Growing a new skin in the year of the green wood snake – the China bond market way

As part of our annual tradition, we reflect on what happens and how the investment world would look when Chinese astrology intersects with the world of finance. In the Chinese zodiac, the snake symbolises wisdom and agility, while the wood element represents growth, flexibility and tolerance, nurturing the fire element that signifies vitality and change. This year, we focus on the China onshore bond market, where opportunities are emerging as the country continues to forge new paths through economic restructuring.

A new skin for China’s bond market

The China onshore bond market is the second-largest in the world, standing at a total market size of USD 24.1 trillion as at December 2024[1]. Historically, foreign investors have focused primarily on Chinese government and policy bank bonds, largely due to considerations of access and liquidity of these instruments. However, this dynamic has evolved as Chinese authorities have intensified efforts to open up the domestic bond market. In addition to the Qualified Foreign Investor (QFI) scheme, foreign investors can now invest through the China Interbank Bond Market Direct or the Bond Connect Scheme, both free from quotas and other repatriation restrictions. Other developments, such as the inclusion of China onshore bonds in global indices, streamlined registration and trading procedures, and increased access to hedging tools, have further improved access to the market.

These changes have led to a surge in foreign ownership of domestic bonds, which has doubled in size since 2019. However, foreign participation remains modest, accounting for around 2.7% of the total bond market as of December 20241.

Uncoiling the potential: the case for greater foreign participation

Given the relatively low level of foreign participation, there is considerable room for growth in terms of foreign ownership in China’s domestic bond market. The market’s low correlation with global bond markets, combined with a relatively stable risk-return profile, should continue to appeal to global investors seeking long-term diversification. Furthermore, the ongoing internationalisation of the Chinese Yuan (CNY) is expected to support long-term demand for CNY-denominated assets.

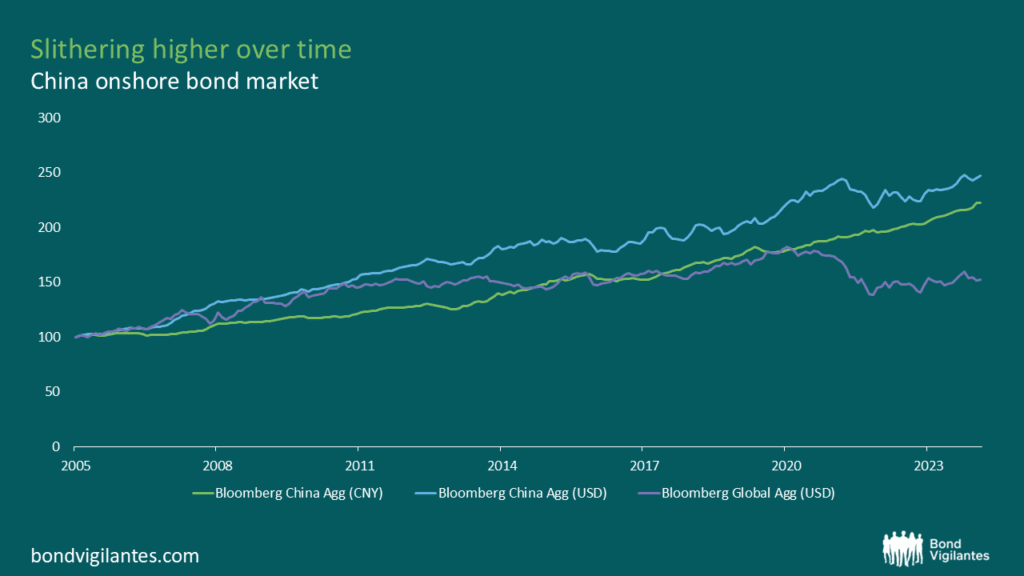

When examining the cumulative performance of the China onshore bond market, as represented by the Bloomberg China Aggregate Index, the chart resembles a snake slithering steadily upward. In USD terms, the picture remains largely intact, with the occasional ‘snaky’ twist, reflecting CNY’s lower volatility compared to major currencies as it continues to be a managed currency. In contrast, the Bloomberg Global Aggregate Index appears more “listless”, with other major currencies underperforming relative to the US Dollar. We expect CNY to continue to outperform during periods of US Dollar strength, as we have seen in the past.

Source: M&G, Bloomberg.

More hiss than fizz as credit markets poised to sizzle

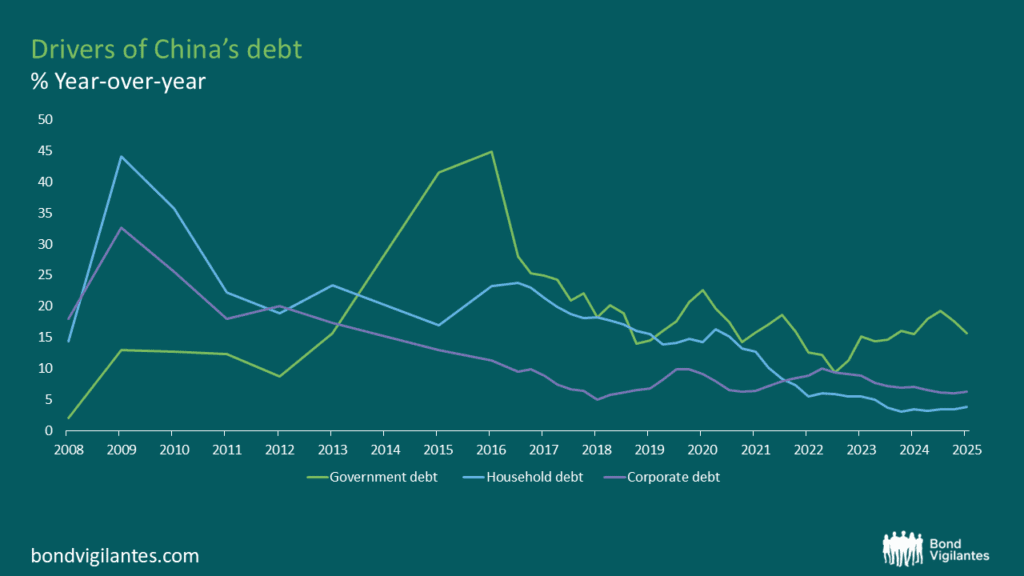

With China onshore bond yields now at record lows, we view the non-government, or credit, segment offering more potential for growth – perhaps with more ‘hiss’ than the traditional government and policy bank bonds. While interest rates in China are expected to remain low for an extended period amid muted inflationary pressures, the credit segment provides an attractive yield pick-up over government bonds. Policy support and ongoing deleveraging in the corporate sector are also expected to provide further stability to credit fundamentals. The chart below illustrates the decline in corporate debt growth, while the default rate – despite concerns about China’s economic slowdown and challenges in the property sector – remains low as a proportion of the overall China onshore bond market.

Source: JP Morgan, January 2025

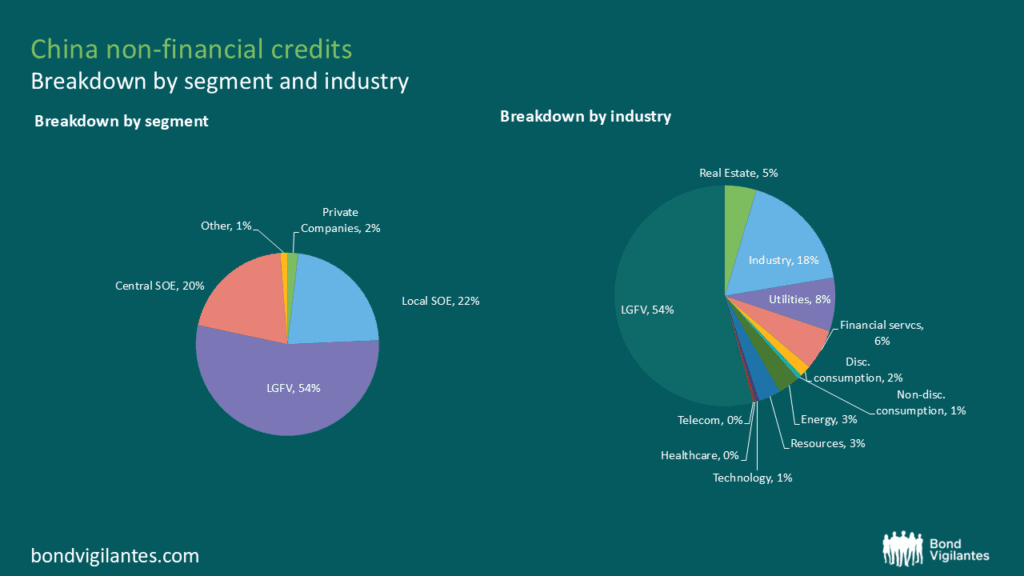

However, investors will need to do their homework to thrive in this evolving credit market. This segment is largely dominated by state-owned entities (SOEs) and, notably, Local Government Financing Vehicles (LGFVs). LGFVs are entities that are directly or indirectly fully owned and effectively controlled by regional or local governments, and they primarily engage in financing, investing and operating public infrastructure and social welfare projects (public policy projects). Their operational scope spans a variety of sectors, including utilities, industrials, infrastructure, and real estate. In addition to LGFVs, financial issuers are a key part of the credit universe. Non-financial sectors such as SOEs and private companies in industries like real estate, utilities and industrials are also prominent issuers. Given the higher cost of financing offshore and ample investor demand onshore, we expect the onshore credit market to continue growing, offering opportunities for investors in the years ahead.

Source : Wind, M&G Investments, December 2024

Wearing the green skin: ESG and the China bond market

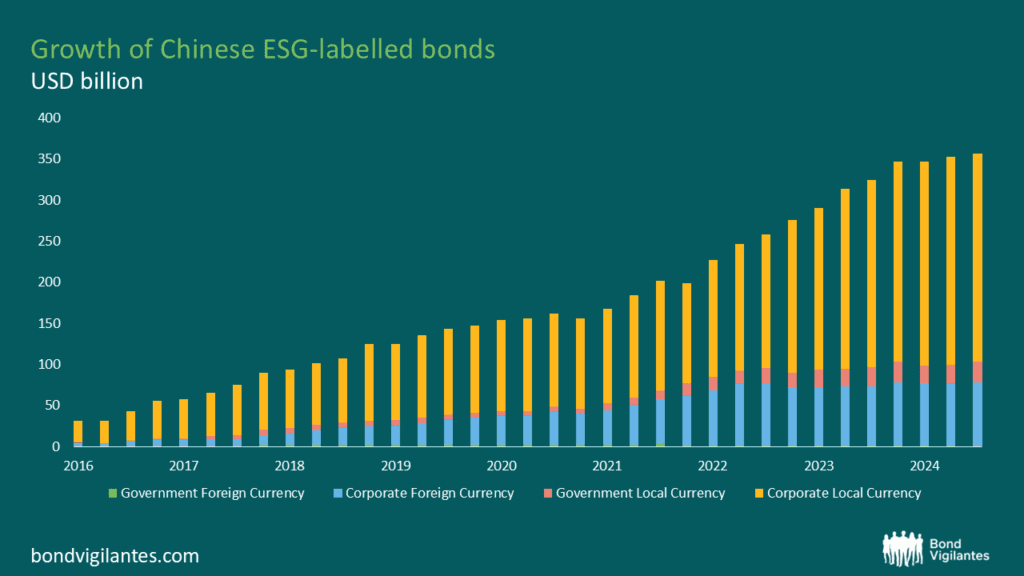

What better way to welcome the green wood snake than by embracing green investments the China bond market way! China has set ambitious climate goals, aiming to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. This transition plan from peak carbon emission to carbon neutrality is notably faster than major economies like the US and the EU, which target carbon neutrality by 2050, suggesting a transition period of around 45-60 years[2] after their peak emissions. To finance these ambitious goals and solidify its position in the global green technology supply chain, China has seen a surge in the issuance of green, social, sustainability-linked and transition (“ESG-labelled”) bonds.

Chinese authorities have also worked to harmonise the country’s green bond classification with international standards, making these instruments more attractive to foreign investors. Additionally, new guidelines have been introduced to improve transparency and standardisation in green bond issuance.

Source: Asianbondonline, September 2024

As of September 2024, China’s outstanding ESG-labelled bond market stands at USD 356 billion, making it one of the largest in the world. We expect continued strong issuance of ESG-labelled bonds in the year ahead, as the wood element aligns with the growing prospects for green investments. While financial, industrial and utilities sectors are typical issuers of ESG-labelled bonds, LGFVs are also increasingly issuing such debt to fund policy-driven infrastructure projects that aim to deliver positive environmental or social outcomes.

That said, investors need not restrict themselves solely to ESG-labelled bonds. Many Chinese issuers whose core business contributes positively to environmental and/or social objectives are also noteworthy. Examples include LGFVs providing railway or metro services that enhance infrastructure and promote public transport use in cities or regions where access has been limited. Additionally, some LGFVs are involved in providing inclusive finance, assisting small businesses, rural areas, and underserved communities in accessing credit and financial services. Local government/municipal owned companies also play a pivotal role in social housing construction in cities like Beijing, providing affordable rental options.

While these segments should continue to attract investor demand driven by policy support and a focus on sustainability, fundamental research remains critical. The LGFV segment, for example, stands to benefit from the government’s ongoing deleveraging efforts, including the recently announced local government debt-swap programme. However, we remain selective in our investment approach, prioritising those LGFVs with strategic importance, strong government backing, and robust access to onshore funding channels.

Change is the only constant

A key characteristic of the Green Wood Snake is change. After all, it is said that snakes shed their skins several times each year as they grow. For a country undergoing significant economic restructuring, investors should be alert to how these changes are shaping company operations, consumer demand and the operating environment for credit issuers. We view that these changes as positive drivers supporting the credit market.

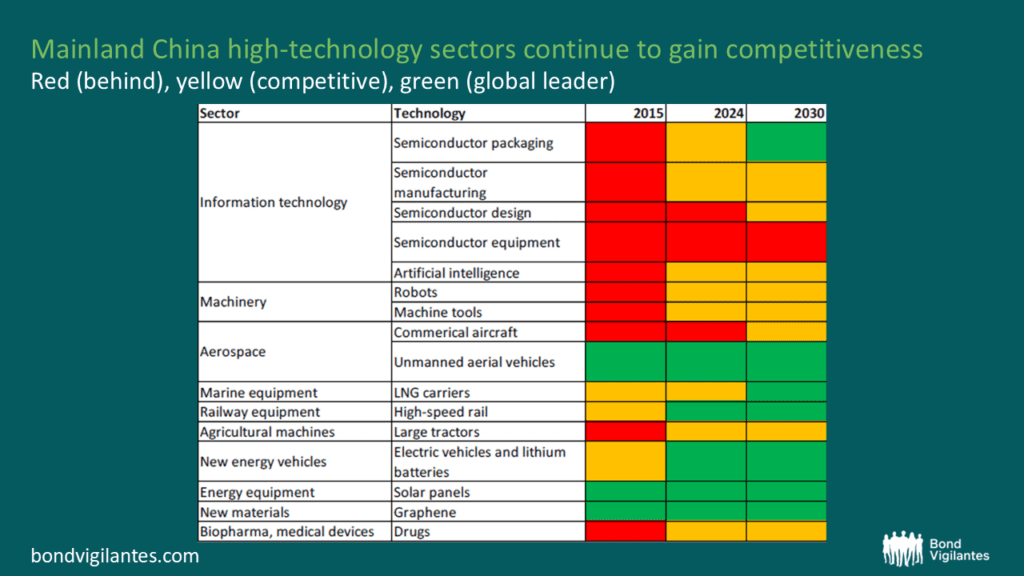

Much has been written about the technology rivalry between the US and China, with trade tariffs and restrictions on China’s access to advance technology weighing heavily on the sector. However, recent headlines about China-built artificial intelligence (AI) reasoning models like DeepSeek reinforce the point that technological innovation in China is poised to continue, with or without restrictions. Over the past decade, Chinese manufacturers have upgraded their technological capabilities, enhancing their competitiveness in high-end/high-tech products, which has supported increased exports in this area. Many Chinese tech companies have also expanded into overseas markets, seeking to grow their global market share despite ongoing geopolitical tensions.

Source: “GLOBAL INSIGHT: Who is Winning the US-China Race? Maybe Still China,” Bloomberg, 30 October 2024.

Adding water for nourishment: the role of policy support

While China’s headline economic indicators point to relatively muted growth compared to the past decade, these figures mask the ongoing shift from traditional growth engines, such as manufacturing and investments, to domestic consumption.

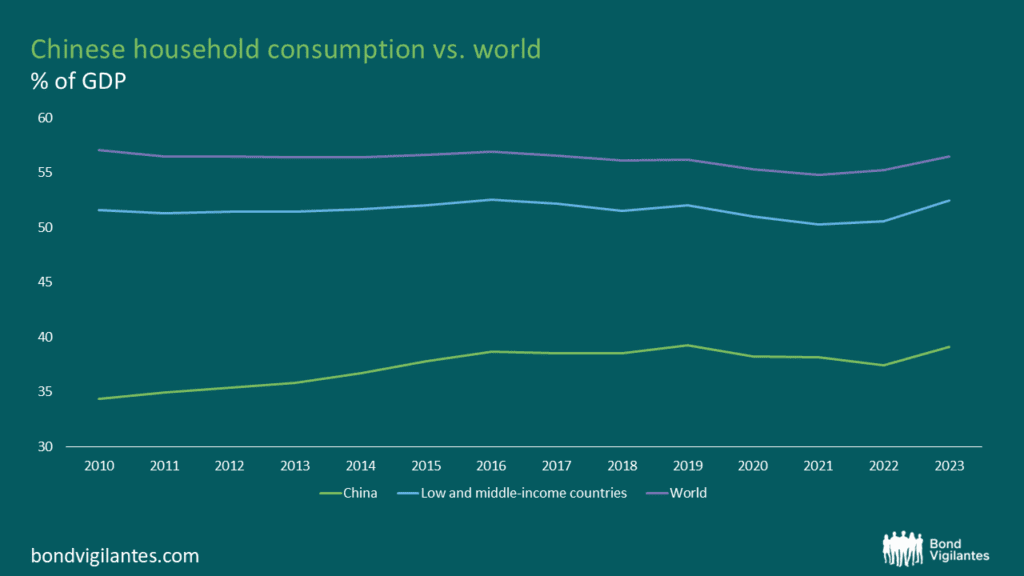

The wood element requires water for growth, and we see the central government’s readiness to provide support through fiscal expansion. Recent policy meetings have indicated a commitment to boosting consumption, including plans to expand the trade-in programme to include consumer items like mobile phones and other personal electronics. Strengthening the social safety net, such as increasing pension payments, is also part of this shift. We view that this policy direction as a positive step toward a more balanced and sustainable growth model for China in the long term. With household consumption as a percentage of GDP still relatively low compared to developed and emerging economies, there is significant potential for domestic consumption to play a larger role in China’s economic future.

Source: World Bank, M&G Investments, December 2023

A new skin for Chinese bonds

As the Green Wood Snake ushers in dynamic changes, the Chinese economy continues to transform. Global investors may, in time, come to appreciate the new skin(s) of Chinese bonds as they evolve.

[1] Source: Wind, M&G Investments, December 2024

[2] DBS, China’s onshore bond and FX markets – a primer, July 2024

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.