Inflation is still moving in the right direction… slowly but surely!

The disinflationary process appears to be back on track. After some higher-than-expected reports, US inflation has finally come in slightly lower than expected. Headline inflation has decreased to 3.4% YoY compared to the previous reading of 3.5%, while core inflation stands at 3.6%, the lowest level in the past three years.

There are two key themes worth highlighting:

- Rents and car insurance continue to play a significant role. Similar to the previous month, rents and car insurance have been the primary drivers of inflation, accounting for approximately 80% of the monthly core CPI. However, it’s important to note that these two components will have limited impact on the Personal Consumption Expenditures (PCE) index, which is the Fed’s preferred measure of inflation. Rents have a much smaller weight in the PCE, while car insurance is calculated differently and, according to the PCE, is currently decelerating.

- There is no evidence of inflation reaccelerating. One of the main concerns in recent months has been the fear of inflation picking up speed; however, Wednesday’s data provided evidence against this view. The core of the distribution is still shifting to the left, indicating that most items in the inflation basket are experiencing disinflation. This is evident when looking at median CPI, which has been declining for the 14th consecutive month.

What can we expect from inflation going forward?

The key driver of inflation is money supply. Throughout history, periods of significant inflation have all been characterized by excessive money printing, and the COVID-19 pandemic was no exception. Today, we find ourselves in the opposite situation: money has been withdrawn from the system and inflation is falling as a result. The chart below illustrates how money supply tends to lead inflation by approximately 18 months. I have also included inflation excluding rents, which I believe provides a more timely reflection of current inflationary pressures, given the way rents are calculated. Inflation excluding rents has already returned to 2%, consistent with what is predicted by money supply.

Source: M&G, Bloomberg, 30 April 2024.

Money supply provides the big picture of inflation, but let’s now delve into the details.

There are four key subcategories of inflation, each driven by different factors:

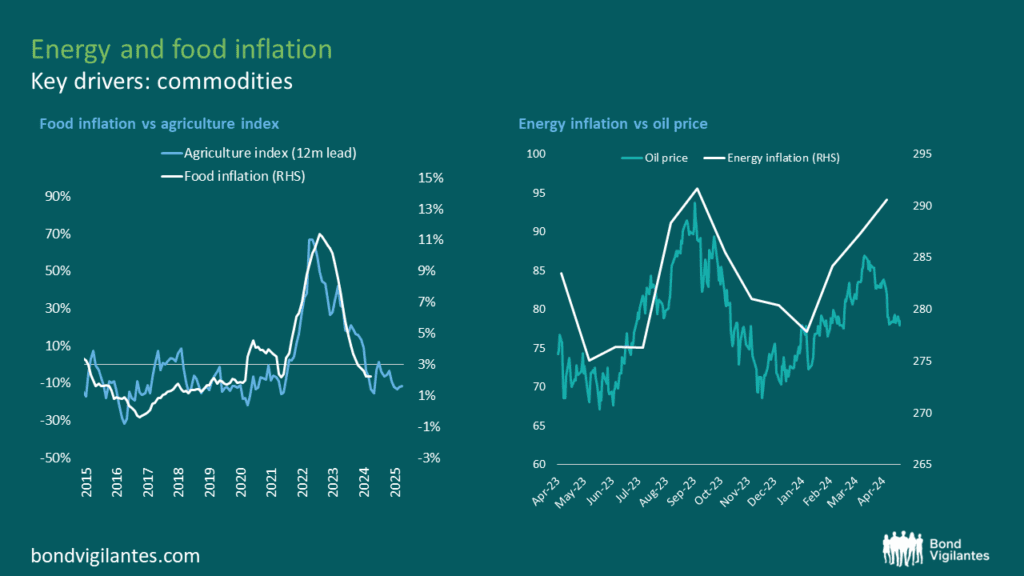

- Food and energy: This category represents 20.3% of the inflation basket and is typically the most volatile component, influenced by commodity prices. Specifically, energy inflation is driven by oil prices, while food inflation is closely correlated to the agriculture index. As shown in the charts below, both oil prices and the agriculture index are on a downward trajectory, suggesting that energy and food inflation are likely to decrease in the coming months.

Source: Bloomberg, 30 April 2024. Indices used: BCOMAG Index (Agriculture index), CPSFFODY Index (Food inflation), CL1 index (oil price), CPUPENER (energy inflation)

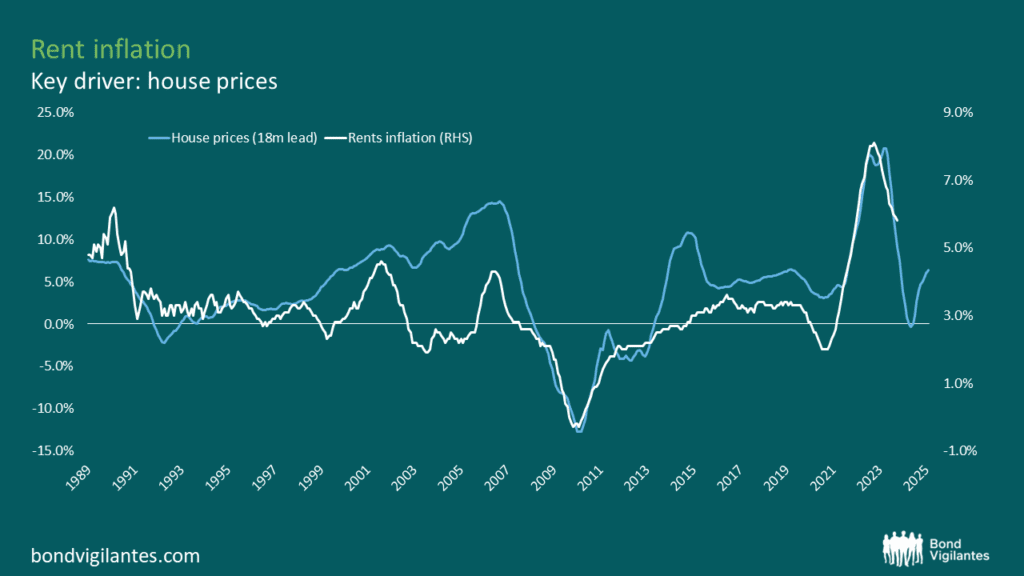

- Rents: This is by far the largest component of the inflation basket, accounting for 36.1% of the index. Understanding the direction of rents is crucial for forecasting US inflation. Fortunately, rents are slow-moving and fairly predictable due to the way they are calculated. A simple way to gauge where rents are heading is to look at house prices, as they typically lead rents by 18 months. As shown in the chart below, rent inflation is expected to further moderate, although it may pick up again towards the end of this year or the beginning of next year.

Source: Bloomberg, 30 April 2024. Indices used: SPCSUSAY (House prices) and CPRHOERY (rent inflation)

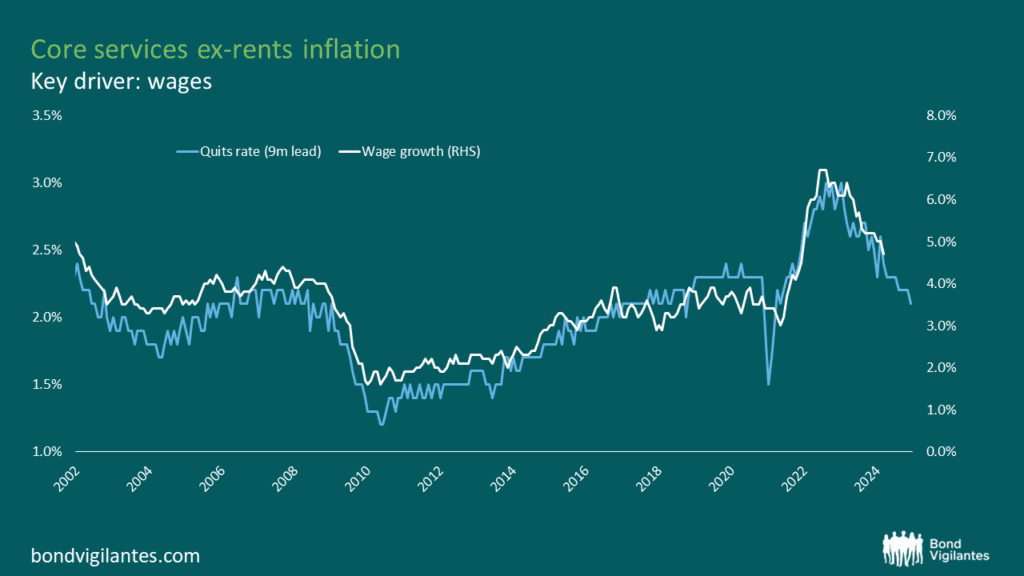

- Core services excluding rents: This category, often referred to as super-core inflation, represents 24.9% of the inflation basket and is heavily influenced by wages, as labour costs are a key input for these sectors. If you are looking for a wage-price spiral, this is where you should focus. It’s why the Fed is particularly concerned about this category. Currently, wage growth is moderating, and leading indicators suggest it will likely continue to moderate in the coming months.

Source: Bloomberg, 31 March 2024.

- Core goods: This category accounts for 18.7% of the inflation basket, and since the US economy largely relies on imported goods, the key driver here is the US dollar. A weaker dollar will make imports more expensive, pushing core goods inflation higher. Conversely, a stronger dollar will likely exert downward pressure on core goods prices. Currently, the USD remains strong, thus exerting downward pressure on core goods inflation.

Source: Bloomberg, 30 April 2024. Index used: DXY Index

In conclusion, inflation is moving in the right direction, albeit slowly. Rents may cause a reacceleration towards the end of the year, but from a lower level compared to where we are today. The question then becomes what will happen to money supply. If money supply continues to rise, inflation will likely remain above its 2% target. On the other hand, if money supply remains constrained, deflation may become a key topic of discussion.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.