Will cash returns ever reach zero again?

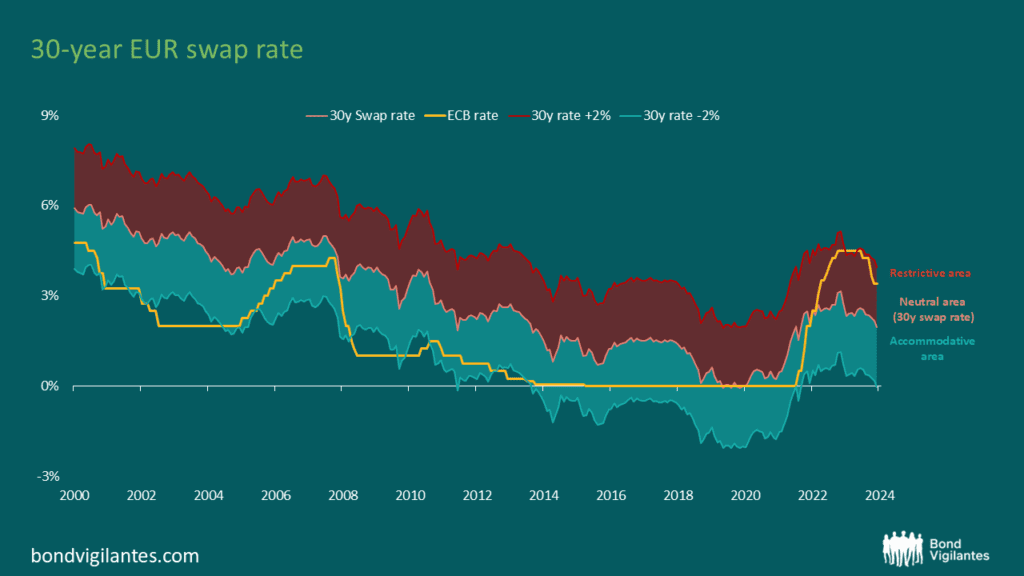

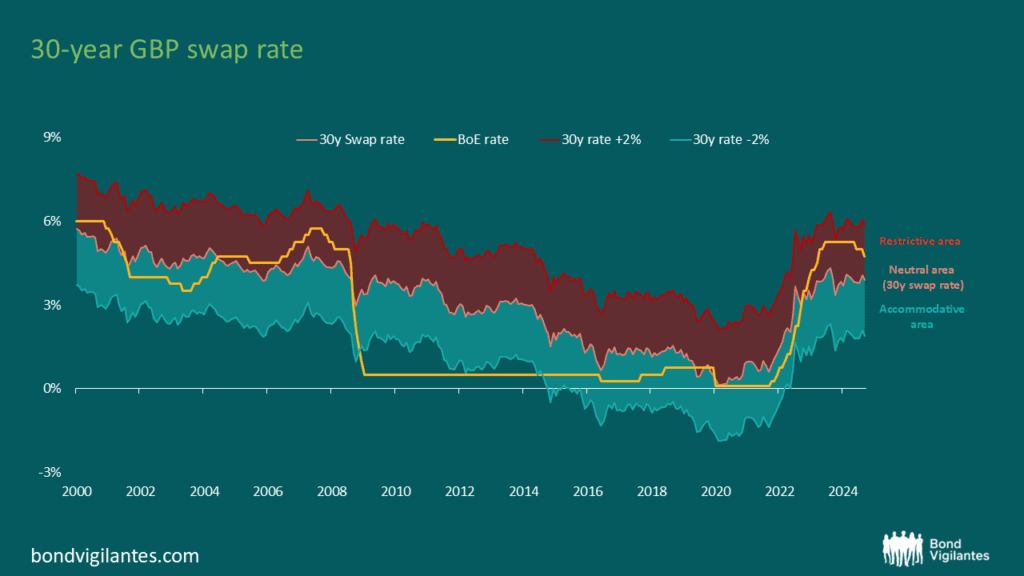

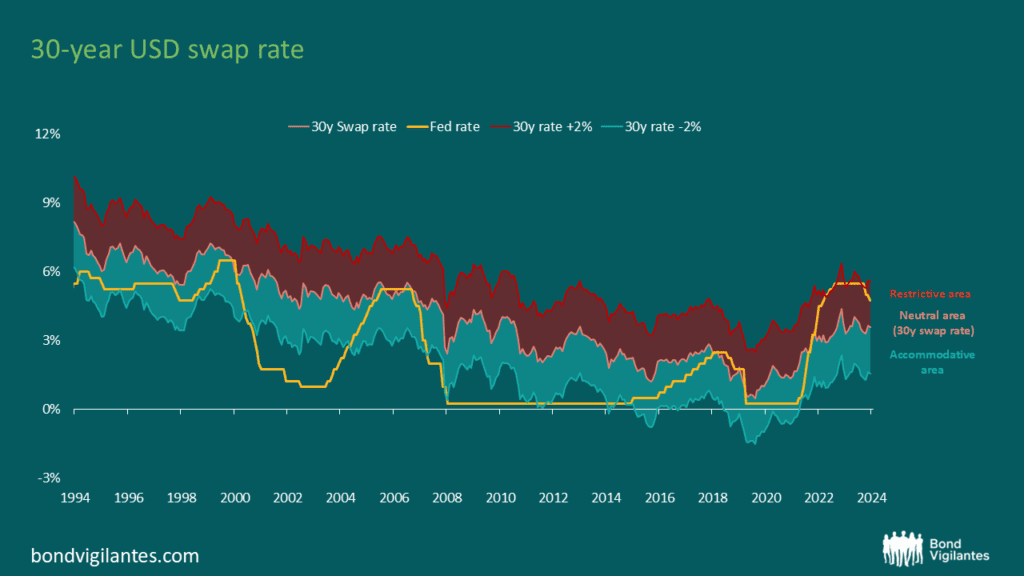

In order to take a dispassionate look at this important discussion, we will focus solely on current long-term market-implied forecasts and work from there. The best way to explore this is to plot the 30-year interest rate swap. This represents the market’s pricing of average short-term interest rates over the next 30 years.

This is the average cash rate. At times, the short-term rate will be above the long-term rate when central banks are running a more restrictive monetary policy, and at others, it will be below the long-term rate when policy needs to be eased.

The charts below illustrate the traditional three main currency blocks over this century: the euro, sterling, and the US dollar. Superimposed on each chart is a yellow line representing actual short-term rates. The charts also depict a range indicating a proxy for maximum easing and tightening, 200bps below and above the average, respectfully, which, for the purpose of this analysis, is considered an appropriate range based on our historic market observations.

Source: Bloomberg, as at December 2024

Source: Bloomberg, as at December 2024

Source: Bloomberg, as at December 2024

As policy has moved from tight to easy historically, short-term rates have reduced by 4% in these developed markets. There were times when this amount was lower, although this was due to the zero bound issue we discussed before. The new monetary policy easing tool of quantitative easing (QE) has had to be used in this century.

The market-implied analysis above demonstrates that yes, euro cash rates could well return to zero during the course of a normal economic cycle. However in the US and the UK, the lower band bottoms out at around 2%.

As an aside, the above charts also illustrate the extent of tightening the economy has faced over the last few years, with the yellow short-term rate lines all within ‘restrictive’ territory. As we have commented on before, and as economic textbooks have stated, monetary policy works with a lag, so it would be very unusual if 2025 is one of strong growth or inflation given the restrictive monetary policies pursued over the last 2 years.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.