Fear and Greed, Demand and Supply

Four words that drive markets

The market moves we have seen over the last couple of weeks in government bond markets, particularly in gilts, have been fairly volatile in what was, at least in the first week of the year, a void of new news. It’s rare that fixed income hits the headlines in the broader press, but there have been plenty of column inches focused on what is traditionally regarded as a market that is a little bit mysterious. All this market noise and commentary has reminded me of a piece of wisdom that a former boss of mine shared with me in mid-2007. I had arrived in Southern California to start work at his small fixed income shop, having previously only worked at large global financial institutions. I brought with me a firm belief that markets were broadly efficient and reflected fundamentals.

In my early days there, he questioned me about what I thought drove markets and why. If markets truly reflect fundamentals, would government bond yields and investment grade corporate bond spreads move up or down every day? On some days, they might spend the morning going in one direction and the afternoon going in the opposite direction. Did I really believe that the creditworthiness of the US government or Walmart really changed so quickly? Could the credit quality or indeed inflation expectations of a supertanker of an economy like the US really pivot so quickly one way and then the next?

Now this was a very experienced investor who had successfully established his own firm and thrived in the shadow of some of the biggest, most well-resourced and well-regarded bond firms in the world just a couple of hours down the freeway. At the time, we didn’t have any of the resources of those giant firms yet had competed with them toe-to-toe, so how did he do it? I listened carefully to his theory.

“It’s all captured in four words, Andy.”

‘Fear and Greed, Demand and Supply’

He went on to explain that, of course, credit fundamentals are important, but they don’t explain everything. His view was that on most days, for most issuers, they don’t actually explain anything! He proposed that what determines a significant part of market pricing is something you learn in your first term of economics: Demand and Supply, and then the factor that can then push prices even further is sentiment, or Fear and Greed. Demand and supply is based on economic theory, so it doesn’t take too much to convince the most academic of investors that it would influence prices. But psychology? We are talking about trillion dollar financial markets, the sharp end of the most hard-nosed capitalism; surely feelings don’t matter! Nearly twenty years later, having managed scores of fund managers, I can assure you that behind every investment decision are people. As with all human decisions, there is an array of factors that influence them. You can call it risk appetite, confidence or sentiment, but he described more simply: Fear and Greed influence markets.

So that brings me to today’s markets and the recent gyrations; can those four words explain gilts in 2025 so far? I think they can.

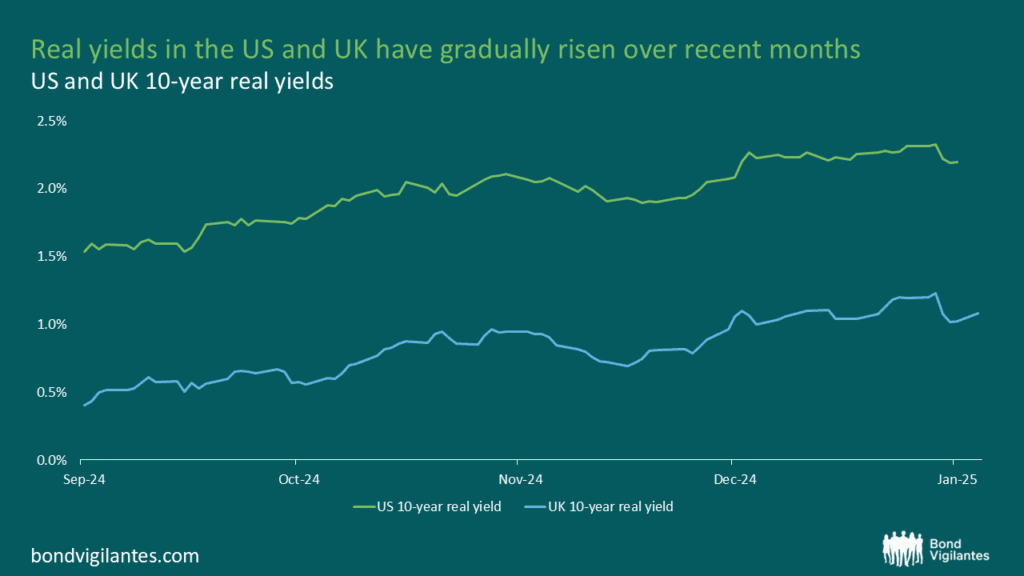

The chart below shows the gradual increase in US real yields over recent months, plotted alongside UK real yields. This move, in my opinion, is at least partly a response to the expected increase in supply of government debt, both in the US and the UK. Occasionally, as perhaps we saw in 2022, governments forget that they, like all issuers of bonds, have to find buyers, and the more buyers you need to find, the higher the yield is likely to have to go to find a clearing price for all those bonds. The UK Treasury, having long relied on domestic pension funds and insurance companies to buy their debt, remembers when gilt curves were inverted and now needs to attract more buyers. In order to entice international investors, banks and individual households to increase their allocation to gilts, those gilts need to be attractive versus alternative investments. It’s a competitive world, with gilts competing against cash, corporate bonds, other government bonds and of course, equities and private assets. So an increase in the Supply of an asset requires a price adjustment to create the Demand.

Source: Bloomberg, as at 20th January 2025

So what about Fear and Greed? I think most readers would agree that behind every asset bubble is Greed, but Fear can also impact markets. I think some of the adjustment in real yields above can be attributed to an underlying Fear of the unknown surrounding the new US administration and the impact of their policies. Another way of looking at that might just be that the market is pricing in uncertainty.

How about the gilt market of early 2025? Did the fundamentals of the UK economy change dramatically on Wednesday January 8th? Was the credit worthiness of the government really different compared to the day before? No.

Judging from the headlines, there was definitely a considerable amount of Fear that this was a repeat of 2022, and gilts were facing an existential threat. Some of the language used by market participants in the various stories across both the financial press and generalist outlets was emotive. I think one of the factors that fed into this feeling of fear and uncertainty was the fact that there was no news that day, no economic data or statement from policymakers that moved the market…

So why did it move? I wouldn’t be surprised if it’s a much simpler reason, driven more by the time of year than anything else. Earlier that week, investment teams were back at full strength, strategy meetings to start the year were held and investors reflected on the change in yields in the fourth quarter of 2024 and thought perhaps they should trim their positions. Yields rose a little, reacting to the sales, and then quickly, the market looked for a narrative to fit the price moves, followed by the media swinging into action.

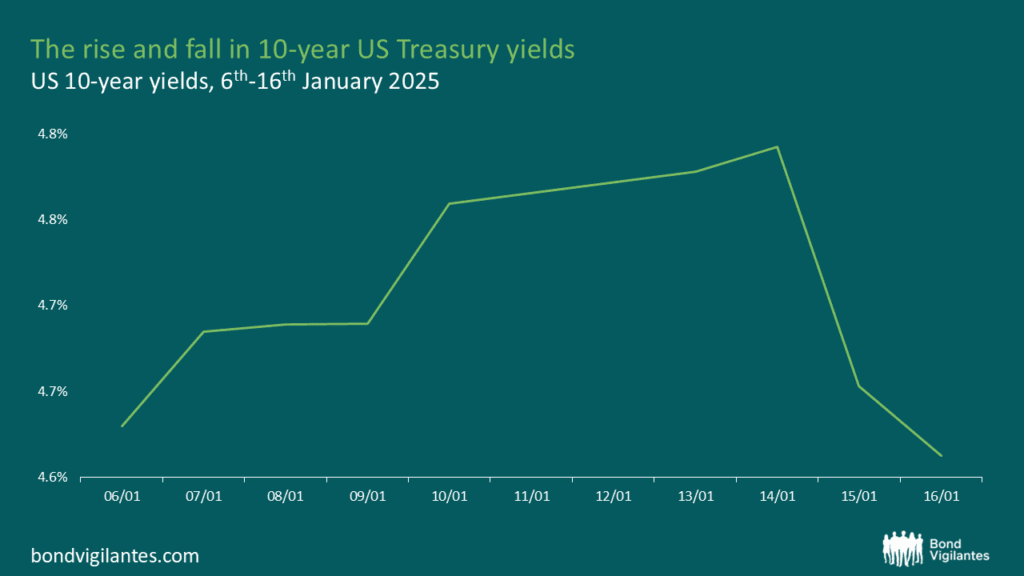

Fundamentals, particularly for developed market governments and investment grade corporates rarely turn on a single piece of data, and economic data published in short succession can often be contradictory. This year has already provided an example of this already in the US. As the chart below shows, we had stronger-than-expected payroll data that triggered yields to jump before softer-than-expected inflation data saw yields fall back a couple of days later.

Source: Bloomberg, as at 20th January 2025

Of course, credit fundamentals matter, particularly given the asymmetric risk of bonds; it’s paramount to have a solid understanding of and confidence in the fundamental credit quality of an issuer, whether sovereign or corporate. The ability of an issuer to pay principal and coupon is a necessary condition for most bond investors. We invest in a very large credit research team around the world for precisely that reason, and the lower down the credit spectrum, the more important it is.

The job of the fund managers who are part of what makes this blog what it is, is to find the value despite all the noise of the market. I often think of the team as the adults looking to provide perspective in the maelstrom of the market. To look through the headlines and find those bonds that overcompensate investors for the risk they are taking, be that fundamental credit risk, macro uncertainty or liquidity risk. I’m sure I’ll write about liquidity risk before long!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.