Are investors gorging on the carry trade?

Japan’s prolonged period of low interest rates, a key feature of its economic policy for decades, has significant implications for global markets. Since the 1990s, Japan has maintained ultra-low interest rates to combat deflation, stimulate economic growth, and manage its substantial public debt. However, given the highly interconnected global financial environment, Japan’s monetary policy has far-reaching implications for international markets.

The current landscape of low interest rates in Japan

The Bank of Japan (BOJ) has kept interest rates near zero or negative for years. This policy encourages borrowing, investment, and consumption while keeping the yen weak to support export-driven growth. The BOJ has also engaged in aggressive quantitative easing (QE), purchasing government bonds and other assets to inject liquidity into the economy.

Despite these measures, Japan continues to struggle with low inflation and subdued economic growth. The BOJ remains committed to maintaining low interest rates as it seeks to achieve its inflation target of 2%.

The carry trade

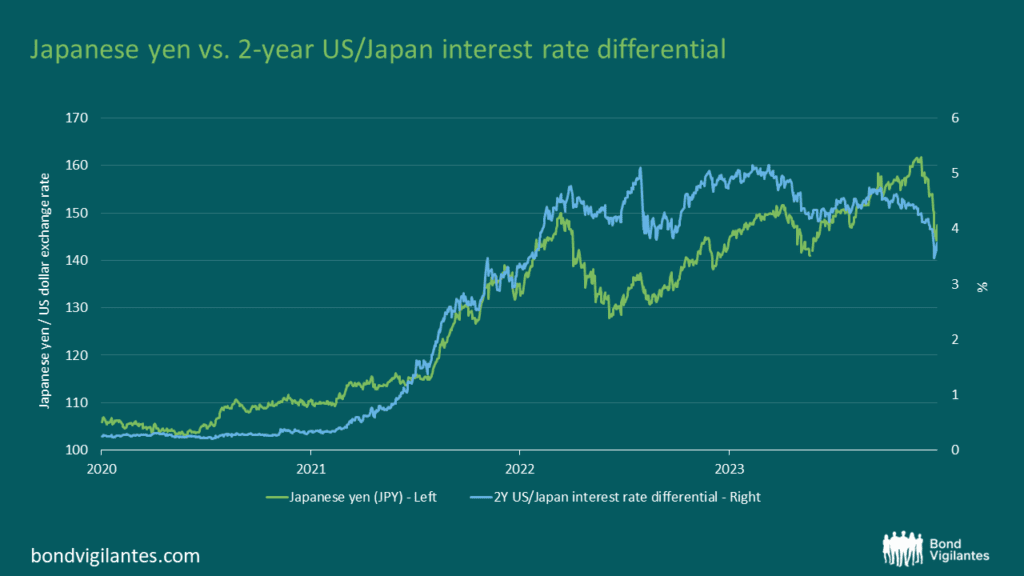

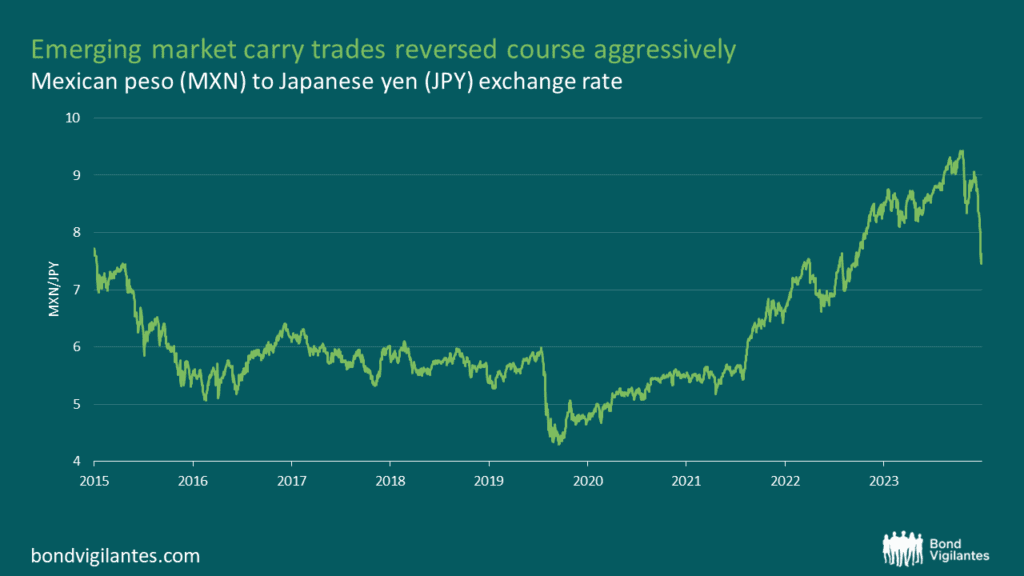

The carry trade involves borrowing in a low-interest-rate currency and investing in higher-yielding assets elsewhere. Japan’s continued low rates have fuelled these carry trades, leading to significant capital flows into emerging markets, higher-yielding assets, and growth stocks. This has supported asset prices globally, particularly in riskier markets, and arguably creating asset bubbles.

Source: M&G, Bloomberg, August 2024

How much has this dynamic supported markets and contributed to financial instability?

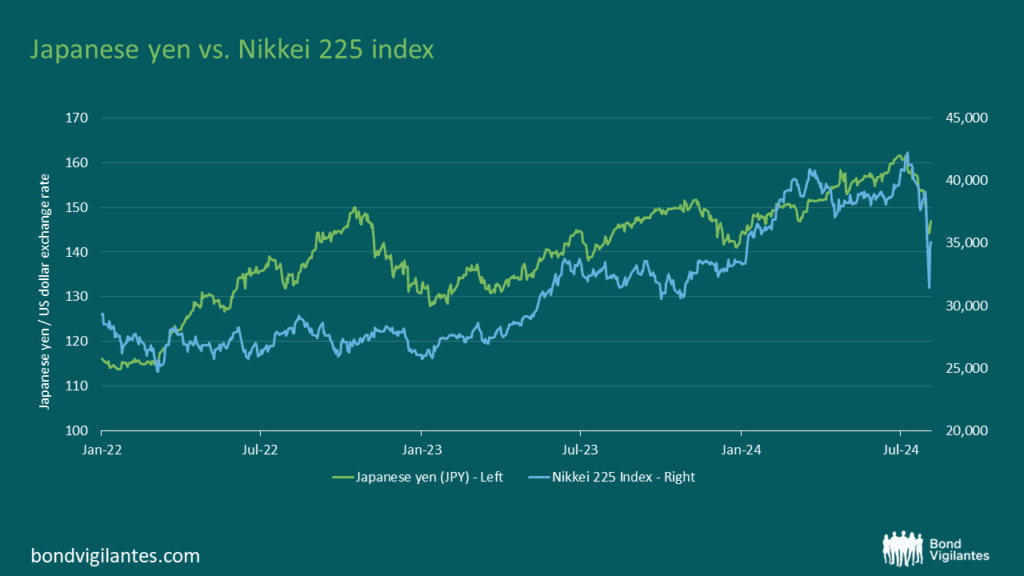

Yen weakness, resulting from persistently low rates and widening interest rate differentials, has further weakened the currency. This has made Japanese exports more competitive, thereby fuelling gains in the export-focused Nikkei 225 index.

Source: M&G, Bloomberg, August 2024

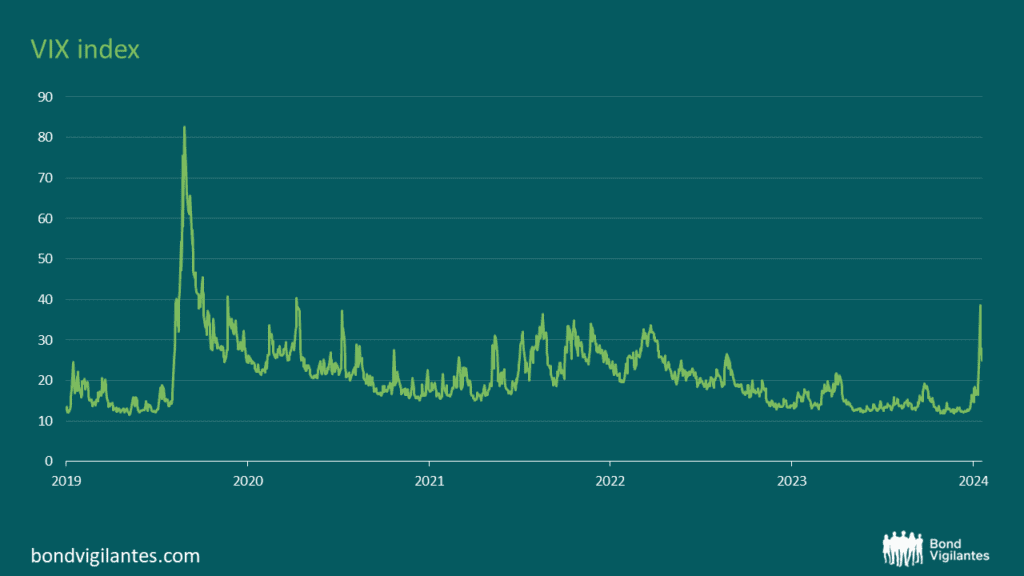

The implications of unwinding the carry trade

The interest differential needs to close for the carry trade to unwind. This can happen if Japan increases interest rates or if the rest of the world reduces theirs. With the Federal Reserve (Fed) signalling its intent to reduce rates in September and the BOJ hiking rates at the end of July, this dynamic came into firm focus. The result was an explosion in volatility as the long-held carry trade reversed, with worrying implications for financial stability. The below chart demonstrates this through the VIX index, which is an estimate of the expected volatility in the US equity market (S&P500).

Source: M&G, Bloomberg, August 2024

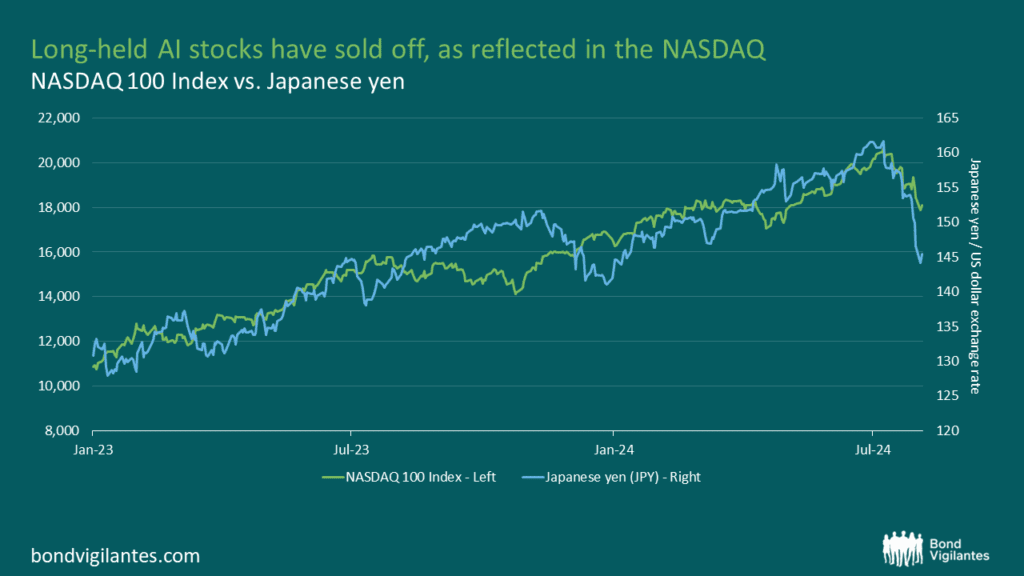

This sudden withdrawal of liquidity has led to a rapid repricing of the yen higher and a sharp fall in risk assets, as further evidenced in the charts shown below.

Source: M&G, Bloomberg, August 2024

Source: M&G, Bloomberg, August 2024

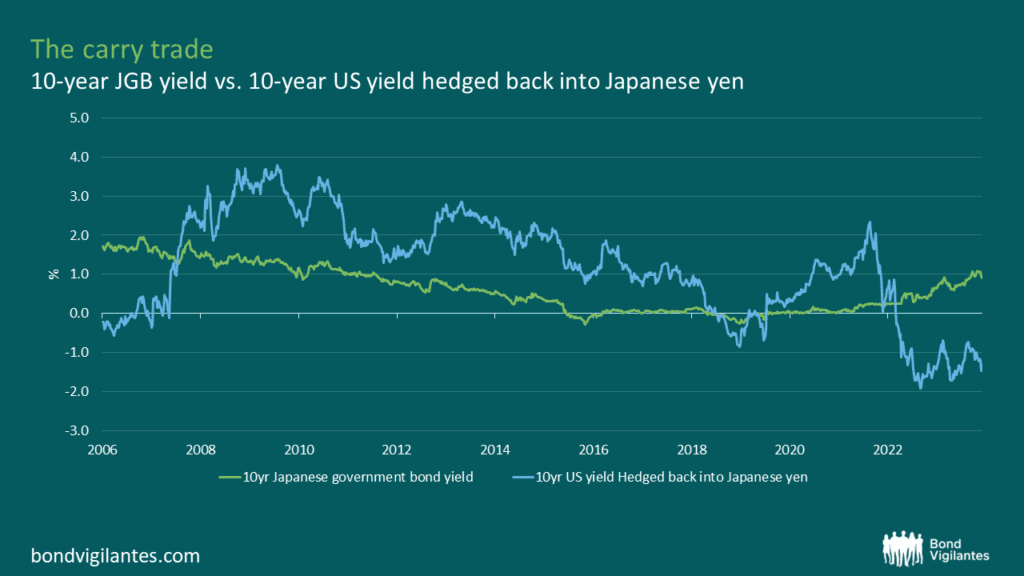

These significant moves suggest that global financial markets are very exposed to the carry trade. With the BOJ now hiking rates and the Fed predisposed to cutting rates, the carry dynamics are becoming deeply unfavourable for Japanese investors on a hedged basis.

Source: M&G, Bloomberg, August 2024

We believe the carry trade is under pressure. Countries such as the US, France, and Australia have benefitted disproportionally from this and, we think, are at risk of facing higher yield pressures if unwinds.

The unwinding of the carry trade leads to a confusing reallocation of capital. For example, if Japan sells treasuries, this pressures yields higher, and if it purchases Japanese Government Bonds (JGBs), this pressures yields lower. In this situation, the yield differential will continue to grow and should weaken the yen further. However, exchanging foreign currency back into the yen should strengthen the currency. This reallocation is likely required and will allow the BOJ to move yields meaningfully higher to combat rising inflation.

The problem lies in Japan’s existing stock of debt, which stands at 250% of Gross Domestic Product (GDP). Allowing interest rates to move higher would mean a higher interest burden. This brings us full circle to a continuation of the existing carry dynamic, which fuels asset bubbles. How do we break this cycle? It’s crucial that we find a solution to the carry trade issue; otherwise, we will have more frequent explosions of volatility.

Conclusion

Japan’s continued low interest rates have profound implications for global financial markets, influencing everything from currency valuations to bond yields and capital flows. The potential unwinding of this policy poses significant risks, including market volatility, currency appreciation, and shifts in global inflation dynamics. Investors and policymakers alike must remain vigilant, closely monitoring Japan’s monetary policy and preparing for the far-reaching impacts of any significant changes. The interconnected nature of global financial markets means that developments in Japan can resonate across the world, underscoring the importance of understanding and anticipating these dynamics.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.