Is the US economy really that different?

With the exception of the US, the rate-cutting cycle is still alive and well. Switzerland and Sweden have recently kicked off the easing cycle with their first rate cuts. Last week, the Bank of England sounded more dovish than expected, suggesting they are also close to cutting rates, and that rate cuts might be sharper than expected. The European Central Bank is also signalling rate cuts this year.

But are these economies really that different from the US? The general belief is that inflation in these economies is generally lower, while economic momentum is deteriorating.

While I don’t necessarily disagree with the idea that the US economy is in a stronger position compared to the others, I don’t think they are in such a better position to justify the valuation gap between Treasuries and other government bonds.

Consider the following:

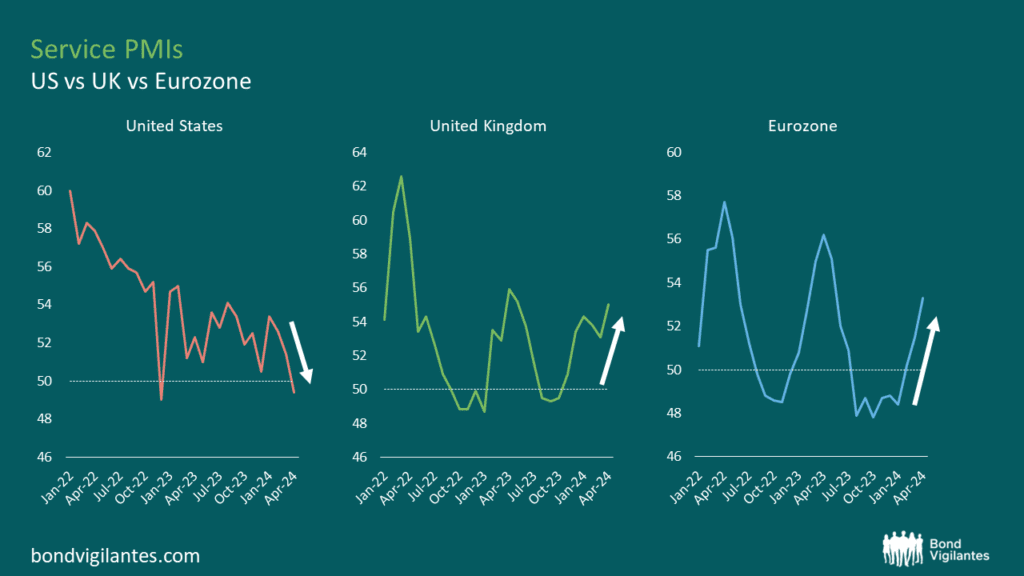

- Economic momentum: Recent economic data has been stronger than expected in both the Eurozone and the UK. On the other hand, data coming out of the US economy has been on the weaker side. A recent example can be found in the PMI indicators. The chart below shows service PMIs over time. A reading above 50 is usually consistent with economic expansion, while a reading below 50 indicates an economic contraction. As of the end of April, it would seem the US has slipped into contraction territory, while the Eurozone and UK have been coming out of contraction and are now well into expansionary territory.

Source: Bloomberg, 30 April 2024 (latest data available)

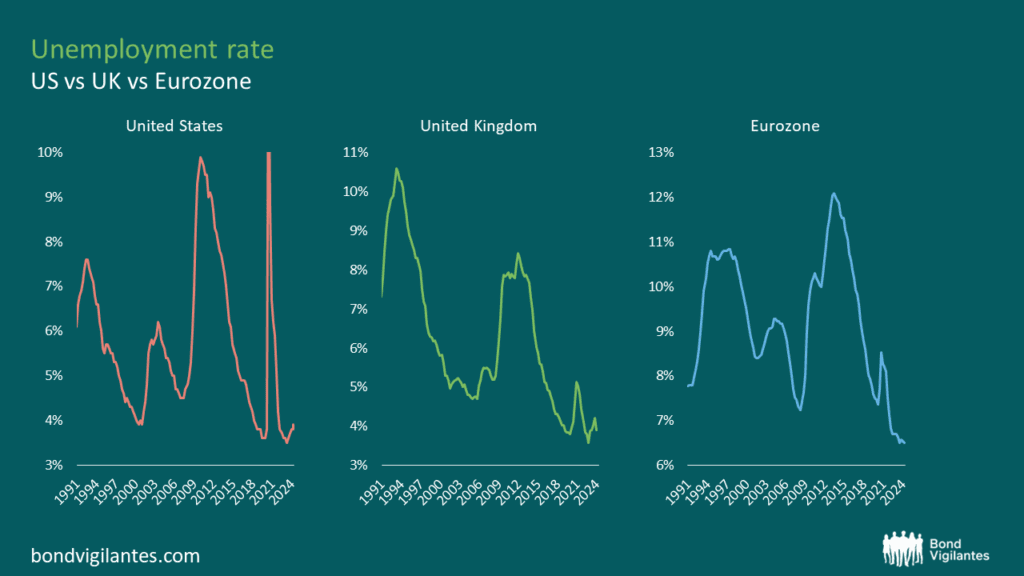

- Labour market: We often hear that the labour market is exceptionally strong in the US, with historically low unemployment rates. But what about other countries? The Eurozone and the UK are also enjoying record low unemployment levels. If anything, the US labour market has recently been weaker than expected, and the unemployment rate is now ticking up.

Source: Bloomberg, 30 April 2024 (latest data available)

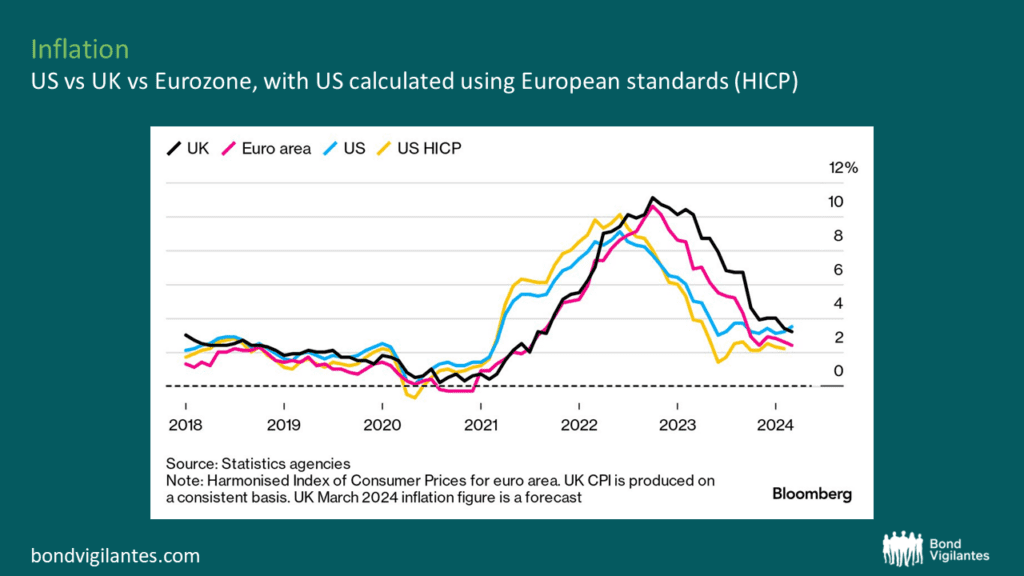

- Inflation: Many refer to US inflation as being particularly sticky at the moment, and some fear that inflationary pressures may be reaccelerating. But does the US really have such a big inflation problem compared to other countries? If we simply look at the traditional inflation measures released by different countries, we would argue that yes, the US is a bit of an anomaly here. The problem, though, is that different countries calculate inflation in different ways. What if we compare inflation across countries using a common methodology? The chart below shows inflation rates calculated using the European HICP methodology. Using European standards, US inflation is lower than both Eurozone and UK inflation and it has been at or below 2% for several months now!

Source: Bloomberg, April 2024

Given the above, who do you think should be cutting first?

Perhaps the US economy is not that different, and the Fed should also consider joining the cutting party!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.