Oil – A Global Tax

Few commodities wield as much influence in the intricate web of global economics as oil. Oil is pivotal in driving economic growth and development as the primary energy source for transportation, manufacturing, and countless other sectors. However, beneath its surface lies a hidden truth: oil can act as a tax on growth, imposing significant costs on economies worldwide.

The Economic Impact of Oil Prices

Oil prices have a profound impact on virtually every aspect of the economy:

1. Cost of Production: For industries reliant on oil as a primary input, such as transportation, manufacturing, and agriculture, fluctuations in oil prices directly influence production costs. Higher oil prices translate into increased business expenses, squeezing profit margins and potentially leading to higher prices for goods and services.

2. Consumer Spending: Rising oil prices can have a ripple effect on consumer spending patterns. As the cost of gasoline and other energy-related products increases, consumers may cut back on discretionary purchases or reallocate their budgets to cover higher fuel expenses, dampening overall consumption and economic growth.

3. Inflationary Pressures: Oil prices significantly impact inflationary pressures within an economy. As production costs rise, businesses may pass on these higher costs to consumers through higher prices, contributing to inflationary pressures and eroding purchasing power.

4. Macroeconomic Stability: Fluctuations in oil prices can disrupt macroeconomic stability, leading to volatility in financial markets, exchange rates, and interest rates. Oil-exporting countries may experience windfall profits during periods of high oil prices while oil-importing nations face trade imbalances, budget deficits, and currency depreciation.

Essentially, a high oil price acts as a tax on growth via its impact on economic activity, as businesses and consumers bear the financial costs – the same level of GDP, but at a higher cost. So far, there is nothing that we don’t know.

The oil dynamics have been changing over the years, which has been interesting to note. The most important change has been the shale revolution in the US. US oil production has boomed since 2005 due to fracking, recently resulting in the US becoming a net oil exporter and, as such, energy independent.

Source: US Energy Information Administration, May 2024

This changing dynamic has important implications regarding foreign policy and energy security. The US’s reliance on the Middle East is no longer what it once was. As a result, the US could be more hands-off in the future and potentially leave the ‘policing’ up to Europe. Presidential candidate Trump has suggested support for Ukraine could be withdrawn unless Europe increases its defence spending meaningfully. It’s fair to say that Europe needs to prepare for wavering US support and, as a result, has been scrambling to increase defence spending, which it can ill afford.

An escalation in the Middle East with the potential for less involvement from the US would not be good and would likely increase volatility in the price of oil. It would be in Europe’s best interest to ensure oil price stability.

Geopolitics aside, this newfound global supply should result in excess supply. This, in theory, should mean lower prices for us all. Unfortunately, this is too simple a view; oil prices are heavily influenced by both supply (largely OPEC) and demand (economic growth) factors. Another consideration is the shift to renewable energy, which should force the price of oil downwards, assuming supply remains constant, which it won’t. This renewable energy shift has been slow; oil will likely remain the dominant energy source for years to come.

So I ask myself, ‘is oil expensive or cheap? The answer: it depends.

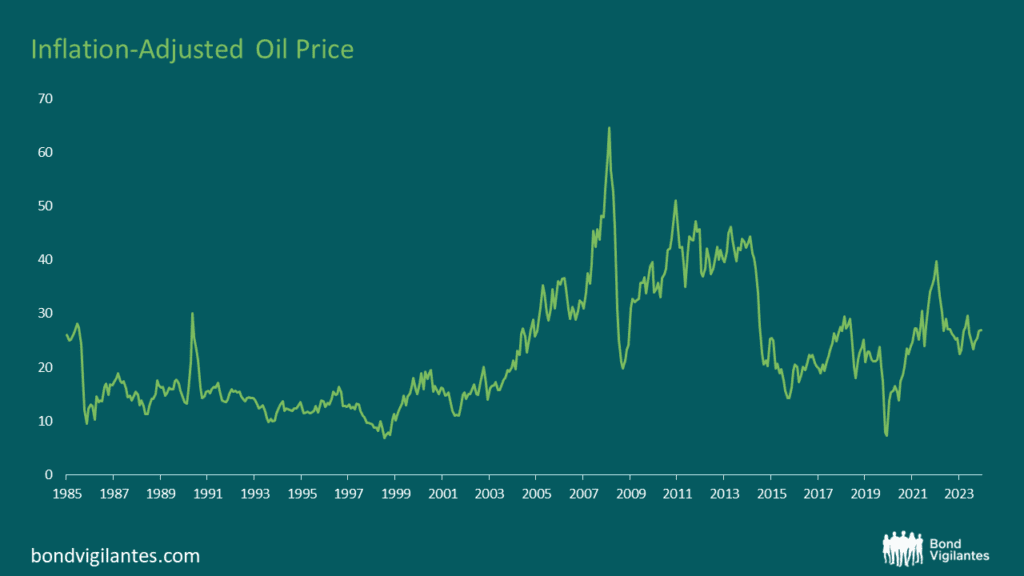

Looking at inflation-adjusted oil prices in the US, we see that prices are in fact sitting at the long run average:

Source: Bloomberg, M&G, May 2024

Prices could double from here before having a meaningful impact on the US. The moderate price of Oil is no doubt contributing to some of the strength that we currently see in the US. This does, however, bring up an interesting dynamic. As we know, oil is priced in US dollars, and countries other than the US are hostage to the price of oil in dollars. Looking at the cost of oil in a foreign currency tells a very different story. The chart below looks at the inflation adjusted price of oil in JPY:

Source: Bloomberg, M&G, May 2024

Oil prices trading at or near the highs will become problematic for the Japanese economy as they are a heavy net importer. The factors discussed above will be at play. Inflation will continue to increase as the Yen weakens, potentially forcing the BoJ’s hand to raise rates more meaningfully, which is a challenge given the debt level.

Circling back to the oil price in US dollars, it has, in fact, been relatively stable despite the instability in the Middle East. A political misstep could see oil prices lurch higher, putting energy importers with very weak currencies in a very difficult position indeed.

Back in 1985, the Plaza Accord was signed, an agreement between the major economies to depreciate the dollar by intervening in currency markets. The dollar depreciated significantly as a result. There are similarities between then and now. Back then, monetary policy was tight, implemented by Paul Volker, and set against expansionary fiscal policy by the government at the time. This powerful cocktail sucked in capital, resulting in an extremely strong dollar. Sound familiar?

In fact, just recently, the US, Japan and South Korea met to “consult closely” on currency markets. What exactly this means is unclear, but it is very interesting. Speculation is rife about whether Japan recently intervened in currency markets as the yen hit 160 to the dollar. Are we inching towards a new Plaza Accord? The stresses and strains don’t look particularly stretched when you compare the DXY ( a weighted dollar index versus international currencies) from 1985 to today, so a new Plaza Accord may be some way off:

Source: Bloomberg, M&G, May 2024

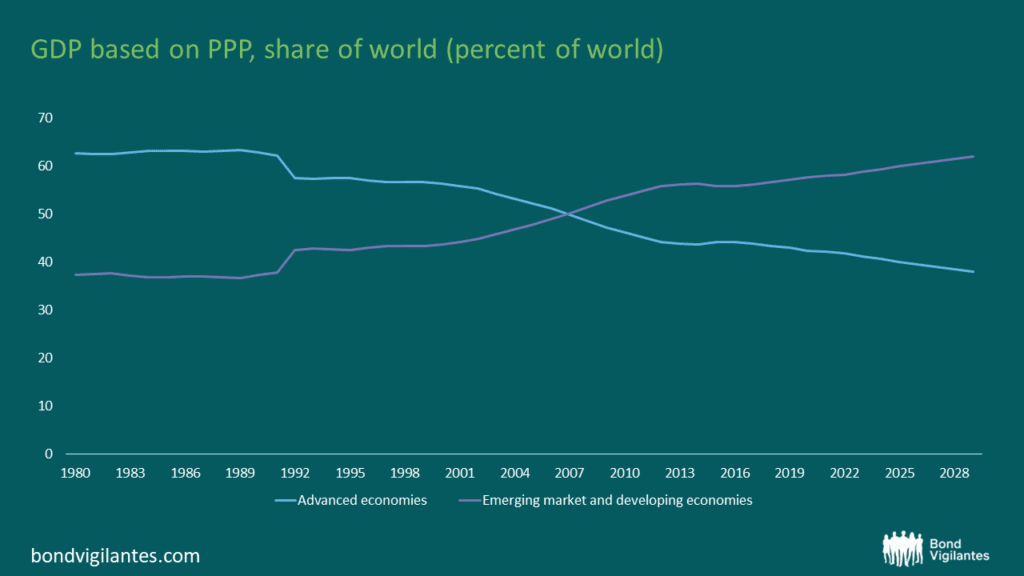

That said, the composition of the world we find ourselves in today is very different. Countries have become increasingly unstable as debt levels continue to rise and the share of GDP between developed and emerging markets has completely flipped. The US has a dual mandate of stable prices and full employment; perhaps international stability should also be a consideration.

Source: IMF, May 2024

Emerging markets and highly indebted oil importers with weak currencies will struggle to continue fighting the strong dollar due to the fact that it is the currency of international trade and settlement.

Something is likely to break unless the Fed changes course. It’s hard to see the Fed cutting rates anytime soon, leaving us waiting for something to break. Will oil be the catalyst?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.