has also been a meaningful increase in expensive credit card debt. The outstanding level of credit card debt recently crossed $1 trillion. The picture may not be so rosy.

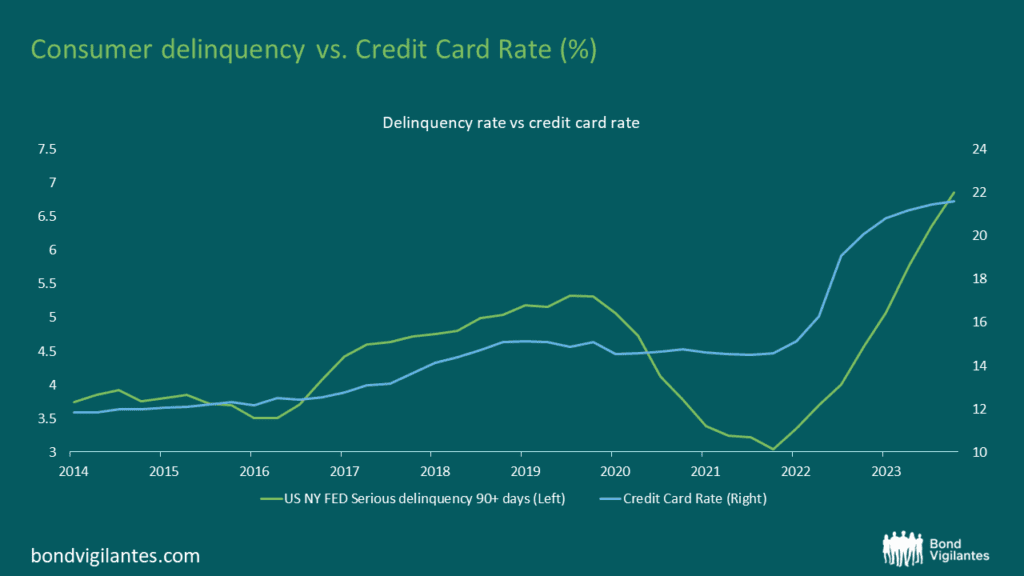

Source: Bloomberg, M&G, May 2024

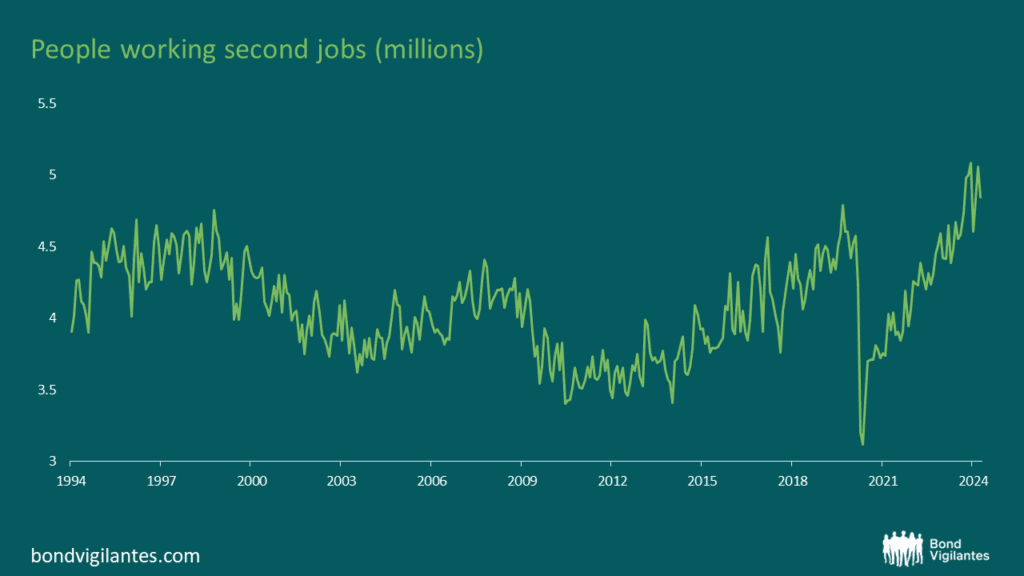

It appears to me that the consumer is extremely vulnerable and is doing what they can to hang on, as evidenced by a significant increase in people working two jobs, likely trying to make ends meet.

Source: Bloomberg, M&G, May 2024

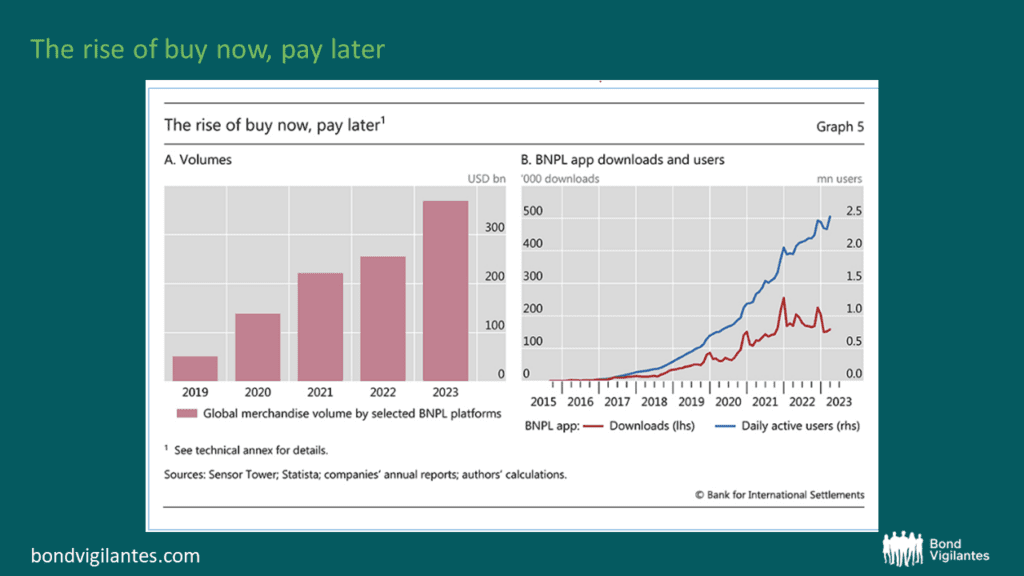

Another development in the market has been the concept of ‘Buy Now Pay Later’ (BNPL). This model allows consumers to purchase goods and pay them down in instalments over several months. The amounts are difficult to quantify as it’s a fledgling industry, but a little digging would suggest that this has contributed somewhat to the economy’s strong growth and supported the consumer’s resilience.

Source: Bank for International Settlements, May 2024

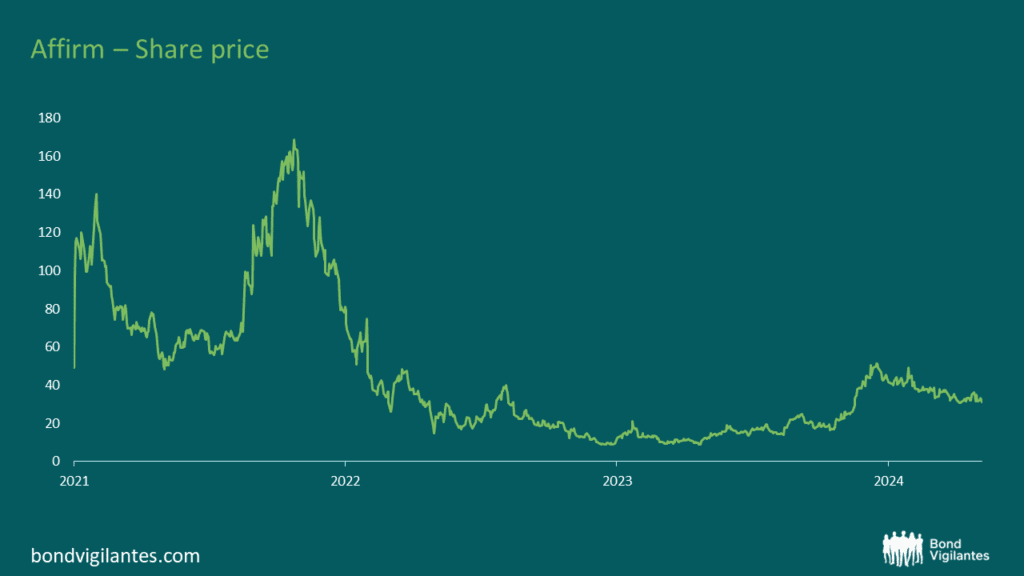

The problem with ultra-loose credit is that someone always gets burned. We are familiar with Klarna, one of the main BNPL firms in Europe. In the US, they have Affirm.

Source: Bloomberg, M&G, May 2024

Judging by the share price, I suspect an impressive growth story initially lured in investors, who then realized that ultra-loose credit lending is a recipe for disaster.

Finally, the 401(k), America’s defined contribution scheme. Vanguard, a titan in the asset management industry with $7.2 trillion of assets under management, has highlighted a recent increase in 401(k) withdrawals and loans against the 401(k). Withdrawals are allowed before retirement age but are subject to an income tax and a 10% penalty charge. One can make a hardship withdrawal under certain circumstances to avoid the penalty charge, but would still be subject to income tax. Recent regulatory changes have made this process a little easier and more accessible. Hardship withdrawals are at a 19-year high, admittedly from a low level but increasing and concerning none the less Putting all of this together, it would seem that cracks are starting to show for what has been a resilient consumer.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.