European Banks M&A – The best defence is a good offence

Over the last few years, discussions around bank consolidation felt like ‘Waiting for Godot’. This was especially true in Europe, where some banks were still restructuring, cleaning up their balance sheets and rebuilding their capital position. Outside of some sparse domestic M&A, distressed acquisitions (UBS/CS, SAN/Popular) and small bolt-on transactions, there was little of note. Suddenly, over the last few months, we have seen a flurry of announcements on bank consolidation in the UK, Spain and Central and Eastern Europe (CEE). Why now? Is this the beginning of a broader trend, and if so, who stands to benefit?

We discuss three drivers for why we expect an inflection point in European bank consolidation. Two of them are structural: scale, which leads to lower costs, and breadth of capabilities in serving an increasingly sophisticated and demanding customer base. The third driver is more cyclical in nature, as banks’ management try to offset earnings declines from the recent highs with deal synergies. While there are risks to bank M&A – poor integration or strategic fit to name just two – successful M&A can translate into meaningful spread compression for the parties involved.

In a subsequent blog, we plan to look at which geographies are most ripe for consolidation and the types of M&A most likely to occur: domestic, cross-border, or diversification ‘beyond banking’ into insurance, private, and wealth management dimensions.

European bank M&A announcements heating up, but why now?

We have seen a handful of bank M&A announcements over the last few months across a number of countries, including the UK and Spain: Nationwide and Virgin Money, Coventry Building Society and Co-Op Bank, as well as BBVA and Sabadell. Why now? We propose three drivers, two structural and one more cyclical.

- Scale

Given its high fixed costs, banking has always been a scale business. However, with both regulatory costs and required IT investments increasing and competition from low cost providers eroding margins, gaining scale to compete becomes critical. In its latest business plan, JPMorgan has announced a 2024 technology budget of $17bn (10% of revenues), an increase from $15.5bn the year before. While JPMorgan is clearly in a league of its own in terms of complexity and thus warrants a much higher spend, banks competing with much smaller budgets are likely to remain at a competitive disadvantage, particularly in innovation.

For example, amongst the 47 banks comprising the European banks stock index (SX7P), some 35% of them would have a technology budget of less than €500m per year if spending the same 10% of revenues. Of course, IT is but one of the benefits of scale. Cost of funding – particularly wholesale – is another. Danske Bank, a Danish bank with €500bn in total assets, has a cost of funding that is 10-15bps cheaper than its smaller local rival Jyske Bank, which has “only” €103bn in assets in the € Senior Non-Preferred space, despite having similar credit ratings.

- Increased complexity of customer needs

In addition to the scale benefits, which translate into lower costs, the increased complexity of customer needs – particularly across the corporate and institutional client spectrum – constitutes the other big structural driver of M&A, namely the benefits of wider depth and breadth of capabilities. While this dynamic is more difficult to quantify, we have seen a notable increase in US banks’ share of investment banking fee pools (trading and fees) at the expense of European banks. Since 2015, European banks lost some 7 percentage points in market share of investment banking to their US-headquartered counterparts.

- Cyclical effects

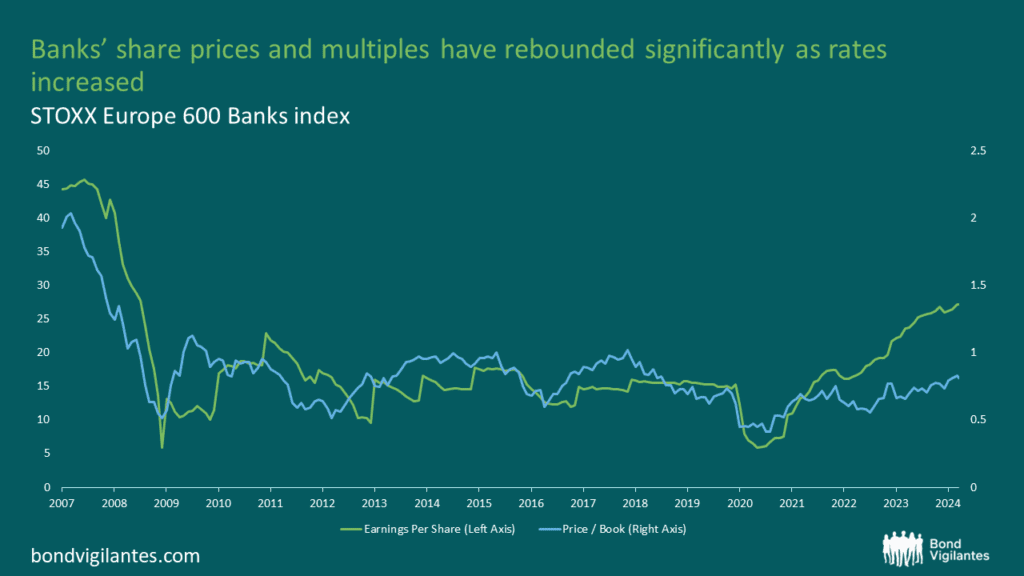

A third driver is cyclical. After a decade or more of restructuring and retrenching which led to a steady decline in earnings, the higher interest rate environment led to a meaningful rebound in profitability. However, with the interest rate cycle paused and likely to move into reverse, we expect banks’ management to want to keep the positive earnings momentum through synergies.

Chart 1: Banks show a steady decline in earnings between 2011-2020

Source: M&G, Bloomberg, June 2024

While the benefits of bank M&A are clear, higher bank earnings have also improved the ‘affordability’ element, with banks’ share prices & multiples up significantly, as shown in the exhibit below. With a renewed currency, peak earnings and clean and strong balance sheets, this should be prime time for bank M&A.

Chart 2: Banks’ share prices and multiples have rebounded significantly as rates increased

Source: M&G, Bloomberg, June 2024

M&A: what’s in it for credit investors?

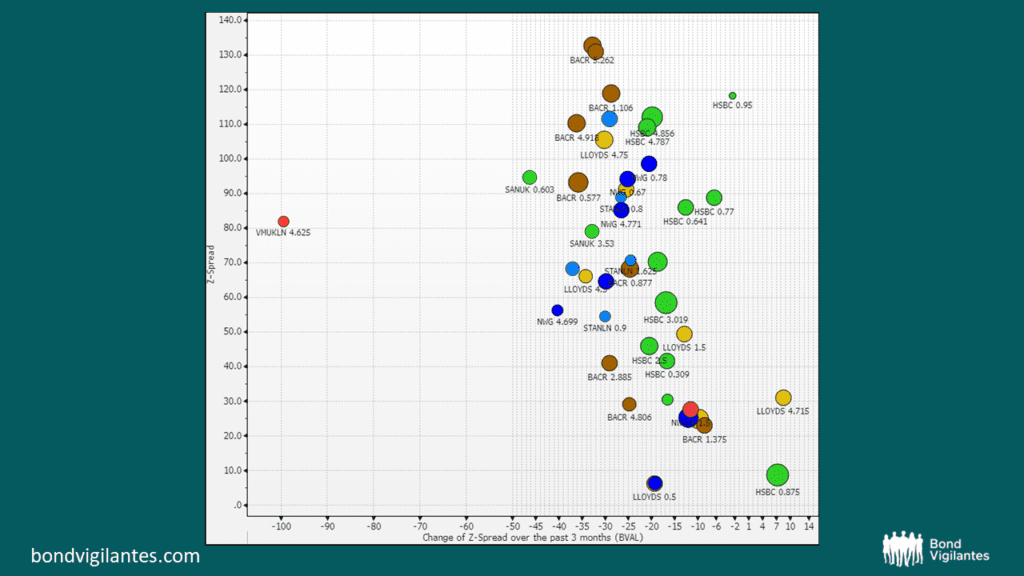

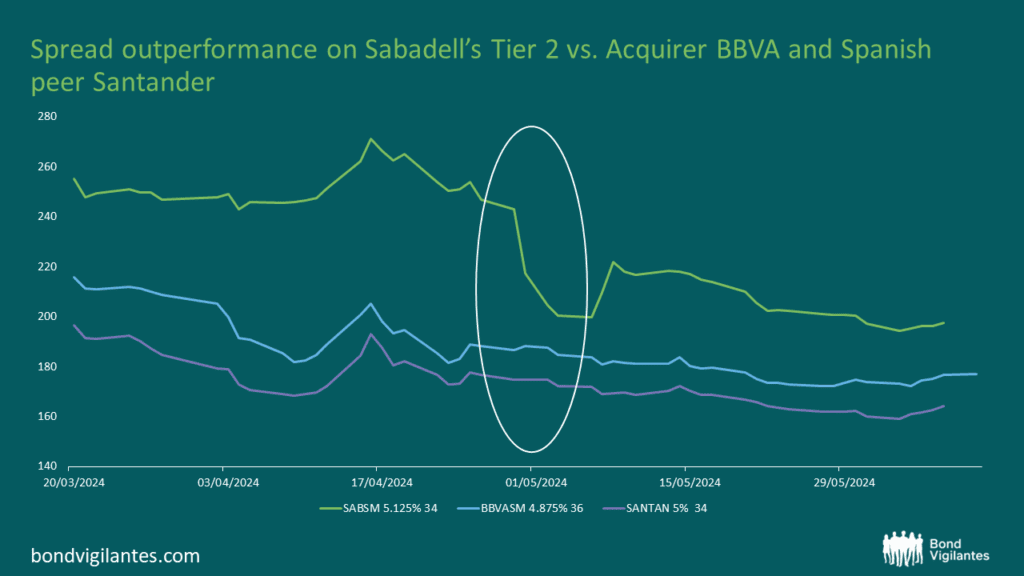

We see significant potential for spread compression in strategically sound, non-distressed M&A. For example, in the recently announced transactions mentioned above, we have seen significant tightening and outperformance in the spreads of M&A targets Virgin Money, Co-Op Bank and Sabadell across their capital structures.

Virgin Money senior unsecured bonds (HoldCo) have compressed by more than 100bps, significantly outperforming its peers and the wider banking sector, as shown in chart 3. In chart 4 below, we show Sabadell’s Tier 2 outperforming Spanish peers following the M&A announcement.

Chart 3: Virgin Money seniors have outperformed the sector post M&A announcement

Source: M&G, Bloomberg, June 2024

Chart 4: This Sabadell Tier 2’s Z spread has contracted by about 50 bp post M&A announcement, whereas the Banco Santander Tier 2 comparable has only compressed by about 10 bp over the same period.

Source: M&G, Bloomberg, June 2024

There are of course risks to bank M&A, with integration issues and weak strategic fit two of the key ones. The acquisition of TSB by Sabadell back in 2015 lead to a bumpy integration when the IT migration, which was supposed to unlock synergies was marred with severe IT issues in 2018. However, some of these risks can be in part mitigated. For example, Nationwide has set a long integration timeline for its Virgin Money acquisition, which we expect is in part to lower the operational risks of the transaction. Good strategic fit is critical as well; for example, the merger of Caixabank and Bankia in 2021 created the largest domestic bank in Spain. Similarly, the merger between Intesa and UBI in 2020 led to external rating upgrades all around.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.