Market musings from a high yield fund manager’s long Easter weekend

Good Friday

7:30 – Woke up to my phone beeping at me: a text from Evri telling me that the cat food delivery would arrive later that morning. Delivery businesses like Evri that serve the domestic UK market should only be marginally impacted by Trump tariffs. Hence, when its 8.125% 2031 bonds were down 3 points in early April, it was a good opportunity to pick up exposure… I turned over to catch up some much-needed sleep knowing both I (and Misha the cat) could relax.

Source: Bloomberg

10:30 – With the sun shining, I decide to head out for a walk. Strolling along the street I couldn’t help but notice all the cars from Easter weekend visiting friends and family. Volkswagen, Volvo, Honda, Ford, Tesla, BYD… As truly international businesses with extended supply chains, car manufacturers are highly exposed to Trump’s ever-changing tariffs. I can’t predict how the tariffs and any tit-for-tat retaliation will play out or exactly how deep the impact of these will be. But I can see that this is inflationary for new cars, and this is a positive for car rental companies like Avis Budget that should benefit as the valuation rises on their second-hand car fleet. Its 7% 2029 bonds initially dropped more than 4 points on the tariff news but have now recovered to 100.5.

Source: Bloomberg

17:00 – Time to plan dinner and my son wants pizza. After some persuasion and a bribe of an early Easter egg, we settled on a pizza meal deal for £10 from the local supermarket rather than a meal in Pizza Express for north of £40. With recession fears, people are more likely to be feeling the pinch and are less likely to frequent casual dining restaurants like Pizza Express. The company is currently undergoing an A&E1 exercise where bondholders are having maturities extended and coupon increased, and the owners injecting equity. Bonds have bounced on the relief of avoiding a refinancing crunch and shareholder support, but is the new structure and liquidity enough to see them through a recession? Conversely, supermarkets (especially the budget ones) should benefit from an economic downturn as consumers tighten their purse strings and eat-in more often than previously.

Source: Bloomberg

Source: Bloomberg

Saturday

8:00 – Eating breakfast whilst listening to the news on the BBC about Europe rearming in reaction to events in Ukraine and the evolving US stance to the region. Rebuilding Europe’s military capacity and capability will involve digital infrastructure , which means satellites will be key. Eutelsat will likely play a large part in this, and bonds hardly moved on the recent tariff news flow but still offer over 9% yield to investors.

Source: Bloomberg

15:00 – After a steady stream of news on conflicts, tariffs and recession, I decide it was time to distract myself, so I opened up my favourite Chinese social media app. I clicked on a celebrity’s quirky vlog (Hu Bing if you want to check it out) where he reviewed his bizarre experience using airport wheelchair services (following a surgery) in Bangkok, Singapore, London, Frankfurt and Milan.

This reminded me of wheelchair manufacturer Sunrise Medical. They were hit hard at the tariff news because they generate about 30% revenue in the US and use parts from China. For the moment, the company was able to offer some relief to investors by confirming that the vast majority of the products are exempt from tariffs. However, even in the event that this changes, I’m not convinced that fewer people are going to need wheelchairs because of tariffs or a tough economic climate, nor that a wheelchair is something that can be easily substituted. The business may prove more resilient than some might expect.

Source: Bloomberg

Easter Sunday

12:00 – Having lunch with my friend Philippa and we consider plans for next bank holiday. A culinary and cultural city break in Athens with guaranteed May sunshine for £800 per person or staycation at Alton Towers chancing the British weather. If we head off to Alton Towers for a break, we’ll still spend time together and the kids will probably enjoy Nemesis Reborn more than the Acropolis. If families start weighing up the costs of international travel versus staycations, a UK-focused leisure provider like Merlin might be resilient in this environment.

If this side of the Atlantic, people are fearing or feeling the pinch, then Americans might feel it even more strongly, given the direct impact of both tariffs and a weaker dollar. Businesses like American Airlines might have to slow down on their debt reduction plans.

Source: Bloomberg

Source: Bloomberg

Easter Monday

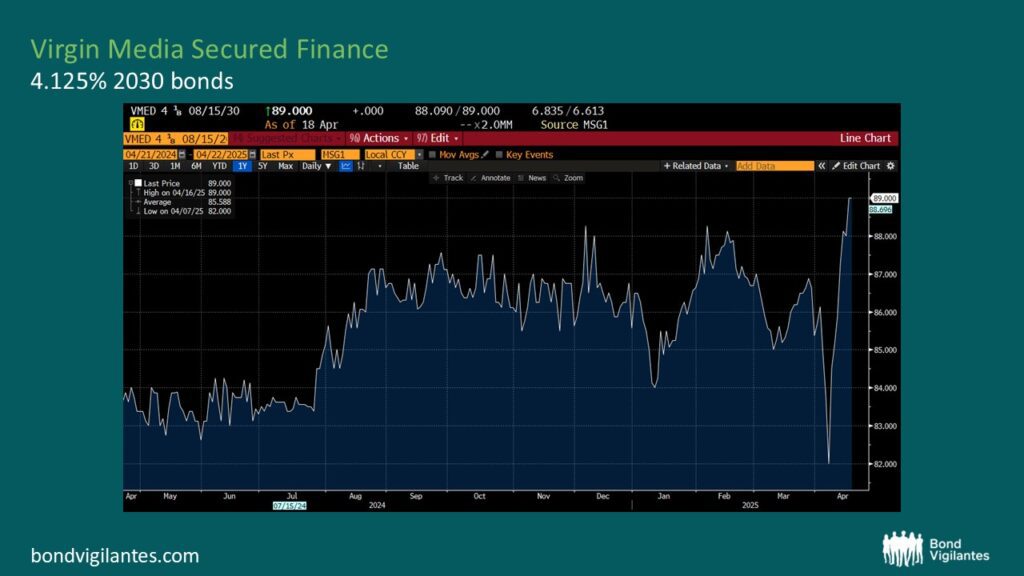

10:00 – A leaflet through my letterbox advertising another broadband offer. Looking at the price, I realised I’m paying a lot more on my current package. Time to consider switching. Virgin isn’t materially impacted by tariffs, and its broadband service is a must-have consumer service. Hence the bonds bounced back to above pre-Liberation day levels. However, Virgin operates in an intensely competitive market with a massive capital expenditure outlay ahead of it to match the BT and Altnet fibre overbuild. To facilitate the funding of this network upgrade, it’s creating an increasingly complex capital structure that’s moving bondholders further and further away from the network’s assets. The bounceback might be overdone.

Source: Bloomberg

19:00 – We planned to watch the new Ghibli movie Flow at the cinema, but then realised that it’s not on at any cinema near us, so decided to stay in and watch TV instead. My family are all Ghibli fans but tempered our disappointment knowing that we can soon watch it on a streaming service like Netflix or Prime as part of our rolling subscription. As much as I like the convenience and range of streaming, I still enjoy weekly “water cooler” schedule TV like Have I Got News For You on the BBC. I wonder whether a recessionary environment would slow the rate of decline in linear TV as consumers spend more time at home and hence see more value in the TV schedule. That could be positive for names like Direct TV if it resulted in a slowdown in the rate of decline in its subscriber base.

Source: Bloomberg

22:30 – Taking a moment before bed to think about this weekend. Before the weekend I thought I would have a break after a busy working week, but didn’t realise quite how many reminders of these high yield issuers I would encounter. So much for the work-life balance – but I wouldn’t have it any other way!

1A&E (Amend-and-Extend): a debt restructuring process where the terms of a bond are modified, typically by extending the maturity and often increasing the coupon, to avoid default and provide the issuer with more time or flexibility.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.