BFF – The hidden risks of light(er) touch regulation

Last month, BFF, a small Italian bank with €12 billion in total assets revealed that its regulator, the Bank of Italy, has requested it to “temporarily suspend profit distributions”, causing its stock to plunge by over 30%. Fortunately for bond investors, the limitation does not apply to interest payments on BFF’s AT1 instruments. Beyond the specific situation of BFF, which we see as idiosyncratic with no read-across to its larger Italian bank peers, we see two broader sector lessons in the event, with implications for both smaller sized banks and the AT1 asset class in general.

- We believe smaller banks may be less stringently regulated than larger ones. Beyond BFF’s experience, we have seen this across other geographies over time. For example, in the US different regulatory standards are applied to different sized banks, with category 1 banks (the largest) having much higher capital and liquidity requirements. This was acknowledged by US regulators to have contributed to the failures of Silicon Valley Bank and First Republic Bank (amongst others) in 2023.

- Regulators are likely to continue to treat equity and AT1 differently, going out of their way to protect the AT1 bondholders. We have seen this in both systemic events (March 2020) and idiosyncratic events (like BFF’s) when the regulators asked banks to stop paying dividends but continued to allow AT1 coupon payments. In our view, Credit Suisse’s AT1 treatment remains the exception here.

BFF – local regulator playing catch-up.

Alongside its results published on the 9th of May, BFF revealed that following an inspection concluded earlier in the year, its local regulator, the Bank of Italy, has ordered the bank to temporarily refrain from (i) dividend payments, (ii) the payment of variable remuneration, and (iii) further expansion abroad. The restrictions were triggered by the regulator’s finding that BFF was not appropriately accounting for its regulatory capital requirements, by diverging from the European Banking Authority’s (EBA) “Definition of Default” criteria.

More specifically, this allowed some of BFF’s public sector exposures which were past due to be risk weighted at 20% vs the 150% required, effectively holding 85% less capital for these exposures. The “Definition of Default” criteria were published by the European Banking Authority (EBA) and went into effect in January 2021. The Bank of Italy published its own circular with Q&A on this in September 2022, with the regulator effectively deeming the implementation period as sufficient for implementation. For context, Intesa, the largest Italian bank by assets had implemented the Definition of Default from November 2019, more than five years ahead of BFF.

Smaller banks – lighter touch supervision a potentially underappreciated risk factor

There are of course limits to how much outsiders can get under the hood of banks’ capital modelling. Indeed, investors heavily rely on regulators to validate banks’ internal models, with auditors serving as an additional check on management’s work. The structure can throw off surprises when regulators seemingly apply different standards in applying the rules depending on the size of the bank.

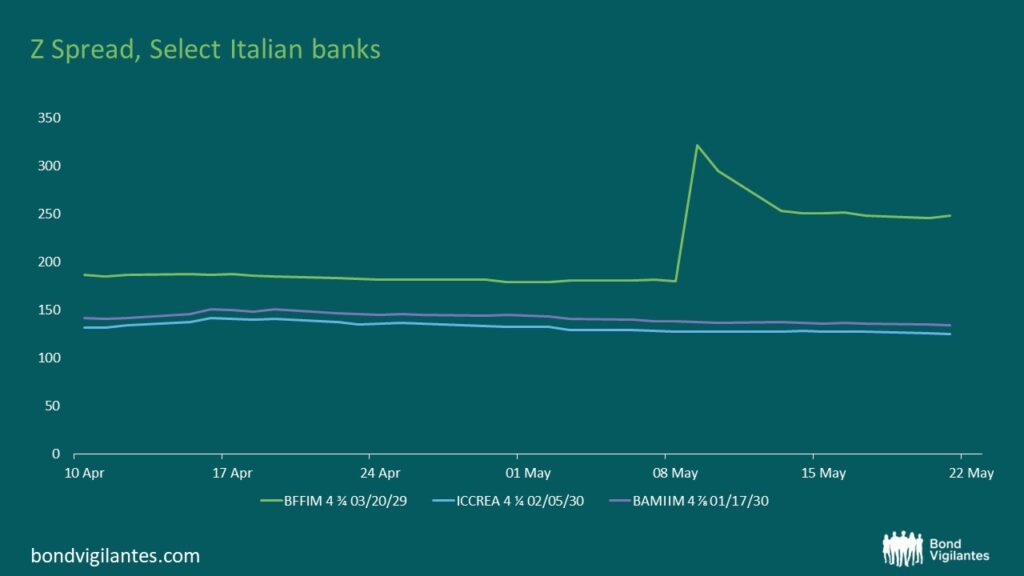

In the Eurozone, the ECB is in charge of supervising banks with total assets in excess of €30bn (with some exception), with the national competent authorities (i.e. the local regulator) in charge of supervising smaller institutions. Given BFF’s size (€12bn in total assets), it fell under the Bank of Italy’s supervisory remit. It is of course impossible to know the counterfactual – i.e. if the bank had been supervised by the ECB instead, would it still have been allowed a four year grace period to implement supervisory guidelines, especially when its larger peers implemented them ahead of time? However, we do note that the market did not appear to price for this risk, across the capital structure. As seen the chart below, at issuance (April ’24), BFF’s Senior Preferred came in only a 40bps wider vs the much larger, more diversified and better capitalised peer Banco BPM’s Senior Non-Preferred issue.

Source: Bloomberg, May 2024

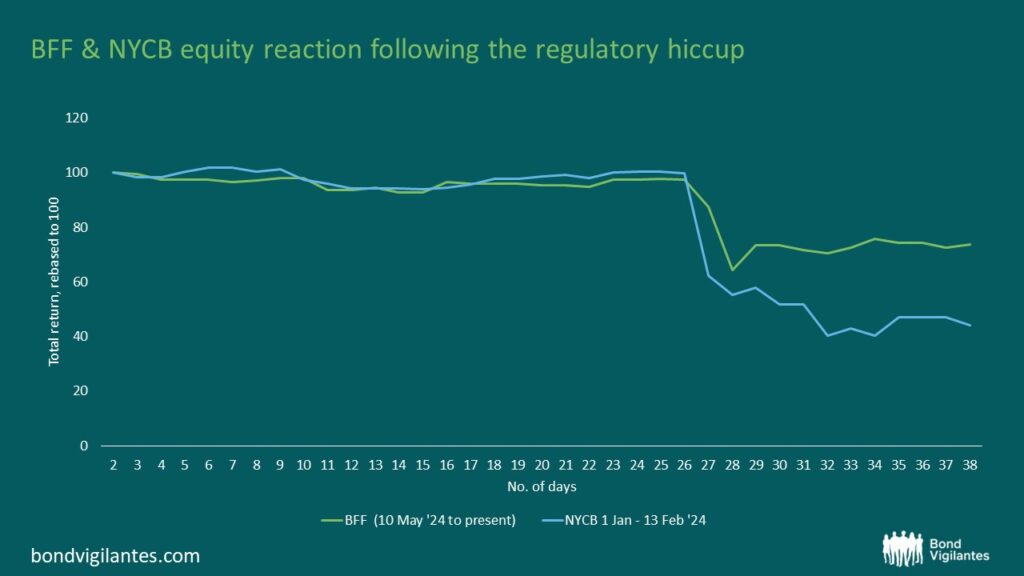

This dynamic happens outside of the Eurozone as well. We have seen this in the US in 2023, with both SIVB and FRB, who took higher interest rate risks than seen at larger peers. In 2024, we saw a repeat of it when NYCB was forced to cut its dividend as it approached the more stringent regulation of a category 4 bank. In the UK, Metro Bank was found to have been improperly calculating its capital requirements for a number of years, between 2016-2019.

How does this translate into market pricing? We note a similar pattern in equity reaction to a surprise regulatory-driven announcement in the US regional bank’s case NYCB when, based on extensive press reports, the regulator took a harsher stance on NYCB’s liquidity and provisioning approach, forcing it to cut its dividend by some 70%, with the equity dropping by >30%, similar to what we have seen with BFF last month.

Source: Bloomberg, May 2024

AT1 – more protected across a range of scenarios

We do see some positive read-across for AT1 instruments from this episode. As we have seen in 1H 2020 – when early Covid days provided a system level uncertainty, the ECB (among others), ordered banks to stop paying dividends (or executing buybacks) but allowed AT1 coupon payments. In this idiosyncratic event, the regulator has followed a similar approach, reinforcing our view that AT1s work to absorb losses in the event of a bank failure.

In our view, the Swiss regulator’s treatment of Credit Suisse’s AT1 instruments, effectively subordinating them to the equity holders during the forced merger with UBS – remains the exception here. We note that both the ECB and Bank of England, among other global regulators, have been quick to reaffirm the creditor hierarchy which dictates that AT1 instruments are senior to common equity holders.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.