What ‘Brat Summer’ can teach us about the bond market and the US Presidential election

What is ‘Brat Summer’?

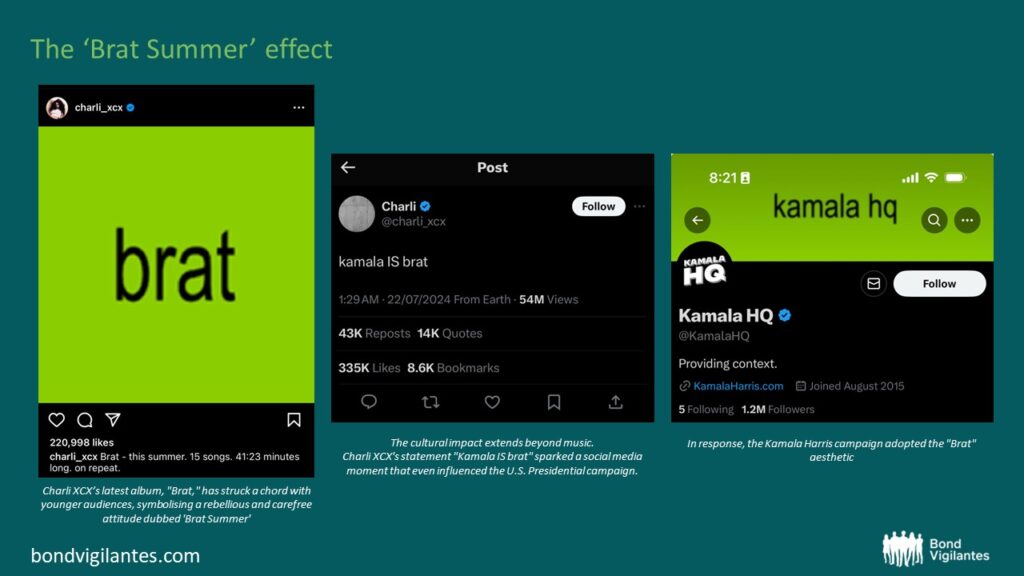

Those young enough to still enjoy the music of Charli XCX, or parents with children tuned in to the latest trends, may be familiar with her latest work, Brat. This album has not only captivated young audiences, but has also sparked a cultural phenomenon dubbed ‘Brat Summer’. The term embodies a rebellious, carefree spirit, resonating with youth culture. Interestingly, ‘Brat Summer’ has even made its way into the US presidential race, with Charli XCX declaring on X, ‘Kamala IS brat’, which led the Harris campaign to adopt the ‘Brat’ aesthetic by changing its X banner to ‘kamala hq’ in the album’s style. I didn’t have that on my 2024 bingo card.

Confused? So was I. That’s why I’ve done some digging (so you don’t have to) to uncover what ‘Brat Summer’ can teach us about the bond market and what its surprising involvement in the US election might mean for November’s Presidential race.

Track 1 – 360 (corporate bonds YTD)

Corporate bond enthusiasts will be familiar with the 30/360 interest accrual method for corporate bonds. Naturally, this led me to consider the current state of the investment grade (IG) corporate bond market. Since the start of the year, we have seen credit spreads (the additional compensation investors receive over government bond yields) on the broad global IG index tighten, moving from a high of 120 basis points (bps) in early-January, to a low of 94 bps at the end of May. So, during this time, having exposure to credit risk has paid off, despite spreads starting from a point of appearing somewhat expensive relative to average historic levels. The question is, does a tightening of spreads align with underlying credit fundamentals?

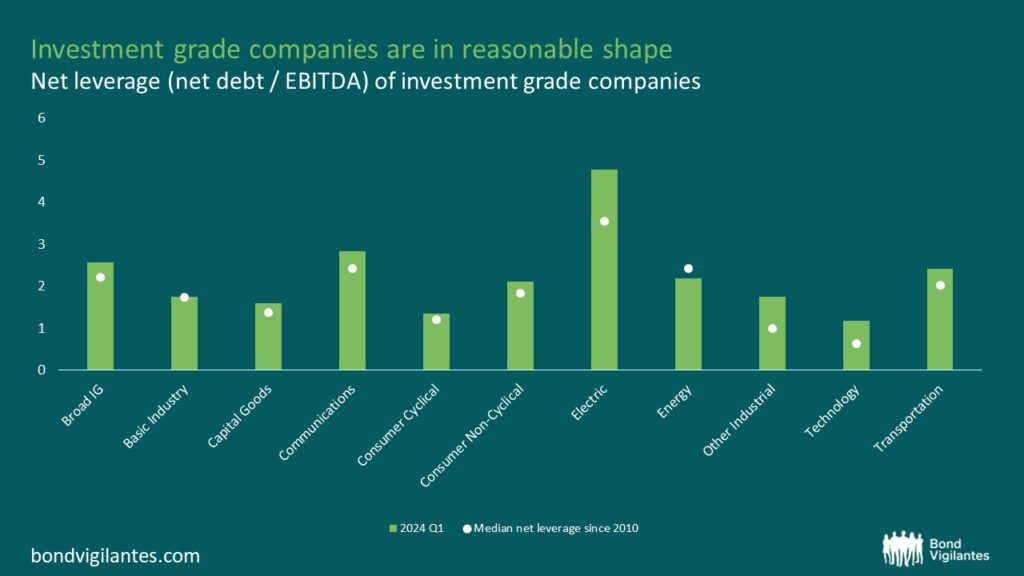

I have taken the net leverage (the ratio of net financial debt to earnings – a high net leverage implies a lesser ability of a company to meet its financial obligations) of some key sectors as of the end of Q1 and compared it to the median net leverage since 2010. What we can see in the below chart is that IG companies are in reasonable shape, being only slightly above the median on average. Given that we have just been through the most aggressive rate hiking cycle in recent history, following an unprecedented period of interest rates at 0%, this should offer comfort for IG investors – default rates should not be a concern at these levels.

Many IG companies locked in favourable rates on their debt in 2021, and given the longer-term maturity profile of IG issuers, there is no impending maturity wall (when a significant proportion of debt matures in a short period of time) on the horizon. The case is not quite the same in high yield (HY), where there is a large maturity wall in the European market over the next 12 months. See Ana Gil’s blog for a more in-depth look: High yield maturity walls are steep but not unclimbable. This means that in IG, valuations are the focus. The yield buyer is dominating the spread buyer in this environment, with all-in yields in global IG north of 4.5% acting as a tailwind for spreads. This has made it important to look under the bonnet at individual credit stories year-to-date to extract value and take advantage of mispricing.

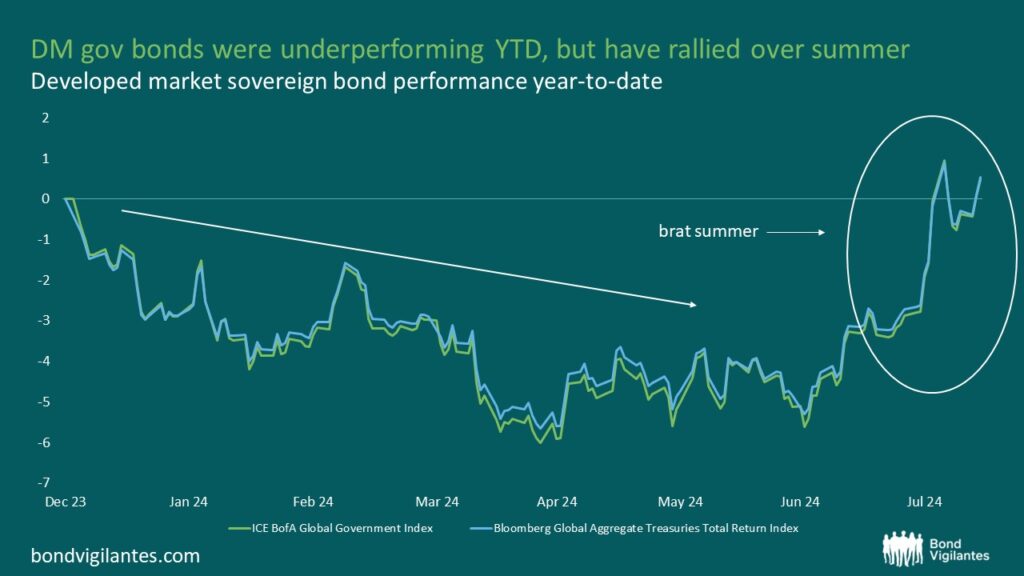

Track 15 – 365 (developed market sovereign bonds YTD)

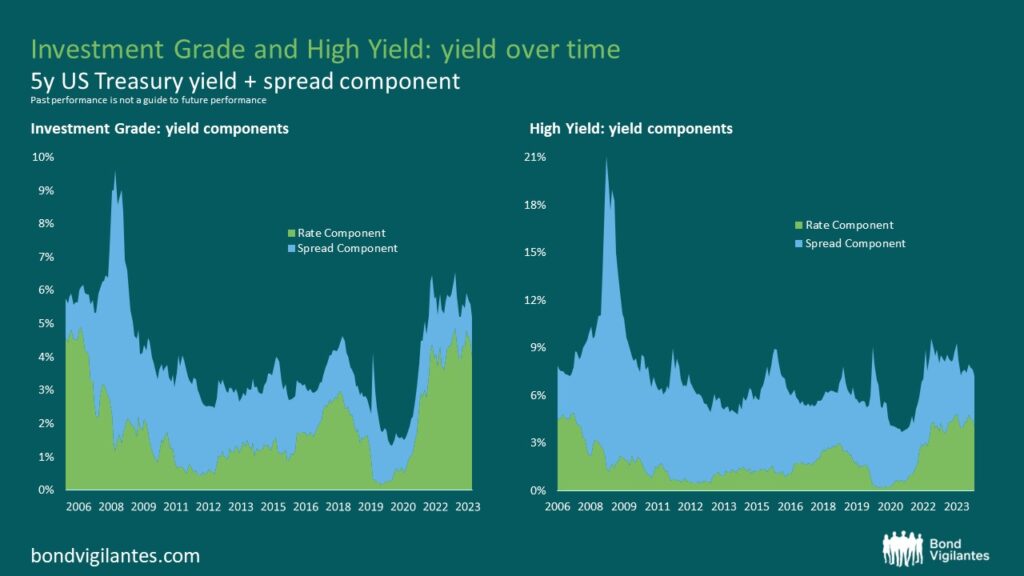

For all the sovereign bond enthusiasts, don’t fear, Charli XCX has you covered with 365 (actual/actual interest accrual)! The first half of 2024 was a story of yields gradually rising, which hurt developed market sovereign bonds and those with a long duration position. So why have we heard so much about the benefits of having a long duration position in financial news if rising yields have been hurting government bonds for most of the year (Track 10 – Girl, So Confusing)?

Well, we can see in the chart below that 80% of the opportunity within corporate bonds is coming from the underlying risk-free rate – that is, the duration component. With credit spreads tight, there are opportunities for both sovereign bond investors, and those holding a long duration position in corporate bonds, to benefit from interest rates moving lower.

As inflation has been trending downwards across developed markets (DM) and some economic data has started to weaken, the performance of sovereign bonds has picked up during their ‘Brat Summer’. The Citi Global Economic Surprise Index – a measure of whether economic data releases have been better or worse than expectations – has been moving lower since the start of April. Falling inflation and weakening data has led to central banks easing monetary policy by cutting interest rates – Switzerland (March) and then Sweden (May) were first, leading the way for the G10. We then saw our first major central bank cut from the European Central Bank in June with the Bank of England following suit on 1 August. This has been supportive for DM sovereign bonds, resulting in positive performance for broad government bond indices over the last couple of months.

Track 14 – I think about it all the time (US Election)

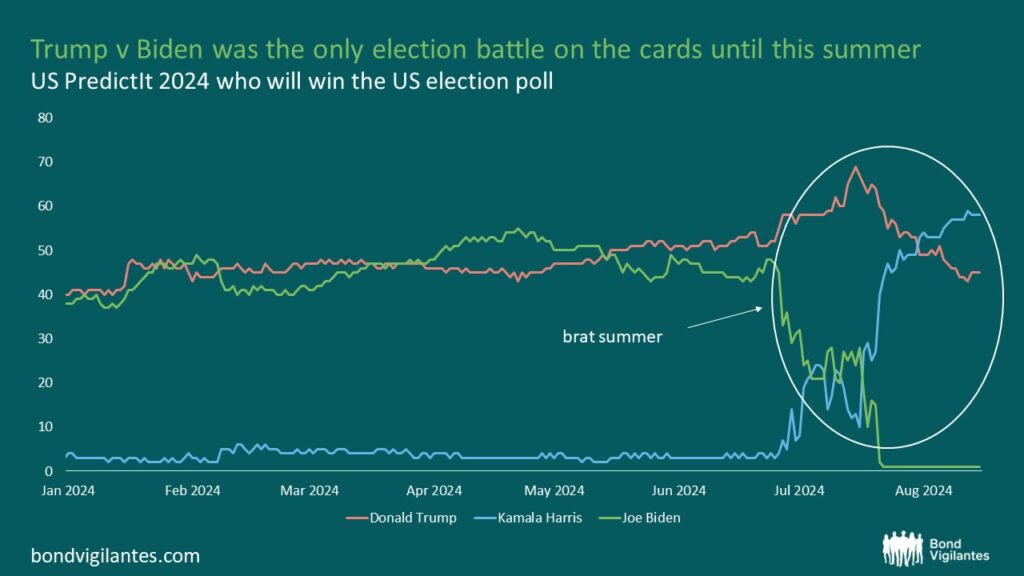

Never before has there been a year in history with a larger proportion of the world’s population going to the polls. The centrepiece is, of course, yet to come – the US election. For much of the year it was set to be a re-run of the 2020 race between Joe Biden and Donald Trump. Despite standing resilient for months amidst calls to step aside after several blunders, President Biden ultimately succumbed. After initially throwing her full support behind Biden and being on the ticket as running mate for a second term, Kamala Harris has now been thrust into the spotlight, emerging as the best option so close to the general election.

In a topsy-turvy couple of months in the US race – which included an assassination attempt on Trump, after which he looked a certain winner of a second term – Harris now finds herself as the bookie’s favourite. Looking a little deeper, what might a presidency under each of these candidates look like from a high level?

(Track 4 – I might say something stupid) – Donald Trump has been a vocal proponent of implementing a 10% tariff on all imports into the US. A second Trump presidency would seemingly head the US into a protectionist era. A key priority would be imposing an additional tariff on Chinese goods – tipped to be as high as 60%, on top of the blanket 10% tariff – in an effort to reduce the trade deficit with China and reliance on the fellow superpower. Although this more America-centric approach will appeal to some sections of the electorate, the maths on the back of an envelope shows some potentially damaging effects on the economy, estimated to reduce GDP by 0.5% and cause CPI inflation to spike by 2.5%.

While Harris takes an internationalist and pro-trade stance, her policies are also potentially inflationary. In general, as is typically the case for Democrats compared to Republicans, Harris is in favour of a larger role for government, with intervention in education, housing and health – areas where Trump is in favour of either reducing government spending or handing responsibility back to state level. Although Harris does not support the blanket tariffs that Trump is in favour of, she does advocate targeted taxes on Chinese steel and aluminium in order to protect US producers.

Whoever wins in November, with the possibility of inflationary policies being implemented, investors may see long-dated US government bond yields rise. This is certainly one to watch out for.

Brat Summer has given1

The story in the first half of 2024 was one of a slow grind lower for credit spreads, a gradual rising of yields and a re-run of the 2020 presidential election. Brat summer – characterised by its volatile nature, silliness, and yet its determination to keep going – has seen a lot of this turn on its head. Many in markets have been looking to see where the big stories might come from, and we certainly now have a bit of excitement. There will be an interesting end to the year for both bond markets and politics. Many thanks to Charli XCX for leading me to consider the story so far this year (even if I’m not the biggest fan of her album – sorry!).

1This phrase plays on Gen Z slang where “is giving” is often used to describe something that embodies a particular vibe or energy. Here, “has given” suggests that Brat Summer has imparted a significant influence, setting the tone for the unexpected and dynamic developments of the year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.